NBC is reporting that Federal Reserve Bank of New York President, Timothy Geithner has been nominated by President-elect Obama to be the new Treasury Secretary.

As new developments occur, I will update. Below is a brief from Wikipedia about the nominee.

After completing his studies, Geithner worked for Kissinger and Associates in Washington, DC, for three years and then joined the International Affairs division of the US Treasury Department in 1988.

In 1999 he was promoted to Under Secretary of the Treasury for International Affairs and served under Treasury Secretaries Robert Rubin and Lawrence Summers.

In 2001 he left the Treasury to join the Council on Foreign Relations as a Senior Fellow in the International Economics department. He then worked for the International Monetary Fund as the director of the Policy Development and Review Department until moving to the Fed in October 2003.[1] In 2006 he became a member of the influential Washington-based financial advisory body, the Group of Thirty.

On 21 November 2008, CNBC reported that Geithner would be nominated for the position of Treasury Secretary for the Obama administration.

He was involved in the Bear Stearns and AIG Bailout and the decision to let Lehman Brothers fail.

from wikipedia

It will be interesting to see if he gets accepted. More to come.

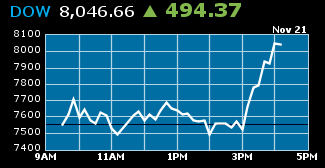

UPDATE 1: More reaction coming in. Markets have indeed gone up on the news. In a related CNBC story there was this interesting quote.

"I would say the market is going to like it," said James Awad, managing director of Zephyr Capital. "[Former Clinton Treasury Secretary Larry] Summers was more controversial. People will view it as a safe choice, an experienced guy. There's a little bit of a question because he's associated with the bailout, and that's still a work in progress and not totally successful. There will be a few who'll be upset because he's asscoiated with the TARP."

- excerpt from "Geithner to Be Nominated as Treasury Secretary", CNBC, 2008

UPDATE 2: Sorry, I'm typing this as fast as I can. Trying to get the stuff out to you as soon as I get it. The Wall Street Journal is now reporting that President-Elect Barack Obama will introduce his entire economic team next week, perhaps as early as Monday. Elsewhere, rumors are now swirling about a possible replacement for Fed Chariman, Ben Bernanke.

UPDATE 3: Washington Post is reporting that New Mexico Governor, Bill Richardson is considered a "top contender" to be Secretary of Commerce. Nothing official from the Obama team, so it remains to be seen if this turns out to be true.

UPDATE 4: Wall Street is looking positive from this announcement of a possible nomination of the New York Fed President. Bloomberg is reporting various comments from some bankers and the market's reaction.

Nov. 21 (Bloomberg) -- U.S. stocks rose and the Standard & Poor’s 500 Index rebounded from an 11-year low after President- elect Barack Obama picked New York Federal Reserve Bank chief Timothy Geithner to head the Treasury.“This news could really give the stock market a badly needed shot in the arm,” Chris Rupkey, chief financial economist at Bank of Tokyo-Mitsubishi UFJ Ltd. in New York, wrote in an e-mail to clients. Geithner is a “fantastic choice to help lead the financial markets out of the wilderness.”

- excerpt from "U.S. Stocks Rally as Obama Picks Tim Geithner to Head Treasury", Bloomberg, 2008.

The S&P 500 is up over 30 points right now. The much followed Dow Jones Industrial Index is up over 35 points. While many stocks are up on the news, the only one bucking the trend is Citigroup, which is facing major problems.

UPDATE 5: Wow...this just gets more interesting and interesting! New York Times is reporting that someone close to Senator Hillary Rodham Clinton will take the job. Than an announcement will come by or around the Thanksgiving Holiday weekend.

“She’s ready,” the confidant said, adding that Mrs. Clinton was reassured after talking again with Mr. Obama because their first meeting in Chicago last week “was so general.” The purpose of the follow-up talk, he noted, was not to extract particular concessions but “just getting comfortable” with the idea of working together.

A second Clinton associate confirmed that her camp believes they have a done deal. Senior Obama advisers said Friday morning that the offer had not been formally accepted and no announcement would be made until after Thanksgiving. But they said they were convinced that the nascent alliance was ready to be sealed.

- excerpt from: "Clinton Decides to Accept Post at State Dept., Confidants Say", NY Times, 2008.

Keep in mind folks, nothing is official yet. No announcement from either President-elect Obama or his transition team have been made. Hey, who knows though, we could get something this weekend! Very exciting times!

UPDATE 7: The market has now closed. News of the very possible nomination of NY Fed President Geithner for the position of Treasury Secretary has sent the markets upwards. The Dow Jones Industrial Index closed @ 8046.42, up 494.13; the S&P 500 closed @ 800.03, up 47.59; the Nasdaq 100 closed @ 1085.57, up 49.06.

UPDATE 8: Bloomberg is now reporting that Lawrence Summers will have a spot in the Obama White House. Summers, currently a Harvard professor was once Treasury Secretary in the Clinton Administration. Like the other potential nominations, this one is also not official. News have been reporting that next week, President-elect Barack Obama will be announcing his economic team. For a while now, Summers has been pitching some sort of stimulus plan.

Nov. 21 (Bloomberg) -- Harvard University professor Lawrence Summers will join the Obama administration with a ready-made sales pitch for substantial economic stimulus and a chance that the role springboards him to the Federal Reserve.

Summers, 53, was Bill Clinton's last Treasury secretary. He will have a wide-ranging portfolio and help craft Obama's economic policies, a Democratic aide said. Summers's appointment, along with the nomination of Federal Reserve Bank of New York President Timothy Geithner to be the next Treasury secretary, will be announced Nov. 24, the aide said.

Comments

Rubin's Robots

That's more and more what it's looking like. Straight globalization, multinational corporations running the show DLC agenda.

God. I just hope you uncover some huge blow out against Robert Rubin and his Hamilton Project gang but I sure doubt it!

markets love it

Of course that will wear off real quick. How wonderful he was involved in handing over huge money to AIG and the bail out, the biggest financial rip off in recent history.

So, we're keeping the ponzi scheme going then?

Richardson is yet another corporate tool.

So it's looking like multinational corporations and their lobbyists win, Progressives - squeezed out. Populists - probably banned from D.C.?

How about Hillary? Notice that if she is Secretary of State then that would shut her down completely on health care, domestic issues.

Geitherner wants "global" unified regulation

I found a good blog piece overviewing his views/agenda on regulation.

Note not regulating hedge funds and so on but requiring a percentage lack of exposure.

hmmmm.....

Senate Testimony

located on NY Fed site.

hmmmmm, nothing about regulation really and giving the Federal Reserve more power?

Change you Can Believe in

Just a side note, I'm now also checking out blogs, comments and overall this is the common comment, that the entire change message was an absolute joke, a ruse and just simple marketing to get elected.

People are really pissed now they realize the only thing changed was the name and face on the Presidency versus real dramatic policy shift.