See these two screws on the left? Think of the little screw as AIG bonuses. That big nasty long screw is AIG funneling $183 billion dollars of your money to foreign banks and to banks that already have wads of cash on hand. Those two screw jobs are not even to scale because the large screw would go past the page. Look those two screws over. Now which one do you believe Populist outrage should be focused on?

So we are all outraged over AIG bonuses. Now lets amplify that outrage to the scale of the ripoff. The bonuses are only 0.001 of the real ripoff that just happened. Your tax dollars were funneled through AIG to foreign banks and to U.S. banks for worthless assets. Your own blind rage is a smoke screen, being used by media elites so you do not see the real screw job going on.

In an Instapopulist earlier we showed the AIG payout disclosure. Now I want to amplify those payouts. In the attached file AIG lists payouts to counter parties.

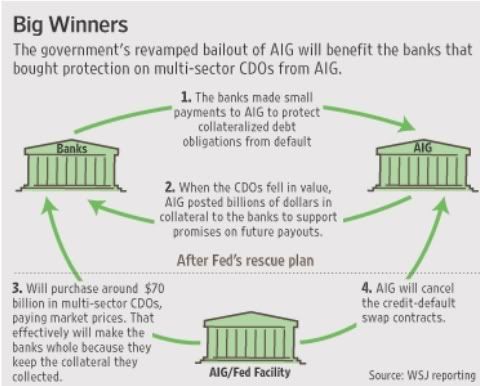

What happened? Basically a bunch of companies placed bets, called credit default swaps, that home mortgages weren't so great and would probably go bust. AIG (Financial Products), as the great global gambling hall, allowed these bets to be placed. Then AIG got a huge mega wad of cash from the government so they could pay out on these casino hall winnings instead of going bankrupt. Banks who won big are foreign banks and of course Goldman Sachs, former Treasury Secretary Paulson's former company.

Think it's about unfreezing credit markets for you and me? Think it's about contracts? Don't you remember something about other nations taking care of their own banking system? Do you believe the United States should prop up the entire globe or payout U.S. taxpayer money to other nations?

Contracts are broken all of the time and considering this is U.S. taxpayer money footing the bill to pay for the below banks gambling bets, yeah, a nation can break such outrageous contracts. This is especially true considering these very institutions are getting billions of your money from the TARP and Federal Reserve. Did you know Goldman Sachs bought an energy speculation firm while receiving TARP funds?

The Wall Street Journal put together an image to show you how this Ponzi scheme works:

Recent comments