"[Obama] will inherit an economy that is in recession and ... is likely to get worse before it gets better."

- Stuart Hoffman, chief economist for PNC Financial Services

The whole world is focused on America's presidential election, but people have forgotten that the next president is going to inherit the mess that the current president has left.

There's the wars in Iraq and Afghanistan. There's the recession and the housing bust. New Orleans is still a disaster. But the biggest mess of all that Bush is leaving behind is the fiscal condition of the federal government.

The U.S. government's borrowing needs will almost double to $2 trillion this fiscal year...The U.S. borrowing requirement will surge as the Treasury buys troubled assets from banks under a $700 billion rescue law, $561 billion in coupon securities mature, and the budget deficit widens to $850 billion, Goldman said.

The government is expected to have to borrow $550 Billion in JUST THIS QUARTER! That's $408 billion more than expected just three months ago, and follows a July-September quarter in which the government borrowed a record $530 Billion.

And that's just the down payment.

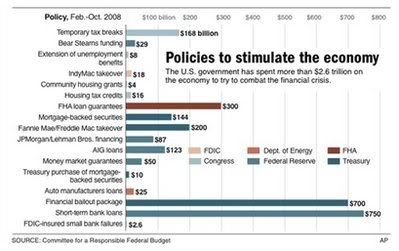

The nonpartisan Committee for a Responsible Budget estimates all the government economic and rescue initiatives, starting with the $168 billion in stimulus checks issued earlier this year, total even more — an eye-popping $2.6 trillion.

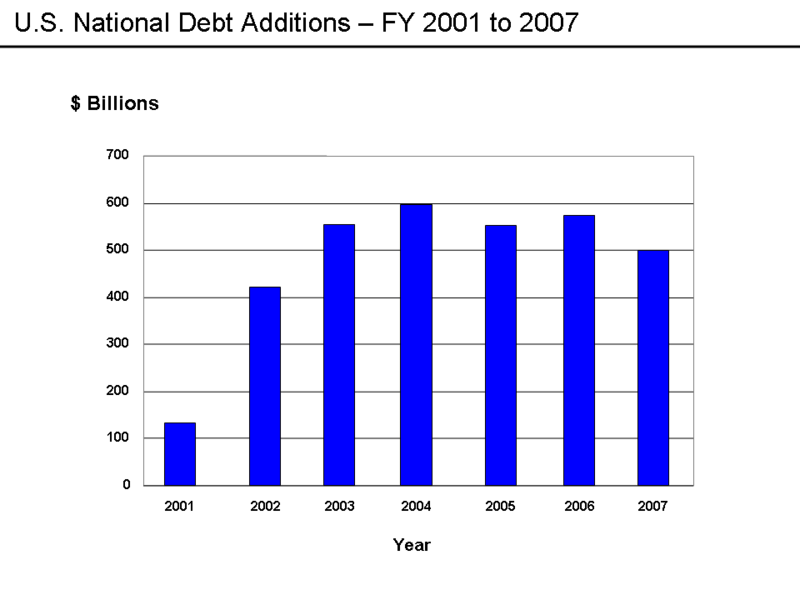

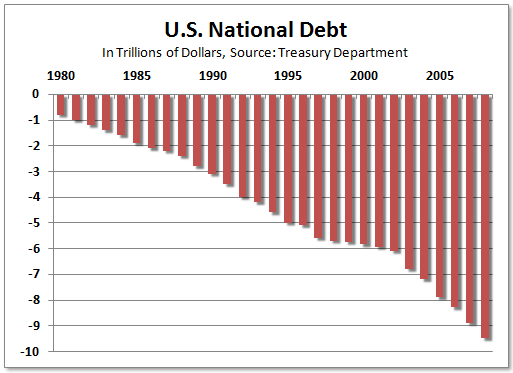

These numbers are so large that I don't think the average person can get their mind around them. So I'm going to post a few charts to help.

Here's what things looked like before the recent binge of borrowing.

Remember when these were the sort of scary numbers that made you outraged and worried?

Now triple those numbers!

Morgan Stanley predicts the 2009 federal deficit will be $1.5 Trillion. That works out to be 10.2% of GDP.

To put this into perspective, the previous post-WWII deficit record was 6.3% of GDP under Reagan. Never before has the nation taken on so much debt so quickly.

Since September 30, the day the national debt hit the $10-trillion mark for the first time, the government has run up over $500 billion in new debt.That’s more than the federal deficit for the entire 2008 fiscal year, which ended September 30. And it’s the most rapid increase in the national debt ever: over half a trillion dollars in less than a month - 23 days to be exact...

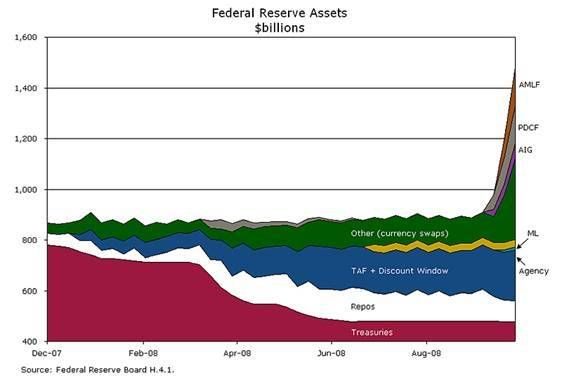

What’s to blame for the most recent surge in the debt? Above all else, it’s the federal government's response to the financial crisis.“It’s the Supplementary Financing Program being run by Treasury to provide cash for the Federal Reserve,” says Corrine Hirsh, spokeswoman for the White House Office of Management and Budget.

By that, she means the billions of dollars disbursed by the Fed to keep the financial markets at home and abroad from collapsing. It includes the $124 billion used to keep insurance industry giant American International Group from going bust.

This brings up an extremely important point that I haven't heard asked in the media:

Where will all the money come from?

Many people point towards China's $2 Trillion in currency reserves as our potential creditor, but people forget that those currency reserves aren't sitting around as piles of cash. Those currency reserves are currently in the form of treasury, corporate, and agency bonds.

It would be pointless for China to sell their old treasury bonds to buy our newly issued treasury bonds. If they were to sell their corporate or agency bonds to buy our new treasury bonds then the problem has merely been shifted from one place to another.

China (and to a lesser extent Japan, Korea, Russia, and the OPEC nations) has built up their massive currency reserves by recycling America's massive trade deficit back into our debt.

The current recession is likely to shrink America's trade deficit by suppressing our consumption. While this is good news in the long run, it only exacerbates the problem of who is going to loan us $2 Trillion.

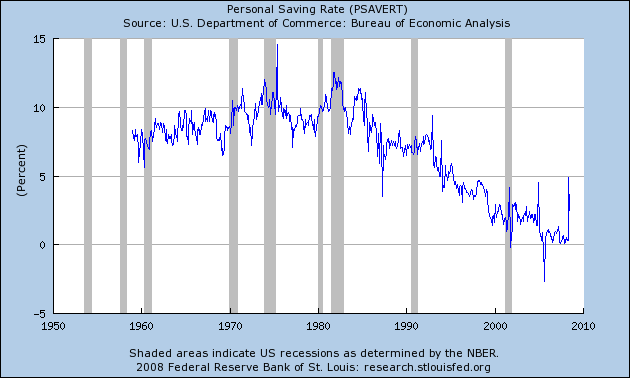

When Japan had a similar problem in the 1990's, its government went on a huge deficit spending splurge, but was able to finance it because of their enormous domestic savings. America does not have that ability because America simply does not save.

Countries like China, Russia, and the OPEC nations do save, but they are still largely third-world nations. They need their savings for themselves.

You can also make the case that foreign investors are already sated with US dollar debt. In the eyes of foreign investors, the entire purpose of buying all that American debt is so American consumers could continue to buy cheap imports. If American consumers are tapped-out then foreign investors lose their motivation for buying our debt.

You can forget the IMF. They only have $250 Billion in reserves, and most of Eastern Europe has already lined up for those hand-outs.

"The resources of the IMF may not be sufficient for wider bailouts if needed," said Vivek Tawadey, head of credit strategy at BNP Paribas SA in London. "If it can't raise the money, some of the more distressed emerging markets could end up defaulting."

Then there is the concept of a limitation on how much savings there is in the world.

The global current account deficit of the United States in 2007 is estimated at $731.2 billion,almost as large as the Treasury’s bail-out plan for troubled assets (TARP) finally approved by the US Congress.

To finance this large current account deficit and its own sizable foreign investments, the United States requires about $1 trillion of foreign capital every year or more than $4 billion every working day.

Such a large current account deficit has been financed by 70 per cent of the rest of the world’s surplus capital or savings.

Let that idea sink in for a moment.

Even before our current fiscal crisis, America was absorbing 70% of the world's savings.

Now our need for borrowing from the rest of the world has suddenly tripled.

You can't borrow more than 100% of the world's savings. So where are we going to borrow that money from?

This lack of readily apparent creditors is causing the credit-default swap market to price in an increasing likelihood of America going bankrupt. America's credit risk has risen 25 fold in just the last year.

So, once again, where is that money going to come from?

To give you a hint, we can look at the Federal Reserve's balance sheet.

America has only one weapon left in its arsenal: all of our debts are priced in dollars. We also happen to be the only nation that can legally create dollars out of thin air.

Put that concept together with the fact that if we sucked out every last dollar of savings in the world we still couldn't finance our borrowing needs, and you get the obvious solution to our troubles...and the cause of the next crisis.

Comments

bail out election damage, other, great post!

I don't have the tally but read that some conservatives at least lost their elections over their bail out vote.

TBD.

On the M1 supply, manfrommiddletown noted that the Fed no longer publishes M3, which can indicate devaluation and inflation much more than M1, which doesn't have a historical correlation.

I personally cannot believe, especially because of the differentiation between deficit spending as investment, engine growth versus just throwing money down the toilet spending....that a great tsunami of shit is coming at us from the bail out.

I'm thrilled the election is over so people start focusing in on the specifics and hopefully remain active and start demanding policy changes that they really want.

I was so sick of the perpetual "non issue" 24/7 election spin.

Great post!

Watch out for the latest.....

....CW.

It won't fly for obvious reasons but.

'Neither candidate will find themselves in a position to do much....'

'How will Obama deal with the blowback from his first term failures...' Yeah, this was on NPR. No messin'

'The situation is such that no matter who wins the nation may find itself with more problems that solutions...'

Uh...huh... The Upper Tenth has set it's minions of the mindless MSM and the vile Villagers the lines to read. Chiefly that there are no solutions.

I beg to differ.

Alternative Minimum Corporate Tax 5% of gross profits.

Alternative Minimum Carbon Tax 50% of gross profits.

Alternative Minimum Income Tax of 80% above 2 million.

Restructure the 'Bailout' to make all Treasury money to be 'earmarked' for new loans only. Impose an 80% minimum tax on all bonuses paid to those making more than 100k a year for fiscal years 2008 and '09.

Spend it all on:

The Solar Grand Plan

Infrastructure repair

The Eduation System and...

Yeah repeal the wasteful stupid 'No Child Left Behind' That Short George and Fat Ted are so stupidly proud of.

'When you see a rattlesnake poised to strike, you do not wait until he has struck to crush him.'

Hey Bernie, is that you?

Senator Bernie Sanders suggested a surtax on the super rich to pay for the $850 billion dollar bail out. Senate leadership wouldn't even allow a roll call vote and dismissed his idea only with voice vote!

At least he got to give damn good speech!

You sound like Bernie in some of these policy suggestions.

That's becaue Bernie and I...

....are both Democrats not bought and paid for lickspittles to the Upper Tenth.

Doesn't matter. As the ReThugs, the MSM and The Village take turns savaging the 'ignorant', 'inexperience', 'New President' the citizenry is going to finally be able to see how our society 'works'. The windbags of the MSM will not be able to help themselves and the seething mass of the Black Underclass along with the white folks who can no longer pay their bills will....

Not be amused.

We know Obama is a fighter.

Now we get to see what happens when he realizes that he is meant to be a token black dude. To STFU and do as his betters tell him.

Should be interesting.

'When you see a rattlesnake poised to strike, you do not wait until he has struck to crush him.'

Bernie

is a socialist. ;) He's an independent, officially the Democratic Socialist of which there is no party in the U.S. but there is in Europe.

Believe this or not, but one of the best fighters for a host of Professional labor issues in Republican Chuck Grassley.