The current debate seems to be centered around whether to spend $700 Billion taxpayer dollars bailing out the Wall Street crooks that have been stealing from us for decades, or to spend a smaller amount.

No one is asking the question of: Will this bailout do any good?

Here's a point you should all understand: We've already spent more than that bailing out Wall Street this year, and we have nothing to show for it. Why should this latest bailout be any different?

Federal Reserve Bailouts: at least $600 Billion so far

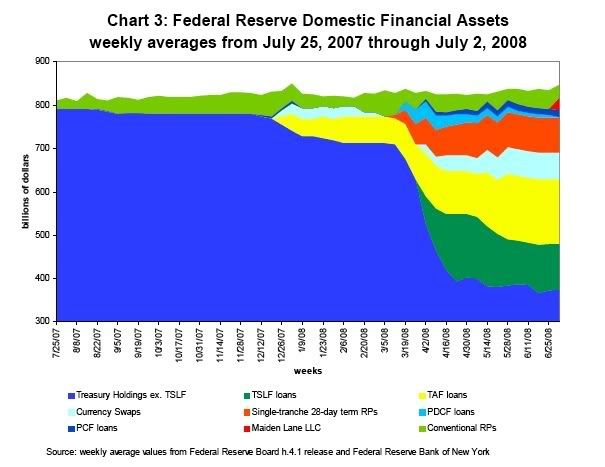

In late December 2007 the Federal Reserve had around $800 Billion in treasuries. By June they had less than $350 Billion in Treasuries because they had swapped out the remainder for toxic securities from Wall Street banks through an alphabet-soup of auction facilities.

The Federal Reserve just recently expanded these programs.

So what does that have to do with you and me? The Federal Reserve portfolio is a proxy for the taxpayer's portfolio. Our tax money backs each and every one of those treasury bonds.

For further proof, look at this.

The Treasury has added almost $300 billion in extra borrowing to offset the impact of central bank programs aimed at helping troubled financial markets and the economy, Karthik Ramanathan, director of the Treasury's debt management office, said in the text of a speech at a conference in New York.

What this means is that the Treasury is borrowing money from the Federal Reserve, at interest that the taxpayer is paying, that it doesn't need to borrow. To put it another way, the taxpayer is now directly subsidizing the Federal Reserve so it can bail out the Wall Street banks (as opposed to the indirect subsidy before last week). The Treasury and Federal Reserve are only resorting to this because the Federal Reserve is running out of Treasuries it can use to swap for bad mortgage securities.

Let there be no confusion on this: you are on the hook for that $600 Billion and no one bothered to ask you.

The chart above was created before the Fed bailed out AIG to the tune of $85 Billion.

The other bailout, which looks very modest in comparison, is the $29 Billion Bear Stearns bailout.

Fannie Mae and Freddie Mac bailout: $200 Billion so far

How can we forget about the largest f*ck up in America's mortgage industry history.

Treasury Secretary Henry M. Paulson Jr. has pledged to invest as much as $200 billion to keep the firms solvent.

This will, of course, be off-budget. So the $200 Billion will not show up in the deficit numbers, and thus doesn't really exist in the political world. Only in the financial world.

If the real estate industry continues to melt down then $200 Billion will be the least of our worries (and expenses in this bailout).

So what does all this add up to? It's hard to give an exact figure because the Federal Reserve's portfolio fluctuates every single business day, and some of it is rather confusing to me. Perhaps someone else can give a more exact figure.

But $800 Billion is definitely in the neighborhood, and that is before this latest bailout request.

Comments

hear, hear!

This is just such a railroad and they are not basically calling cash on the consequences, the results and Dems putting forth real plans that have a good estimate to work. And where is the CBO and the GAO on this? They should be working night and day to figure out what is actually going to have an effect.

Overtime baby. Give 'em triple.