I was a little surprised at the total lack of coverage of the GDP report yesterday on the political blogs (the econ blogs had a few things to say). I suspect it was because most people expected GDP to be significantly negative (I sure did) and yet here was this positive number.

Some people will just say the numbers are cooked, but as I keep pointing out, as long as the bias is regular (like a clock that is always 10 minutes slow) the data gives a lot of information.

So, a few thoughts.

1. I think this is a "Two Americas" GDP number. It would be interesting to take a look at Saks and Nordstrom's and see if they are doing better this quarter. Are the affluent/upper middle class spending again? Or is wealth now so concentrated that the top 5-10% is entirely responsible for the positive spending? - UPDATE: I just checked the charts for affluent/upper middle class retailers Macy's, Nordstrom's, and Saks. All are still in the tank. So spending is coming from one or both of two places: (1) upper class wealthy; and/or (2) tapping even deeper into credit cards.

2. It is clearly a "Two Americas" report with regard to where the spending is occurring: take out gasoline, and the retail and GDP reports are negative iirc. So spending is shifting to food and gas, and away from consumer discretionaries -- but Americans are still spending.

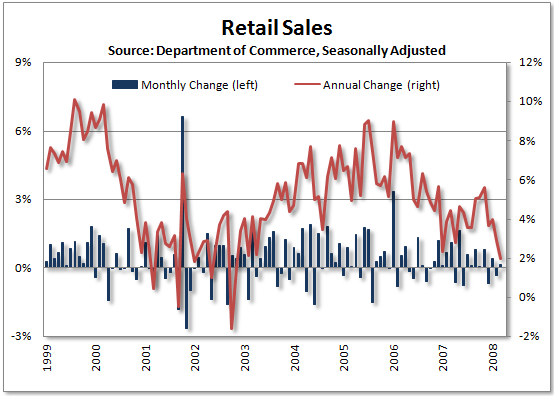

Here's the retail sales graph:

That is confirmed by privately obtained data from Shoppertrak from the first four months of 2008:

Jan. +2.6%

Feb. +2.8%

Mar. +3.2%

Apr. +2.1% (thru 4/26)

3. We constantly overlook the stimulus from the Iraq war. It may be wasteful spending in the economic sense, but it is clearly priming the pump.

4. I am growing more confident in my call for a "respite" in the economy in the second half of this year. The bond market is calling for it, the recent stock rally is calling for it, and now even at what should be the nadir of the recession, per last year's inverted yield curve, you get a positive GDP print. All we need now is for the Fed to print more money (M1) and the picture is complete.

Here's a graph of recession probabilities. The chance was at its peak last month:

5. But if we are going to have an economic expansion later this year, that means my inflation call is more likely to be wrong. (I've been calling for the inflation rate to decline substantially by the end of this year in response to a cut in consumer spending because of a recession). Right now commodities are rolling over a little bit (wheat and gold are rolling over a lot!) but if there is only a brief period of weakness left, I would expect food and energy inflation, after a brief retrenchment, to resume their upward march by Q4. That will really put average Americans over the barrel, and put the Fed in a hell of a bind. It will have to raise rates to rein in inflation, but raising rates may well kill the incipient recovery.

This is by no means a set prognostication. But yesterday's GDP number was significant for not being negative, when just about everybody was expecting a negative, recessionary number. I will probably update this blog entry later with a few graphs and further comments. - DONE.

UPDATE: Well, after going through the looking glass to Redstate, there were 3 brief nani-nani diaries without any analysis. It does answer the question of why Bush seemed so sure last week that we were only in a slowdown, not a "recession." Suppose he knew what the number was going to be ahead of time?

UPDATE 2, 4: My buddy bonddad says the GDP number stunk. The NY Times points to the importance of exports due to the new American peso.

I think I disagree with part of his conclusion though: "This report ... points to serous trouble ahead." The GDP reported on Jan-March, and is in no way a leading indicator.

Bonddad also has a diary at HuffPo, opining that A Consumer Recession is coming. Again, most of his data is coincident (e.g. retail sales) rather than leading indicators, so I'm not persuaded.

Here's a graph of the leading economic indicators on a monthly basis for the last year:

These indicators predict the economy 6-9 months out. As I see it, we are in the teeth of the recession, or growth recession right now. It is likely slowly to abate after summer.

UPDATE 3: Econbrowser warns that GDP numbers tend to be heavily revised at turning points. At this point in the 2001 recession, the current numbers still showed expansion. Only much later did revisions show an actual contraction. Krugman (see link at center bar) says purchases of goods were down; only purchases of serivces such as healthcare (which are usually incorporated in health insurance) made the number positive.

All points well taken, but these read a little like excuses. Most everybody in blogland thought the number would be negative; it wasn't. What is going to change in this quarter or the quarters ahead to make it so?

Comments

Alice in the looking glass

How I feel about the current state of things.

I'm positive we're looking at two Americas, an economy for multinational corporations and the super rich and another for the rest of us.

But, today the stock market is rallying. I just have a hard time understanding this at all considering the overall fundamentals are so weak and 70% of the US economy is consumer.

today's market

Well, I never put too much faith in one day's trading. That being said, the market has rallied on bad news in the last month. Enough so that this rally is saying something about the economy improving between now and the end of the year. Today is generally about the Fed being done easing

(maybe), so the dollar is strengthening, which means OIL, gold, rice, wheat, and did I mention OIL are tanking. *IF* the trend continues, that would play into my scenario in which we have reached the top in inflation readings until the (growth) recession is over.

could be

I'm just not sure, unless the only thing really being decoupled from in the global economy is the US middle class. i.e. they are replacing their consumer market on a global scale as the US middle class gets wiped out.

If I look at it all from just a US macro economic data, I cannot for the life of me understand this at all.

I think you have the big picture exactly correct

The big story of the last 20 or so years is the gutting of the wealth of the American working/middle classes, and its redistribution to developing Asia, especially China, to corporate executives and old money, and more recently to petro-sheikhdoms.