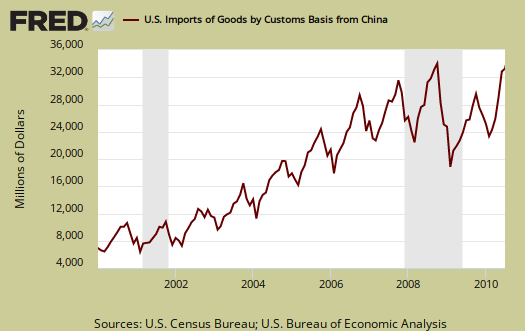

A little noticed bill was voted out of committee Friday from the House Ways and Means Committee, H.R. 2378, the Currency Reform for Fair Trade Act. This bill finally addresses China's currency manipulation by enabling tariffs. It passed out of committee by voice vote and all it will take to pass is to hear from constituents demanding Congress do so. The Senate version of the bill is S. 3134. You have to be brain dead to not see China is artificially keeping their currency exchange rate low for a trade advantage and have no intention of allowing the Yuan to float. If you don't believe that, believe this graph below. It's the China imports into the United States.

China's currency is considered undervalued by 23%-40%. Economist Robert Scott estimates the United States will lose half a million jobs to China in 2010 alone. Fred Bergsten of the Peterson Institute estimates China's currency manipulation costs the United States 1.4 percentage points in GDP annually. Anyone reading this site knows in every trade report, China is by far the largest contributor to the U.S. trade deficit. Below is a summary of the bill passed out of the committee:

H.R. 2378, AS AMENDED, IS WTO-CONSISTENT

As amended, H.R. 2378 is WTO-consistent because countervailing duties may only be imposed when Commerce finds, based on an assessment of all the facts, that the WTO criteria for an export subsidy have been satisfied, i.e., only if: (1) the foreign government’s interventions in the currency markets result in a “financial contribution”; (2) a “benefit” is thereby conferred; and (3) the resulting subsidy is “contingent on export”.

The key element of the amended bill – indicating to Commerce that it may no longer dismiss a claim based on the single fact that a subsidy is available in circumstances in addition to export – is consistent with WTO precedent. One relevant case is the U.S.-FSC case, which expressly stated that a subsidy may still be export contingent, even if it is available in some circumstances that do not involve export.

Importantly, the amended bill does not legislatively “deem” that a finding of fundamental currency undervaluation satisfies the requirement of export contingency, as the original bill did. With the elimination of this requirement, as well as other changes, the amended bill avoids the WTO vulnerabilities that may have been attributed to earlier versions of the legislation.

Meanwhile as China moves quickly to be the world's dominant economy, believe this or not, they are still getting aid as if they were a poverty stricken 3rd world nation.

Aid to China from individual donor countries averaged $2.6 billion a year in 2007-2008, according to the latest figures available from the Organization for Economic Cooperation and Development.

Ethiopia, where average incomes are 10 times smaller, got $1.6 billion, although measured against a population of 1.3 billion, China's share of foreign aid is still smaller than most. Iraq got $9.462 billion and Afghanistan $3.475 billion.

The aid to China is a marker of how much has changed since 1979, when the communist country was breaking out in earnest from 30 years of isolation from the West. In that year, foreign aid was a paltry $4.31 million, according to the OECD.

Today's aid adds up to $1.2 billion a year from Japan, followed by Germany at about half that amount, then France and Britain.

The U.S. gave $65 million in 2008, mainly for targeted programs promoting safe nuclear energy, health, human rights and disaster relief. The reason Washington gives so little is because it still maintains the sanctions imposed following the 1989 military crackdown on pro-democracy demonstrators at Tiananmen Square, said Drew Thompson, a China expert at the Nixon Center in Washington, D.C.

China is also one of the biggest borrowers from the World Bank, taking out about $1.5 billion a year.

Ever wonder about that? While America has over 14% of it's population in abject poverty, we and other nations are giving China poverty aid?

Roughly three-quarters of the world's 1.3 billion poor people now live in middle-income countries, according to Andy Sumner, a fellow at the Institute of Development Studies at the University of Sussex in the U.K.

That's a major shift since 1990, when 93 percent of the poor lived in low-income countries, Sumner said. It raises the question of who should help the poor in such places: their own governments or foreign donors?

Experts say it's hard to justify giving aid to China when it spent an estimated $100 billion last year equipping and training the world's largest army and also holds $2.5 trillion in foreign reserves.

The insanity abounds. Today the New York Times ran a story, Job Loss Looms as Part of Stimulus Act Expires. Now there was a minor, $1 billion direct hire jobs program, which assuredly the U.S. needed much more of as Stimulus. That said, buried in the story is the reason people lost their jobs in the first place, thus needing the government to step in and create one for them. The reason? Their manufacturing plant shut down and moved to Mexico.

In rural Perry County, Tenn., the program helped pay for roughly 400 new jobs in the public and private sectors. But in a county of 7,600 people, those jobs had a big impact: they reduced Perry County’s unemployment rate to less than 14 percent this August, from the Depression-like levels of more than 25 percent that it hit last year after its biggest employer, an auto parts factory, moved to Mexico.

The pure insanity of this is to go into debt to create jobs, all the while enabling more offshore outsourcing, more U.S. worker displacement and more corporations moving their manufacturing offshore. Trading people, trading jobs is not free trade. Trading finished goods is free trade, what U.S. trade policy is, particularly the China PNTR, is pure global labor arbitrage.

That's why this bill is so important. First, there is bi-partisan support to confront China on their currency manipulation. Second, American plain needs those jobs back. EPI estimates 2.4 million jobs were lost to China from 2001-2008 and now we have another half a million lost to China in 2010 alone.

One of the most odious current economic fiction is claiming unemployment is structural, a nice way of hiding the insult Americans are just too fat, lazy and stupid to do the jobs of tomorrow. This is a complete discriminatory, disgusting falsehood to the American people and also factually false. We have millions, literally millions of highly skilled and educated people needing a job right now. It is global labor arbitrage at play, not the quality of the American worker. The reality is when need to confront a host of policies which enable global labor arbitrage and are destroying the U.S. middle class. The structural issue is trade and other policies, not the U.S. worker and their skill sets.

Econbrowser did a back of the napkin estimate on just trade with China and the U.S. if China's currency was allow to appreciated 10%. Bear in mind, theoretical is not the real world, so this is a simplistic model.

A 10% appreciation of the bilateral yuan, holding constant other currencies, leads to a 10% reduction in US imports of Chinese goods in the long run, and a 16% increase in US exports of goods to China.

Some economists continue to be in denial, claiming China's wage inflation will take care of the trade deficit and level the labor costs playing field. Uh, yeah, in 50 years or so and by then, we'll all be dead and the United States will be in 3rd world status.

Corporate lobbyists, including many U.S. multinational corporations will lobby against this bill. Why? Because they don't give a rats ass about America. They want their cheap Chinese labor and their continual firing of American's like Schindler's List.

Comments

Also, End the Corporate Foreign Tax Credit

When Big Tech does business in China, their profits are taxed by the Chinese. Not to worry, because the U.S. Corporate Tax system allows a credit or deduction for the tax paid China against the total tax liability. The size of this credit in macro terms is about the size of the $70Bn annual cost ending the Alternative Minimum Tax for the top 2 Per Cent.

http://www.irs.gov/taxstats/bustaxstats/article/0,,id=210069,00.html

There is an unfolding debate here on the death of the AMT and other Bushie perks. My take is that it's time for let's make a deal. Informed folks know that by taking away a perk like the FTC, Big Business will find other tax strategies. So if Exxon loses the FTC, Exxon can find Intangible Drilling, Depreciation and other offsets. The U.S. corporate liability is like modern art: whatever Exxon and the rest want it to be.In 2009, Exxon paid $178Million on $50Bn of taxable profits.

The Business Round Table, Chamber of Communists and the Economic Suicide Lobby will scream that the End of the FTC is a tax increase. So, move the end of the Bush era Alternative Minimum Tax end ahead for a few years. Now for the Economic Suicide Lobby Bush Era Alternative Minimum tax is the Dutch Communist to blame for the Burning of the Reich Stag. The cause of the double-dip will then not be Credit, Trade and other macro forces but the tax increase on the rich.

The other side of the ideology war is how some Progressives will act on a discussion extending the Bushie AMT cuts. Some like to run the key along the bodies of the luxury cars, and I can't blame them but this does not give us something to use and win with.

This Administration owns a favorable end-game on this chess board, but they are not brave enough to play to win. With the AMT hostage, Obama could get much of what the Administration stood for before it abandoned 'Tit for Tat'.

Burton Leed

corporate taxes

Me thinks this might happen in the Lame Duck session (I would hope, instead they seem hell bent on "comprehensive immigration", which does jack for the unemployment situation, which should be their top priority!). But yes, this is simply the opening salvo.

So many Democrats promised trade reform and a host of other reforms which have been offshore outsourcing jobs in droves, esp. starting in 2000. Where is it? Where is any reforms? Instead we have the Obama administration toying with more FTAs! (more bad trade agreements modeled on NAFTA).

But this might be possible on the infamous "tax vote", ya know where the GOP is arguing to keep the Bush tax cuts (sigh) and on the other side, Democrats are busy with a lot of wasteful spending (not that the Republicans ever want to cut spending, except on the meager social safety nets still in place).

But getting this government to directly confront China on currency manipulation, when even the IMF has said as much (the OECD too), is like pulling teeth. I hope all contact their Congress representatives and the White House and demand they pass and sign this bill into law.

That said, this is just a 1st step.

Folks don't forget the arrows to move content to the front page

I think a lot of people are forgetting the arrows, which move content to the front page, alternatively, if you've got a really outrageous post, or spam, you can down vote it off of the site (use sparingly, only for real economic fiction, spam!)

Cogent points in the post and

Cogent points in the post and comments but I've reached the conclusion that the Democrat's aren't just spineless, they're simply playing the game of the folks that bought them (and the Republicans) - the same big playerz that continue to profit from the current trade regime. So while we can say there is "bipartisan support to confront China with their currency manipulation" and applaud HR 2378 passing out of committee, I have absolutely no confidence that we'll see anything but posturing or hear anything but blather - even if Obama signs it into law. Maybe when more sh!t hits the fan, we add another 20% to the ranks of the unemployed, pitchforks are selling briskly, and effigies of the president, prominent congressmen, and CEOs are burning in town squares . . . but I'm not holding my breath.

good points, the actual bill

gives authority to impose tariffs, but does not directly impose tariffs.

I agree, these Democrats are all posturing. To make matters worse, the "tax cuts" actually had the repeal of the foreign tax credit, another factor to lessen the incentives to offshore outsource jobs.

If they had any guts they would pass that as a stand alone bill. They won't act, then Republicans spin this crap to beyond the pale insanity and because Democrats do not act, they are sitting ducks...

and the American people, royally pissed Democrats didn't act....are going to vote in "worser" to office.

this vote is after midterms

but please write your reps regardless. This is being reported by Reuters (via Manufacture this).

House to pass Bill 09/29/10, today

The House took up a China currency manipulation bill and it's being reported to pass. When it does, I'll look over the bill text and see what it actually does.

We need our Congress to take some damn action on these global labor arbitrage issues! It's amazing how ignored they are and beyond the financial crisis, the implosion of construction, housing sector, bad trade, offshore outsourcing, insourcing, weakening of U.S. labor laws and so on have been decimating the middle class, on steroids, since 2000. It's been going on for over 30 years, but it's when two things happened, communications (Internet) costs dropped like a stone in 2000 and the China PNTR trade agreement was signed (again, 2000).

Chinese Currency Manipulation Bill passes House 348 to 79

Here is the roll call vote.

That's the bottom line, finally, finally, there is something all sides of the isle agree on. The corporate lobbyists are already at work, demanding this die in the Senate (where they have even more influence). But, that said, we have an actual shot and the reason is on this issue, currency manipulation, a slew of conservatives are in agreement with Progressives so we might have a shot at overriding the corporate and special interests.

You might note, if the House goes GOP, Boehner voted against this very obvious bill. The GOP members generally were split. Only 5 Democrats voted against this bill.

China Cuts Off Rare Earth to Japan

Rare Earth is used in semi-conductors, wind turbines magnets, LiPo batteries and a host of cutting edge stuff. It is a composite of 7 rare elements on the atomic chart. China cut off all trade with the Japanese on this stuff.

China Inc. controls over 90 percent of world-wide production. In 2007, Chinese Overseas Investment Company tried to buy the last major mine in the U.S. during the Chevron take-over attempt. Thank Lou.

MolyCorp is the sole domestic mine owner but not producing just looking for help at this time. China Inc. bankrupted RE producers in the 90s. Around the time of the WTO application by China. Australia also has some production. As policy, the U.S. should be standing shoulder to shoulder with the Pacific Alliance but sadly it is not. This one does not take legislation, it takes some Executive action.

This story is just a repeat of the Software Encryption key piracy, steel, semi-conductors and the rest. So to repeat the historical maxim: show me the volumes of trade on a map, I will show you where the next conflicts occur.

Burton Leed

from today, for a few days ago this was claimed to be false

although it amplifies the power China has, to control supply of rare Earth minerals.

Public Citizen, new trade center website

Has some good statistics on how many jobs were lost due to what bad trade deal with a separate section for manufacturing.

here.

Geithner Grumbles More on China currency manipulation

We have more grumblings, political maneuverings on China currency manipulation and after that, of course Geithner said "this takes time".

I think they should just do it, like ripping off a band-aid, apply the tariffs. They could do a scaling on them, whatever but get movin! It's obvious China will never do a damn thing and as it is, they should be preparing for counter moves from China. (I would hope!).

Also, they should be gathering up U.S. multinationals with manufacturing in China, finding out how long it will take for them to move manufacturing back to the United States!

At least he's grumbling.

What, Still Not Moved to Righteous Anger? Let AFL-CIO help.

The AFL-CIO has published a site with a search by zip of all the Corporate Outsourcers. It is heartening to hear the screams from the hangers-ons and defenders of outsourcing. There is said to be resentment, whatever that means.At some point, we cannot say when, society will evolve to the point where labor arbitrage is viewed as an economic equivalent of kidnapping or murder. Or we will enter a new Dark Age.

http://workingamerica.org/jobtracker

Burton Leed

Thanks Brleed

Generally if you see research or any actual databases on how many jobs are offshore outsourced, aggregator, I would like to see it. I cannot prove labor arbitrage in this recession yet but I strongly suspect it writing up all of these reports. Anything that moves us closer to quantifying the numbers is great info!

Following The Money From OnShore Shells Co's Campaign Donations

Maybe just warning the shell companies would be enough if they were smart of decent. What is about to happen is that lines will be drawn in the data from the hollowed out shell companies to the Federal Election data. FEC data is rich with company names. But just as in 1972, the criminals will figure the voters will be too dumb and lazy to connect corporate contributions with the foul stench emanating from the political campaigns.

Our good friends in the Chamber of Commerce have already been tagged with taking from China and Abu Dabi and funneling it into domestic campaigns. This should enrage at least 90 per cent of the electorate. It will get much more interesting when the connection is made between shell companies, CoC and the politicians.

Burton Leed