You've Been Warned. So says the European Central Bank about an impending collision between the never ending European debt crisis and Europe's increasingly slowing economies.

You've Been Warned. So says the European Central Bank about an impending collision between the never ending European debt crisis and Europe's increasingly slowing economies.

Risks to euro area financial stability increased considerably in the second half of 2011, as the sovereign risk crisis and its interplay with the banking sector worsened in an environment of weakening macroeconomic growth prospects. Indeed, several key risks identified in the June 2011 Financial Stability Review (FSR) materialised after its finalisation. Most notably, contagion effects in larger euro area sovereigns gathered strength amid rising headwinds from the interplay between the vulnerability of public finances and the financial sector. Euro area bank funding pressures, while contained by timely central bank action, increased markedly in specific market segments, particularly for unsecured term funding and US dollar funding.

Here's the money shot statement from the ECB. Things are worse than right after Lehman Brother's, the OMG Economic Armageddon global meltdown almost, collapse:

The transmission of tensions among sovereigns, across banks and between the two intensified to take on systemic crisis proportions not witnessed since the collapse of Lehman Brothers three years ago.

Here come the dominoes in the form of global economic malaise. Contagion is when one nation's economic disaster spills over and affects the globe. That's the United States folks.

The ECB in part blames the credit ratings agencies who have been on the attack.

While several catalysts were at play in prompting the materialisation of these key risks, a combination of weakening macroeconomic growth prospects and the unprecedented loss of confidence in sovereign signatures were key factors, crystallising in downgrades, both within and outside the euro area, by major credit rating agencies.

Earlier we had S&P almost declare war on the entire Eurozone with downgrades. Fitch is downgrading as we type, as is Moody's.

Fitch Ratings has placed the Council of Europe Development Bank's (CEB) and the European Investment Bank's (EIB) Long-term Issuer Default Ratings (IDR) on Rating Watch Negative (RWN). The agency has also revised the International Finance Facility for Immunisation's (IFFIm) Outlook to Negative from Stable and affirmed the European Investment Fund's (EIF) IDR with a Stable Outlook.

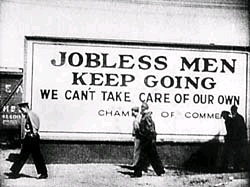

The IMF is also warning of a 1930's style global depression:

The managing director of the International Monetary Fund has warned that the global economy faces the prospect of “economic retraction, rising protectionism, isolation and . . . what happened in the 30s [Depression]”, as European tensions again flared over suggestions in Paris that the UK’s credit rating should be downgraded before France’s.

“There is no economy in the world, whether low-income countries, emerging markets, middle-income countries or super-advanced economies that will be immune to the crisis that we see not only unfolding but escalating,” Christine Lagarde said in a speech at the US state department in Washington. “It is not a crisis that will be resolved by one group of countries taking action. It is going to be hopefully resolved by all countries, all regions, all categories of countries actually taking action.

Economist Paul Krugman also argued for the "D" word to be used:

It’s time to start calling the current situation what it is: a depression. True, it’s not a full replay of the Great Depression, but that’s cold comfort. Unemployment in both America and Europe remains disastrously high. Leaders and institutions are increasingly discredited. And democratic values are under siege.

Here are the four ECB identified points causing a global economic pending crisis starting....well, right now.

- Contagion and negative feedback between the vulnerability of public finances, the financial sector and economic growth

- Funding strains in the euro area banking sector

- Weakening macroeconomic activity, credit risks for banks and second-round effects through a reduced credit availability in the economy

- Imbalances of key global economies and the risk of a sharp global economic slowdown

Such a notice should be signed....

Dear World, Merry Christmas and Happy New Year! A lump of coal for you and all your kin is here within! Sincerely, The Global Financial and Banking System

Comments

ECB speaks Greenspan-ese

Fortunately, kids are still elated at Christmas. But all the adults continue less than enthusiastic about the news. (Oh, goodie goodie! Congress has agreed to continue defunding the Social Security trust fund.)

Meanwhile, the ECB waxes almost Greenspanesque --

"The non-financial private sector also faces some challenges, notably from an ongoing macroeconomic slowdown, but with aggregate euro area balance sheet positions that make it relatively more robust to weather such forces."

I think that means that everything will be managed so as to avoid adversely impacting the interests of TNCs?

Also from the ECB press release (19 December 2011) --

"Stability Mechanism (ESM) and a solution for the unique challenges faced in Greece – is pivotal in making a decisive contribution to curtailing the cycle of risk intensification in the euro area that characterised the latter half of 2011."

I think that means the ECB is begging Greece, "Go ahead, make my day"?

"Things are worse than right after Lehman Brother's, the OMG Economic Armageddon global meltdown almost, collapse" -- Robert Oak

MF Global is the new Lehman Bros?

Von Mises Moment and M.K.Hubbert

There are two aspects of all this - fundamental financial decline while simultaneously running up against the limits of growth. Firstly, financially we seem to be approaching a Von Mises moment and from the words of the man himself:

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

I think the latter will be the outcome as no one is willing to take their medicine - greedy, stupid, etc. So lets pointlessly kick the can down the road a few more times shall we. There is no solution from the right (Austrian school) or the left (Keynesian) as neither has an answer to 'bubbles'. They only treat the symptoms and any politician anywhere in the world that says there is should be placed in a padded cell.

Secondly, the other observation is that there is no solution to our real 'problem' in terms of the impending failure of our civilisation. Infinite debt finance is dooming us as we continue to operate within a finite system (the earth) as if it were infinite. To understand the ramifications of this it is interesting to look at the works of M.K.Hubbert and his explanation of the impact of rising resource use. His model (see his paper Exponential Growth as a Transient Phenomenon in Human History - 1976 - can be downloaded - http://www.uvm.edu/~gflomenh/CDAE170/2003/Hubbert-growth.PDF) really brings home the fact that if we do not change the current paradigm human civilization as of today is doomed. Hubbert flagged this but no one was willing to listen.

This is, as Hubbert points out, a unique and transient episode of human 'development' (the diagrams are interesting). Consequently, the implication is that global population WILL collapse at some point due to, one, resources being depleted and two, infinitely expanding debt finance. The outcome is not a good one as it is resulting in over exploitation of said resources and a massive overshot of population relative to the actual resources that are truly exploitable.

Hubbert was using his model to articulate the limitations and constraints of the current system (not sustainable) and point the world to an alternative based around stabilising population, resource preservation, recycling and the elimination of the debt finance system.

Amusingly and sadly, many have tried to refute Hubbert's model but it is pretty robust and has been used to successful predict the growth, peak and decline of a range of resources - oil being one but also things like fish stocks, etc.

Nexus789

your insights are most detailed as usual. Please create an account and logon. Due to the never ending spam battle, even links are now disabled for anonymous comments and are moderated.

What I think would make an excellent detailed research article is where all of this debt originated from. Spilled milk, yet it makes a huge difference in terms of solutions in my view. i.e. is this debt from financialization, derivatives, doing a loan-lease of public assets and other techniques? I believe much of it is, yet the message is being spun that somehow it's just folly, too much "welfare" and so on. uh huh.