The most widely watched release the past week was on retail sales for February from the Census Bureau; but there were also two Census reports on January inventories which will contribute to that major component of first quarter GDP: January wholesale trade and January business inventories. Furthermore, we also saw the release of 2 price indexes that will be used in computing the deflators for 1st quarter GDP; the import and export price index for February and the producer price index for February, both from the BLS Bureau of Labor Statistics. This post looks at the wholesale sales, business inventories, and producer prices reports.

January Wholesale Sales Drop 3.1%, Wholesale Inventories Rise 0.3%

The first release we saw on sales and inventories last week was the Wholesale Trade, Sales and Inventories Report for January (pdf) from the Census Bureau, which estimated that seasonally adjusted sales of wholesale merchants fell 3.1 percent (+/-0.5%) to $433.7 billion from the revised December estimate of $447.4 billion, and was down 1.0 percent (+/-0.9%) from January a year earlier. The December preliminary sales estimate was revised down $2.4 billion or 0.5%, and hence is now 0.9% lower than November. Wholesale sales of durable goods were down 1.4 percent (+/-0.9%) from December but were up 5.2 percent (+/-1.2%) from January a year ago, as wholesale sales of electrical equipment and appliances, metals and minerals, and miscellaneous durable were all down by more than 4%, while wholesale sales of automotive equipment rose 2.5%. Seasonally adjusted wholesale sales of nondurable goods were down 4.6 percent (+/-0.9%) from December and down 6.7 percent (+/-1.2%) from last January, as wholesale sales of petroleum and petroleum products fell by 13.5% for the month and 37.1% year over year, largely due to lower prices. However, even excluding oil sales, wholesale sales of non durable goods were still down 2.2% in January, as all wholesale sales of nondurable goods other than paper and alcohol were lower.

This release also reported that seasonally adjusted wholesale inventories were valued at $548.7 billion at the end of January, 0.3% (+/-0.4%)* higher than the revised December level and 6.2% (+/-0.7%) above last January's level, while December's preliminary inventory estimate was revised down by $0.7 billion, or 0.1%. Wholesale durable goods inventories were up 0.6 percent (+/-0.4%) from December and up 7.7 percent (+/-1.1%) from a year earlier, as inventories of electrical equipment and appliances rose 2.4% and automotive inventories rose 1.6%. Inventories of nondurable goods were down 0.1 percent (+/-0.4%)* from December while they were up 3.7% (+/-1.1%) from last January, as wholesale inventories of farm products fell 4.6% while wholesale inventories of paper and paper products were 3.0% higher and drugs and drugstore sundries inventories were up by 1.7%. Note that the asterisks where included here indicate that Census does not yet have sufficient statistical evidence to determine whether inventories actually rose of fell for the periods indicated. Due in part to the distortion caused by lower petroleum prices, the closely watched inventory to sales ratio of merchant wholesalers rose to 1.27, up from 1.22 in December and up from the inventory to sales ratio of 1.18 in January of last year, as the inventory to sales ratio for petroleum and petroleum products, which was originally about 12% of wholesale sales but just 3% of wholesale inventories, rose from 0.34 to 0.39.

In judging how this report might affect GDP, we have to remember that GDP only includes adjusted final sales and inventory as a means of measuring of our output of goods and services, so the value of wholesale products exchanged is not a GDP factor itself, but only insofar as the value of the trading margin extracted, which would be included in PCE under "other services". However, the change in private inventories is a major factor, but that has proven to be not as easy to compute as we have done in the past. The problem is that some inventories may be "on the shelf", so to speak, for more than one month, the value of which is not changed for GDP accounting purposes while it sits there. In addition, different companies use a wide variety of accounting methods in valuing their inventories, such as LIFO, FIFO, average cost or weighted average cost, all of which the BEA adjusts for before including that in the their totals (see the National Income and Product Accounts Handbook, Chapter 7 (22 pp pdf), for details). Thus our blanket deflating of wholesale inventories with an appropriate index from the producer price index does not capture all of these adjustments, which led us to a big miss when we tried to gauge the impact of December inventories on 4th quarter GDP revisions. So while an increase of 0.3% in January wholesale inventories deflated with the 2.1% decrease in prices for January wholesale goods would seem to imply a 2.4% monthly increase in real inventories, or growth at a 33% annual rate, we now know that an undetermined amount of those inventories were accounted for in prior months, and adjusted for accounting methods and inflation appropriately at that time, and the information we'd need to mimic the same calculation is not available to us on any BEA site we know about..

January Business Sales Fall 2.0%, Business Inventories Unchanged

Following the release of retail and wholesale reports, Census released the composite Manufacturing and Trade Inventories and Sales report for January, which is covered in the media as the "business inventories" report, and which includes the wholesale sales and inventory report we just reviewed, the factory shipments and inventories we reviewed last week, and retail sales and inventories, the later of which is also available as an excel file here. This report estimated the combined value of seasonally adjusted distributive trade sales and manufacturers' shipments was at $1,302.5 billion in January, down 2.0% (±0.2%) from December, and down 0.3% (±0.3%) from the total monthly sales of January of last year. To recap, manufacturers sales were estimated at $479,126 million, down 2.0%, retailer's sales were estimated down 0.9% at $389,684 million and, as previously noted, sales of merchant wholesalers were down 3.1% and accounted for $433,730 million of the overall total. Once again, much of the drop in business sales was associated with January’s lower oil prices, as even manufacturer's sales are more than 10% shipments from refineries...

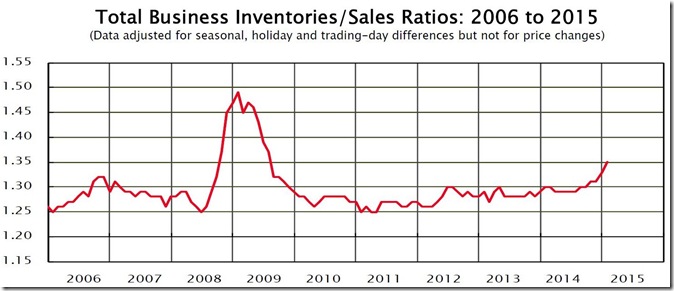

Meanwhile, total manufacturer's and trade inventories were estimated to have been unchanged (±0.2%)* from December to a seasonally adjusted $1,761.7 billion at the end of December, which was up 3.9 percent (±0.5%) from January a year earlier. Seasonally adjusted inventories of manufacturers were estimated to be valued 0.4% lower at $650,469 million, inventories of retailers were estimated to be valued at $562,520 million, statistically unchanged from December's $562,601 million, and inventories of wholesalers were estimated to be valued at $548,720 million at the end of January, up 0.3% from December. The month end total business inventories to total sales ratio, the metric which is widely watched to determine if inventories are becoming excessive, was at 1.35, up from 1.33 December and up from 1.30 in January a year ago, again likely distorted by record high petroleum inventories. Nonetheless, many financial writers are becoming excited about the historical trend of this ratio shown below:

Now, as we've pointed out, the dynamic of this ratio changes when oil and oil products fall in price precipitously, because much more oil products are sold than are inventoried, and hence overall business sales go down more than inventories do when oil prices drop. If we look at retail inventories, however, we note that this ratio is actually falling year over year for every business type except for food stores, clothing stores and gas stations, which means most retail inventories are lower than last year. The ratio for types of wholesalers is more mixed, with hardware and metal wholesalers seeing relatively large inventory to sales ratio increases, but again price might play a role in the later. A similar mixed situation exists with factory inventories, but the overall inventory to shipments ratio for manufactures has only risen to 1.36 from 1.34 a year ago, despite the distortion caused by the rising ratio for refineries...

Producer Prices Turn Negative Year over Year in February on Largest Ever Drop in Demand for Services

The Producer Price Index for February from the Bureau of Labor Statistics now indicates that producer prices have fallen by 0.6% from a year earlier, the first negative year over year reading since the depth of the recession, as the seasonally adjusted producer price index for final demand fell 0.5% in February, after falling 0.8% in January, 0.2% in December, and 0.3% in November. Unlike those previous months, however, the price of oil & oil products was not a major factor, as lower prices for final demand for services, down 0.5%, accounted for 70% of the February drop, while final demand for energy was unchanged.

The price index for final demand for goods, aka 'finished goods', fell by 0.4% in February, moderating after falling 2.1% in January and 1.1% in December, as the price index for final demand for foods fell 1.6%, in part due to a 17.1% drop in prices for wholesale fresh and dry vegetables while only wholesale fresh eggs, up 12.5%, saw a double digit price increase. The index for energy prices was unchanged as a 1.5% increase in wholesale gasoline prices was offset by a 1.5% drop in wholesale diesel fuel, while wholesale home heating oil rose 9.9% and residential natural gas fell 2.1%. The index for final demand for core goods also fell by 0.1% in February, as producer prices for mens and boys clothing fell 3.0% while wholesale women's and girls clothing prices rose 1.7%.

Meanwhile, the index for final demand for services fell by 0.5%, as both the margins for final demand for trade services and the index for final demand for transportation and warehousing services dropped 1.5%, while the index for final demand for services less trade, transportation, and warehousing services rose 0.3%. Big swings in the services included a 16.2% increase in margins for TV, video, and photographic equipment retailers and a 13.4% drop in margins for fuels and lubricants retailers such as gas stations...

This report also showed the price index for processed goods for intermediate demand fell by 0.6% in February, after a 2.8% drop in January, leaving intermediate processed goods 6.4% lower priced than a year ago. That included a 1.9% drop in the index for processed foods and feeds, a 0.6% decrease in prices for intermediate energy goods, and a 0.4% decrease in the price index for processed goods for intermediate demand less food and energy. In addition, the price index for intermediate unprocessed goods fell by 3.9%, after falling 9.4% in January and 6.4% in December and is now 25.0% below the level of a year ago, on a 6.7% drop in the index for unprocessed foodstuffs and feedstuffs led by a 21.9% drop in prices for slaughter hogs, while even the index for other raw materials fell 1.6% on a 19.3% drop in scrap iron and steel prices and a 11.2% drop in raw natural gas prices.

Finally, the price index for services for intermediate demand rose 0.1% in February, as a 0.8% decrease in the index for transportation and warehousing services for intermediate demand was offset by a 0.2% increase in prices for intermediate services less trade, transportation, and warehousing and a 0.1% increase in the index for trade services for intermediate demand. Over the 12 months ended in February, the price index for services for intermediate demand has risen 1.2%...

(the above has been cross-posted from Marketwatch 666)

Comments

Pointing to slowdown everywhere except Wall Street

Seems we have slow down, sluggish reports everywhere except our great divorced from the real economy Wall Street.

They all are busy timing the Fed interest rate rise but I wonder if they will considering.