As it turns out, that old saw about how a frog slowly boiled in water never jumps, isn't true. The frog jumps. Recent surveys show that over 80% of Americans believe the country is on the wrong track. They too are "ready to jump."

In order to convince them to jump, and to stay with a revived and long-term progressive coalition, we need to provide them with the coherent, persuasive, intellectual underpinnings of why the Right Wing has failed, and why they should embrace a new New Deal.

There is an absolutely compelling case to be made, but too often among the blogosphere, that case seems to be marginalized, and drowned out by the shouts of "The End is Near!" More than one economic blogger I respect has gone overboard calling for the Apocolypse, only to have to explain why it keeps getting delayed.

No, the case to be made isn't that Armageddon is just around the corner. It is Inequality of Economic Opportunity: the corporations and the wealthy have gotten the benefits, and the average American has taken on the risk and picked up the bill.

Armageeddon was supposed to be imminent when "America: What Went Wrong?" was written in 1991. It didn't happen. By 1992, "Bankruptcy 1995" made a specific prediction of the year of the cataclysm. It didn't happen. People like Robert Prechter and Joseph Granville predicted imminent stock market crashes throughout the 1990s. It didn't happen. When the dot-com bubble burst in 2000, there were more predictions of immediate economic ruin. It didn't happen. Even highly recommended diarists on progressive blogs have been shouting doom and gloom for a long time.

Well, it could always be that disaster is around the corner, but is that the reason people should embrace a populist economic agenda? Relying on the idea that an economic Apocolypse is imminent, undermines our support among the broad middle-of-the-road Americans, and makes us look like tin-hatters every time cataclysm doesn't show up on average Americans' front doorstep. And it isn't the case we need to make.

The progressive economic case is quite simple: the 28 years since Ronald Reagan's election have resulted in the middle class suffering, and suffering more acutely as time has gone on. Reagan used the hoary old line that "a rising tide lifts all boats" but we have seen in the generation since, that it just isn't so. The rich got bigger and more ornae yachts, while everybody else had to make do with the same old dinghy, a dinghy ever more difficult to maintain. And every year, about 10% of those dinghies get a hole, spring a leak and sink.

The case to be made isn't Armageddon. It is Inequality of Economic Opportunity: the corporations and the wealthy have gotten the benefits, and the average American has taken on the risk and picked up the bill.

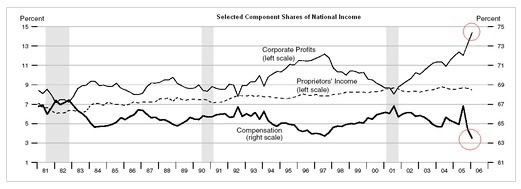

The case is compelling. The percentage of wealth concentrated on big corporations and financial institutions compared with labor is at a high not seen since the 1920s:

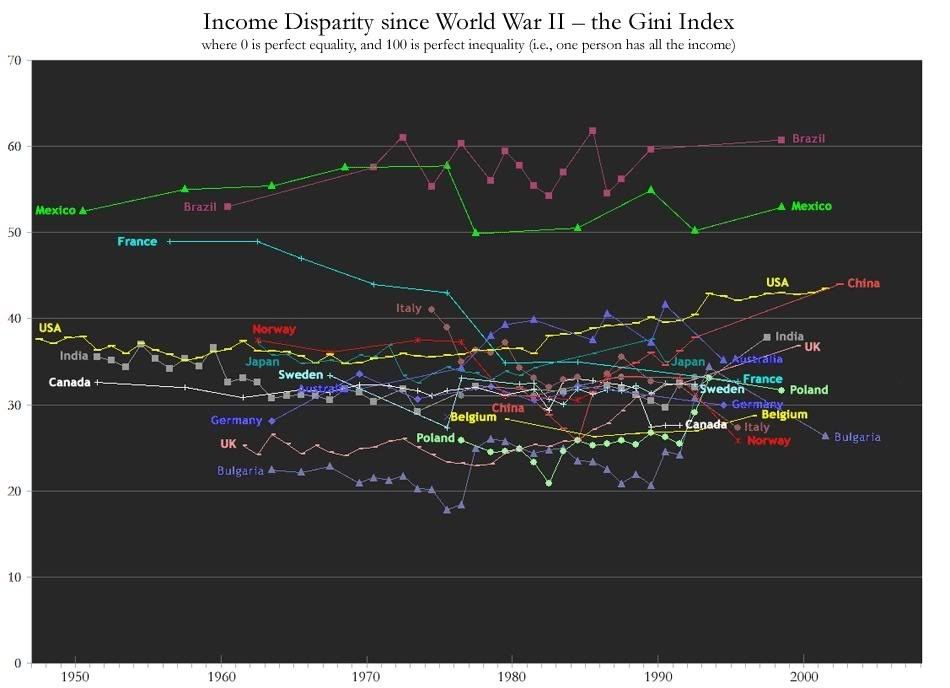

And not only is the Gini Coefficient of inequality in society growing, the US is getting closer to the economic stratification of Mexico or Brazil, than to the relative equality of Europe, Canada or Japan:

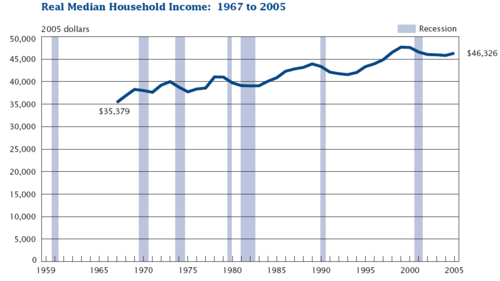

It's not a case of the average American's wealth growing, just more slowly than that of the wealthy. Rather, the middle class hasn't made any economic progress at all in the last 10 years, and is about to see their wealth decline again in this recession:

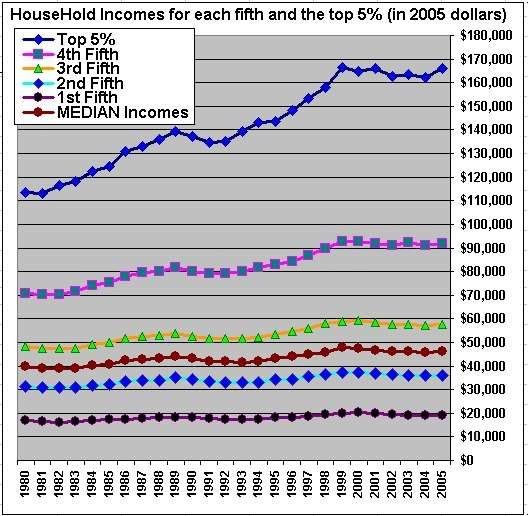

And measured by quintiles, the lowest 20% has actually lost ground since the GOP came to power.

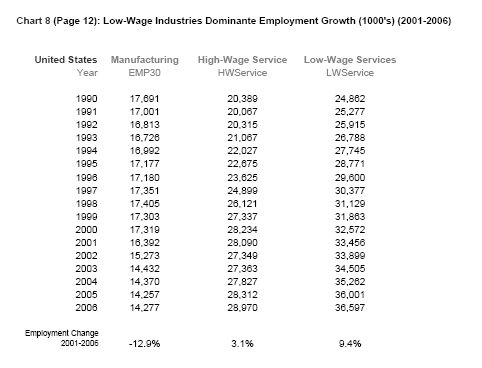

Such job growth as there is, has been concentrated in low wage industries:

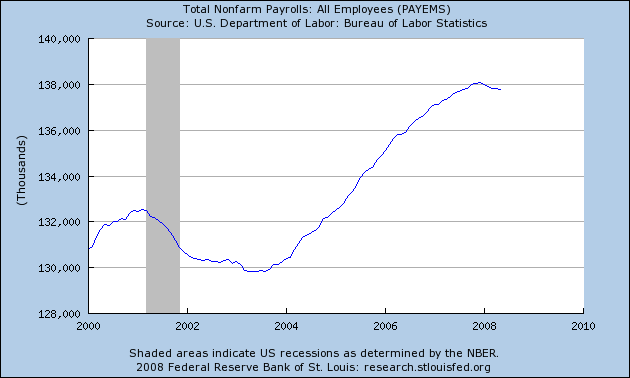

This situation is only going to worsen, because the Bush economy never managed to create enough jobs to keep up with population growth. In the graph below, to keep up with population growth since 2000, the economy should have added ~13.5 million jobs. It only added ~6 million, and with the new recession, close to half a million have been lost again.

This is a permanent loss in middle class earning power.

To try to keep up, Americans have been taking on ever more debt:

Add on to that the fact that it is necessities: housing, medical care, and education the costs of which have spiraled seemingly out of control during the GOP ascendency.

Meanwhile pension plans have evaporated. And the average American now lives in a society where each year about 1 in 10 households faces a 50% or more loss of income. But when large financial institutions get in trouble, savers are punished in order to bail them out with low interest rates, if they aren't bailed out directly. The problem isn't Armageddon, it is inequality. Specifically, there is one set of rules for the Lords of Finance, and another set for the peon on Main Street. Finance is "too big to fail". The little guy or gal gets crushed, and has to deal with an onerous new Bankruptcy Law to boot. So profound is this inequality of economic opportunity that there is less social mobility now in America than there is in Europe.

This can't go on forever. And for the young, already it hasn't. Crushed by debt, the average 35 year old male is less well off now than his forebear of the 1970s.

This is an absolutely stunning, devastating indictment of GOP economic policies. After 28 years, the statistics and the graphs can no longer be ignored. The historical record has been made. They have worked to engorge those already wealthy, while leaving all the risk on the backs of the middle and working classes.

Profit has been privatized and risk left to the public, again and again and again.

The frog is ready to jump. A pro-middle class agenda is all we need to create a generation of progressive middle Americans who will vote for their own best interests. That agenda isn't too hard to imagine: an increase in progressive taxation. A re-commitment to reasonably priced higher education. An end to the system whereby your medical insurance and care depend on your job and medical costs are exploding. The re-invigoration of Usury Laws and action against predatory payday lending. A firm commitment to minimize leverage and speculative bubbles in the financial markets. Methods to make sure existing regulations are enforced. A VAT or similar tax to capture profits from overseas outsourcing and to make sure the funds are directed at those in the US who suffered as a result. A commitment to rebuilding and modernizing our physical infrastructure. Sufficient budget discipline that progressive needs can be funded while the nation's long term financial well being is safeguarded.

It is neither necessary nor particularly productive to base the appeal of progressive economic solutions on the idea that the four horsemen of the Apocalypse -- whether insolvency due to the national debt, or hyper-inflation, or peak oil, or Great Depression 2 -- are just around the corner. Telling the truth about the slow, decades long assault on average Americans will suffice.

Comments

I'm glad to see this

and I'll go further. I have seen more people argue for candidate x versus candidate y and ignore, I mean completely ignore what the specific policy positions are, the people behind candidate x are and what that means to the middle class. Now this is driving me nuts because trying to label something Progressive simply because people want it to be sure isn't going to get the policy changes needed either. I want to be free to stick to actual policy, facts, statistics versus be condemned because I don't subscribe to a particular person or in some cases wrong presented policy that actually will make the US middle class, working America's plight worse.

I mean what is the point of all of this if we, as not super rich lobbyists and other DC insiders, if we cannot get the public and our representatives actually representing us with policy that is reality based, statistically based and good for the nation as a whole.

Your chicken little comments where once again, we do not have people looking at the statistics. Although I must say timing or slope judgment (i.e. a dribble to despair over 30 years or the 4 Horsemen are galloping towards us and right over the hill), is quite tough to estimate.

Certainly Chicken Little doesn't help build up any credibility and assuredly creates yet another cult type movement or a me too movement instead of in this day and age of blogs, trillions of bits to analyze everything and information at the click of a mouse, getting people to think for themselves and look at the details.

The Devil resides in those details, luring, waiting to stick us with his pitchfork and there is no sudden Armageddon, this is a slow torturous death of the US middle class.

Spot on

An excellent article

New New Deal

That is the first time I have seen a chart showing the breakdowns by wages of the stagnation in the mid and lower brackets and the tremendous increases at the top brackets. - The usual right wing response is "see average wages are up!" - because they take the wages as a whole - and I have long suspected that the huge gains at the top skewed the numbers. would be interesting to see a trend lin of the totals of all combined overlayed on the chart

My question always becomes, how much more does the playing field have to be slanted in favor of the haves and have mores before it actually starts trickling own? I think we all know the answer.

The fact is that under the old New Deal we had four decades of unprecendented and sustainable growth as well as a more shared prosperity and this was during a time when the taxes on corporations and the wealthy were much much higher than they are today. Now we have some of the lowest upper bracket and corporate taxes since pre New Deal and yet the economy - at least for most of us- is in the crapper. The right's response is along the lines of - "the reason it isn't working is because we just aren't doing enough supply side"

Your Concerns are My Concerns, But

All of what you have so finely shown has occured during our presently so called progressive income tax. Most all of our nation's income comes from taxes on Labor. Social Security is wonderful, but it should not be financed by a tax on labor. 66,000 pages of IRS loopholes don't help the poor. The poor do not have mortgage interest or property taxes to deduct, neither do they have IRA's and 4O1 K's.

Working and Investing are both desirable we should not penalize either one when it is done more often or better.

Taxing only American workers and investors in a highly automated global economy is stupid.

I do not favor the FairTax as it is written, but it deserves consideration. I believe it could be ammended to support health care and social security. It would tax industries that are not labor intensive, imports and outsourced labor. These are things we are not taxed now. A couple of things make it much less regressive tax than you might think