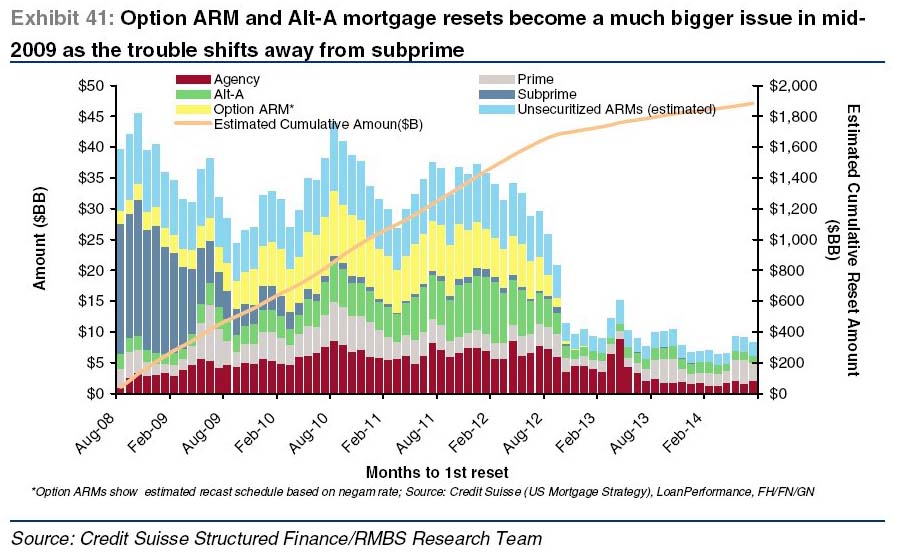

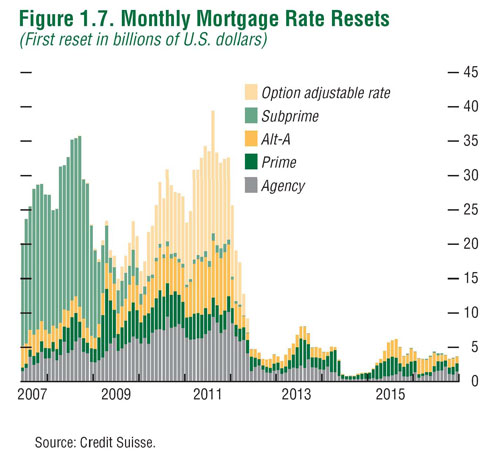

States are now warning the Obama administration on a coming tidal wave of option arm mortgage resets:

"Payment option ARMs are about to explode," Iowa Attorney General Tom Miller said after a Thursday meeting with members of President Barack Obama's administration to discuss ways to combat mortgage scams.

The mortgages differ from other ARMs by offering an option to pay only the interest each month or a low minimum payment that leads to a rising balance in the loan's principal.

In other words, these are those interest only mortgages that eventually want some principle in payment. These are those teaser rate mortgages.

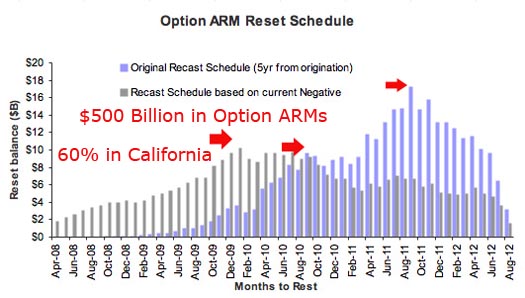

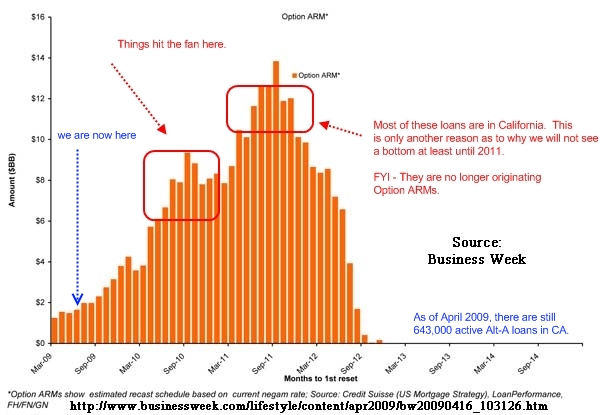

Dr. Housing Bubble reports there are $500 billion in option arms about to reset and 60% of them are in California.

Src: Dr. Housing Bubble

Foreclosures and Banks

This could get interesting. Uncle Ben spoke at Brookings this week and remarked about federal actions to "save homeowners from foreclosure," when he might more accurately have called them programs to save the banks from foreclosures. The wave of defaults leaves banks facing ugly alternatives. If they foreclose, they are stuck with deteriorating properties with a string of costs (security, insurance, taxes, rehab, legal fees), whereas forbearance means they might be able to carry the debt into the future and perhaps get some revenue out of it. A distant relative of mine was in default over payments of about $800 per month; they reduced her payment to $275. Sure, the principal gets kicked down the road, but the house stays inhabited and maintained. Foreclosures are way beyond the banks' staffing and this next wave of resets should be handled creatively by banks that, after all, have no desire to be in the real estate business. If the loans are performing at interest-only, why invite problems by demanding principal?

Frank T.

Frank T.

on the other hand

We have reports that banks are making profits by foreclosing in fees and so forth, so all they need to watch out for is falling prices and not being able to resell the property.

So far, and one can see this from the foreclosure rates plus the reports that the "programs" are pure spin, run around, end up getting higher payments etc. "no help in reality" that one group who isn't winning are homeowners.

I don't have any answers either because if someone signed up to buy a $500k house when there is no way their income can support the normal 30 yr. fixed payments...

Well, this bothers me. To me that's individual responsibility to know one cannot afford that basic home price.

The point is that people

The point is that people believe they can pay in too many years. They don't plan that things must happen and finance can get into trouble... It's important to make a good personal finance plan to avoid problems in the future

Wrong terminology

Misuse of the term "homeowner" is one of the problems.

You "own" something only when you pay up the entire amount you promised. Otherwise the real owner is the one who actually paid for it, i.e., the lender who allows you to rent it from him until he is fully repaid. Until then you are only a homebuyer and not a homeowner and there is a huge difference between the two.

If the homebuyer is unable to pay the promised price then the house should go back to the real owner so that he can resell it to someone else who can and that process is called a foreclosure. Artificially blocking them to favor one side against the other penalizes the responsible saver (lender) and rewards the irresponsible spender (borrower) and sends a wrong message to everybody.