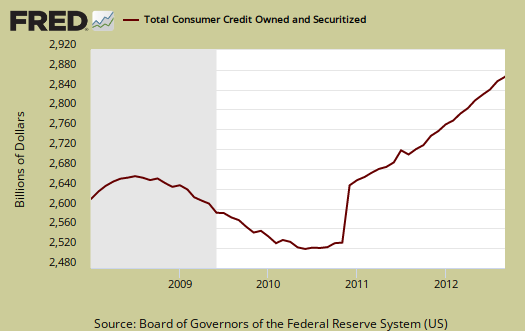

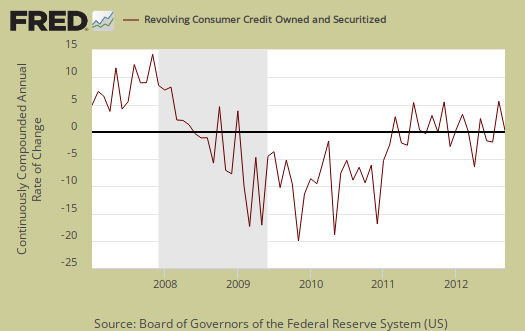

The Federal Reserve's consumer credit report for September 2012 shows a 5.0% annualized monthly increase in consumer credit, once again driven by student loans. Revolving credit declined, -4.1%, and non-revolving credit increased 9.2 %. For Q3, consumer credit increased 4.0% annualized, with revolving credit declining -1.5% and non-revolving increasing 6.5% for the third quarter.

Revolving credit are things like credit cards and non-revolving are things like auto loans and student loans. Mortgages, home equity loans and other loans associated with real estate are not included in this report.

Overall consumer credit increased $11.4 billion dollars to $2.74 trillion, seasonally adjusted. Revolving credit decreased -$2.9 billion while non-revolving increased 14.3 billion from August.

The report gives percent changes in simple annualized rates, also known as a continuously compounded annualized rate of change. Consumer credit contractions correlate to recessions. The consumer credit report does not include charge offs and delinquencies. Credit card charge-offs declined 4.11% in September and the delinquency rate increased by 2.39%.

Below is total consumer credit.

Student loans continue to roar. Federal government non-revolving credit, which includes student loans increased another $13.8 billion to $509.5 billion, not seasonally adjusted. When removing student loans from the not seasonally adjusted data, we have a consumer credit increase of only $900 million by institution type. The federal government started making 100% of guaranteed student loans in July 2010. People went more into debt, clearly, to pay for the soaring, absurdly high, educational costs. Below is the not seasonally adjusted ballooning non-revolving credit held by the Federal Government.

Below is non-revolving credit, seasonally adjusted, annualized percentage change.

Revolving credit, which is mainly credit cards, has declined for three of the past four months. Charge offs are not included in this report. These numbers are seasonally adjusted. Interest rates for credit cards with a balance was 13.22% in August for commercial banks. Think about that and how the Federal Funds effective rate is essentially zero.

Below is the monthly revolving consumer credit annualized percentage change.

Now below is the pools of securitized assets, which increased by $3.8 billion to $57.9 billion. The Fed describes this category as:

Outstanding balances of pools upon which securities have been issued; these balances are no longer carried on the balance sheets of the loan originators.

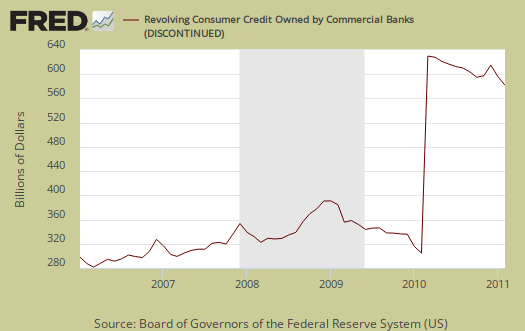

The shift of consumer credit from pools of securitized assets to other categories is largely due to financial institutions' implementation of the FAS 166/167 accounting rules.

They are off-balance-sheet securitized assets originated by all major holders.

Below is commercial banks revolving credit.

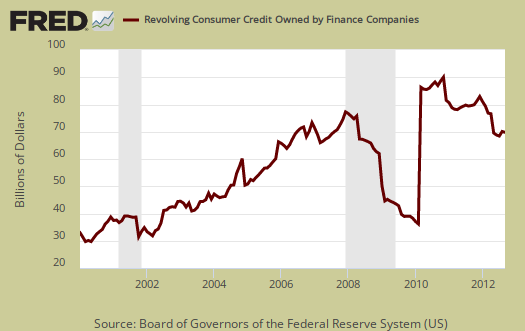

Below is revolving credit by finance companies, which did decline $100 million.

Those 2010 "cliffs" on pools of assets and commercial banks graphs were the off the corporate books derivatives. They were brought back onto the liabilities book, via FSAB accounting rules changes in 2010.

We somehow doubt crushing student loan debt has a stimulative effect to consumer spending or the economy. Every month we see student loan debt just piling up and this month is no exception.

student loans as welfare...

with unemployment rations running out, some are going back to school just to survive...