I don't know about you all, but I was reading Ben Jones' Housing Bubble Blog 3 years ago when house prices were still climbing 20% a year and housing bulls were laughing at the bubbleheads. To them, the naysayers obviously missed the boat and were just sore losers who rented.

Way back in 2005 there were plenty of people (Federal reserve economists excepted of course) who saw the bubble and predicted that when the adjustable rate mortgage resets came due (beginning en masse in 2007) there was going to be one heckuva housing bust, and a cacophony of calls for a bailout of the greedy and the stupid.

Now that those predictions have come to pass, the question is, should we just let the mortgage/housing debacle play out, or are there ways to intervene that would be socially beneficial?

We ought to at least be able to narrow down the options, filtering out those that mainly bail out the greedy, or else entail too much cost or moral hazard. Of those options that remain, we ought to at least be able to narrow down areas of disagreement. Below are my suggestions.

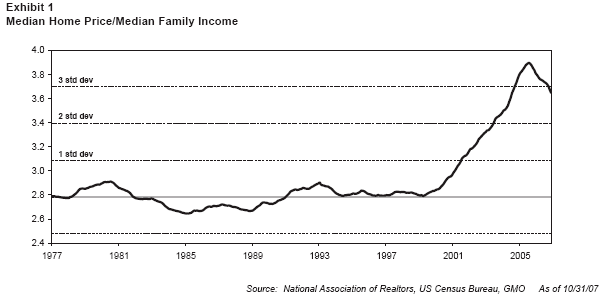

To begin with, the fundamental problem is that the average (median or 50th percentile) house price has gotten completely out of whack with median household income, as show in this graph:

To return to a normal price, home prices must fall almost 50% from their peak, in other words, another 30% plus from where they are now.

To give you an idea just how major a correction this is, a house that sold for $250,000 in 2005 would need to fall to less than $150,000 before we could say that house prices had returned to their "normal" level as a multiple of income.

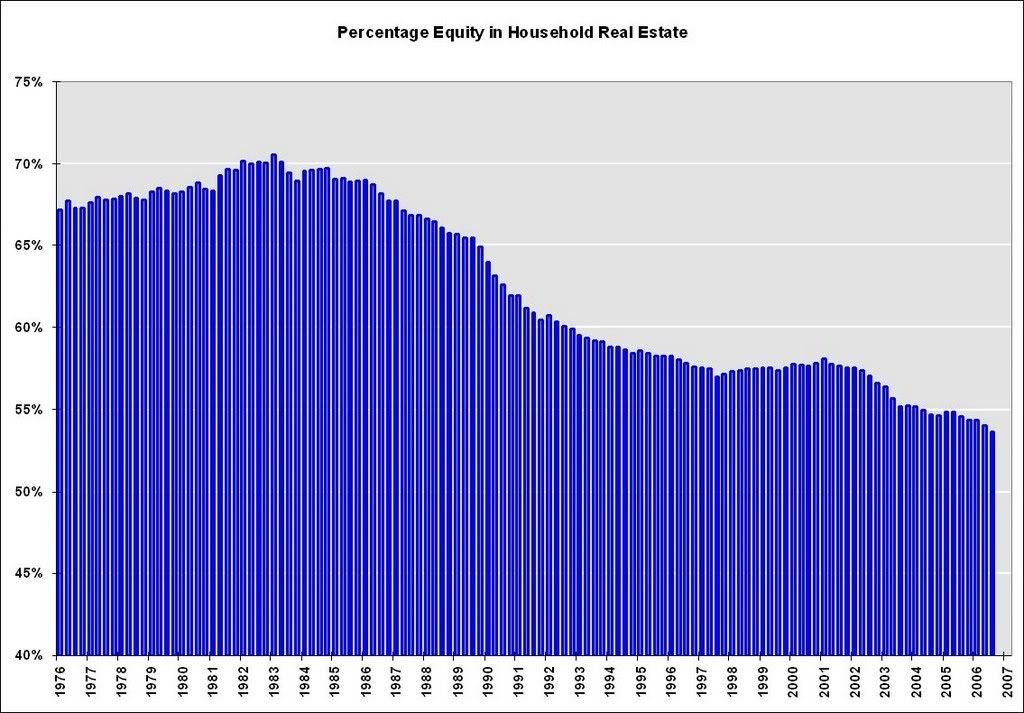

Falling home prices creates another problem: a vast percentage of Americans would be living in houses whose mortgages are more than their house was worth! The average American household has only about 50% equity in their house:

Which means that perhaps 1/3 of all American households would be underwater, owing more in their mortgage than they could get by selling their house. Home owners would be unable to move and would be trapped in their overpriced residence.

Needless to say, this creates a major problem. With the opening acknowledgment that there is no Mortgage Crisis Fairy who can wave a magic wand and make the necessary correction happen painlessly, nevertheless, I happen to think that there are some ways that government can intervene. Intervention have modest cost and moral hazard, and can be extremely helpful to the vast majority of Americans. Not to mention intervention just might help to avert economic Armageddon.

Let's start by seeing if there are classes of people who don't deserve our sympathy or our help.

- Bankers and mortgage brokers. Is there anyone who thinks that these people deserve anything less than a full heapin' helpin' of free market discipline? I didn't think so. That means we should eliminate anything that smacks of a bailout for lenders from our list of government actions to endorse. This includes essentially everything that originates from the Bush malAdministration -- after all, we know who Bush's base is. And sure enough, all of the proposals that have been floated by Hank Paulson, Bush's Secretary of the Treasury, when examined closely enough, have turned out to be bailouts for bankers, and the back of the hand to everybody else. Better to do nothing at all than to enact one of these proposals before January 2009.

- Flippers. Anybody want to help out the get-rich-quick idiots who own 2,3, 10 houses? Didn't think so. So any program that we enact should be limited to the primary residence, and better yet, should not apply at all to anybody who owns multiple residences.

- Owners of McMansions. If you got in over your head by buying a house that is more expensive than 2/3 of all other houses, with wood floors and granite counters, why should I want to subsidize you?

Who does that leave? Potentially only two groups:

- People who were suckered into mortgages more costly than they actually qualified for, possibly because of mortgage broker fraud (people who found out that they didn't qualify for the mortgage they thought they had, only at closing, frequently after they'd already made settlement on their existing residence).

- Lower income families who purchased smaller homes and because of ignorance or being bamboozled, got stuck with the wrong mortgage.

Stay Tuned for Part II, where I discuss the solution proposal in more detail.

New Deal Democrat is on vacation and sent this piece via email for posting while away, edited by RO - admin

Comments

Insurance - Disability and Employment

I think there is another category here. Most bankruptcies are due to medical bills. I see more people lose their homes when they become ill and cannot work. There is no national long term disability insurance. Social security, if someone can get it, gives them enough money for a card board box and maybe a free Burger King begging cup as a bonus gift. Employers now barely cover health insurance, still workers are left with high deductibles and copayments but more importantly seemingly long term disability insurance is rarely offered or does not cover living expenses.

Obviously this cost could be exorbitant but things really do happen, people get sick, get injuired and cannot work and the way things are set up now, if one gets sick they lose everything.

Bail Outs

Bailouts will make the problem worse, not better. Pumping money into the housing market will keep prices higher, and maintain widespread housing unaffordability in such areas as California, where affordability had dropped as low as 10% during the peak of the bubble in 2006.

Propping up home prices does not make homes affordable, nor does it allow more people to buy homes. It does the exact opposite. More money available to lenders makes more money available to borrowers, which keeps prices high. The increased ability to borrow is more than offset by the increase in prices. Home ownership increased because of speculators, buyers of multiple homes, and leasers of homes, not from residential buyers.

By propping up and bailing out lenders, it preserves their capital and loan-making ability, allowing them to loan larger individual amounts to prospective home buyers, which allows sellers to continue charging exorbitant, above-market prices for homes.

The government needs to stay completely out of this. The government created this problem by encouraging and subsidizing investment in a non-productive asset -- housing. Little real wealth was created from this misdirected investment, unlike the real wealth that would have been created had it gone into industrial production.

Government subsidization has gone into inflating the value of fixed assets like homes, instead of into productive assets like factories and manufacturing equipment.

EconomicPopulistForum

EconomicPopulistForum

New Deal isn't here

He's on vacation and this is a 3 part blog series.

So, I think tackling the housing crisis, he's saying there is already a massive bailout of Freddie/Fannie and he's not talking about that here at all.

Good to see ya unlawful.

New form of bailout

As in: The federal government WILL guarantee tax bailouts for any property that does not sell in a TAX foreclosure.

Most of these bank foreclosures now, will, in the next 6 years, become tax foreclosures- because banks don't want to be property managers, and if they can't unload their foreclosed property right away, they'll simply stop paying taxes on it and make the local government deal with it.

What if the federal government stepped in and said to the cities, counties, and states "If you can't auction off a tax foreclosure property, HUD will buy the house for back taxes and turn it into a low income rental".

Effectively, you will have provided housing for the poor *AND* a potential additional stream of income for the federal government to pay some interest to China with.

The bank deserves to lose the house. The guy who lied to get a loan deserves to lose the house. But that guy's family, who is now out on the streets, will need some low income rentals to live in, and right now the free market isn't entirely willing to provide. But auction it off first- because if there are any takers, that means that the free market *MIGHT* be willing to begin to provide again.

-------------------------------------

Maximum jobs, not maximum profits.

I agree with that

I know places like Cleveland and Detroit are loaded with abandoned homes to the point it's a real crime and infestation problem.

I don't see why they don't auction them off for a buck to people who are responsible and can afford the upkeep and taxes as well as turn them into housing for the poor.

Keep out the crime and so on.

The Commoditization of Housing

Mortgages have been pooled and commoditized since the '70s.

Could pooling, and marketing of residential real estate be part of the solution? Of course, a triage of the mortgage meltdown is coming. As Robert Oak suggests a division of mortgages between the wealthy and speculator classes, the middle class with ARMs, and the poor is natural.

The wealthy get no help. The middle class can survive with rate relief and the poor just need help.

But that still leaves the question of the lack of liquidity in the housing market. The inventory overhang is huge. The time to sell is forever.

What if residential housing was sold like stocks with certificates? The certificate is the initial offering value changed by the market with buyers and sellers. The name of the game would be quick listing of properties on a national scale with ease of paperwork.

Mortgages could follow the owner for life of term and buyers could move in and out of properties like time-shares.

Empirically, NY Times suggests that housing prices over time track other commodities, roughly. In an unsentimental way, a house is another commodity, without liquidity.

Burton Leed

Well....

...maybe I am biased but I do not see any 50% drop in housing values. What housing values may be is certainly unclear but...

I've been in housing construction at all levels for 35 years and never in one of those years has construction met the theoretical demand for new houses in that year. In short, housing is despite the current turmoil in short supply. That's one big reason why folks were willing to sign up for crazy loans.

Other factors enter here. Right now at this very moment I have subcontractor bids on my desk which say that the costs of wire and pipe for a project will be calculated the day they are installed. Inflation is raging.

Another factor...where I live, my immediate neighborhood in Berkeley, CA, rapid transit, BART, can be walked to, and the commute to downtown SF and Oakland is and will remain doable. If...if you live in Tracy or further out into the Central Vally where much of the new housing has been erected, on flood plains by the way CA has 10 time the amount of levees LA does, you are.....

Fucked.

My point. It's not very responsible to be making predictions of 30 to 50% corrections. The housing market is too diverse and has lots of wrinkles folks not familiar with it are unaware of for such to be credible. I'd be more apt to agree with a Case-Shiller analysis than this.

People need a place to live all the rest of it flows from that. The problem with the current market is: Folks bought housing they could not afford because that's all that was available.

Flipping and all the rest of the scams are always happening and do not drive the market.

Underneath all this is the secret that dare not speak it's name. The average American, not McSame and not Barkey who have other folks buy their houses, cant' afford a good house because they don't get paid enough.

Corporatist America is siphoning off all the productivity gains and telling the populace, 'You are poor because you lazy, ill-educated and don't love Got enough.'

There are signs this scam is about to implode also.

'When you see a rattlesnake poised to strike, you do not wait until he has struck to crush him.'

write a different analysis post

NDD is on vacation, although I'm sure he'll respond when he returns. But, ya know we're all up for looking at this from all angles. I personally cannot get around as to who in hell can afford these housing prices? Even an income of $100k, way above the national median, this is stretching it.

Housing values

The Sacramento Bee statistics this week showed values since the peak have dropped 39%. This does not take into account the new very low prices from banks that are dumping. We have been told for years that housing was in short supply in California. This is not a business cycle. This is Wall Street gone crazy.

Time for a Bailout for all Legal American Citizens

The big problem is that we are about to see ourselves force from one of exponential growth to that of static state. All forms of exponential growth are ponzi schemes: they are not sustainable. This represents the most drastic economic change since the invention of the wheel. We are in deep doo doo.

Is it fair, or smart, to expect that the America people should be expected to shoulder a complete reversal on everything that we have associated with "the American Dream?"

Two things need to happen immediately:

(1) The Neo-Cons need to be brought to the mat and forced to admit that they are responsible for this mess.

(2) The Legal American Working Class needs a major "stimulus check" and I'm not talking about $600 per wage earner.

If we don't do this we will be completely overtaken by foriegn carpet baggers. I've made an attempt to explain this in the following video but don't think my first attempt at a solution is as equitable is it needs to be. But this at least allows people to understand that what we have been enduring is not "free trade" but rather "corporate trade" -- and it is screwing the American Working Class.

Challenge for Obama to Stop Home Foreclosures

http://www.youtube.com/watch?v=5j57qdQi8Qg