Seasonally adjusted retail sales rose 0.5% in May after retail sales for March and April were revised slightly higher.. The Advance Retail Sales Report for May (pdf) from the Census Bureau estimated that our seasonally adjusted retail and food services sales totaled $455.6 billion for the month, which was an increase of 0.5 percent (±0.5%)* from April's revised sales of $453.6 billion and 2.5 percent (±0.7%) above the adjusted sales of May of last year. April's seasonally adjusted sales were revised from the $453.4 billion originally reported to $453.6 billion, while March sales were also revised higher, from $447.8 billion, to $447.9 billion, with this report. Estimated unadjusted sales, extrapolated from surveys of a small sampling of retailers, indicated unadjusted sales rose 4.5%, from $412,328 million in April to $471,421 million in May, while they were up 3.6% from the $462,615 million of sales in May a year ago...

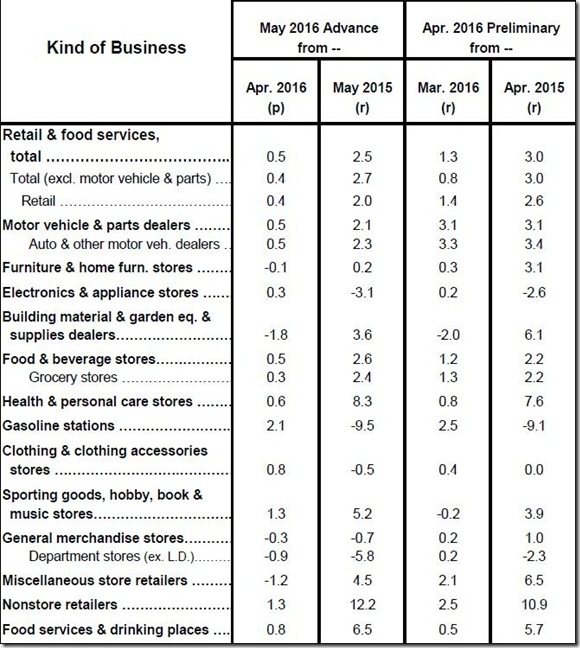

Included below is the table of the monthly and yearly percentage changes in sales by business type taken from the Census pdf.. The first double column below gives us the seasonally adjusted percentage change in sales for each type of retail business from April to May in the first sub-column, and then the year over year percentage change for those businesses since last May in the 2nd column. The second pair of columns gives us the revision of last month’s April advance monthly estimates (now called "preliminary") as revised in this report, likewise for each business type, with the March to April change under "Mar 2016 revised" and the revised April 2015 to April 2016 percentage change in the last column shown. For your reference, our copy of the table of last month’s advance April estimates, before this month's revision, is here....

From the above table, we can see that a 2.1% increase to $39,999 million in seasonally adjusted sales at gas stations, largely due to higher prices, helped boost May sales. Without those, May's retail sales would have just been up 0.3%. Similarly, without sales at motor vehicle and parts dealers, which were up more than 0.5% to $96,973 million, other retail sales would have only been up a bit more than 0.4%. Meanwhile, retailers showing well above average increases in May sales included non-store retailers, including catalog and online, which saw sales rise by 1.3% to $45,238 million, and specialty stores, such as sporting goods, book & music stores, where sales were also up 1.3% to $7,901 million. On the other hand, sales at building material and garden supply stores fell 1.8% to $28,365 million, sales at miscellaneous store retailers fell 1.2% to $10,515 million, and sales at department stores fell 0.9% to $12,349 million.

Estimating May Real Retail Sales Using May CPI Data

With the May release of Consumer Price Index Summary by the Bureau of Labor Statistics a few days later, we can also attempt to estimate the economic impact of these May retail sales figures. For the most accurate estimate, and the way the BEA will be figuring 2nd quarter GDP at the end of July, we would have to take each type of retail sales and adjust it with the appropriate change in price to determine real sales. For instance, May's clothing store sales, which rose by 0.8% in dollars, should be adjusted with the price index for apparel, which indicated prices for clothing were also up by 0.8%, which tells us that real retail sales of clothing were actually unchanged in May. Then, to get a GDP relevant quarterly change, we'd have to compare such adjusted real clothing sales for April and May with the similarly adjusted real clothing consumption for the 3 months of the first quarter, January, February and March, and then repeat that process for each other type of retailer, obviously quite a tedious task to undertake manually. The short cut we usually take to get a quick and dirty estimate of real sales is to apply the composite price index of all commodities less food and energy commodities, which was down 0.2%, to retail sales less grocery, gas station, and restaurant sales, which accounts for nearly 70% of aggregate retail sales. Those sales were up by just about 0.3% in April, while their composite price index was down 0.2%, meaning that real retail sales excluding food and energy sales were up by roughly 0.5%. Then, for the rest of the retail aggregate, we find sales at grocery stores were up 0.3% in May, while prices for food at home were down 0.5%, suggesting a real increase of around 0.8% in the quantity of food purchased for the month. Next, sales at bars and restaurants were up 0.8% in dollars, but those dollars bought 0.2% less, so real sales at bars and restaurants were only up by about 0.6%. And while gas station sales were up 2.2%, gasoline prices were up 2.3%, suggesting a real decrease in the amount of gasoline sold, with the caveat that gas stations sell more than gasoline, and we don't have the detailed info on that. Weighing the food and energy components at roughly 30% of total retail sales, and core sales at 70%, we can estimate that the aggregate of real retail sales in May were up slightly more than 0.5% from those of April…

Next, to get an approximation of the real adjusted changes for April and May to the 3 months of the first quarter, we use Table 7 in the pdf for the April personal income and outlays report, which shows real sales of goods were up 0.2% in February, up 0.4% in March, and up 1.2% in April. Normally, we'd have to adjust those figures for any revisions in the retail sales figures for those months, but since this months retail revisions are small fractions of 0.1%, we'll forgo that step today. Thus, without compounding, that leaves real inflation adjusted May retail sales roughly 1.7% higher than those of March, 2.1% higher than those of February, and 2.3% higher than those of January, or, on average, more than 2.0% above the real retail sales of the first quarter. In national accounts terms, that's real growth in consumption of goods at an annual rate of over 8.1%, a pace that would add at least one-third of 1.92 percentage points to 2nd quarter GDP (ie, since May is one-third of the 2nd quarter). That follows an April contribution to GDP from real goods consumption equivalent to one-third of 1.35 percentage points, which we incorporated into our calculation of the impact of the April incomes and outlays report of two weeks ago. Thus, even if June retail sales are flat, personal consumption of goods would add 1.73 percentage points to 2nd quarter GDP...

(note: the above was excerpted from my weekly synopsis at Marketwatch 666)

it is looking like Q2 GDP

is going to be fairly solid so that makes Q1 just a bump. TBD on the employment report but the recent follows Q1.

inventory wild card

April inventories were up 0.1% with a 0.2% increase in producer prices...it's only one month, but if it doesn't improve it could wipe as much as 200 basis points off GDP...

rjs