"Put the jam on the bottom shelf so the little man can reach it," Sen. Ralph Yarborough used to say in the 1950s and 60s, when Texas still elected populist democrats to the Senate.

Well, it's time for Obama and the Congress to put some jam, in the form of stimulus and jobs (like a new WPA) in the reach of the little people, because if they aren't careful, the little people are about to get dragged back over the precipice into a chasm of wage deflation.

I've been optimistic about the economy moving out of free fall and actually improving by about autumn, and I still am. But I am bothered by the fact that while all other sectors of the economy, especially manufacturing, are on the cusp of improvement, the average American -- the wage earner and consumer -- is being left behind. My renewed concern is prompted by the report that consumer expectations of the future as reported in the U. of MIchigan survey yesterday, declined for the second month in a row, falling to 62.1 from 63.2. That is the lowest reading since March when this category measured 53.5. This is just about where the index was reported when Black September created the panic that (literally) decimated the economy last fall and winter. It also is one of the 10 acknowledged Leading Economic Indicators I have been citing relentlessly for the last 4 months. One month's decline might be an outlier. Two months decline looks suspiciously like a trend:

Back in the old days, a reading on this index below 80 meant a recession was likely. You can see that all during what Larry Kudlow used to call "the greatest story never told", the alleged "Bush Boom", consumer sentiment never really penetrated 80 to the upside. Consumers -- accurately -- figured out that none of the growth was accruing to them, and as we all know by now, that growth was vacuumed up into the pockets of the top 0.1% of society, creating a Gilded Age that has not been seen since the cusp of the Great Depression. It is fair to say that with the inauguration of Obama, and the quick passage of the stimulus package, Americans started to have hope that the economy might be turned around. Now that hope is fading, and consumers can be expected to act on their beliefs, spending less as we enter the back-to-school and pre-holiday seasons.

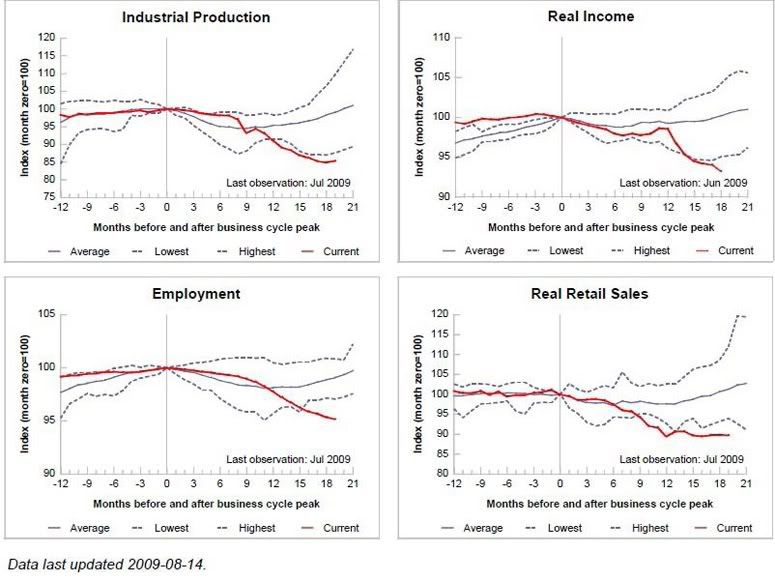

It isn't just the decline in one leading indicator that is causing me concern, it's that wages are on the cusp of out-and-out deflation. Here's a look at the four items of economic data that typically are supposed to coincide with recessions and recoveries:

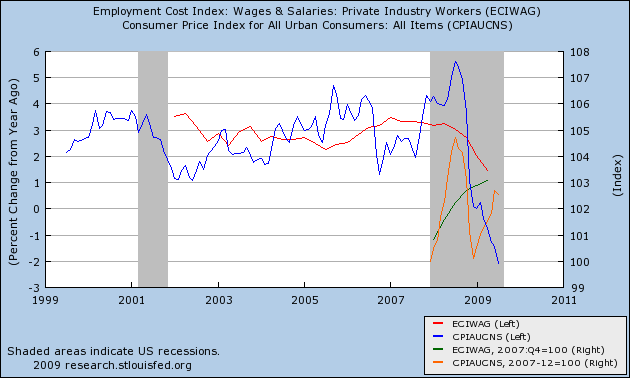

You can see that retail sales have bottomed out but stayed basically flat all year. Industrial production probably just bottomed. Employment is still declining, but at a much lower rate in the last few months, and looks likely to turn positive by the end of the year if not sooner. But the metric at the top right -- real personal income -- as of June was still resolutely declining with no sign of change. Paul Krugman has written about this several times, pointing to the steep downward trend of the employment cost index (a data series that tracks median rather than mean wage growth, that can be distorted by the top tier of earners). What is most concerning is that, while wage growth is rapidly approaching 0, inflation appears to have bottomed, and is beginning to pick up. So far this year inflation is running at +2.1%. It is very unlikely wages will keep up with any further increase in inflation, meaning that real wages will enter deflation. Here is a graph, showing the ECI in blue, and CPI in red, both in year over year terms. On the right scale, they are shown in absolute terms since the beginning of the recession in green and orange, respectively.

One thing we know for sure from the Great Depression is that wage deflation + heavy debt is absolutely deadly. Personal savings statistics from the last year show that consumers are paying down debt and increasing savings such as they haven't in 20 years. But by no means has the overhang of consumer debt been substantially resolved. Attempting to pay back such debt in an atmosphere of declining wages creates a vicious cycle of continuing collapse in demand, and continuing declines in wages, exactly what made the Great Depression so severe.

So far, we have escaped that. As Krugman among others says, we have been pulled back from the abyss. But if wages are allowed to tip over into actual deflation, then just as the economy as a whole is primed to enter actual growth, it might be cut off at the knees by increasing consumer distress.

The actions undertaken in the form of the stimulus plan, as well as the massive injections of cash into the financial system by the Federal Reserve, have set the stage for a turnaround, but it will all go to waste if wage deflation pulls us back over the precipice into the abyss. It's time for cash-for-consumers, and it's past time for a new WPA type of plan. The $750 rebate to consumers in Spring 2008 gave us 1 season of actual economic growth during this "Great Recession". Another direct injection of spending money for average consumers is needed NOW to create sufficient demand over the next 6 months to counteract the pull from the death vortex of wage deflation. It's time to "put the jam on the bottom shelf where the little man can reach it."

Comments

The question is does anyone in Washington care.

Wage deflation is not in the vocabulary of policy makers.

All is well as long as you have a strong financial oligarchy - the oligarchs will save us.

LOL

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

The real issue is too much debt

I think this article highlights a lot of important data and makes several good points concerning the potential for wage deflation, but I respectfully disagree with the claim that deflation is "deadly."

I actually think that in this case deflation is a good thing. It may not be good for the politicians in power, but the current standard of living for the large majority of people in this country is no longer sustainable, and is reliant upon too much debt. And the longer everyone tries to maintain this standard by creating more debt to fund it, the worse things will ultimately get when the debt must be repaid.

But since our government and financial elite remain in power and they continue to try to reflate the debt bubble, the average person is caught in a vicious cycle and has very few ways to protect himself. That is why I continue to advocate investing in gold related assets, which have proven throughout history to do well in times of high deflation and high inflation.

Ignoring your gold plug - debt replaced wage growth

Restore the link between wages and productivity!

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

edited

We do not allow what is called referrer spam on EP. PERIOD. So, trying to peddle some "gold site" which is promoting some product...buy an ad.

Accounts are for participating in discussion, only.

EPer's, if you see such a post, comment, whatever, please troll rate it and you might also alert me so I can ban that user.

I think you're right

I've thought for a long time that the destruction of the middle class eventually will pull the entire economy down and from the graphs on unemployment, wages, hours worked, numbers on food stamps, the beyond belief income inequality...

This might well be the inflection point.

They still are not doing true Keynesian, which was to put money into the pockets of workers, i.e. increase income.

A focus on wages, on workers, on the middle class....

now if we can analyze the need for this from a macro economic view, from a strategy of long term economic growth, ....maybe we will get heard?

It seems like when one talks about the general economic state of the middle class, not only is that ignored in D.C. it's almost "poo poo ed", as if the citizens, beyond demanding everyone shop, get little attention at all on the very obvious...

people need a paycheck and one that pays the bills and then some.

If the U.S. could get a WPA, I would hope it would be a strategically wise WPA, CCC in terms of projects.

I think the nation has been taking all of those public works for granted and now 75 years later, they are crumbling in many cases.

Cash for clunkers system

You are right when you say that there most consumers are not seeing any of the effects promised by the stimulus. They had a perfect opportunity with the cash for clunkers system to make it good for those without cars but they even dropped the ball with that. online casino

cash for clunkers

Honestly I'm not so sure how taking on a new car payment helps that much....that said, it's better than nothing and it sure seems to have jacked up durable goods as well as industrial production and that's all very good because it implies U.S. jobs.

Someone bought gas futures options (not oil, natural gas) to triple in the next year (large hedge fund) so if oil jumps back to insane prices AND someone bought a super fuel efficient car with the cash for clunkers, it will help out in the long run.

unemployment "rate"

the nominal unemployment rate may be turning up/levelling off, but what about the actual employment numbers? The numbers seem to indicate a state of limbo developing--not employed OR unemployed, just job/incomeless. How is an overspent, overleveraged working/middle class going to generate any real demand(not government debt offsets) without an extended retrenchment period? It is not easy, maybe not even possible, to rebuild personal finances while spending enough to support general growth in consumption, I mean,cis a vis "the paradox of thrift", if we can barely meet current obligations, how are we supposed to buy more crap?