Back in August 2007 I wrote a diary entitled, Are Hard Times near? The Great Decline in interest rates is ending, that began:

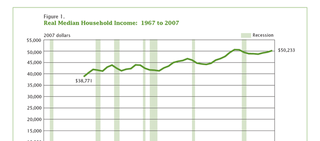

The American consumer has had largely stagnant wages since 1974. While from 1980 through 2006, the median income of an American household has risen only from $39,700 to $48,200 in real terms, house prices for example have shot up form nearly $125,000 to $246,500. Consumers have responded generally by taking on more and more debt. Total household debt service has risen from 16% in 1980 to 19.4% in 2006.

Fortunately for consumers, there has been a generation-long decline in interest rates since they peaked at 15.21% for the 30 year US Treasury bond in October 1981. This has allowed consumers to refinance their debts at ever lower rates every few years. They have also been assisted by a bull market in stocks that took the S & P 500 from 102 in 1982 to 1553 in 2000, and the subsequent housing boom/bubble.

There are signs that this "Great Disinflation" of declining interest rates is coming to an end. Only twice in the last 27 years has the consumer been unable to refinance debt or tap into his or her stock or house ATM. Below I will show you that the 3rd and final time is almost certainly near.

My thesis in this diary is a simple one. Wages for middle and working class Americans have not improved significantly since the 1970s....Thus, the only way American consumers have been able to significantly improve their lifestyles is either to take on debt, using assets which have appreciated in value as collateral, or to refinance their debt at lower interest rates. If consumers are unable to tap the value of assets, or to refinance, then without improvements in wages, they will pull back and cause a consumer-led recession.

In that diary, I showed how wages, stock prices, home prices, and interest rates had all been simultaneously stagnant only twice since 1981, precisely coinciding with the 1982 and 1991 recessions. I noted that it appeared we were on course for the third such event.

That prediction has finally been shown to have come true, via data from the second quarter of this year that was just published within the last month.

Recently the Census Bureau updated its data on household income, showing that once again in 2007, the median American household was still making less than it had at the peak of the last expansion in 2000.

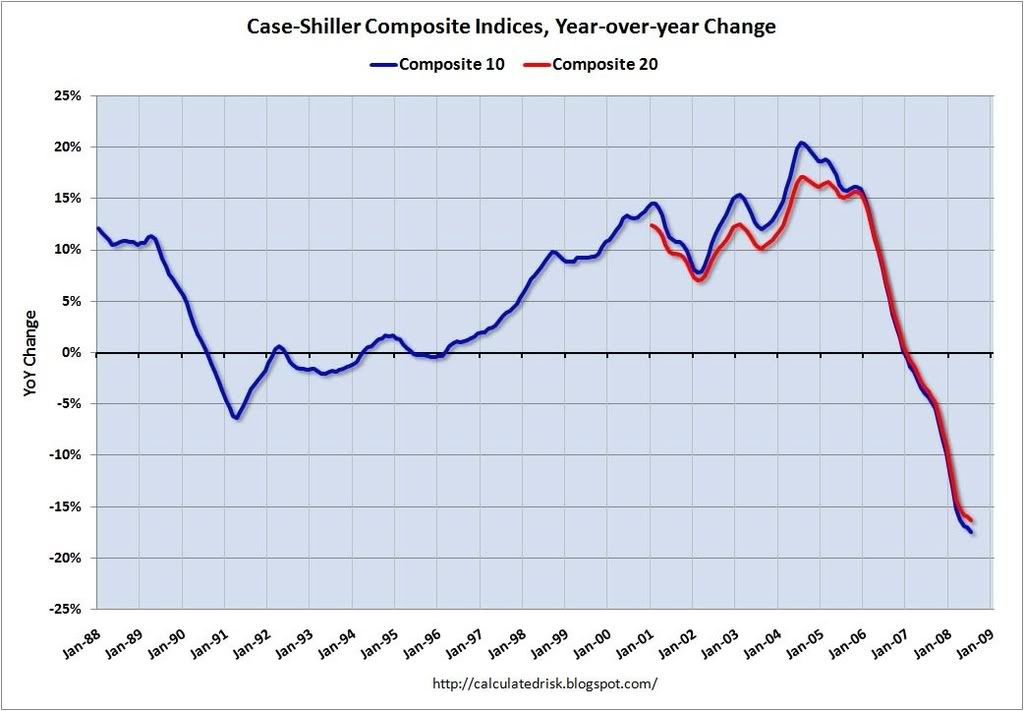

Thus to fuel expanding consumer expenses, either house prices or stock prices on investments would be necessary. But for the first time since 1991, neither were appreciating. In fact, over the last year, both housing and stock prices have deteriorated badly. Here is the Case-Schiller housing index for August 2008, showing a 16% or more decline since the previous year:

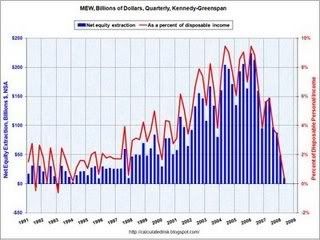

As a result, borrowing against Home Equity as virtually stopped as of the second quarter of 2008:

(Courtesy Calculated Risk).

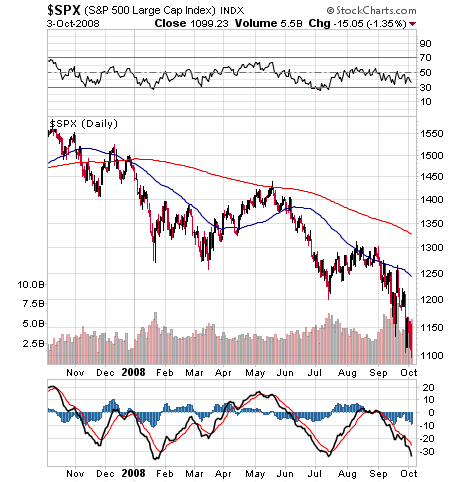

And here is the chart of the S^P 500 from October 2007 through early October 2008, showing approximately a 30% decline in stock prices:

Meanwhile as shown by the blue line in the below graph, interest rates have still failed to make a new low since 2002. They have essentially trended sideways for 6 years, denying consumers the chance to refinance debt at lower rates:

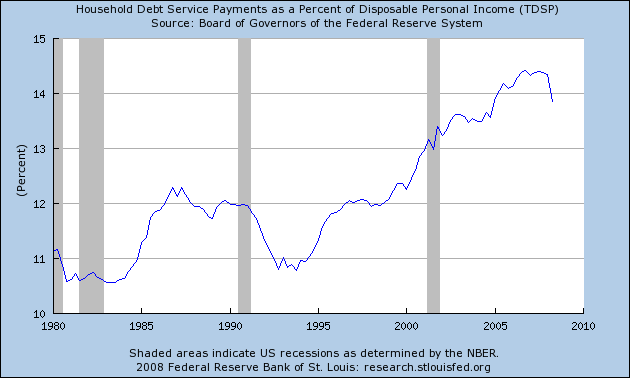

With no increase in real earnings, no ability to refinance home equity, no ability to cash out stock market gains, and no ability to refinance at lower rates, American consumers are retrenching for only the third time in over 25 years, choosing to pay down debt instead of consume. The final piece of information is shown on this graph from the Federal Reserve, just released a few weeks ago, showing household debt obligations as a percentage of disposable income as of the second quarter of this year:

This is only the third time since 1981 that consumer debt has decreased by 1/2% or more. Both previous times were associated with recessions.

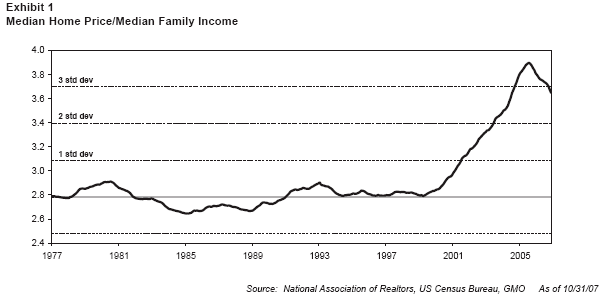

With all avenues of increased spending cut off, American consumers started to retrench earlier this year, a retrenchment that has increased substantially in the last month or so. And there is a long way to go before the problem is resolved, Here are two graphs showing the ratio of median home prices to median income:

and also the ratio of median home prices to disposable income:

As the New York Times noted yesterday:

In response to the falling value of their homes and high gasoline prices, Americans have become more frugal all year. But in recent weeks, as the financial crisis reverberated from Wall Street to Washington, consumers appear to have cut back sharply. ....

Recent figures from companies, and interviews across the country, show that automobile sales are plummeting, airline traffic is dropping, restaurant chains are struggling to fill tables, customers are sparse in stores.When the final tally is in, consumer spending for the quarter just ended will almost certainly shrink, the first quarterly decline in nearly two decades.

Both of the last two charts above are slightly dated at this point, but suffice it to say, until house prices retreat to their historical norm, it is doubtful that neither are stock prices likely to make new highs, nor are consumer interest rates are likely to decline to new lows as they had in previous recessions. It will be quite some time until the forces unleashed in this "slow motion bust" are sufficiently favorable so that the American consumer will return to economic health.

Comments

spot on

While I doubt they will get that the middle class is the economy, you would think that by now they realize they have already squeezed every damn dime from them and there simply is no more.

Great post New Deal, sums the situation up perfectly.

FCI

This graph if from Seeking Alpha and is saying this private index FCI:

They are saying the pullback from consumers will cause a recession. This country is so whacked....moving to push the American people as nothing but shoppers and not strongly pushing to revamp a production economy and do something about bad trade deals, admit they are not working...is apparently the thing these ideologues will never consider.