Greetings everyone, and welcome to a new edition of the Manufacturing series! Been ill again, so haven't kept up. Rest assured, I'm in somewhat top form now. But enough about me, we got manufacturing stuff to talk about! Some interesting news out there, but first, of course the Numbers!

The Numbers

Times have been tough for manufacturing, we all know this. And the current business cycle has been especially cruel. Month after month of job losses, plant closures, the pairing down of work hours, you name it. In some places, this has sadly been old hat, just ask the folks around Detroit. It's as if you could amalgamate this country's industrial base as a very large person, say back to the middle of the last century, and is now looking like one of those sickly persons one sees in a famine. But could we start seeing a bottoming?

Now no one is saying that this is the deepest point in the economic valley where things begin to look up. Please take a gander at the chart above. It is the latest update on the Manufacturing Index produced by the Institute of Supply Management (ISM). For the folks new to this column, the ISM Manufacturing Index registers the health of the business of this nation's industrial base. Anything above 50.0 means that there is expansion, where as anything below is the opposite. As you can see, we've been on a ski slope of destruction. The latest figure for February (the index reflects the previous month) came in at 35.8, marking a second month of increases; the previous month was 35.6. While still in the below 50 area, the consensus for February was supposed to be 33.8!

Could this be the mark of a total recovery? Probably not, if you look back in Jan '05 through October of '05, you'll see another "recovery." But what has got me interested, is that the increases have come from months of massive drops (look at April through December of 2008). Unless we're going to zero, there is only so much one can squeeze out of manufacturing. Indeed, there is a story below that shows what I'm talking about. We may not be on the road of recovery, instead we have where the rate of change of going down is shrinking but we could be establishing some kind of "floor" . What this means for jobs remains to be seen.

Our next indicator is Factory Orders. Now Factory Orders are what the name implies, new orders and deliveries from such places. The indicator is also a lagging one, with the recently released one reflecting the month of January. Still, this "rear-view window" sorta acts as a confirmation.

As you can see from that chart, we had something of a pick up after a major crash. The latest figure, for January, came in at - 1.9%. I grant you, it's still in negative land, but given that the previous number was - 3.9%. On top of that, you had a consensus ranging from - 3.5% to as low as - 6%. So that almost minus 2 percent ain't looking that bad.

Going back to the previous ISM number, there is a good chance we could see a further uptick for the month of February in next month's Factory Orders. Of course, let's be open to the possibility that January could be an aberration and we could go back in the negative 3s region. Another route could be a flattening, like we inferred on our speculation on ISM, were we reach a "floor". But I still got that nagging suspicion that we could go from - 1.9% to perhaps - 1.5 % to even - 1%. We're still in the bad part of the business cycle, but it is a cycle and will turn....eventually.

Anderson, Indiana and Nestle become Coffee-mates

Many times a town or a city becomes one of those areas where a single company or one industry dominates the economy. That municipality's fortunes becomes meshed with that said business. And when that enterprise falters, so does that town or area; the area soon becomes the geographic version of a zombie, not dead but not really alive either (look at many townships in places like Michigan and Ohio). Yet, sometimes luck shines, and when one industry goes or becomes less dominant (in which you had a plethora of industries), another takes the mantle.

Anderson, Indiana was going through what I just mentioned above. Well actually, that's not entirely true. They did have other businesses like Northstar Aerospace and HDP Home Products, not to mention a university. But automobiles, that is the production and distribution of GM products, were a BIG business so much so that some considered it at one time a rival to Flint, Michigan. Sadly, in the wave of consolidations that General Motors initiated, Anderson became a casualty of this.

Yet now the town is getting a caffeine shot in the arm (sorry couldn't help it). As the Indystar and the New York Times is reporting, the beleaguered city is going to be home to a new Nestle plant.

Executives of Swiss food-maker Nestle on Wednesday commemorated its massive new plant, scaled to be one of the world's largest food-processing centers, handling 360 million tons of milk a year.

While it's unlikely that the 400 to 500 new jobs can offset the blow of General Motors pulling out 26,000 jobs in the 1990s, politicians at the event lauded Nestle as a food giant with a future.

"This is a truly great company," Gov. Mitch Daniels said. "In a worldwide recession, this company is growing."

- excerpt from "Nestle's grand opening is sweet for Anderson", IndyStar, 2009

Michael J. Hicks, director of the Center for Business and Economic Research at Ball State University in Muncie, Ind., said the new plant was part of Anderson’s effort to recover from “the G.M. hangover” — an affliction that more cities will face as G.M. continues to shut plants.

“What we have experienced is a lot of jobs lost in an industry that, even when the plants were here, was subject to boom and bust,” he said. “Anderson is trying to replace that highly cyclical industry.”

- excerpt from "Piecemeal Recovery Fills Void in a Former G.M. Town", NY Times, 2009.

Nestle's plant will become the nexus of it's production and distribution of the Coffee-mate and Nesquick for North America. The average wage at the plant will be between $16.50 to $24/hr with full benefits. It's expected to employ approximately 500 people. Lastly, the plant will be employing the latest in environmentally-friendly technology and methods for production.

A lean, mean...manufacturing machine?

Year after year, you read about it, job losses, factory closures, complete product line terminations. American manufacturers, facing what is now decades-long onslaught from relatively-extreme low wage foreign competitors, had to cutback and find ways to maximize productivity. Something had to give.

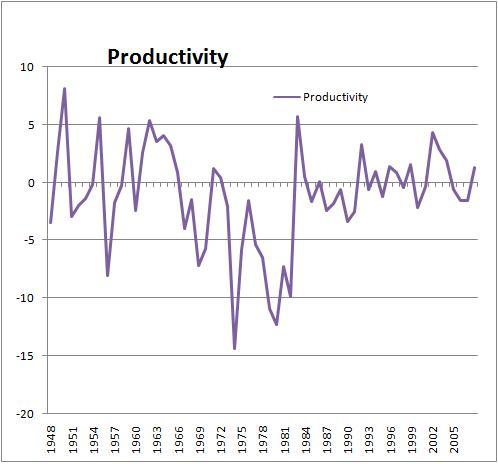

(original data courtesy of the Bureau of Labor Statistics, provided gratis via Moody's Free Lunch site)

Please take a look at the chart above, but first let me appologize, I used the free data provided but needed to merge the data. Unfortunately my Excel skills, well my MS Paintbrush skills I should say, aren't that great. The chart above is the annual percentage changes in both output per worker and unit labor costs. What I'm trying to show is the impact of the economic war on America's factory floor...via charts. We've all see the employment charts, but I needed show how industrial concerns needed to "improve" productivity. Now American workers, at least this author's opinion, have always been good productive folk. But economically speaking, we haven't been, well for the lack of a better set of terms, relatively affordable.

Now please, don't think I believe we should work for slave wages or anything like that (I would think by now you would all know me better than that), that's not what I'm trying to say. Just that costs of employment tend to go up and down here. The American worker has been fighting to maintain a decent standard of living, but unless the whole globalisation game comes to a grinding halt we will be in competition. They say that experience through battle makes us wiser and better in our craft. The chart below is a spread or difference of the two factors mentioned in the previous graph.

You will notice that the rate of change for the most part has been positive. Like I said, American workers are a hard working bunch! But there have been times when we've had a net loss. This mainly stems when output per worker is less than unit labor costs. The first half of the chart shows a downward trend, bottoming out around 1972. From then on, "productivity" or the difference between output per worker and unit labor costs begin to trend up. What gives? Well it was the same year that Nixon went to China, and from then the (my opinion) parasitic relationship with the Peoples Republic began between our industrialists and their armada of peasants and our wallets. Work had already to trend towards the "cheap labor mecca of the day", Japan, but they started to get "expensive" relative to the new pool of labor that just opened up because of our opening of relations with Beijing. But of course, it wasn't just China, other (primarily Asia-Pacific) countries began manufacturing deals as well. The 1980s saw the development of trade deals and even a full blown free trade zone with our North American neighbors by 1994.

Let's fast forward to the present. Years of looking to make our manufacturing base as efficient as possible may have reached a bottleneck of sorts. The Wall Street Journal has a piece that basically tells us that we've cut as much of the workforce as we can in many manufacturing industries. While others may point to excess capacity in the auto sector, the story is much different in other places.

SPARTANBURG, S.C. -- At a factory here that churns out plastic parts for everything from spray cans to blasting caps, laying off just one worker can be more trouble than it's worth.

The plant, owned by Cleveland-based Parker Hannifin Corp., has become so lean over the past decade that many assembly lines run with only a handful of highly trained workers.

- excerpt from "Lean Factories Find It Hard to Cut Jobs Even in a Slump ", Wall Street Journal, 2009.

But still the winds of the business cycle cannot be ignored. Given how stretched that they are, manufacturers are now looking towards cutting hours instead of people. And if some areas of the business need not be looked at, workers are being trained to work on something else within the range of products a company may make.

In the years of battling it out with foreign competitors, companies have been looking in ways to get things done faster or with less people. Technology has played a key role here. There are now many lines of assembly work that once was done in groups, that today a single trained operator can do. Of course, this has all come at a steep price.

Streamlined production and technological improvements also mean fewer jobs need to be cut in a downturn. In another section of Parker's Spartanburg plant, two long rows of machines churn out plastic tubes for blasting caps. The small explosive devices are used by construction and mining companies to clear debris. With demand down for blasting caps, Parker recently went from making them on two shifts to just one.That move cost the jobs of two workers who ran those machines on a second shift. A decade ago, those same two blasting-cap lines required up to eight people to operate. Eliminating production on that second shift would have meant shedding four times as many workers. The labor-saving improvements included replacing nearly 400 mechanical rollers that required workers to painstakingly apply lubricant throughout the workday. Now the line has mechanisms that don't need oiling.

- excerpt from "Lean Factories Find It Hard to Cut Jobs Even in a Slump ", Wall Street Journal, 2009.

Could this be the future of manufacturing in America? Smaller more efficient factories home to a smaller number of humans on the line. Machines taking on batch jobs, or perhaps even near-total automation of an entire product line? Something along those lines has already been going on in the automobile industry.

At one time, our nation was home to giant manufacturing concerns, "company towns" where you had some massive complex. One had in many instances generations going from the high school classroom to the shop floor training and getting on the line. The new blue-collar (or do we dub them green collar now?) most likely will require more training than her or his predecessors. American manufacturers will most likely continue to face low-cost human labor in foreign lands, efficiency especially through technology is beginning to look like a must for survival. Of course, as companies get "leaner" and "meaner", what does that mean for the average blue-collar person's survival?

I think what Lynn Mahuta, the CEO of a local manufacturing concern mentioned in the article said it best:

"The highly skilled person, you're not going to lay them off," says CEO Lynn Mahuta. "You will find other work for them to do."

Folks, that means investing in our education system! Time to rebuild our schools. Time to reinvest in whatever is needed to making sure our children now only can read and do math, but also is prepared to take on ever more complex things. Time to get our culture to promote learning, reading, and what have you. I remember growing up, this country seemed to have an antipathy towards school or trying to learn, often osticising kids who showed any intellectual spark. We talk about the school system, but this also has to move on to outside the classroom. Our culture must be molded to foster learning and promote academic achievement (to you theocratic hard right social conservatives, I basically mean "make learning cool" so drop the Intelligent Design garbage!). Because folks, time is not on our side.

Comments

Welcome BACK JV!

Glad to see your post! We missed you and these updates.

On education, honestly they are so busy trying to labor arbitrage educated workers in the U.S. believe me, they will be after those jobs too through "guest worker Visas"...

but if we could get some sanity by putting U.S. workers first for jobs in the U.S....

I can see this smaller work group with advanced manufacturing skills be a way out.

Glad to see Anderson got a chocolate factory too as well as you mention local economies diversifying. That's one thing about Detroit, but my impression is they are diversifying too.

Why thank you, Robert.

It is good to be back, my good man. There is so much work that we need to do to get this country back on its feet. Regarding education, if the "Visa people" don't take away jobs or help get us more jobs, I'm fine with it. But if the end result is a net negative on this front, well, you know where I stand.

Applied Deflators & Outsourcing

I could work for $20/day, too if my housing expense was

$85/mo., which is basically what it is in those outsourced zones.