The truth comes out on the mortgage fraud settlement. The OCC announced the payout terms and for most people, they get less than $1,000 out of the deal. Only in America can one be fraudulently foreclosed on, lose their home, have their credit ruined, only to be compensated less than $1,000 for the ordeal. A whopping 4.2 million borrowers are part of this settlement for years 2009 and 2010.

Payments to 4.2 million borrowers are scheduled to begin on April 12 following an agreement reached by the Office of the Comptroller of the Currency and the Federal Reserve Board with 13 mortgage servicers. The agreement, which was reached earlier this year, provides $3.6 billion in cash payments to borrowers whose homes were in any stage of the foreclosure process in 2009 or 2010 and whose mortgages were serviced by one of the following companies, their affiliates, or subsidiaries: Aurora, Bank of America, Citibank, Goldman Sachs, HSBC, JPMorgan Chase, MetLife Bank, Morgan Stanley, PNC, Sovereign, SunTrust, U.S. Bank, and Wells Fargo.

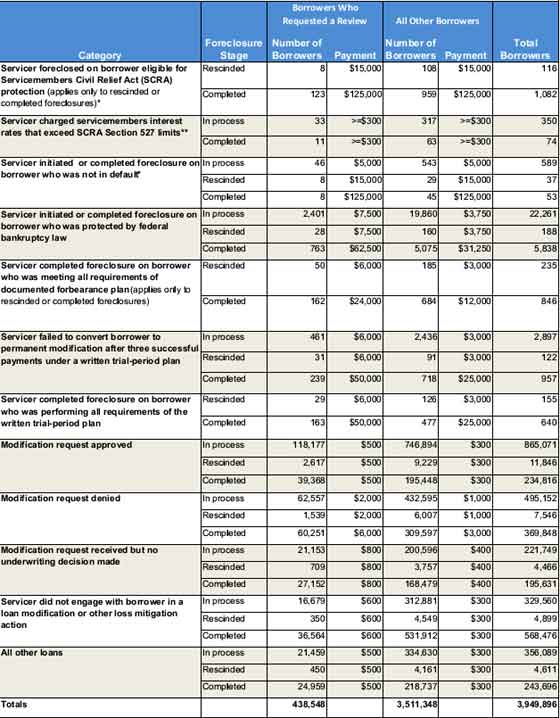

Below is the OCC table of payouts, which doesn't include Goldman Sachs or Morgan Stanley yet. Look at the number of people illegally foreclosed on when they were in bankruptcy versus the settlement amount they will actually get. Only the first three categories in the below table can potentially receive more money over lost equity, but it is unclear if the individual has to sue to get it. The vast majority of people given the run around while they lost their homes will get $300 and $400 dollars.

From the above table, asking for a review mattered for compensation received. Those who were foreclosed on while in bankruptcy who also requested a review received double what others did. Yet from the raw numbers, we see systemic home mortgage abuse by the too big to fail banks and once again, those who pay for this are not the banks. but the individuals who were the victims.

Earlier we warned the 50 state settlement was pig in a poke, corrupt and people would get chump change and now here it is. The real news of the details is just how many people were given the runaround by the banks as they went completely financially under in the process.

In 2009 and 2010 there were 3.9 million actual foreclosures. From the settlement details we see even when one is in the military active service, where it is clearly illegal to start foreclosure proceedings, yet they get a maximum pf $125,000, that's the best an individual military service member can do under this settlement. Most people who were illegally foreclosed upon while in bankruptcy are getting next to nothing in comparison to their real losses. The Huffington Post cranked some numbers on the percentages of people who got taken on a ride by mortgage servicers and bear in mind the above payout table is missing two major banks from their figures.

Nearly a third of all foreclosed borrowers who faced proceedings brought by the biggest U.S. mortgage companies during the height of the housing crisis came to the brink of losing their homes due to potential bank errors or under now-banned practices, regulators have revealed.

Close to 1.2 million borrowers, or about 30 percent of the more than 3.9 million households whose properties were foreclosed on by 11 leading financial institutions in 2009 and 2010, had to battle potentially wrongful efforts to seize their homes despite not having defaulted on their loans, being protected under a host of federal laws, or having been in good standing under bank-approved plans to either restructure their mortgages or temporarily delay required payments.

More than 244,000 of those borrowers eventually lost their homes,

This is an astounding number of people being treated badly by our TBTF banks with homes being seized left and right. Now those same people have insult added to injury with such small payouts and this settlement leaves 'em on their own to sue to recover any real damages. Individuals suing the big banks, how do you think that's going to go with our clogged courts and massive legal expenses just to proceed with a civil case?

If all of this wasn't bad enough, in a banking Senate hearing, Senator Elizabeth Warren exposed how the number of foreclosure fraud victims was made up by the banks themselves.

The OCC and the Federal Reserve allowed the banks to determine who had been harmed and in what manner. The OCC said it “spot checked” the work by the banks. When asked how the results could be legitimate if only 100,000 foreclosure files out of 4 million had been reviewed for errors or fraud, not a large enough amount to be a statistically reliable sample, the OCC spokesperson said the injuries were only hypothetical and might have happened.

There is another hearing by the Senate banking committee on April 17th. Let's hope we hear more about made up numbers from banks and their payout decisions on this settlement. Who knew one could settle with the government and then write your own term details, complete with a tally of your victims. There ya have it, our TBTF banks at work in full partnership with the government.

Comments

The shaft from beginning to end

When the banks captured the mortgage market they entered a market regulated by states, but in the Gramm-Leach Bill they said they would ignore state mortgage laws and be free from prosecution. They had no "fiduciary" duty to anyone unlike someone licensed under CA real estate laws. They hired people willing to robo-sign, fake notary stamps and fail to keep records. It was a pass-thru process with the banks selling unread mortgages to investors buying blind. After at least ten years of toxic undocumented mortgage creation it is impossible to convert that toxic dump site to a legal system. Those foreclosed by the sheriff were collateral damage of no concern to a government who allowed the process and the banks who continue today restrained only by the massive numbers of law-suits from investors around the world. Between the government doing fake prosecutions of some big banks for chump change and freedom from prosecution to the statute of limitations, the banks hope to run out the clock free to continue business as usual. Most of the toxic mortgages have been shifted to the federal government. As some say "the biggest heist in history" and they got away with it.

Even Worse

Not only did they foreclose on those behind in payments, NYTimes reported that banksters foreclosed on individuals not behind in payments at all. Folks who requested loan modifcations were routinely foreclosed. Let's show them!

All this made the crisis bigger and worse. In the Great Depression, FDR had the wisdom to subsidize the mortgages of those who had a chance of making payment, thereby aleviating some of the 30's banking crisis. Nothing like the New Deal solutions was re-attempted in the Great Recession.

Burton Leed

in the chart

you see people who were foreclosed on who were not behind in payments and there were some who did not even have a mortgage at all. So they get $32k and you know there is no house worth $32k.

Foreclosure settlement

What a real joke this is to the consumer. Again another Government settlement that benefited the Banks/Lender...Thanks Feds

You should see how funny

You should see how funny everyone thinks it is when they try to cash their settlement checks.... No banks would cash them saying that there are insufficient funds on the account that the check is drawn. This ain't funny in the least!

Foreclosure Settlement

I had pursued a loan modification for 14 months and continued to do whatever it took pay our mortgage. The request was due to my being laid off because of the recession. Early in the process Wells Fargo for some reason updated our income to double what it was and sent us a statement saying our loan modification was approved and our new payment would be $1,000.00 more a month than it was. When I spoke to someone at the bank they assured me our income had been corrected. Then the request was lost, sent to the wrong department and then lost again even though I was sending all the required documentation each month. Finally after 14 months we heard from someone in the correct department and who had our request. We were told the history of incorrect updates, transfers to wrong departments and losing our file and then finally that they were only a servicer and "the person who held the note" would not do a loan modification. He also said that we had 3 months to try and work something out that it took at least that long before it would be sent to their attorney and more time after that before notice of foreclosure would be sent to the county assessor. The next day, seriously, we received a letter from their attorney stating they needed a bunch of money including fines and attorneys fees or the property would be foreclosed. We also received, the same day, a notice from the county assessors office notifying us of the foreclosure date. I appeared at the hearing as Wells Fargo reported they were foreclosing because we did not honor our loan modification (the one based on our income being recorded as double what it was) to challenge if nothing else the reason for the foreclosure. The judge told me the banks could say whatever they wanted. In November of 2011 I sent very detailed documentation of everything that happened to Independent Auditors. And so now the final note to the chapter. Because according to bank records they gave us a loan modification, you know the one based on incorrect information in our records, we received a settlement check for $500.00, consistent with that category in the table. Oh and they sold the house for $80,000.00 less than we had bought it at, which would have been totally doable had they offered the same to us. The original effort to provide help did not provide oversight and failed to consider greed. The subsequent effort to, in some way hold the banks accountable, did not provide oversight and failed to consider greed. What's that saying...as long as you continue to do things the same way, you will continue to get the same results.

Crock of more mortgage CRAP!

I was booted out of my home in 2010. I had tried unsuccessfully over 20 times to send in the modification package. They(JP MOrgan Chase) kept losing it!! I sent 3 certified checks to JP Morgan Chase, which they cashed but could never find. Throughout this process of receiving letters I am told no JPMC does not list you as someone foreclosed on. I explain that they gave me 3 separate foreclosure dates, during bankruptcy proceedings. To this day April 2013 they are sending demand letters to the address foreclosed on telling me I have to prove valid homeowners policies. Funny, because the house was sold through the bank in 2010. But JPMC has no record of it? Really! We were all victimized once, now we are getting it again! Through this entire settlement process all information is cloaked in secrecy. We do not know where we fall in the categories unless we were told by JPMC the category we were going to fall. Because again, JPMC does not even have records they foreclosed, not even after losing my payments, records of my bankruptcy, etc. No one at all involved in this case knows anything nor can they tell anyone what is going on other than some checks were mailed if we received a post card we will someday get a check of unknown amount. This has been a horrifc run around! I have to wonder if no one knows who is getting what or when it will be paid out, are they just throwing darts at names. More frustration mounting on more frustration. Will it ever end?

Victimized not once but twice now!

Watch "The Grapes of Wrath" to see the same thing

The scam is no one is ever responsible when it comes to facing a customer who's been wronged, or when law enforcement or someone else finally tries to hold someone in the corporation responsible, etc. It's always someone else's fault up the food chain or in some local office down the food chain, but damn if they don't know who exactly. "Well, I just file paperwork, I don't sign it." "Well, I sign it, but I don't mail it." "If I didn't sign these papers, my manager would yell at me, and his manager would yell at him." "The CEO isn't responsible, he answers to the board." "Well, we're responsible to the shareholders, and they are everyone." And so on. It's all crap.

Every single one of these people is responsible, they sure as Hell are responsible enough to collect $ on payday and bonuses and bribe Congress so that they can write their own laws and loot the Treasury and Fed, right?

If corporations are people too, then surely they can take responsibility like human beings. They can be jailed and fined and sent to maximum security prisons like humans without gobs of cash. They can be blamed for society's woes and screamed at for their sense of entitlement just like the people that are homeless and unemployed (although they never felt "entitled" and did nothing wrong). If they screw up, every person that gave an order or signed a paper or sent an email can be blamed for being an idiot or lazy.

Incorporation protects these criminals, but hey, if they want to be people too, by all means, everyone is responsible inside the corporate buildings then - enjoy! If the CEOs of JP Morgan or BOA want to name charities after themselves or make donations in their names (from corporate profits), then surely they like the spotlight and want to be held responsible for all they do, so by all means, they must be responsible because they want the credit and to be seen as the face of the banks.

Grapes of Wrath

The book is even better. That's what we need a modernization of The Grapes of Wrath for it is the same story in reality. The tech bust of 2000 alone was so underplayed, one literally could not rent a U-haul and the streets were lined with them like a wagon train, all going home to Mom & Dad busted.

Now we have third world cities all over while Wall Street cheers about home prices rising.

The movie's quicker; reason 10,000 the "elite" hate education

Oh, history repeats itself time and time again. This game's been played out ad nauseum. Greece, Rome, China, Russia, Japan, the UK, the Middle East, and on, and on, and on. Specifics may change, but the plot's the same - a small elite ignore people with a clue and the game ends badly for the vast majority of people. And the small group of elite blame everyone but themselves. Let me go check the Hearst and Pulitzer papers to confirm this, sorry, I meant Bloomberg and Murdoch.

See, that's why the fools that were born into money or stepped on every living soul to steal and rape for their money hate an educated populace. That's why they bitch and rail again "liberal arts" (which, by the way, also include math, science, languages, and many other subjects). Because Thomas Jefferson's vision of an educated populace and a populace that didn't suffer tyrants would never tolerate the dolts we have now in business or politics. Those who read, ask questions, and don't think MSNBC and Fox and Bloomberg all have some sort of monopoly on information or knowledge are the key to DEMOCRACY and never tolerating the destruction of the USA.

Banksters destroying the middle class, "The Gilded Age," Hamilton and Carnegie and Rockefeller and Mellon and Ponzi, it's all been done. Fighting wars in Afghanistan that cost blood and treasure? It's been done by nation after nation. There are books in libraries that describe the very tactics and strategies to avoid. Russia? Check. India? Check. Britain? Check. Russia/Soviet Union again? Yup. Corporations running foreign policy? Gosh, sounds like the British East India Company or the Dutch East India Company. Military-industrial complex? It was such a threat we had a former General and President warning us about it in 1961 during his Farewell Address. France in North Africa? Hmmm, wasn't that only 40 years ago? Governments around the globe ignoring massive unemployment so that they can cater to their cronies and make them richer still? And that leads to wars?

History repeats itself because the folks in charge don't care and want drones that shut up and die.

still falsifying documents

So i received my check for 600 dollars. basically they r saying i never was in a modification process with them. ya i did all the paperwork for fun then. only to be told i was denied. got rid of my car payments, still didn't help. stopped paying my cards while still trying. didn't help enough. finally had to move because we weren't able to make the payments. went from 2 incomes to one and dropped more than 30000 a year in income isn't enough. to top it all off, all the homes in my old neighborhood were sold for less than 25% of what i bought it for and r subsidized housing.

Shafted American

I am one who "...had to battle potentially (it wasn't potentially) wrongful (if you only knew what Wells Fargo did to me and my family it would make you nauseated) efforts to seize their homes despite not having defaulted on their loans (me), being protected under a host of federal laws (me), or having been in good standing (me) under bank-approved plans to either restructure their mortgages or temporarily delay required payments (I got a 6-month run around on the restructuring...banks did this with intent to foreclose). We were promised again and again it would be restructured, finally the day before the house went up for auction (we were part of the South Carolina office that screwed us) we had no choice and my wife drove 220 miles to file chapter 13 and halt the foreclosure). As my wife was on the road, a representative of Wells Fargo said "if she turns around I think we can get this to go through." That shameful course of action by Wells Fargo was nothing compared to what they did while we were under protection. And yet, having never missed one house payment, we lost everything; including the home we spend a decade fixing up with sweat and real equity, turning a house realtors would not even touch because of its condition, to a very special home for my family. The only reason I would like to think God exists, would be to correct what happened to us and all those others treated like dirt by the banks and derided by a public who thought folks such as us were freeloaders that wouldn't pay our mortgage. Gotta luv a stone throwing society that stands with the stone makers.

Wells Fargo is the worst of the lot

I have no idea why Wells Fargo isn't at the top of the list of protests of outrageous, abusive banks for story after story proves they ripoff people right and left. From ATM fees to checking account fees to foreclosures to credit cards, they are really a predatory lender.

Yet the focus in on Chase, who isn't anywhere near as bad by the numbers, not saying they are good, but in terms of regular people don't come close to Wells Fargo.

wells fargo and asc loan servicing

Three times applied for loan modifications, the second and third efforts resulted in higher payments, baffling. No improvement for my situation other than cash for keys at a loss, the old mortgage was down to 112K from 132K after 18K down payment. when house went back on market after 4 months vacant, it sold for 166K. Now this was a bank robbery. I know the culprit, know where they are and there is a paper trail for the feds to direct file charges, I should be able to sue. Congress, insider trading, lack of bank regulations=lost equity, wrecked my faith in banks and home ownership in U.S

Forclosure settlement check

I received my foreclosure settlement check and only got 300.00 back. Is this some kind of joke. Not only I lost my home but these banks took out money from my own bank left me with nothing. This is a slap in the face.