I know we all believe the housing bubble has already popped and all things real estate are over. One might think this post should be from 2006 from the title. But it's not, this post is from 2010 and below are the reasons for the question.

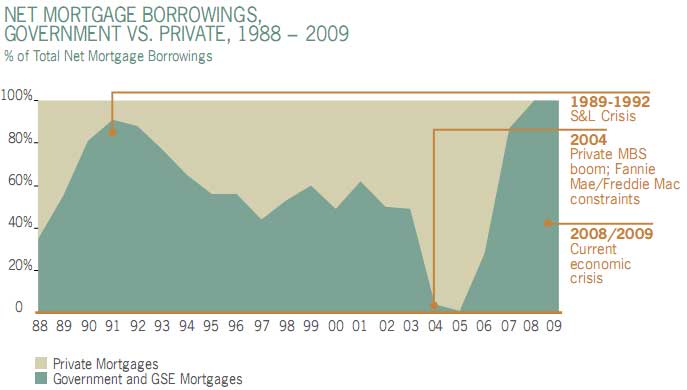

First is the latest SIGTARP report saying the Government has become the mortgage market with U.S. taxpayers shouldering the risk. From the SIGTARP report we have a 100% government mortgage market at this point.

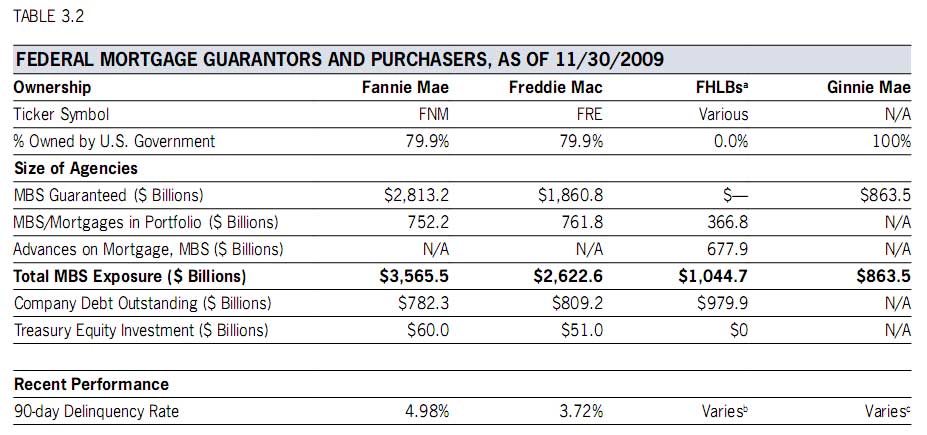

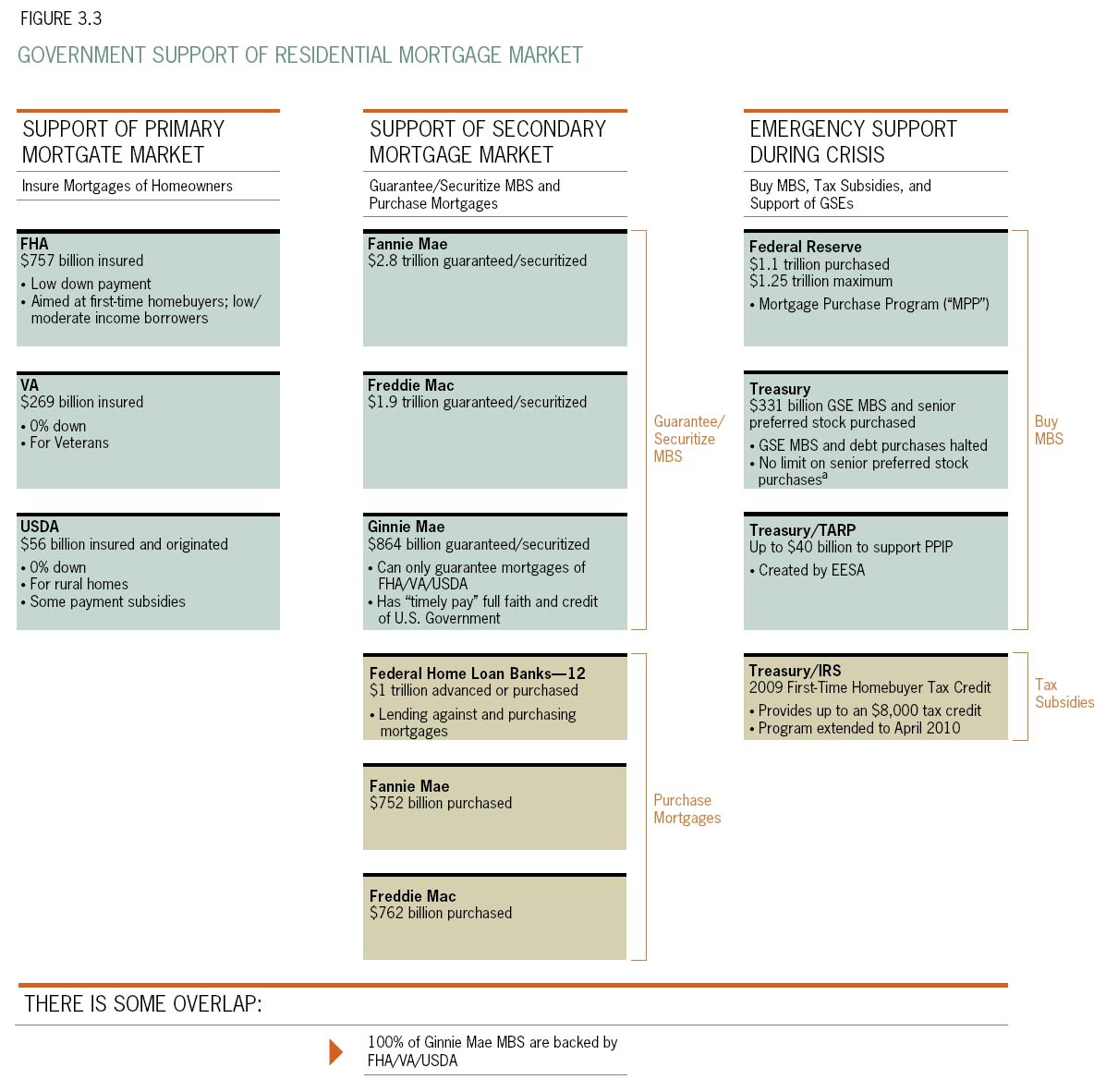

SIGTARP reports 100% of Ginnie Mae MBS are backed by FHA/VA/USDA, 100%. The current financial support for Fannie Mae and Freddie Mac is $1.4 trillion dollars. Look at the actual risk exposure of the above table of government backed GSEs, their MBS exposure, their funds and relationships. There is not enough taxpayers or bail outs in the world if those MBSes implode. The below table summarizes the primary, secondary and emergency support for the U.S. residential real estate market. I have to wonder if every single person in the U.S. was just given a home for free, if it would not be cheaper. Seriously.

Fannie and Freddie now have an unlimited bailout and it is estimated they have lost $400 billion dollars. The plan is to purchase $1.25 trillion mortgage backed securities from these two GSEs until the end of March.

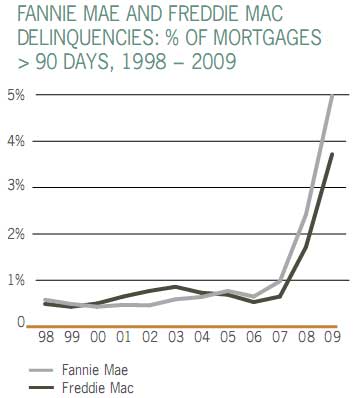

Note how the mortgages held by Fannie and Freddie are increasing in payment delinquency.

SIGTARP has literally written up a flow chart on how the government is attempting to re-inflate home prices (they left out population increases), below and note how some of those things, uh, like a job aren't panning out too well.

The number of homeowners who are strategically walking away from their mortgages is up to 10% this year. We also have the percentage of home ownership to the general population back to slightly below the year 2000 levels. Recall the overall population is increasing about 2.3 million each year.

4.5 million homeowners had reached the critical threshold, with their home’s value dropping below 75 percent of the mortgage balance.

Note we might have $448 billion in GSE losses, $48 billion more than estimated just last month.

New Home Sales for December 2009 were 7.6% below November. Bear in mind there is an $8000 tax credit for first time home buyers plus a $6500 dollar tax credit for existing home buyers. These expire at the end of April 2010. The first tax credit expired at the end of November 2009. We also have actual rates low with no end in sight at least in signaling of the Fed rate.

Foreclosures for next year estimates vary, but seem to solidify at 3 million. 2009 foreclosures were estimated at 2.8 million.

Just today we had mortgage delinquency rates pass 10% for December.

So, with unemployment predicted to hover around 10% for all of 2010 and the U.S. taxpayer on the hook for residential real estate to this extent, plus more incentives to buy a home disappearing and lending standards are tightening.

I am not an expert in residential real estate but frankly these graphs, data scare the shit out of me. It seems to all be tittering on some very invalid assumptions:

- These mortgages are good

- Home prices won't drop dramatically

- The U.S. can continue to increase the population while decreasing the actual number of jobs

- That money from somewhere will increase to make the payments

Think about it. All of the above free money, the government pouring in trillions of dollars to prop up the housing market. Yet while price declines have slowed, prices are still declining and the above simply cannot go on forever. In fact one thing isn't going on forever. The Fed will stop buying MBSes at the end of March, 2010. So, when our government created illusion does pop, do we then have the real housing bubble implosion?

Comments

Insanity

Re-inflating the bubble. Every day is "Ground Hog Day" - same thing over and over again. I don't want to say anymore.

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

oh damn Rebel!

If only I had written this yesterday, what a theme! Damn I missed an opportunity.

That is what I felt like when I was looking over all of these figures...I thought it was 2006 but instead of BoA, or Countrywide or whatever, I had in those names places Fed, Treasury, Gimmie....

Honestly I think us little Populists sometimes can see the forest through the trees. Forever I was asking myself, who can afford a house payment when their salaries are crap, they are fired all of the time, it's totally permatemp work culture and houses are so expensive?

It's like duh, it doesn't add up, because...it does not add up!

Nothing changed

We still have questionable underwriting practices. It is still an illusion. When Fed pulls out and no more bail outs for Fannie/Freddie the illusion will finally be over.

All of this for what - to save the financial oligarchy. If they really wanted to help people we would have macro principal reductions a long long time ago.

Here is a prediction: When the book is closed on the one-term Obama Administration - its handling of the mortgage crisis will go down as its biggest mistake - even bigger than its health care fiasco.

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

Rebel, feel Validated

gotta asst. Treas. sec. whistleblowing on Obama and principle reduction.

You gotta read this one because you are going to feel validated on some past posts you wrote.

Great Analogy

Bernanke's college professor said 'we are doing everything possible to return to just before the crash'.

We must re inflate the bubble in order to maintain the status quo. Its that simple. Bail out the wealthy and blame subprime mortgages and welfare for the crash. Now that Bush is out of office drink the kool aid and blame Obama for everything. Its a very simple formula. Not that Obama has done much to pull 'us' out of this but he certainly didn't get us here.

I also love the right wing mantra that Fannie and Freddie were mostly responsible when they couldn't buy subprime mortgages by law. What killed them was 'AAA' rated CDO's filled with subprimes that were garbage sold by banks.

FT NCO post goes along with this one

I just read this post on the Financial times blog, which goes over shadow bank losses.

One huge issue is foreclosures are not on normal housing inventory and the way NCO are accounted for, there might be a hell of a lot of restructured loans, with high redefault rates, that are not currently "on the books".

Since we're outsourcing all our jobs...

Since all our jobs are being outsourced and wages being driven down to the lowest common denominator, it sure would be nice if the government would allow housing prices to equalize... so then we workers could reasonably afford ONE OF THE BASIC REQUIREMENTS FOR HUMAN SURVIVAL: SHELTER.

The government wants to have it both ways - overpriced housing AND globalization (causing depressed wages and unemployment). How are these not mutually exclusive? You can keep pumping tax dollars into Fannie and Freddie but eventually something has got to give - globalization or housing. People cannot buy houses they cannot afford.

http://jims-blog.com

Thank goodness for the internet!

It might be time to drag out the conspiracy theories. I have several up my sleeve.

1. The banks are taking over the country and will ultimately own us all. (oh wait that happened already)

2. China will buy up so much of our debt they will own us (oh wait that's happening now).

3. We are headed toward a one world government and since we have so many war toys we get to be the police.

4. The President is just a figurehead and makes no decisions, ultimately the ones with the money (globally) really run things (ulminatai? bilderbergs?)

5. We are so distracted by threatened plagues (swine flu), wars (every generation gets to have one), and natural disasters we miss the really important news. However, the news media in prime time and morning shows only show us the "distractions". (Real news, if discovered, is quickly turned into a conspiracy theory.)

6. There is no wind on the moon.

A quaint story

The area I live only recently (in the last year or two) saw a rise in housing prices. Cruise ships stop at our little port and thousands of tourists swarm our 'quaint' little town. They help the local shops and restaurants, but they also noticed how inexpensive our homes were. They are mostly restored victorians and quite beautiful. Many were bought sight unseen and the people came in droves to buy them. Overnight, housing prices almost doubled leaving the regular workers here unable to buy a home. The greed of sellers upset the balance. Now the market is sluggish with overinflated prices. We are just waiting.....for the tourists to leave.

MBS and CDOs

I'm not sure that I would count on the Fed exiting their MBS purchasing plan at the end of March as they say they will.

They run a kiting scam (credit Chris Martensen) between central bank custody accounts to fund purchases with our own money.

Them they protect GSE debt at all costs, since China (mostly) and Russia hold nearly a trillion in agency debt, much of it Fannie and Freddie originated bonds.

In the long run, it all comes back to the "household sector" in an ironic twist of socialized neo-facism. The taxpayer is the phanton holder of 1.88 trillion in debt issuance for year-end 2009.

http://letthemfail.us/archives/3204

Will Martindale

Would you consider creating an account and logging in? You write some insightful comments. This would give you the ability to bypass CAPTCHA plus have your own account so you can track all of your comments, replies.

I don't track as much on residential real estate as I do manufacturing, jobs and so on, so if others are giving some insight into this 'prop up' and what is the real end game here, that would be helpful. I was reading the SIGTARP and just couldn't believe the outlays here with things clearly still heading "down" and "south" on residential real estate.

I don't see any end game but eventually it has to stop and because people plain don't have any money, it has to all go significantly down in value. (at minimum).

But if there are others, who are more expert digging around in this, it would be useful for us!

I saw Hank Paulson claim China and Russia were colluding to collapse the U.S. through their treasury holdings but if they are the primary lender on GSEs, that adds just a whole other dimension.

I did

THX Robert I just created an account.

I think we're on to something, but I'm not ready to put it out there yet (I sometimes get accused of being a conspiracy theorist--fancy that).

So If I can back it up, I'll post it here.

In the meantime I'll keep practicing spelling words like "then" and "phantom".

-WM

http://letthemfail.us

-WM

http://letthemfail.us

Welcome to EP

Surely you had this account for some time because new accounts are on manual approval. Well, glad you're on.

Yeah, we try and i certainly try to dot all i's and cross all t's when I feel fairly "CT" on something...

Paul Farrell on CBS Market watch I notice he writes these heavy doomsday sorts of opinion pieces...but....no statistics, no details and things need to be heavily verified...

else we'll turn into some sort of online blog version of the Glenn Beck show. ;)

Hank Paulson, truth speaker?

But at least that devout religionist, Hanky Paulson, didn't swallow any of those meany sleeping pills. What devotion!!!!!

Geez, that guy is such a creepazoid phoney, and so far he has failed to establish any veracity whatsoever in his public pronouncements (since so many of them have turned out to be lies).

While I wouldn't doubt Russia might have done that, given the context. Recall if you will, the Georgian president met several weeks before with Karl Rove at a international summit at Crimea, then he (Georgia) next attacks South Ossetia in the middle of the night, killing thousands of civilians with their indiscriminate bombing -- including the Russian peacekeeping force stationed there.

Wouldn't you be kind of pissed off, too?

CIA moonlighting on lie detection

I don't know if you saw this but our poorly paid CIA experts are moonlighting for big business, hedge funds and one cited area was lie detection.

So, I can imagine Paulson and others have detailed training on how to not signal body language, facial ticks and so forth to indicate they are lying scum.

;)

That said, for every lie, there sometimes is a grain of truth and I'm convinced China is waging economic war against the U.S. at least and Russia...that wouldn't surprise me either.

So, I would not be surprised that this particular story is true.

Truly a non-story story-but super-important

This really falls into the category of a non-story story -- although I appreciate the reporter at (I think it was Politico) who brought this to light (again).

They've been doing this since the Wall Streeters created and founded the American intelligence establishment dating from around WWII. They not only bounce back and forth between the top directorate jobs, but they continue working at Wall Street while working at the various intel agencies --- actually now private contractors, since the majority of the American intel community has been privatized.

Example: Stephen Friedman -- former top guy at Goldman Sachs. On several intelligence advisory boards of both Bush and now Obama administrations (he was the guy who had to leave the NY Fed chair position as he "appeared" to be involved with insider trading).

He is also involved with other intel-affiliated organizations, including the CIA's venture capital firm, In-Q-Tel, as well as having been on past intelligence boards (NRO reform panel, etc.) and is either involved with the Markle Foundation (an intel-type foundation as intel people bounce back and forth from that foundation to the CIA, etc.) and/or the Center for a New American Security (those two, Markle and CNAS are intimately connected).

An excellent accidental reference on the Financial-Intelligence Complex is the section of chapters on the Kennedy presidency from Richard Parker's outstanding bio on John Kenneth Galbraith (it is almost inadvertent since he's really not covering this subject -- it just becomes apparent with a reading of it).

A little known recondite fact is that during the first Reagan Administration, when he appointed Wall Streeter Casey as CIA director, Casey immediately moved to classify the output from their earth resource recon satellites, and freely handed said information (which had always been open to the public) over to his Wall Street investment cronies.

And the latest move to have full access to SWIFT, begun by the Bush administration and now successfully rendered by the Obama administration, isn't really about that there global war on terror, but simply financial intel.

Financial intel is what it is always about. Always.

Agreed, with one difference.

Correct. The dollar is based upon the mortgage loan market, and that's why they are propping it up (I've spoken with at least four individuals over the past six months who have received zero-down payment mortgage loans, and I don't get out all that much).

But I wouldn't describe the system so much as "socialized neo-facism" as a socialist plutocracy (Michael Parenti's term): socialism only for the ultra-rich, while the rest of us are on our own.

They hope to gradually reduce the vast majority to economic serfdom, if they can hold off the complete economic collapse they've engineered -- but if they can't, it may inconvenience them while being devastating to the vast majority.