Debt, Debt Trading and Why It Is Important

You don’t have to repay the advance we gave you last week, provided you spend half of it next week.

A bit of history on debt from Prof. Buckley of the University of New South Wales (Australia),

The beginning was in the early 1980s. And in the beginning were bad loans, and from the loins of these bad loans sprang debt-equity exchanges, which quickly begat debt-for-nature exchanges, and then debt-for-education exchanges, and most recently, debt-for-health exchanges. And today, when all the begatting has been done, the progeny are known mostly as debt-for-development exchanges, or sometimes as debt-for-investment projects (by those who wish to suggest for the technique a more commercial focus).

Where is the exchange when a rich country offers to cancel some of its loans to a poor country, if the poor country spends money on a development project? That’s like our saying to our daughter, ‘You don’t have to repay the advance we gave you last week, provided you spend half of it next week’. [1]

Thus we observe early forms of debt trading, of sorts.

In the debt-for-health segment of the professor's report, we also note:

The Global Fund to fight AIDS, Tuberculosis and Malaria, is another UN initiative. It is a public-private partnership which seeks to finance public health initiatives in developing countries.[1]

The honorable professor mentioned the early 1980s, so let us examine a presidential-level cabinet meeting which was taking place in the White House, 1600 Pennsylvania Avenue, USA, at that time.

From the memoirs of James Watt, Reagan's Secretary of the Interior we learn:

"Secretary Reagan was explaining the inability of those destitute countries to pay even the interest on the loans that individual banks such as Bank of America, Chase Manhattan and Citibank had made. The President was being told what actions the United States "must" take to salvage the situation.

After the Reagan and Stockman briefings, there were several minutes of discussion before I asked, "Does anyone believe that these less developed countries will ever be able to pay back the principal on these loans?" When no one spoke up, I asked, "If the loans are never going to be repaid, why should we bail out the countries and arrange payment for their interest?"

The answer came from several voices at once, "If we don’t arrange for their interest payments, the loans will go into default, and it could put our American banks in jeopardy." Would the customers lose their money? No, came the answer, but the stockholders might lose their dividends.

In amazement, I leaned back in my large, leather chair, only two seats from the President of the United States. I realized that nothing in the world could keep these high government officials from scrambling to protect and bail out a few very large and sorely troubled American banks."[2]

Thus we are gifted with the Depository Institutions Act, which allows for those banks to treat that debt as a security -- thus setting the foundation for future securitization of international debt, debt trading and debt swaps.

And what better way to create that debt for future trading than the public-private partnership, a new vehicle for fun and profit. I briefly covered this in a previous post, A Brief History of Securitization.

From the United Nations’ Secretariat (30 April 1997), titled, Public-Private Partnerships: The Enabling Environment For Development:

Thus, the implementation of initiatives for military conversion must find resources from a diversified portfolio of sources, some conventional, others non-conventional, as exemplified by debt swaps, buy-operate-transfer (BOT) finance, offsetting of government civilian procurement, etc. [3]

And from this United Nations report for the Philippines, in their Annex E below,

Annex E - Public-Private Partnership and Debt Swaps in the Philippines [4]

PPPs Revisited: A Global Scourge?

From a survey of the global literature on public-private partnerships, we see the following sectors covered:

- power generation and distribution,

- water and sanitation,

- refuse disposal,

- pipelines,

- hospitals,

- school buildings and teaching facilities,

- stadiums,

- air traffic control,

- prisons,

- railways,

- roads, (and toll roads, of course)

- billing and other information technology systems, and

- housing.

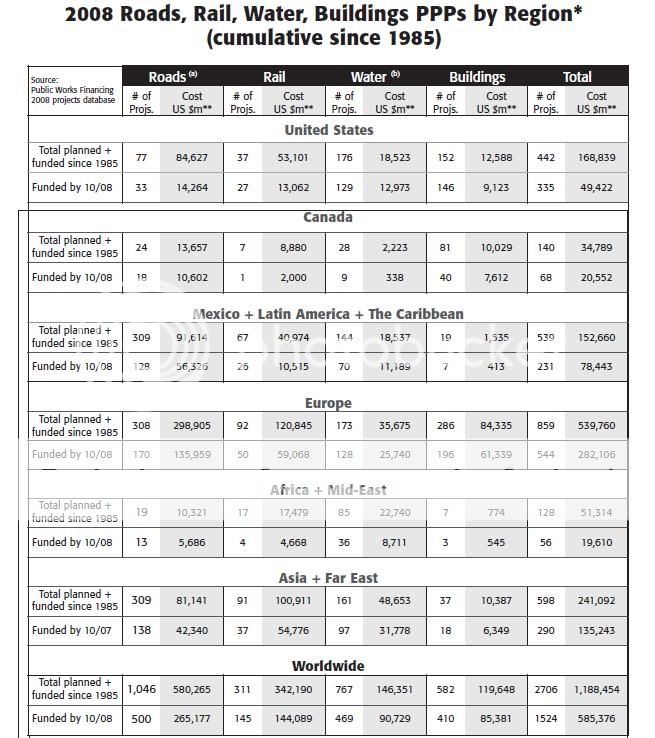

The following graph gives a limited idea of PPPs' growth:

From the Asian Development Bank's Public-Private Partnership Handbook (a "DBFO" is a configuration of a public-private partnership),

An advantage to DBFO projects is that they are financed partly or completely by debt, which leverages revenue streams dedicated to the project. Direct user fees (like tolls) are the most common revenue source. However, other sources of finance in the road sector, for instance, might include lease payments, shadow tolls, and vehicle registration fees.

It is extraordinarily important for thinking people to understand that, just as a leveraged buyout makes massive use of the target's collateral to leverage its buyout (a little-understood concept: imagine telling the mortgage officer at a bank that you wished to purchase a new home, but planned on using it as collateral for your loan!), so too does the leveraged buyout of a local, or national, government utilize those government's assets as collateral.

The full optimization of nefariousness!

And here is where more debt (as in tax avoidance) appears:

The operator will typically establish a project company for implementing the contract, often called special purpose vehicle (SPV). The company owners may be a consortium of companies or a single large company. The company owners will not usually finance all project requirements; instead, they will provide a proportion as equity and borrow the remainder of the required financing from financial institutions or place debt securities in the capital market.[4]

The SPV, of course, is an offshore tax avoidance vehicle, which also conveniently can be utilized to hide the amounts of debt involved.

From the Public Employees Federation website we have an excellent summary of some of those public-private partnerships in the USA:

A $340 million, 14-mile private toll road, called the “Dulles Greenway,” which linked Washington D.C.’s Dulles airport and a rapidly growing suburban area was built in 1995. It never turned a profit and defaulted on its loans in 1996. (South Bend Tribune {SBT} 1/23/06)

Despite optimistic predictions by all involved, the road failed to attract anything close to the 33,000 vehicles a day required for the company to make loan payments, let alone the 68,000 vehicles a day needed to turn a profit. In early 1996, the road was averaging 10,500 vehicles daily.

Ten miles of private express toll lanes were built in California, along a highway in Orange County. The non-compete clause in the lease prevented the state from building or improving roads within 1.5 miles of the toll road, resulting in decaying roads that created a political nightmare. In 2003, the state bought the toll road for $207.5 million in bonds. (Briefing Papers, Pg. 15 and SBT 1/23/06)

Cities in South Carolina, Florida and California have built toll roads to serve real estate projects of politically connected developers. Traffic has missed projections and road operators are headed toward default. (Business Week 8/5/02)

For example, the $200 million, 16-mile Southern Connector in Greenville S.C., was designed to steer traffic towards some private developers’ planned projects, the road opened just as the recession hit in February 2001. Drivers detour to avoid the $1.50 toll so less than half the projected 28,000 commuters use it daily. (Business Week 8/5/02)

There is a history of feasibility studies for toll roads being overly optimistic,” says John J. Hallacy III, director of municipal bond research for Merrill Lynch and Co., told Business Week.[6]

And we are left with an interesting conclusion,

“Of the 10 major private toll roads constructed since the mid-1990s, nearly half carry far less traffic than projected. Some $4 billion in toll road bonds risk default over the next five years unless they’re refinanced, estimates Robert H. Mueller, a municipal bond analyst at the J.P. Morgan securities Inc. (Business Week 8/5/02)[6]

The above quoted material is but a smattering of what you'll find in that article should you wish to follow up on it.

The PPP map for the USA (for now anyway....) appears below:

[g-1]

A crucial factor to understand is the existing relationships between the World Bank and its finance arm, the International Finance Corporation (IFC), along with the IMF, United Nations and O.P.I.C.

When I previously covered cost factors and drivers in the rising costs of health care (The Cauldron), I covered the interlocking financial relationship between state (and union) pension funds and their investments in private equity leveraged buyout funds --- which exascerbated the rising unemployment levels of union and non-union workers.

That occurs at, or within, the national level. On the global front, the World Bank through the IFC, and other international organizations, conveniently use public-private partnerships to build the necessary infrastructure in foreign lands (both the requisite transportation, networks, and facilities) for the labor arbitrage which is to follow (jobs offshoring, etc.).

From a chapter covering the USA in a United Nations' report:

In April 2007, USTDA launched the U.S-India Aviation Cooperation Program (ACP), a public-private partnership between USTDA, the U.S. Federal Aviation Administration, and U.S. aviation companies. The ACP will identify and support India’s civil aviation sector modernization priorities and serve as a mechanism for Indian and U.S. civil aviation representatives to highlight areas for bilateral technical cooperation.[7]

A World Bank slide presentation likewise demonstrates this.

From the Public Services International Research Unit:

PPPs have been widely promoted in developing countries for many years by the World Bank and other donors and development banks, although it is now generally acknowledged that they have failed to deliver investments.[8]

Also under the auspices of the Overseas Private Investment Corporation (O.P.I.C.),

The unique public-private Partnership for Prosperity initiative was launched by U.S. President George W. Bush and Mexican President Vicente Fox in September 2001 to target economic development in the areas of Mexico which generate the most emigrants based on the premise that no Mexican should feel compelled to leave his home for lack of economic opportunity. [9]

Another PPP which may not have worked out too well?

And, speaking of the Bush family, from the site of their very own law firm, James Baker’s Baker Botts:

PPP Representations

Baker Botts lawyers have represented developers and project lenders, including commercial banks, institutional investors, rating agencies, and bilateral and multilateral government lending agencies, in groundbreaking PPP projects worldwide. For example, our lawyers:advised multilateral financial institution in connection with due diligence and financing of a group of companies engaged in water supply and sewage services in six Russian cities

represented leading Russian bank in restructing its participation in a consortium bidding for a toll road concession in Russia

represented an international developer in connection with a PPP transit project development and financing in the U.S.

represented a project sponsor in several PPP highway projects in the U.S.

represented a consortium on the bid, and development and financing for the bid, for the BOT concession for the Saudi Landbridge Project, a planned railway that will provide a container and cargo link from the Red Sea to the Persian Gulf

represented the EBRD on the limited-recourse financing of the refurbishment of the water and wastewater systems of a major Russian city

represented the lenders to the Midway Toll Road Project in China

represented the lenders to the Autobahn Toll Road Project in Brazil

represented a consortium in a bid for an international terminal concession at the St. Petersburg Airport in Russia

represented the sponsor in the concession and expansion for the Juan Santamaría International Airport in Costa Rica

represented the World Bank in its support for an Indian toll road concession

represented the arranging banks in the £250 million U.K. PFI project financing of Ministry of Defence helicopter simulator training facilities

assisted in the establishment and financing of a southern China toll road project

represented a Hong Kong company in its due diligence review of toll road projects in central and southern China in connection with the IPO of these projects

represented an international bank in the financing for the expansion of the Panama City Airport in Panama

Baker Botts has been actively involved in the nascent PPP initiative in the U.S. For example, Standard & Poor's turned to Baker Botts for advice on the strengths and weaknesses of the Chicago Skyway Concession and Lease Agreement, one of the first significant road concession projects in the U.S., in connection with its rating of the Rule 144A offering of project bonds for the refinancing of that project shortly following its award and acquisition. We also were instrumental in the development of the early Exclusive Development Agreements by the State of Texas, which were antecedents to the current Comprehensive Development Agreement (in which concession terms are negotiated between each winning sponsor of a project and the state).[10]

The privatization of education or public-private partnerships in education.

And, chief among the goals of the neofeudalist movement to privatize everything is, of course, the privatization of public education as noted below from a handbook on public-private partnerships from the World Bank’s International Finance Corporation (IFC).

A Global Phenomenon

In this era of globalization, trade alone does not connect nations; international ties now clearly go beyond mere economic linkage. Even educational systems, whose mandates are to preserve and transmit their nation’s unique culture, are affected by the interactive and homogenizing trend toward globalization. One clear example of this trend within the education sector has been the shift from pure state monopolies in the delivery of education to a move toward greater marketization and privatization.1 This change is manifest by the expansion of the non-public or private sector education industry and the emergence of innovative financing and delivery mechanisms within education sectors in both developing and industrialized nations.

This trend has intensified the debate around the dual aspects of education – to what extent is education a public or private good? The definition of private (non public) offered in this Handbook considers private education to comprise any type of formal school that is outside the public education system (i.e., non-government, NGO, Church, Trust, Foundation, parastatal or municipal).[11]

The graph below may provide an idea of the scope of things.

[G-2]

And some of the culprits involved:

[G-3]

Naturally, even the FDIC uses public-private partnerships. From an article by Anusha Shrivastava at the Wall Street Journal Online:

March 30, 2010

NEW YORK—The Federal Deposit Insurance Corp., seeking to rid itself of assets from failed banks, is tapping the securitization market with three new guaranteed deals totaling $4 billion.The first of these deals, expected to be sold this week, is a $1.8 billion offering, according to documents obtained by Dow Jones Newswires.

The offerings pool assets held by failed banks that the agency has seized to protect depositors, including Franklin Bank in Houston and Corus Bank in Chicago. The FDIC took over Franklin in November 2008 and Corus in September 2009.

Over the past two years, the FDIC has had to take over 165 financial institutions brought down by nonperforming commercial and residential loans. For more than a year, the banking regulator has been selling some of the loans through a vehicle structured as a public-private partnership.

Essentially, in these deals, the buyer pays 20% of the assets' value and tries to work out the loans by reducing the interest rate, extending the maturity, writing off some principal or getting buyers to put up equity. Once the loans start to perform, the FDIC, which retains 80% ownership, shares in the returns. The arrangement allows the FDIC to reduce its risk.[12]

Of course, not everyone appreciates these public-private partnerships, and are cognizant of all those negative outcomes. From the ASU, Australia’s largest Water Industry Union,

At the recent National Water Industry Committee meeting the following issues were discussed:

- The ASU opposes the introduction of Private/Public Partnerships

- Greater recognition of the skills of Water Industry workers is required – including the contracting out of employees work

- As job creation is a major industry requirement in the Energy Industry, so too do the employers in the Water Industry need to increase employment in the Water Industry [in both Local Government Water treatment plants] as well as in the Water Joint Authorities.

And, later on we come across some further interesting remarks:

In particular Professor Stillwell explored the problems with Public Private Partnerships (PPP's). Delegates were informed that the current orthodoxy that PPP's reduced the need for Government borrowing freezing up money for other purposes did not stand up to scrutiny because the ultimate responsibility for the provision of these services still rests with Government.

The message: PPP's are not good economics and even worse politics![13]

As one might easily guess, public-private partnerships were used to extract debt situations from Latvia, Greece, Spain, Ireland (and probably Iceland, although their major problem was the purchase of too many credit derivatives).

Regarding Latvia, from the European Bank for Reconstruction and Development’s newsletter, dated November 2006:

Several interesting PPP projects have already been undertaken in Latvia. In addition, five pilot projects will be implemented, pursuant to research carried out by LIDA. These include:

In Salaspils, a private partner has agreed to construct 150 apartments, 50 of which are designated for the needs of the municipality. The municipality will provide the private partner with the land necessary for the construction of the houses. The approximate value of the project is €6.6 million.

In Cesis, a private partner will construct and manage a preschool educational establishment. The municipality has agreed to provide the private partner with the land necessary for construction and to pay a monthly fee for the provision of services. The approximate value of the construction is €4.6 million.

In Jekabpils, a private partner is set to modernise and operate the local heating system. The municipality has leased the heating system to the private partner for 30 years and has granted it the right to receive income for the services from end-users. The approximate amount of investment is €4.3 million.

Various Latvian institutions, including the central government, are currently considering the implementation of extensive PPP projects. These include the reconstruction and management of state main roads (valued at approximately €960 million), the construction of the administrative centre of the Riga City Council (approximately €61 million), the renovation of the Riga light system (approximately €283 million) and the construction of the Via Baltica northern corridor in Riga (approximately €1.3 billion).[14]

PPIP and That Healthcare PPP

The PPP, or public-private partnership is currently working at the steroidal level now, with Treasury Secretary Geithner's implementation of the Public-Private Investment Partnership (or PPIP), which we know from the Special Inspecter General Barofsky's SIGTARP report, and previously posted on this site by Mr. Oak.

As mentioned in the IG's SIGTARP report, and most cleverly predicted by Prof. Hudson some time back, this PPP, like most, if not all the others, was gamed for corruption.

And this Sunday, amid all the propagandistic hoopla of some such historic "healthcare reform" legislation being passed, it is important to understand that this health insurance legislation is structured as yet another public-private partnership, simply extending the privatization of health insurance and subsidizing the consolidation of the health insurance and pharmaceutical industries.

The best explanation, to date, is Glenn Greenwald's outstanding article on it.

While I don't agree with Joan Veon on all her variegated world views, I find the following quote to be spot on.

Joan Veon, founder of the Women’s International Media Group, shows us that the “Public-Private Partnership” has been around since at least 1996 and talks about the history of such arrangements.

“I first heard the term Public-Private Partnership (PPP) when I attended the June 1996 United Nations Habitat II conference in Istanbul Turkey. The first time I read the conference’s Programme of Action, I missed it completely. After I returned from Istanbul, I went back over the document and was shocked at its prominence. I spent six months trying to figure out what it was and I even conducted several interviews with people at the U.N. and other agencies.

A Public-Private Partnership is exactly what it says it is. First, it is a partnership that is business arrangement, and it is for profit…Historically, such deals were considered glaring conflicts of interest, and as such, not in the best interest of the people…When you marry government and business, all existing rules of law and government change as the checks and balances of our Constitution no longer pertain…The door is open for anything – politically, socially, and economically. Plunder is tyranny.” (The United Nations Global Straightjacket (1999) Joan Veon, pp83-86)[15]

And, perhaps a final public-private partnership we can live without:

InfraGard is an information sharing and analysis effort serving the interests and combining the knowledge base of a wide range of members. At its most basic level, InfraGard is a partnership between the Federal Bureau of Investigation and the private sector. InfraGard is an association of businesses, academic institutions, state and local law enforcement agencies, and other participants dedicated to sharing information and intelligence to prevent hostile acts against the United States. InfraGard Chapters are geographically linked with FBI Field Office territories. Learn more about InfraGard [16]

And please let us not forget everyone's favorite Vampire Squid and their take on debt financing and PPPs:

[G-4]

[G-5]

NOTES

- Buckley, Ross. P. University of New South Wales. “Debt-for-development Exchanges: The Origins of a Financial Technique” June 15, 2009.

http://www.austlii.edu.au/au/journals/UNSWLRS/2009/20.html - Watt, James (with Doug Read). The Courage of a Conservative 1985. ISBN 0671528351.

- United Nations’ Secretariat. “Public-Private Partnerships: The Enabling Environment For Development.” p. 9. April 30, 1997.

http://unpan1.un.org/intradoc/groups/public/documents/UN/UNPAN000727.pdf - Stewart, H. United Nations Development Programme (Energy and Environment). “Financing Sustainable Development.” March 1998

http://www.energyandenvironment.undp.org - Asian Development Bank. “Public-Private Partnership Handbook.” Pp. 45, 59-60

http://www.adb.org - Public Employees Federation website. “Public-Private Highways: Careening Toward Failure Nationwide.”

http://www.stopprivatization.com - US Government Submission, p.6, United Nations International Conference on Financing for Development, Doha, Qatar, Nov-Dec 2008.

http://www.un.org/esa/ffd/doha/chapter2/USA_submission.pdf - Hall, David. Trade Union Advisory Committee to the OECD. “A crisis for public-private parterships (PPPs)?” p. 6

http://www.tuac.org/en/public/e-docs/00/00/01/AA/telecharger.phtml?cle_d... - http://mexico.usembassy.gov

- Baker Botts website

http://www.bakerbotts.com/departments/practice_detail.aspx?id=7ad6a95b-f... - p. 5

http://www.ifc.org/ifcext/edinvest.nsf/AttachmentsByTitle/HandbookTOC/$FILE/HandbookTOC.pdf - Shrivastava, Anusha. Wall Street Journal Online. “FDIC to Tap the Securitization Market.” March 30, 2010

http://online.wsj.com/article/SB1000142405274870448650457509786399490507... - ASU News Edition 7 November 2004. pp. 4-5

http://www.asu.asn.au - European Bank for Reconstruction and Development. “Law in Transition Online 2006.” November 2006.

http://www.ebrd.com/li> - http://news.kontentkonsult.com/2009_03_01_archive.html

- http://www.infragard.net/

Graphics

G-1

US Department of Transportation. “Innovate Wave: An update on the Burgeoning Private Sector Role in U.S. Highway and Transit Infrastructure.” July 18, 2008, p. 33

http://ncppp.org/councilinstitutes/dotpppreport_20080718.pdf

G-2

Public Works Financing. “2008 INTERNATIONAL SURVEY OF PUBLIC-PRIVATE PARTNERSHIPS.” Volume 231. October 2008.

http://www.pwfinance.net/pwf_major_projects.pdf

G-3

Slide 3

http://i1012.photobucket.com/albums/af248/james_m_woolley/global-ppp-2.j...

G-4

Slide 9

http://www.csg.org/knowledgecenter/docs/Meeting%20presentations/Goldman%...

G-5

Slide 11

http://www.csg.org/knowledgecenter/docs/Meeting%20presentations/Goldman%...

Comments

nice work again

Yup, anything for the national interest, general welfare, public domain is under attack. I'm so surprised libraries haven't been privatized.

On health care "reform", while Democrats are pleased as punch, I'm torn. Is it really that tough to pass anything, anything at all, that is not written 100%, with "here's a campaign contribution/book deal/job for relative x/whatever deal" in Congress and that is why they are so pleased?

Myself, when I starting thinking about credit ratings agencies literally being able to control, through downgrades, the interest on sovereign debt, it hit me just how powerful these corporations are. I know many have evaluations/revenues larger than most countries GDP.

Glenn Greenwald nails it!

This article by Greenwald really nails it with regard to this legislation.

Plus, it sets a legislative legal precedent for allowing the federal government, at the behest of whatever industry is paying it bribes, to mandate future purchases from private companies and corporations.

Plus, by adding that executive order verbiage on anti-abortion, it allows an ungodly amount of lattitude in refusing pregnant mothers (by the insurance companies, that is) a number of treatments as it "might" induce a "possible" miscarriage, i.e., "abortion."

Plus, of course, on the financial end, much super-leveraging can now be done by health insurance companies and the pharmaceutical industry with the promise of mandated future remittances.

(Securitizations gone wild!!!!)

Now that was a very crucial, and overlooked, economics point!

They've done for the health insurance industry exactly what the Bush administration (with the help of Sen. Kennedy - who voted for it) did for the pharmaceutical industry when they put in that legislation (Medicare Part or Section D) for the pharmaceutical price-fixing, as well as legislate against incoming cheaper medical drugs from Canada (or elsewhere).

Once the Supreme Court privatized emminent domain with that decision of theirs regarding that Connecticut neighborhood, the writing was most definitely on the wall.

It was telling how upon the

It was telling how upon the passage and signage of this so-called healthcare reform package, that insurance and hospital stocks didn't crater into the ground. Indeed, these folks have seen their stocks' value skyrocket over the past year.

India is rejoicing too

They are projecting more money due to the offshore outsourcing of health care sector jobs from the U.S. to be bigger than Y2K.

I believe the health care sector stocks immediately went up, but I didn't catch the percentage (after passage).

Yo, Johnny Venom, check this out!

And an excellent and enlightening article from the healthcare (Kaiser) industry.

Somebody is overjoyed, after all.

link is broken

I went hunting for this piece, the Greenwald and it's a "403" error, also can't find it cached even.

Most interesting, did he get censored for speaking too much truth?

The Greenwald link was OK when I just tried it, just a glitch?

Or Snivitz/

Here's that link again

Redo:

Or Snivitz?

.It's OK now.

who knows

but I can read it now I don't know, maybe Salon doesn't understand permalink?