On The Economic Populist you might have noticed the right column. We try to list other sites and blogs who have exceptional insight and writing on what is happening in the U.S. economy.

Sometimes though, one cannot say it better but miss those who did.

Must Read Post #1

The Wall Street Journal piece, Extend and Pretend, shows Commercial Real Estate loans are being manipulated to keep the losses off the books and loans out of default.

Restructurings of nonresidential loans stood at $23.9 billion at the end of the first quarter, more than three times the level a year earlier and seven times the level two years earlier. While not all were for commercial real estate, the total makes clear that large numbers of commercial-property borrowers got some leeway.

h/t Naked Capitalism

Must Read Post #2

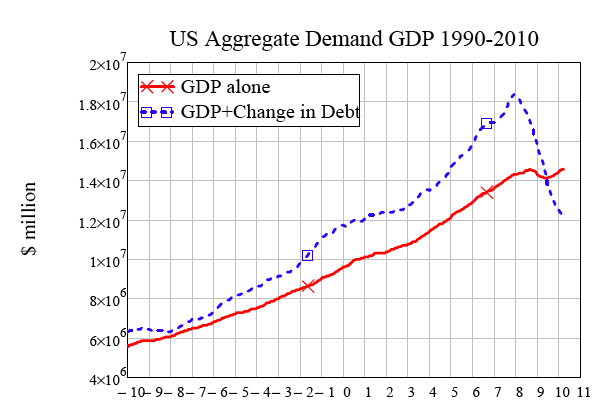

Naked Capitalism overviews Steve Keen's Scary Minksy Model showing the divergence between aggregate demand and aggregate demand financed by private debt, which used to be correlated. The new ratios appear frighteningly familiar to the Great Depression. Steve Keen expands on the post on his own blog. Just incredible how we cannot get good policy and focus on U.S. middle class jobs and income considering these graphs.

Must Read Post #3

Calculated Risk answers how large is the outstanding value of Sovereign Bonds:

Debt issued by governments worldwide is immense. According to the Bank for International Settlements, at year end 2009 worldwide sovereign debt exceeded $34 trillion, and is greater than the amount of corporate bonds outstanding.

Japan and the US dwarf most other borrowers. Together they have about half of all sovereign debt worldwide. Still, 23 other countries have over $100 billion of debt outstanding. The other 100+ countries worldwide have a total debt of about $1.4 trillion.

Must Read Post #4

Eliot Spitzer and William Black show how corruption in regulators is systemic in The SEC and the MMS: A Tale of Two Failures:

the regulators accepted industry assertions about the reliability of their safety mechanisms while failing to acknowledge — much less investigate — the darker, more complex reality. In each crisis, we had the same story of a belief in the reporting done by corporations, and in each case, we had a failure to recognize the enormous potential for fraud and the lack of incentives these corporate entities have in ascertaining and measuring potential risks to the public. The regulators continued to believe the lies fed them by CEOs even when the lies had become absurd. Both times, the agencies charged with regulating ignored the advice of their own experts, neglected to enforce rules, and engaged in an alarmingly cozy relationship with the industry they were supposed to be monitoring.

Must Read Post #5

The Associated Press notices how Congress issues studies instead of law when they wish to bend to corporate lobbyists will. They focus on the (cough) Financial Reform Bill as a prime example. As if we do not know exactly why the meltdown happened. Of course we do, Congress just refuses to fix it per their corporate lobbyist masters demands. We don't need a study. We need Congress to stop being so corrupt.

Must Read Post #6

Just another foreboding on PCE, only 44% of retailers made their numbers.

Among 28 retailers that have reported their results, 44% exceeded Wall Street expectations while the rest fell short, according to Thomson Reuters

Comments

Wall Street Runs for Congress

This is a classic, we have a Bankster representative, running against Carolyn Maloney because she dared to defend the Consumer Financial Protection Agency.

At least you know what you're voting for and they are pouring gobs of money into this primary. I always thought instead of Democrat/Republican, Congressional and Senate seats should be marked, Goldman Sachs, JP Morgan Chase, Oracle, Microsoft and so on.

The resume is our classic point by point Wall Street agenda. Three Hedge funds and spinning global labor arbitrage as discrimination to boot, so you can have your Wall Street nightmare and unlimited global labor arbitrage all in one!

Poor poor Wall Street, they have been so maligned! (sic)