It's hard to understand why, with so many Americans still unemployed and looking for jobs, why additional work requirements and/or job training would be imposed on those receiving food stamps (SNAP) and/or welfare (TANF) to qualify for these benefits. Especially when so many of the new jobs that have been created are so low-paying that workers still qualify for SNAP and other government benefits.

And it's equally hard to understand why so many policymakers still believe that training (or re-training) unemployed workers will magically create more jobs.

Atlanta Federal Reserve: Have Changing Job and Worker Characteristics Restrained Wage Growth? (by Roberson and Terry):

Our results are consistent with the analysis in a previous macroblog post, which found that changing industry-employment shares could not explain much of the sluggish growth in the average hourly earnings data from the payroll survey.

So then, the U.S. didn't go from a strong unionized manufacturing economy to a low-paying non-union service economy ever since offshoring became really popular for our "job creators" with bad trade deals? — because ever since 1997 the U.S. now has 67,161 less factories. And that's not to say anything about the phony skills gap or stem skills myth being used as an excuse to displace well-paid tech workers with lower-paid H-1B visa workers.

Dean Baker - Center for Economic and Policy Research: If the Fed raises rates, it will force people into Uber type jobs:

Would a doctor work for Uber? Probably not, but if it turned out there were no jobs for doctors and the only way she could support her family was to work for Uber, then a doctor may work for Uber. That is an important point left out of an interesting New York Times article ("Growth in the ‘Gig Economy’ Fuels Work Force Anxieties") on growing economic insecurity for workers.

A big part of this story is the decision by the Federal Reserve Board to raise interest rates to deliberately limit the number of jobs in the economy. This disproportionately hits less educated workers, who are the first ones to be fired when the economy slows. If jobs were plentiful, then employers would be forced to offer higher wages and more job security in order to attract the workers they need. The Fed's policy to keep the labor market weak in the last three and a half decades has been a major factor in the deterioration of job quality.

It is also bizarre that the article cited a study by Michael Greenstone and Adam Looney to support the case that, controlling for education, men have been seeing declines in wages for forty years. The Economic Policy Institute had been documenting this decline in The State of Working America for decades.

FYI: Atlanta Federal Reserve: What's (Not) Up with Wage Growth? (also by Roberson and Terry):

None of the characteristic-specific median growth rates we looked at are close to returning to prerecession levels. Lower-than-normal wage growth appears to be a very widespread feature of the labor market since the end of the recession.

Below are some comments from readers via Mark Thom's blog on the previously aforementioned post by the Atlanta Fed (Have Changing Job and Worker Characteristics Restrained Wage Growth? (by Robertson and Terry):

Comment One: (Quote by Thomas Pynchon) "If they can get you asking the wrong questions, they don't have to worry about answers." How is it possible that Robertson and Terry don't

know they're asking the wrong questions?Comment Two: They both work in the Atlanta Fed's research department. In the system of political capture then the Federal Reserve System is a captive of the banking system and the "investment" and credit cartel in general. "Stockholm syndrome" describes the effect of captors on their hostages. Robertson and Terry have become empathetic to the needs of investment bankers without really being self-aware of the transformation. Of course they could just as easily be willing establishment sock puppets trying to get ahead in the game.

Comment Three: Here is what restrains wage growth: excess labor supply. People working longer hours for lower wages.

Comment Four: The retirement boom is driving down wages because newly crested entry level workers drive down wages. This is the paradox.

Comment Five (reply to Comment Four): As people retire, that ceteris paribus [other things being equal] would means lower labor supply, which would drive up real wages. But it is not ceteris paribus when the driving factor in our economy is extremely weak aggregate demand.

Comment Six (reply to comment Five) I have to agree and call bullshit on this. The retirement boom didn't suddenly go stratospheric in 2009, but the economy did fall of a cliff — a cliff constructed by the terrible lending practices of an unregulated financial industry.

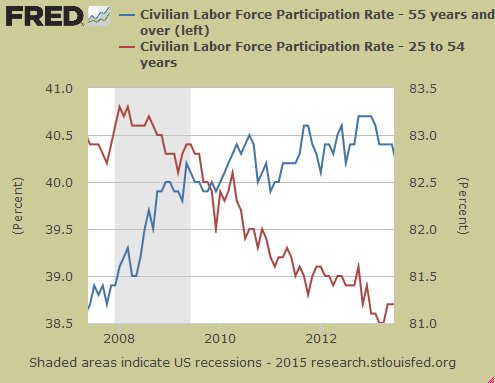

The force force participation rate for older workers and retirees isn't to blame (as shown in the chart below); it's prime-age workers who can't find jobs. (More about the banks further below.)

Dean Baker - Center for Economic and Policy Research: Why People Aren't Working, Can We Talk About the Fed?

There is not much about the drop in labor force participation that is very surprising. It goes along with a weak labor market. When people can't find a job after enough months or years of looking, they stop trying. Here's what the picture looks like over the last two decades...

It's great for politicians to round up their favorite usual suspects in trying to explain why so many prime age workers no longer feel like working, but to those not on the campaign payrolls, it seems pretty obvious. We don't have enough demand in the economy and therefore we don't have jobs...

If the Fed is determined not to allow the unemployment rate to fall below some floor like 5.2 percent, then it will prevent the economy from creating large numbers of jobs. In this case, the LFPR will not rise much regardless of whether we follow the prescriptions of Bush or Clinton, since people will not look for jobs that are not there indefinitely...

Paul Krugman:("The Big Meh") New technologies have yielded great headlines, but modest economic results:

If you go back to the 1930s, you find many influential people saying the same kinds of things such people say nowadays: This isn’t really about the business cycle, never mind debates about macroeconomic policy; it’s about radical technological change and a work force that lacks the skills to deal with the new era. And then, thanks to World War II, we finally got the demand boost we needed, and all those supposedly unqualified workers — not to mention Rosie the Riveter — turned out to be quite useful in the modern economy, if given a chance.

Who Should Pay for the Great Recession?

"Speculators may do no harm as bubbles on a steady stream of enterprise. But the situation is serious when enterprise becomes the bubble on a whirlpool of speculation." ~ John Maynard Keynes (1936) when he first proposed a financial transaction tax.

Mark Thoma (Financial Times) Wall Street Should Pay for the Recessions they Cause:

Who should shoulder the burden? The CEOs, managers, and the like who made millions and millions from the activities that eventually led to financial problems; or typical working class households who had nothing to do with causing the financial problems ... A financial transactions tax, or something similar, forces the financial industry to internalize these costs and curtail the risky behavior that can cause big problems for the economy ... Of course, any attempt to implement a financial transactions tax will be vigorously opposed by the politically powerful financial industry.

Below are comments from Mark Thoma's blog on his post at the Financial Times:

Comment One: Seems the greater burden falls on those who lose their means of livelihood. This loss is often followed by loss of home, divorce, [job, dignity, suicide]...

Comment Two (Regarding Keynes quote) Rescuing enterprise from becoming "the bubble on a whirlpool of speculation" was also an intended purpose of the 1972 Tobin tax and is a common theme in several other types of financial transaction taxes.

Comment Three: Taxing transactions doesn't really limit risk-taking. Any reasonable transaction tax would not stop the kind of risky lending which could cause a financial panic, but would simply lower liquidity a bit. Why would paying a few basis points in transaction fees stop me from financing some risk investment? Transactions taxes stop trading, but what is risky is origination. Once the debt exists, slowing the trading doesn't reduce the risk, it simply slows down the transfer of the risk from one party to another. Reducing liquidity might lower risk appetite, but it's such a minor effect I wouldn't count on it...

The UK example: No financial institution actually pays the tax, only retails investors pay it and it has sparked a massive increase in Dublin listed ETFs, which neatly avoid the transaction tax itself. There are several derivatives products that allow financial companies to avoid paying the tax. The only successful stamp duty (or transaction tax) in the UK is on property.

The idea that all financial transaction go through an exchange is also quite wrong. Most derivatives are OTC, so they never touch an exchange. You can mandate banks to act through exchanges, but it's harder to control the shadow banking system.

Comment Four in reply to Comment Three: Interesting thoughts. The goal is less raising taxes as it is giving the right signals to the market. Currently the rules of the game tell financial institutions - heads you win, tails the rest of us pay up. That kind of perverse risk structure encourages these institutions to gamble with other people's money.

Comment Five had left a link from Dean Baker at the Center for Economic and Policy Research:

The idea of a financial transactions tax (FTT) has made it into polite circles. Two of the declared presidential candidates openly support it, with long-time proponent Bernie Sanders leading the way.

The Tax Policy Center of the Brookings Institution and the Urban Institute did an analysis showing that a tax could raise more than $50 billion a year and would be highly progressive. And Representative Chris Van Hollen, a member of the Democratic Party leadership in the House, proposed an economic plan that had a FTT as its financing mechanism.

The financial industry is of course hugely powerful. The cost of the tax to the industry swamps the cost of Dodd-Frank and any other financial reform measures currently being discussed. For this reason, the Wall Street folks will do almost anything to stop a FTT, so we are very far from having a bill passed into law or even being seriously debated. But we have made enormous progress. The FTT is no longer treated as a nutty idea.

Comment Six: James Tobin proposed something like this for international finance decades ago ... the Tobin Tax. But Republicans and neoliberals like Bill Clinton prevailed in their arguments that we needed to deregulate and cut taxes on the finance industry to get more growth. It just gave us unsustainable bubbles and more inequality.

Comment Seven: In addition to the financial transaction tax, we need to tax capital gains at twice the rate of earned income [or taxed at the same rate as regular wages], since it is those who realize capital gains [earned when they sell stocks, real estate or SWAG investments] that are the primary beneficiaries and drivers of the bubbles.

So if the rich caused the Great Recession, why has everyone else but the rich been paying for it? But the Republican Congress would never consider taxing the rich any more — they'd rather tax them much LESS. So a financial transaction tax or a tax hike on capital gains will be almost impossible — even if Congress was dominated by "Third Way" Democrats. So, as usual, the working-class will continue to be the ones that pays for all the reckless Wall Street greed.

Job Training and Hillary Clinton

And speaking of Wall Street --- New York Times: "Hillary Clinton Offers Her Vision of a ‘Fairness Economy’ to Close the Income Gap" [my notes in brackets below]

She stopped short of endorsing policies championed by Senator Bernie Sanders and others in the liberal [progressive] wing of the Democratic party, including breaking up the big banks and endorsing a financial transaction tax ... A heckler who interrupted Mrs. Clinton with a question about whether she would reinstate the Glass-Steagall Act seemed to disagree.

The act, which Bill Clinton repealed parts of in 1999 leading to the commingling of commercial and investment banking, is widely criticized by liberals [by many people on the left and the right] as contributing to the 2008 financial crisis.

But Alan S. Blinder, a former White House economic adviser under Mr. Clinton who helped Mrs. Clinton shape her proposals, told Reuters she would not reinstate the 1933 act, which many [very few] economists believe is antiquated.

Some of what Mrs. Clinton presented, particularly a plan that would offer companies incentives to increase profit-sharing with employees, left some liberal [and conservative] economists skeptical. “It’s unlikely companies are ever going to give something for nothing,” said Dean Baker, an economist and co-director of the Center for Economic and Policy Research.

It's not "what you know" but "who you know". We already have lots of over-qualified workers (college grads) doing jobs that high school grads and dropouts used to do. Below are a few bullet points from a New York Times post: Sizing Up "Sizing Up Hillary Clinton’s Plans to Help the Middle Class":

- The laws, norms and institutions that supported the middle were crushed in the four-decade-long effort ostensibly [perhaps not actually] intended to help American business compete.

- More than 30 percent of men in their prime are either unemployed or earn less than what’s needed to keep a family of four out of poverty.

- The Economic Policy Institute estimates that wages in the middle of the distribution have increased by all of 6 percent since 1979. Stagnant wages have failed to keep up with continuing productivity gains.

- Middle-skilled jobs were disappearing due to automation in the United States and Europe.Now we are seeing a similar pattern in Japan and South Korea. Even Germany has experienced an explosion of low-wage service jobs.

- Even Singapore, which imports millions of workers from the rest of Asia to perform low-skill jobs, has introduced a wage subsidy to help mostly older Singaporean workers whose wages have failed to keep up.

- The American political system has not done enough to build a social insurance apparatus to help everyday workers and their families sustain prosperous lives.

- Success won’t hinge on a list of proposals [such as Hillary's]. It will require reshaping entrenched political positions, and convincing solid majorities of voters of the vital role of government in their lives.

- Jobs in the economy’s largest, fastest growing occupations, in retail sales, food preparation and the like are awful, because companies have created strategies that use people as interchangeable parts.

- [Regarding job training and apprenticeship programs], corporate executives are more focused on enhancing their own bonus through short-term measures, have scant incentive to invest in developing talent.

- Relying on corporate incentives to change the economics of the middle class might appear irretrievably naïve. But it offers candidate Clinton perhaps her best shot. Otherwise she will have to build a strategy for all-out political war. [Senator Bernie Sanders calls his strategy a "political revolution".]

From The Washington Post, quoting Wisconsin Governor Scott Walker on Hillary's proposal in her recent speech to raise the minimum wage:

I'm going to let people like Hillary Clinton and others to let that be the basis of their economic plan. I want to talk about ways for people to get careers that pay two or three time more than the minimum wage through education and job training.

In her economic speech, Hillary Clinton also said:

Workers are assets. Investing in them pays off. Higher wages pay off. Training pays off. To help more companies do that, I’ve proposed a new $1,500 tax credit for every worker they train and hire. And I will soon be proposing a new plan to reform capital gains taxes to reward longer-term investments that create jobs more than just quick trades.

Now we have to pay employers (aka "job creators") to hire people with tax incentives? That is just plum crazy! Where will the tax revenue shortfalls come from, cuts to other programs?

For-profit schools that offer courses for bartendering, dental assistants, (etc.) or culinary schools that train cooks, and online schools that offering college degrees — do not create jobs, but only provide (sometimes questionable) skills that might become eroded over time while that person later attempts to find an open job — and all the while being in debt to those schools.

And if one takes out a federal loan to pay for their school's tuition, it must be paid in full or they risk losing Social Security benefits later. That's why college should be free up to a certain degree (for at least 2 years, but maybe up to 4 years if one's grades are adequate).

In another New York Times article: A New Look at Apprenticeships as a Path to the Middle Class, they note these programs were devastated by the sharp losses in manufacturing and construction jobs. Like college degrees, what's the point of paying for job training if there are no jobs — or they are offshored to lower-wage countries?

Job training or college isn't a Silver Bullet for job creation. We can be a nation of Ph.Ds, but it doesn't mean we'll also won't be a nation of really intelligent or highly skilled fast-food workers — not unless jobs are actually created that require those skills — and that's why there should be more on-the-job training.

With over $2 trillion in profits stashed away, not only can our "job creators" afford to pay for job training — they could also afford to send potential job candidates to college if they wanted to — and even put them under contract to work for them for a given amount of time (the way the Air Force does when they train pilots). So why should the government have to pay to train people to work in the private sector?

If employers were really sincere about hiring people — workers that they really need to fill whatever positions necessary — they can specifically state years in advance what skills they'll be looking for, instead of rejecting job applicants for being "over qualified".

Comments

Paul Krugman on Wages

"The case for “skill-biased technological change” as the main driver of wage stagnation has largely fallen apart. Most notably, high levels of education have offered no guarantee of rising incomes — for example, wages of recent college graduates, adjusted for inflation, have been flat for 15 years."

NYT

no NYT links plz

Any site which isn't a clean link, please do not put it there.

Removed

I had no problem as a visitor to this website in accessing those links, but I removed all NYT links per your request (and readers can just Google the titles I used.)

good deal plus

I must say that CBS Marketwatch gets it right much more on statisics, Krugman's fine but there are so many, better financial/economics papers and Journalists out there (and they don't do some ridiculous spyware trap nightmare thing on their links, articles).

The Mystery of Sluggish Wage Growth

In response to the Atlanta Fed's post (Have Changing Job and Worker Characteristics Restrained Wage Growth?) MarkThoma at CBS concludes in a new post (The mystery of sluggish wage growth) :

Now I'm confused. So then, what is "the mystery of sluggish wage growth"?

Is it one or a combination of these reasons:

1) rehires moving into lower-paying occupations

2) new technology eliminating middle-class jobs

3) lack of education/skills

4) demographics (older workers depressing wages)

5) a decline in better-paying manufacturing jobs vs. an increase in low-paying service jobs

6) the offshoring of all and any types of jobs

7) an over-saturated labor force (immigration and work visas)

8) increased productivity (aka profits) are not equally going to workers, but to corporate executives

9) some of the above (and if so, which ones?)

10) none of the above

11) all of the above

12) other reasons not mentioned above (meaning, it's still a mystery)

are you kidding?

"sluggish wage growth" is because "they can". Employers import foreign workers, fire older workers because they are perceived to be more expensive, use illegal labor and offshore outsource anything not nailed down.

The rest of this is just corporate press release copy. EP doesn't "do" corporate press release copy.

Job training in underemployment.

Can't make a program that can't be spun into abusive self interest. Job training in an economy driven to improve numbers by cutting costs is simply culling under trained workers. Government provided program in anti labor climate improves profit margin, not creates jobs.

Chester L Ruminski

Mystery Solved? Where the Jobs Are.

From New York Times: "Gap Widening as Top Workers Reap the Raises"

A recent survey by CareerBuilder found that 37 percent of employers were hiring college graduates for jobs that once required only a high school diploma. The great exception to this trend is for holders of degrees in the so-called STEM (science, technology, engineering and mathematics) fields. Of course, even STEM graduates can lose out, finding that the skills they learned in school are becoming obsolete in rapidly evolving specialties like social media.

Some blue-collar workers who lack a college degree but have specific skills are better off than college graduates who do not. Anthony P. Carnevale, a Georgetown University professor who runs the Center on Education and the Workforce, says: “If you have an associate’s degree or a certificate in a technical field like heating and ventilation, machine repair, carpentry or plumbing — you’ll do better than the average B.A. holder, both at the beginning and 10 years out of school.”

ridiculous, quit with the New York Times please

College grads lose jobs, have them offshore outsourced right and left and age discrimination is an institution. NYT simply is not "the source" more the Financial Times, or Wall Street Journal, MarketWatch etc. are better sources. NYT gets it oh so wrong and where is the study here? I don't see any.

skills "shortages"

In those rare occasions when you can pin a "skills shortage" promoter down as to exactly what skills are lacking they will say its creativity, critical thinking, and communication - all skills not usually part of a typical stem curriculum, but are part of those dread liberal arts courses

Job Training

Job Training is important for those who have not worked--not just directly for one job or another. Soft skills, including showing up on time, work behavior and values and updating skills on computer are important for those who have been out of the workforce. Just as important is having a high school diploma or GED. These days, it is important to have these skills in addition to specific skills learned at college. For many, just having the soft skills will get them to the first job level.

Flooding market with educated workers

Don't forget that "Easy Al" Greedspan advocated the idea of flooding the market with educated workers as a way to suppress middle class wages.

It is a common fallacy among the punditry and political class that creating a supply of skilled and educated workers somehow magically creates demand for them