"Countdown to $100 Oil?!?" is my contrarian series on the direction of Oil prices. The premise of this series is that, even if we have arrived at the plateau of "Peak Oil", there will still be wild swings in its price (in fact, there already have been) and that demand destruction is taking place sufficiently such that oil will recross the $100 boundary before it ever reaches $200.

In the first installment, I argued that unsustainable heavy subsidies to the consumption of Oil in Asian economies, together with some evidence of hoarding of supply, and already apparent demand destruction in the US, meant that Oil was ready to decline below $100 sometime soon. Just a few days later, a number of Asian countries cut their subsidies, giving rise to my second installment.

Then Oil went on a sudden tear to $147+, before breaking down and by yesterday trading at $119.50, and at $118 this morning.

Since my first set of diaries, demand destruction in the US has continued, and now there is some evidence of demand destruction in China as well. In July the worm may finally have begun to turn. The price of a barrel of oil broke trend and went down from $147 at its high point to $119.50 yesterdy, a new short term low -- the first time that has happened in 6 months.

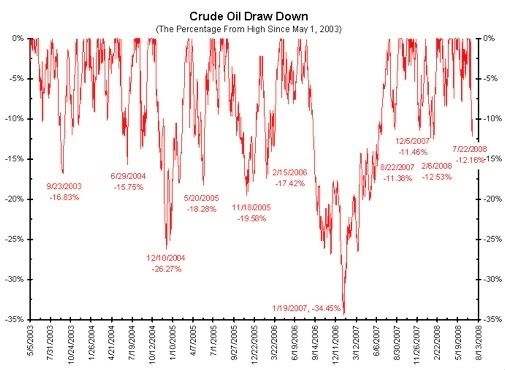

Even if you believe that long-term the price of oil must continue to rise due to the constraints of "Peak OIl", the record shows that there have been significant and sharp pullbacks in price a number of times in the last 5 years -- interestingly, with both of the biggest declines, at 26% and 34%, occurring during the autumns of Congressional elections in 2004 and 2006:

An equivalent decline now would take us back to $100/barrel Oil.

There has been a lot of speculation about whether speculation (ha!) or supply and demand was causing the surge in the price of oil. In the last two months we may have gotten a good answer. First, on June 6, as related by Bloomberg

Crude oil surged more than $10 a barrel to a record as the dollar weakened after the U.S. unemployment rate grew the most in two decades and Morgan Stanley said prices may reach $150 within a month.

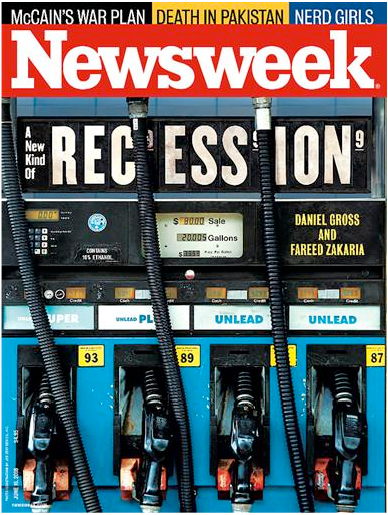

Having briefly already reached $135 a barrel, as noted on the subsequent cover of the "Economist" newsmagazine, after a brief decline to $121, in the following 2 days including the date of the Morgan Stanley call, oil surged in price from $121 to $139 a barrel, prompting cover stories in "Newsweek" and "US News and World Report" as well:

Although "Time" magazine has not completed the set, according to the magazine cover indicator, Oil's appearance on the cover of these magazines means that it was ready to reverse.

Not to be outdone by Morgan Stanley, on June 16,

Gazprom Chief Executive Officer Alexei Miller made [a] forecast ... that ... Oil will reach $250 a barrel ``in the foreseeable future,'' about 85 percent more than the current price

Interestingly, that very same day,

SemCrude Pipeline was removed [ ] as project manager on the planned 524-mile pipeline project - connecting Platteville, Co. to the SemCrude storage terminals in Cushing - after it defaulted on the terms of the loan, lawyers for General Electric Capital Corp. wrote in a filing late Wednesday evening.

....

SemGroup’s collapse later became evident on June 17 after shares of its publicly traded subsidiary, SemGroup Energy Partners, dropped by 50 percent in one day.

The details of SemGroup's bankruptcy were detailed in its July 22 filing:

Oil traders said SemGroup could have exacerbated the spike in oil prices this month, when the market experienced unprecedented swings of more than $10 a barrel, as the company was buying back some previous bets on lower prices.

SemGroup bet in the futures market that oil prices would fall as a way to hedge its positions in the physical market. But as prices jumped this month to a record of $147.27 a barrel from less than $100 a barrel at the beginning of the year, the mounting losses triggered large margin calls from banks – a request to put up more collateral – draining the company’s cash reserves.

I have no evidence whatsoever of any wrongdoing on the part of either Morgan Stanley or its analyst who called for $150 oil by July 4, but it is interesting that it may have coincided with a "short squeeze" of SemGroup.

It has been speculated that

SemGroup's forced cover is the catalyst for one of the biggest recent corrections in crude oil.... But the fact that this correction started literally hours after SemGroup were forced to cover (July 16/17) seems to be more than mere coincidence.

The news of SemGroup's collapse came on a day that oil prices plunged to their lowest levels since early June, falling to an intraday low of $125.63 a barrel, down $5 on the day. After rebounding late last week, yesterday at one point Oil declined $5 to $119.50, with rumors of another hedge fund's forced liquidation front and center.

If demand destruction continues in the US and Europe, if China's bubble is bursting, and if speculators are caught wrong-footed on the "long side," the rout of Oil to less than $100 seems likely to occur.

Comments

Yes but

Will we ever see Oil return to cost+ pricing instead of supply and demand?

From what I've read, even tar sand or shale or coal based oil production *should be* someplace around $25/barrel, cost.

Add the standard 10% for labor and profit, and that makes $27.50/barrel oil.

I just don't understand why somebody hasn't undercut the big oil production companies with these alternative synthetic oils yet. There's obviously something going on that we can't see.

-------------------------------------

Maximum jobs, not maximum profits.

Not an expert, but ...

2 non-exclusive possibilities:

1. Large energy companies already own (but aren't developing) the tar sand and shale deposits.

2. A small company that started to develop those deposits wouldn't have the firepower to resist competitive attacks by the huge energy companies (so why try in the first place?).

Exxon and China

The oil companies just pulled the biggest profit in history, yet this article claims that's not enough for investors!

On China, one of the issues is supply chain costs so to me if oil goes back down to $100, any sort of dip in their economic growth seems highly unlikely.

Nice call on oil by the way, you said this when we had hundreds of the sky is falling on energy prices.

SemGroup

This makes no sense to me. (Naked Capitalism). Are you saying because they have physical oil in storage there demise would increase supply, thus causing a drop?

Did they go short (as in when oil was closer to $100), long before the pop and as oil hit $147 crash and burn? Did they have options that expired before the drop in price?

Why would they horde physical oil if the price was going up anyway?

I saw they are being investigated for fraud and have moved money to the Cayman Islands.

I don't get this at all.

My understanding is, option #2

They weren't hoarding oil, but they bought and sold physical oil for themselves and for accounts. As far as I know, no net gain or loss in supply.

But they were "caught short" and had to liquidate at enough of a loss that they went bankrupt.

At the Big Orange Political Blog, when I posted my first diary there were a bunch of derisive dismissals. Those voices have gotten quiet.

adsf

Well, it still doesn't completely add up, I mean how many are that stupid to dump so much risk into assuming a commodity will drop? (don't answer that!) I guess this is something to watch the facts come out on.

Well, dismissals are nothing new in a knee jerk reactionary plane of sliced reality based on philosophy or feeling. ;)

I'm just thrilled that we're growing, so hopefully the methodology of civil debate, researching one's topic and making conclusions that are fact based can help in grounding the blogosphere to hard cold numbers. ;)

Just say hello.

Hi, Just subscribed to your blog feed. This blog seems to have some very good advice, interesting articles and great analysis. I look forward to reading more!

Hey, Hello to you too, Welcome to EP!

We ain't just fer readin' anymore! Lots of tools and stuff available to write your economic brain until your fingers bleed!

Some Charts - All Horn no Bull

None of the production / consumption data explains price for

my pay grade.

For a view of production - so called peak oil

http://polizeros.com/2008/01/15/peak-oil-oil-production-chart/

For a look at consumption see:

http://www.eia.doe.gov/steo - go to the Oil tab on right.

For Price, go to the Oil Price Tab.

Burton Leed

Seasonality

As someone who has traded in the futures markets, what I saw this past year was not exactly new. Oil, like many other commodities, go through seasonality cycles. For example, corn has this big blow up peaks in the months between June through early September. Oil and gasoline go through peaks and valleys as well. Yet, saying this, these cycles also work within lager trends, of which oil is in a northward motion of one. Since it was in an uptrend, when it's seasonal highs arrived, one should've expected all-time new peaks to be achieved. Goldman Sachs figured this when they said oil would reach $100 a year or so back. Seasonality plays with both technical analysis and fundamental supply & demand laws. Oil could even reach $80 or lower (doubtful), but then it will have to deal with the longer-termed trend which is very powerful. Add in the fundamentals, and we're still on track towards $200 oil. Of course, with the recent news of the Israelis preparing for an attack on Iranian nuclear development sites, that $200 could come a lot sooner!