The Federal Reserve's consumer credit report for May 2012 shows a 8% annualized monthly increase in consumer credit. Revolving credit surged, 11.2%, and nonrevolving credit increased 6.5%. The Credit Kraken comes out of it's cave.

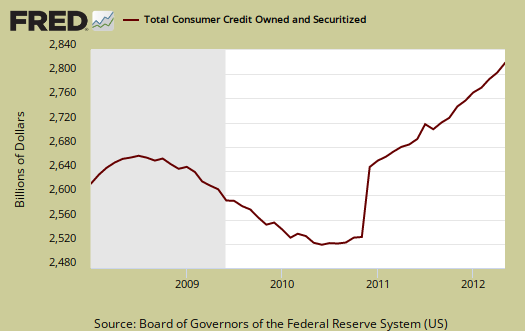

Overall consumer credit increased $17.1 billion dollars to $2.573 trillion, seasonally adjusted. Revolving credit increased $8 billion while non-revolving increased $9.1 billion. Revolving credit are things like credit cards and non-revolving are things like auto loans and student loans. Mortgages are not included in this report.

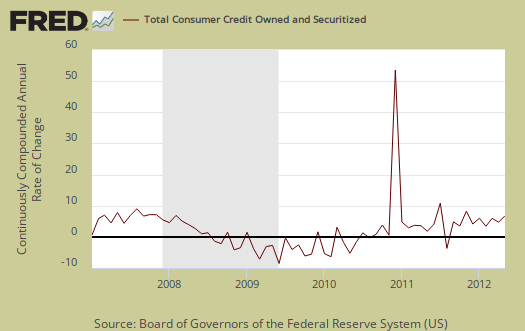

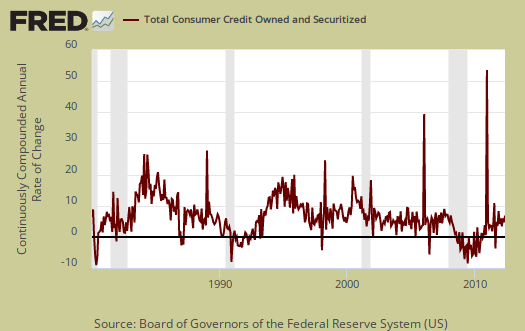

The report gives percent changes in simple annualized rates, also known as a continuously compounded annualized rate of change. Below is the graph of the monthly annualized percentage changes in consumer credit going back to 1980. Monthly consumer credit hasn't increased this much since September 2007, when computer credit showed an 8.1% monthly increase.

From the above graph we can see outstanding consumer credit drops correlate to recessions. This report does not include charge offs and delinquencies, which hit another low, October 2007 levels, in May:

Securitized credit card charge-offs in the US declined 31 basis points in May to 4.90% from 5.21% in April, according to Moody's Credit Card Indices. The drop more than reversed an anomalous one-month increase in April, says Moody's in the index report "Credit Card Charge-offs Fall in May; Payment Rates Reach Another All-Time High."

The May decline in the charge-off rate index is consistent with Moody's forecast that the index will continue to fall lower in the coming quarters to reach about 4% by the end of 2012.

The delinquency rate and payment rate indices also improved in May, underscoring the exceptionally strong credit quality of securitized credit card receivables in the US, and the payment rate reached a record high.

The delinquency rate continued to improve in May, declining 12 basis points to 2.47% from 2.59% in April. Typical for this time of year, the improvement led to a fourth consecutive monthly record low.

The early-stage delinquency rate also reached an all-time monthly low of 0.65% in May, down a single basis point from 0.66% in April.

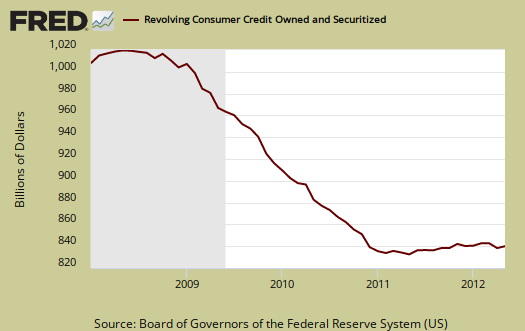

Below is total consumer credit.

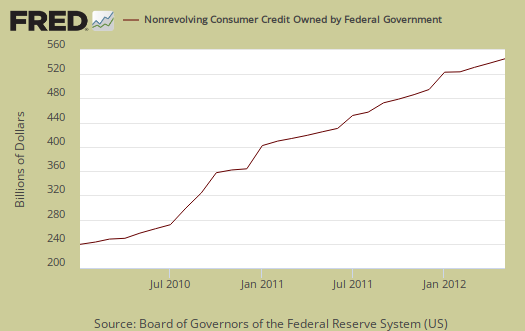

Student loans continue to roar. Federal government nonrevolving credit, which includes student loans increased another $6.2 billion to $464.9 billion, not seasonally adjusted. The federal government started making 100% of guaranteed student loans in July 2010. People went more into debt, clearly, to pay for the soaring, absurdly high, educational costs.

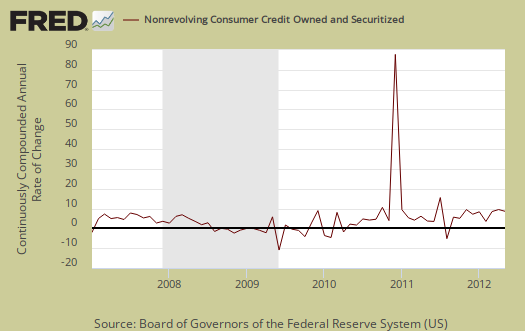

Below is non-revolving credit, seasonally adjusted, annualized percentage change.

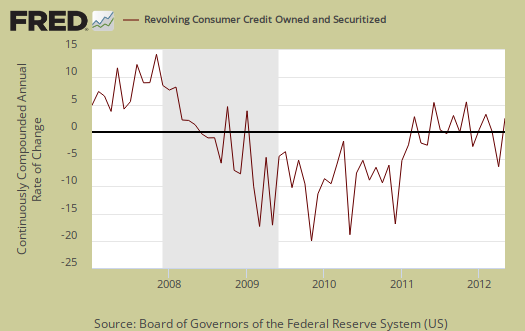

Revolving credit, think credit cards just soared, mainly from banks. Finance companies revolving credit actually dropped by $7.9 billion. Charge offs are not included in this report. These numbers are seasonally adjusted.

From the graph below, we can see revolving credit had the highest increase since November 2007 when revolving credit increased 12.3%.

Other press claimed the increase is due to a better economy. We think differently, what is offered shows a better economy, but what is actually used of consumer credit is simply not good news. People don't go into more debt unless they have to, although offering up more debt implies banks think people can pay it back. Students who have reasonable tuition and can get part-time jobs don't go into absurdly high debt. Parents who have careers and savings to help their kids pay for college don't go into debt either. Most importantly, people with good incomes do not go into debt.

I'm leery of private debt bubbles

"People with good incomes do not go into debt." You nailed it.

Increasing private debt could be a sign of increased confidence about the future -- or it could be a sign of desperation, if people in dire straits feel compelled to use their credit cards as a last ditch effort to maintain their standard of living.

The problem with personal debt is that it has to be paid back. A private credit bubble can stimulate the economy for a few years, but it's not sustainable.