This proposal is nothing new "new" but borrowed from Denmark.

Our mortgage finance system is broken. It needs some serious restructuring or a complete overhaul. We can learn a lot about a new structure from the Danes. The Danish mortgage system is one of the oldest and most sophisticated housing finance markets in the world.

Increased Financialization in the U.S.

Our home mortgage finance system is broken and dysfunctional because of an overwhelming drive for higher investment returns (more risk) and dispersion of credit risk. Back in the day, before financial conglomerates poisoned the system, the purpose of securitization was to provide more liquidity (ie. more cash) to the home mortgage market. It worked fine for a while: mortgage lenders would make loans, Fannie Mae/Freddie Mac would purchase the loans and pool them, and then sell mortgage backed securities to the bond market. Everyone was happy until the financial conglomerates realized that Fannie/Freddie had a nice thing going for them and they wanted in on the action.

They jumped into the securitization market hungry for more fees, investment returns and but they wanted this with very little risk. But, simple mortgage backed securities were not enough for financial conglomerates so then, through "financial innovation" they created "collateralized mortgage obligations" for more fees and higher investment returns. Meanwhile, the supply of home mortgages was getting low because of all of this securitization. The call goes out to mortgage lenders and mortgage brokers: "get us more mortgages". But most of the people with good credit had mortgages already so what happens next: lower lending standards to qualify more borrowers for more mortgage loans to securitize.

The financial conglomerates didn't care because they were just packaging the loans and selling the securities that were backed by these pools of mortgages - they had no skin in this game. Fannie/Freddie didn't care because they had the implicit backing (which turned into actual backing) of the federal government. This had all the makings of classic bubble but the financial conglomerates, mortgage lenders/brokers and Fannie/Freddie were making a killing off of securitization so they didn't care and those that did care and warned about it were ridiculed as contrarian loons.

The challenge for the financial conglomerates was how to market these securities backed by risky mortgage loans - enter AIG and credit default swaps (CDS). AIG saw an opportunity to make a killing by writing CDS - what a great way for the largest insurer in the world to capitalize on its "AAA" rating. Financial conglomerates marketed their risky securities by saying they had "insurance" through these CDS written by AIG. The credit rating agencies, with the help of a very generous fee from the financial conglomerates, bought the scheme "hook line and sinker" and they gave these risky securities the highest rating available because of AIG's CDS. With the highest rating available, financial conglomerates could market these risky securities to pension funds, mutual funds, college endowment funds and anyone else who bought securities based on the highest rating available.

What a great scheme the financial conglomerates had going for it? They didn't care that this was all based on one thing: ever increasing real estate prices. When real estate prices started to tank for the first time in generations the "House of Cards" created by the financial conglomerates collapsed bringing our entire economy down with it. It is time to examine how we can do better than the same old layer upon layer of debt and deception that is so prevalent in our current mortgage finance system.

Danish Mortgage Finance System

Denmark's mortgage finance system began in the 18th century as a cooperative or mutual system that served local communities - basically not-for-profit enterprises. The first Danish Mortgage Credit Act was passed in 1850 and it created the concept of cooperative mortgage credit institutions. The most recent changes included removing existing restrictions to the establishment of new mortgage credit institutions, as public limited companies and authorizing commercial banks to own mortgage credit institutions. Currently, there are eight mortgage credit institutions some affiliated with commercial banks (DLR, LR, Nordea Kredit, RealKredit Danmark, FIH), others operating on a standalone basis, as foundations (BRFKredit, NykreditRealkredit).

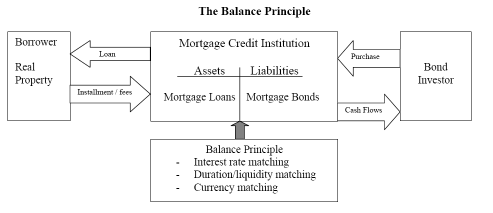

Danish mortgage finance system is a highly regulated industry that is based on a strict adherence to the Principle of Balance (POB) that was established in the Mortgage Credit Act. Danish mortgage system is a pass-through system that allows mortgage borrowers to benefit from close to capital market financing conditions. In the Danish system, borrower/homeowner don't obtain a mortgage from a mortgage loan originator such as a bank or mortgage lender. They borrow from investors in a transparent and standardized bond market through a mortgage credit institution (MCI). MCI issues bonds in the bond market that match as much as possible the amount and maturity of the borrower's mortgage. The beauty of this system is that a mortgage is exactly matched and balanced with an actively traded bond.

MCIs play the vital roles of advisors to the borrower/homeowner and bearer of the credit risk of the mortgage – they remain “on the hook” in the event of delinquency or default. They are mortgage credit insurers. The MCI originator bears full responsibility for timely payments from the borrower/homeowner. So, MCI has an incentive to make sure borrower/homeowners obtain a mortgage loan that is affordable for that family. Meanwhile, bond investors worry about only interest rate risk, with complete insurance on the mortgage that backs the their bond investment. This makes for a highly efficient system.

The mortgage loans are standardized. Typically, fixed rate and long term such as 30 years. Although, some MCI have recently originated adjustable rate mortgages with a corresponding short-term mortgage backed bond.

There is one more very important aspect of the Danish mortgage system and that is it offers homeowners the ability to buy back their own mortgages when the price of the mortgage backed bonds drops in the open bond market. That is right the borrower/homeower buys back the corresponding bonds in the bond market. When interest rates rise, the value of existing mortgage backed bonds drops. Borrower/Homeowner can essentially refinance his/her mortgage by purchasing the corresponding bond at the lower market value. Why is this important? Because it helps reduce the risk of "negative equity" that so many homeowners in the U.S. are facing right now - where the home value is less than mortgage amount.

POB allows for this direct connection between the mortgage loan and mortgage backed bond. This optional redemption future, which is similar to refinancing, is only available to homeowners who are current on their mortgage. This is how it works: the homeowner directs his/her MCI to purchase the correct current face value amount of the bond at its discounted price and use it to redeem the existing mortgage loan. This is paid for by the simultaneous issuance of a new mortgage loan, for a smaller face amount, often at prevailing higher mortgage rates. This feature is radically different than the U.S. where a homeowner continues to pay the face amount of the mortgage even if the market value of the mortgage and mortgage backed securities dropped.

There are other important aspects of the the Danish mortgage system. Loan to Value ratio of 80% is strictly enforced - meaning a new borrower/homeowner has to have at least 20% down payment. Mortgage loans are serious full recourse loans meaning if borrower/homeowner sells the home and there is difference between market value of home and what is owed on the mortgage loan that homeowner is still on the hook for the difference no matter how long it takes to pay that difference.

What I am working on is a proposal for FHA/Fannie/Freddie/Ginnie Mae? I leaning towards a merger of these entities. The merged entity would act as the very first MCI.

The Danish Mortgage Market, BIS Quarterly Review, March 2004 (PDF file)

Recent comments