The World Bank released a report Prospects for the Global Economy.

Here are some highlights for the year of the dog (sic) 2009:

| Global Economy | -2.9% |

| World Trade | -10.0% |

| Industrial Production (1st world) | -15% |

| Private Capital Flows | -52% |

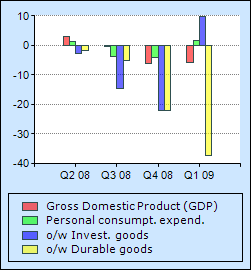

U.S. GDP components Q1 09

The level of industrial production in rich countries has dropped by 15 percent since August 2008, and that in developing countries, excluding China, by 10 percent.

Why are they excluding China all of the time?

Answer: China is clearly kicking the global economy's ass and seemingly not even a glitch in becoming the world's dominant economy.

GDP growth in developing countries is expected to slow sharply, from 5.9 percent in 2008 to 1.2 percent in 2009. However, their performance surpasses rich countries, whose collective GDP is expected to fall 4.5 percent in 2009. Notably, when India and China are removed from the total, developing countries as a group will experience a contraction in GDP of 1.6 percent, a real setback for poverty reduction.

| Global GDP growth | |

|---|---|

| 2% | 2010 |

| 3.2% | 2011 |

| Global Developing Countries GDP growth | |

|---|---|

| 4.4% | 2010 |

| 5.7% | 2011 |

So, what we see is almost a redistribution of wealth from 1st world countries to emerging economies and once again it appears the World bank removed the China and India statistics.

Investment fell at a 37 percent annualized pace in the United States, and by close to a 30 percent annualized rate in Japan, Germany, and Russia.

Drop like a cliff right? Yet look once again at developing countries:

In the 25 developing economies that report quarterly national accounts data, investment growth in the final quarter of 2008 fell by an average of 6.9 percent, or at an annualized pace of 25 percent.

Anyone else sick to death of jobs, wealth and investment pouring out of the United States along with our standard of living and quality of life? China and India remind me of the British empire of the last century.

Here is a World Bank statement of the bailouts effects I see no proof for:

Policy reactions to the crisis have been swift and, although not always well coordinated, have so far succeeded in preventing a broader failure among financial institutions, and thereby avoided a much more severe collapse in production.

The GAO just released a report stating they could not directly correlate the Treasury & Federal Reserve actions to Macroeconomic effects.

Recent comments