The shock of "Black September", at least on consumer non-durable spending, might be wearing off somewhat. Like Freddy Kreuger, Michael Myers, or Jason Voorhees, it appears that American consumer simply refuses to stay dead, but instead is rising, zombie-like, from the grave to spend another day.

might be wearing off somewhat. Like Freddy Kreuger, Michael Myers, or Jason Voorhees, it appears that American consumer simply refuses to stay dead, but instead is rising, zombie-like, from the grave to spend another day.

Private retail service Shoppertrak issues weekly bulletins about foot traffic and sales in the nation's malls. While not a perfect indicator, it is both more frequent and also a separate source to compare with the official data. In the past it has provided early indications of the holding up -- or not -- of the consumer. For example, by the end of September it had published a special note on the collapse of foot traffic that month, the first indication of the appearance of the consumer collapse of "Black September."

Now, it seems to be signalling that consumers have mainly, but not completely, returned to their pre-September behavior. Keep in mind that due to population increases, a 1% Year over Year increase in retail sales adjusted for inflation (not done in the tables below) should be the norm. The first table is weekly (except aggregated for the holiday season):

| Week | YoY % Change |

|---|---|

| 2/21/09 | (-0.5%) |

| 2/14/09 | (-1.2%) |

| 2/7/09 | (-2.9%) |

| 1/24/09 | (-4.1%) |

| 1/17/09 | (-3.8%) |

| Xmas | (-4.4%) |

| 11/15/08 | (-3.1%) |

| 11/8/08 | (-2.6%) |

| 11/1/08 | (-1.1%) |

| 10/25/08 | +1.0% |

| 10/18/08 | +1.1% | 10/11/08 | (- 1.0 %) |

The second table is the same data aggregated by month. Note that due to differences in volume (e.g., Valentine's Day sales) you cannot simply average the weeks):

| Month | YoY % Change |

|---|---|

| 1/09 | (-3.8%) |

| 12/08 | (-4.5%) |

| 11/08 | (-4.3%) |

| 10/08 | (-1.4%) |

| 9/08 | (-2.0%) |

| 8/08 | (+3.5%) |

If Shoppertrak's data is any indication, February retail sales will not show the cliff-diving of the holiday season.

Mall traffic is not the only indication that consumers are returning to their former ways. Petroleum usage has, for the first time since the beginning of 2008 shown a year over year increase:

I'm keeping good company on this observation, as I see that Russ Winter has noticed this too:

Joe [Sixpack] has even been saving some money. And now there are clear signs that he is crawling out of the bunker, and “normalizing” or “naturalizing” his behavior.

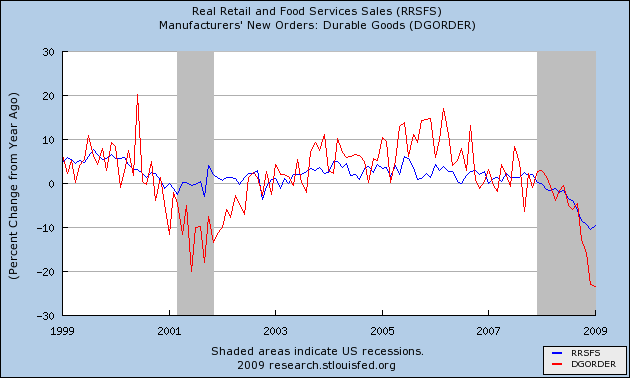

Even if the US consumer has not remained in capitulation on ordinary day-to-day items shown in retail sales (blue in the graph below), I would not expect that to be translated into bigger-ticket durable goods items such as cars -- or houses (red in the graph below):

Yesterday's positive surprise in personal spending was for January. Today and tomorrow we'll get a test of my hypothesis (and notice I'm being fair and posting this before the data is released): auto sales for February is being released today, and ISM services tomorrow. Let's see if ISM services - mainly small retail spending - improves from last month to at least 43+, while auto sales continue to tank. I'll updata later after the data is released.

UPDATE 1: Well, auto sales did not disappoint! Or rather, they did a lot more than disappoint, which is what I predicted.

On to ISM services. (NOTE: I originally said they'd be issued today. Actually it's tomorrow, and I've edited the post accordingly).

UPDATE 2 (March 12): no sooner had I published the above than Shoppertrak sales for the last week of February declined precipitously and ISM Services actually declined to ~41.

Before I declared the US consumer officially dead again, I figured I'd wait for February retail sales.

Well, today I was rewarded. Bloomberg reported that:

Sales at U.S. retailers in February fell less than forecast and January’s gain was almost double the previous estimate, indicating the biggest part of the economy may be starting to stabilize.

Purchases decreased by 0.1 percent, led by the slump in demand for cars, following a revised 1.8 percent jump in January, the Commerce Department said today in Washington. Excluding automobiles, sales unexpectedly climbed 0.7 percent.

Please note that gasoline sales, which continued to (cough, cough) tank, are a significant part of even the -0.1% decline.

This supports the idea that consumers are normalizing their spending on smaller items, even while big ticket durable purchases like cars continue to swoon. This is, as things go, good news, because it suggests that the largest part of the economy may be stabilizing.

Comments

ISM/autos

NDD, it's confusing because this was posting this morning yet ISM was released yesterday. I'm hoping you update this because ISM is down 10% and autos just plunged off the cliff and into the river and to make matters worse, I believe trapped instead are a host of small businesses. Divers are there on the river bottom trying to rescue many of the trapped but we fear the efforts are for naught. The current is too strong.

ISM services will be issued tomorrow

IT was ISM manufacturing that was issued yesterday. I'll edit the blog entry accordingly (I shouldn't have edited on only one cup of coffee!).

side comment

but check the last video on the Sunday Morning comics...I think they are also making USB interfaced coffee. ;)

Yeah, we need more bloggers who are diligent...there is so much going on, I also was confused on the ISM figures, posted too fast.