There seems to have been some confusion in the financial press this past week as to the significance of the May report on Consumer Credit from the Fed, which resulted in headlines with as wide ranging differences as "Consumer Borrowing in U.S. Rises $19.6 Billion, Most in Year" to "May 2013 Consumer Credit Growth of 8.25% Is Imaginary". There's also been some concern that the Fed's seasonal adjustment process may have inflated the reported credit expansion.. So maybe we should dig a bit deeper into this release and the historical data available to find out what really happened in May, and how it compares to what has happened previously...

Let's start by reviewing what was reported. According to the Fed, seasonally adjusted aggregate consumer credit increased by $19.6 billion, from $2,819.7 billion in April to $2,839.3 billion in May, which they figure to be at an annual rate of 8.3%. By the same reckoning, the revolving credit subset, which mostly represents credit card borrowing, rose $6.6 billion from $849.9 billion in April to $856.5 billion in May, which would be at a seasonally adjusted annual rate of 9.3%, while non-revolving credit, which is longer term borrowing for major items such as cars, yachts, and tuition (but not real estate), rose $13 billion from a seasonally adjusted $1,969.8 billion in April to $1,982.8 in May, or at an annual rate of 7.9%. Our adjacent FRED graph shows the seasonally adjusted annualized change in revolving credit in red, non-revolving credit in green, and the aggregate monthly change in blue since January 2011. Now those increase percentages are annualized, such as we've seen in other reports such as GDP and housing. If the jobs report was reported this way, you'd see a report that 2 million jobs were created in June at an annualized rate.. However, if we do the math, we see the increase in the aggregate credit from April to May was 0.695%, while revolving credit rose 0.777% over the month, and non-revolving credit increased 0.657% from April to May...

Let's start by reviewing what was reported. According to the Fed, seasonally adjusted aggregate consumer credit increased by $19.6 billion, from $2,819.7 billion in April to $2,839.3 billion in May, which they figure to be at an annual rate of 8.3%. By the same reckoning, the revolving credit subset, which mostly represents credit card borrowing, rose $6.6 billion from $849.9 billion in April to $856.5 billion in May, which would be at a seasonally adjusted annual rate of 9.3%, while non-revolving credit, which is longer term borrowing for major items such as cars, yachts, and tuition (but not real estate), rose $13 billion from a seasonally adjusted $1,969.8 billion in April to $1,982.8 in May, or at an annual rate of 7.9%. Our adjacent FRED graph shows the seasonally adjusted annualized change in revolving credit in red, non-revolving credit in green, and the aggregate monthly change in blue since January 2011. Now those increase percentages are annualized, such as we've seen in other reports such as GDP and housing. If the jobs report was reported this way, you'd see a report that 2 million jobs were created in June at an annualized rate.. However, if we do the math, we see the increase in the aggregate credit from April to May was 0.695%, while revolving credit rose 0.777% over the month, and non-revolving credit increased 0.657% from April to May...

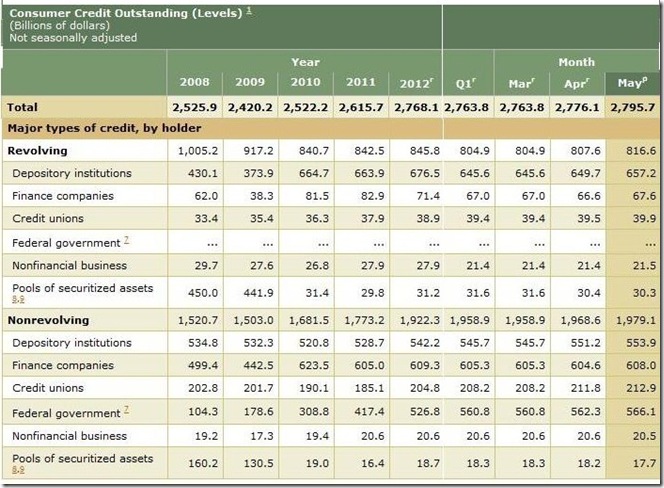

Now, those are also seasonally adjusted numbers, as computed by a program which adjusts each month's data from the actual month to month changes to what it would be versus the historical change for that month, something that's done with every economic report, because otherwise seasonal factors would render the data useless for comparison purposes (ie, every year there'd be job growth in November before the holidays & job losses in January). So what are the actual month over month changes in consumer credit? As shown in the excerpt from table 2 from the report included below, the unadjusted change in revolving credit was from $807.6 billion in April to $816.6 billion in May, a $9.0 billion increase, while the unadjusted increase in non-revolving credit was from $1,968.6 billion in April to $1,979.1 billion in May, a $10.5 billion increase. What this means is that the seasonal adjustment decreased the reported revolving credit change, and increased the non-revolving credit change, suggesting that May is historically an above average month for credit card use, and below average for longer term borrowing for such auto & student loans. However, the change in total credit is virtually the same as the reported $19.6 billion seasonally adjusted increase; so the overall increase in May consumer credit was not altered significantly by the seasonal adjustment process.

Next notice that the unadjusted total of $2795.7 billion of consumer credit outstanding at the end of May is $43.6 billion lower than the reported seasonally adjusted total of $2,839.3 billion, but the 2012 year end total of $2768.1 billion is identical in both the seasonally adjusted totals and the unadjusted totals. That means that seasonally adjustment process boosted reported credit expansion for the first four months of the year. We can see most of the reason why in the unadjusted decrease from $845.8 billion year end revolving credit outstanding to the 1st quarter revolving credit total of $804.9 billion; the seasonal adjustment process boosted the unadjusted number by $44.2 billion to $849.1 billion, $3.3 billion higher than the year end total.. What the seasonal adjustment is allowing for here is the normal fall off of credit card use during the first three months of the year, when many consumers are already overextended from holiday shopping. What that seasonal adjustment process will continue to do between now and the end of the year will be to reduce the reported borrowing during those months where it is above normal, most likely when student borrowing peaks in the fall, and during the November and December shopping seasons..

Now, let's compare the historical change in adjusted and unadjusted credit expansion from April to May over the past few years. The seasonally adjusted increase from April to May 2012 was $19.9 billion; for April to May 2011 it was $8.4 billion, and for 2010 it was a decrease of $10.1 billion The actual, unadjusted change in consumer credit outstanding from April to May for those years was + $19.8 billion in 2012, + $8.6 billion in 2011, and minus $9.2 billion in 2010. Since seasonal adjustment algorithms give a heavier weighting to more recent years, that contraction of consumer credit in May of 2010 may have slightly inflated subsequent May reports, but judging by the differences noted, not by much.

Since we have that table of unadjusted consumer credit above, let's check out a few other trends that we can glean from it. Notice that we have year end totals for both revolving and non-revolving credit; it's obvious that outstanding revolving credit, or credit card debt, shrunk from $1005.2 billion in 2008 to $840.7 billion in 2010 and has barely recovered since. Meanwhile, non revolving credit has increased from $1520.7 billion in 2008 to $1979.1 billion in the recent month. But look at each of the line items under non-revolving credit, which represent the major holders of that debt, and you'll note that longer term borrowing from banks, finance companies, and credit unions has barely budged. It's only borrowing from the federal government, in the form of student loans, which has driven credit expansion over the last five years.. Indeed, over the four years from year end 2008 to year end 2012, consumer debt held by the federal government has increased more than fivefold, from $104.3 billion in 2008 to $526.8 billion in 2012, and is now the largest asset on the government balance sheet, More importantly, were it not for the $422.5 billion in student loans doled out by the federal government over those four years, net consumer credit would have contracted by $180.3 billion over the period. We’ve inserted a small FRED graph showing the historical growth of consumer loans owned by the Federal government; there’s no need to enlarge that to see the trajectory.

Since we have that table of unadjusted consumer credit above, let's check out a few other trends that we can glean from it. Notice that we have year end totals for both revolving and non-revolving credit; it's obvious that outstanding revolving credit, or credit card debt, shrunk from $1005.2 billion in 2008 to $840.7 billion in 2010 and has barely recovered since. Meanwhile, non revolving credit has increased from $1520.7 billion in 2008 to $1979.1 billion in the recent month. But look at each of the line items under non-revolving credit, which represent the major holders of that debt, and you'll note that longer term borrowing from banks, finance companies, and credit unions has barely budged. It's only borrowing from the federal government, in the form of student loans, which has driven credit expansion over the last five years.. Indeed, over the four years from year end 2008 to year end 2012, consumer debt held by the federal government has increased more than fivefold, from $104.3 billion in 2008 to $526.8 billion in 2012, and is now the largest asset on the government balance sheet, More importantly, were it not for the $422.5 billion in student loans doled out by the federal government over those four years, net consumer credit would have contracted by $180.3 billion over the period. We’ve inserted a small FRED graph showing the historical growth of consumer loans owned by the Federal government; there’s no need to enlarge that to see the trajectory.

(crossposted at Marketwatch 666)

Comments

student loans drive consumer credit

That certainly is what what I've noticed when analyzing the consumer credit statistics.

The press just is incredible in not digging into these statistics. Your point that annualization will show huge percentage changes in comparison to monthly percent changes needs to be pounded on for I don't think, honestly, some even know what annualization means and how that gives much larger percentage changes on a month by month basis.

Nice digging, the Federal Reserve statistical releases are difficult to read, especially the flow of funds and they mix tables and also truncate in financials instead of round.

I found error margins earlier due to their truncation of figures, and it was fairly amusing, I called up asking why for this is not the normal process for intermediate calculations and the response was "we have always done it this way".

Generally speaking a little anal detail on using excel plus the role of significant digits in intermediate calculations needs to be had! I've run into this on other reports.

Great article!