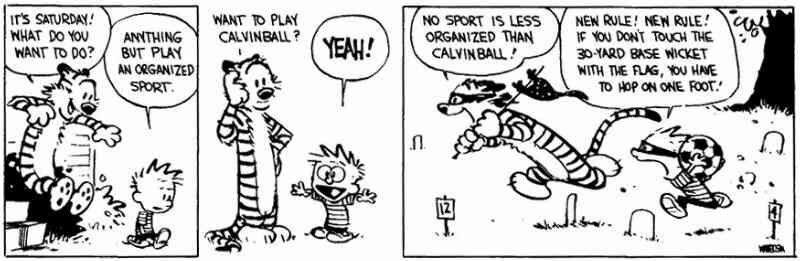

Both national and international finance over the last few weeks have appeared to degenerate into what could be called "Global Financial Calvinball":

For those of you who may not be familiar with the comic strip, "Calvin and Hobbes", Calvinball is an imaginary sport where the rules were made up on the fly by the players, and always of course to the detriment of the other player.

Whether it is the SEC in the US suddenly deciding that shorting financial stocks is not allowed, or the Irish and Greek governments insuring unlimited bank deposits, or the Dutch bailing out Fortis Bank, or the Chinese disallowing lending to US banks,not to mention the gargantuan, ill-thought-out $700 billion Wall Street bailout, national and international financial regulators are making up the rules week by week, and sometimes changing them day by day.

This sort of situation creates chaos, and lots of unintended consequences. It should rightly be regarded as fraught with peril. For example, as Johnny Venom points out below, if the Irish will guarantee your deposit, why not transfer your funds, en masse, there? If money markets are suddenly granted an unlimited guarantee, why keep any of your funds in a Certificate of Deposit in a bank with a $100,000 (oops, rule change! $250,000) insurance limit?

In the next few weeks, huge credit insurance bets on Fannie and Freddie will have to be resolved. California is teetering on the edge of insolvency. The likelihood that a serious mistake will be made is increasing geometrically. It is impossible to undertake any kind of serious commentary on the markets or the economy when the entire structure is degenerating into a Wild West casino, where the house keeps changing the rules.

Calvinball was a fun joke in a comic strip about a boy and his imaginary friend. It's not fun at all when it involves the entire global economy.

Comments

So true

and also shows that the entire free trade, free markets is anything but. What happened to the phrase live by the sword, die by the sword?

Between the fear mongering and the rule changes on a daily basis, I've been waiting for the analysts to point to inflection points generally and prove as you say, this is creating exponential instability to an already fragile situation.

There is one rule that never seems to change though...

and that is refusing to recognize the underlying supports of the system, the workers, the middle class, are the beams which are rotting and buckling under debt and predatory credit practices and until they shore up the fundamental root problem....I don't see anything but a collapse.

I just read a WSJ article blaming the CRA modifications, requiring more low income home loans as well as subprime vehicles...

and it never dawns on any of these people the best poverty program are high wage jobs, stability, benefits including day care. If they want more low income people to own homes....well, give them work opportunities so they are no longer poor!

Anything Keynesian, anything focused on the bottom up, regardless of the multitude of examples on how well this works in Democratic systems...this new oligarchy of multinational elites ignore. It's clearly against their religion to have a middle class and because of that...

promoting home ownership while reducing people's work stability, wages, safety nets is incredibly stupid!