Nowhere is the evidence of unbridled corporate greed stronger than in what the financial crisis did to the U.S. economy. The losses are staggering. Economic growth was killed to the tune of over $13 trillion. Homeowners lost a whopping $8.1 trillion in home values. Personal income nose dived. Between 2007 and 2010 median household net worth fell by $49,100 per family. That's a 39% loss.

What's worse is most have assumed the economy will eventually recover. There is an increasingly more real possibility. It never will. The reasons are a loss of private investment and since the U.S. worker has been scuttled, all of the expertise and skills have become atrophied. As the phrase goes, use it or lose it and businesses refusing to hire are making sure American workers are losing their skill sets.

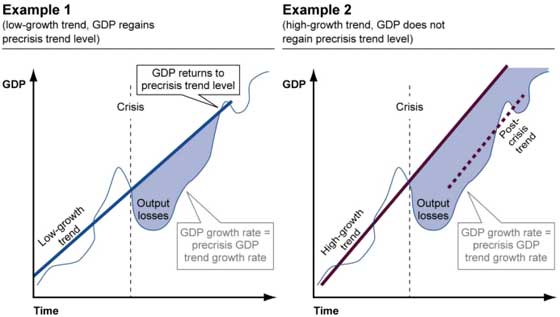

Below is a graph from the GAO report which shows the two scenarios. The first is when GDP recovers and returns to normal growth after a financial crisis. The second scenario is a financial crisis that has permanently destroyed the nation's economy. The bold line is potential GDP and what has been the trend of economic growth in the past. The wavy lines are actual economic growth.

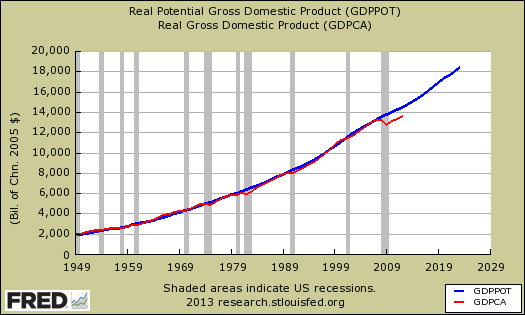

Now take a look at the below graph. This is potential GDP (blue) that our nation could generate versus what the real economic growth was (red) per year. We can see the United States has been really humming along ever since WWII from the below graph...until December 2007. You see that red line drop? That's real GDP. Now which of the two above scenarios, does the below graph look like? Is it example one or example two? It is graph two above. In other words, it's looking like the financial crisis has permanently decimated America's economic growth.

The GAO is really implying this is what has happened, the economic damage is permanent. So says the IMF as well. Their research gives a 25% economic loss as a trend for the four years following the crisis. That means that red line is now repressed by a whopping 25% of the past output trend.

Not only was economic output shifted lower like a 9.0 earthquake and tsunami, there are additional losses, many of which cannot be quantified, such as the human toll.

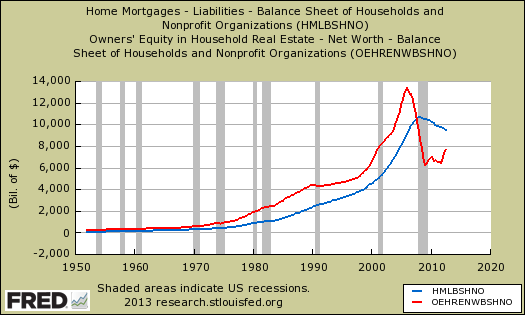

There was $9.1 trillion lost in home equity between 2005 and 2011 and dropping home prices is only part of the reason as people went bankrupt and were foreclosed on. For the first time since statistics were kept, mortgage debt exceeded home equity. That's all the way back to 1945. According to the GAO by December 2011 home equity was $3.7 less than total home mortgages owed. The below graph shows mortgage debt (red) against home equity (blue) as reported in the flow of funds report.

The recognition of just how bad the financial crisis was comes from a new GAO report, Financial Crisis Losses and Potential Impacts of the Dodd-Frank Act which, believe this or not, was chartered to justify the cost of implementing the Dodd-Frank financial reform bill.

Various political spinners blame the federal debt on Obama and the Democrats. There too, the ones to really blame are the Banksters and the reckless behavior of Wall Street. Federal debt went from 36% of GDP in 2007 to 62% by 2010. The causes are actually multi-fold but a huge one is decreased tax revenues. When people don't have jobs, they don't pay taxes. When businesses aren't making any money, they don't pay taxes. When people don't have jobs, they need unemployment insurance benefits and food stamps. Yes, the stimulus did add to the debt but so did bailing out the Banksters. Much to the contrary of what one hears about TARP turning profits, many of the bail outs did not did not make profits. The biggest are Fannie Mae and Freddie Mac, which the GAO reports have cost $316.2 billion.

The main point of the GAO report is letting banks run amok is costly. The financial sector really did implode the U.S. economy, along with most of Europe. Implementing Dodd-Frank is currently estimated at $1.2 billion. Hmm, let's see, $1.2 billion versus $22 trillion, which is larger? The question isn't whether there should be financial reform, obviously there should. The real issue is the ineffectiveness of Dodd-Frank. Even the GAO hints at this with the wishy-washy could work, depends paragraph opener:

The Dodd-Frank Act contains several provisions that may benefit the financial system and the broader economy, but the realization of such benefits depends on a number of factors.

The reason for that is way too much is left to regulators and some imply the bill actually increased systemic risk. Take derivatives for example. They still are going strong and have the potential to once again blow up the economy.

Assuming the risk of counterparty default—most CDS and most other swaps have been traded in the OTC market where holders of derivatives contracts bear the risk of counterparty default.

In addition, swaps traded in the OTC market have typically featured an exchange of margin collateral to cover current exposures between the two parties, but not “initial” margin to protect a nondefaulting party against the cost of replacing the contract if necessary. As of the end of the second quarter of 2012, the outstanding notional value of derivatives held by insured U.S. commercial banks and savings associations totaled more than $200 trillion.

These derivatives have been moved to clearing houses and systemic risk along with it. Now the clearing houses themselves are vulnerable to need a bail out. But that's what ya get when Congress is corrupt and derivative loving lobbyists rush in to prevent any reform passage.

The costs of Dodd-Frank are shockingly high. Yet when one writes a labyrinth that's the price. But that's really not the issue which needs to be brought to light. Will the financial reform bill stop the next financial crisis? From the report:

The Dodd-Frank Act’s potential benefit of reducing the probability or severity of a future financial crisis cannot be readily observed and this potential benefit is difficult to quantify.

What a surprise but when one has a swiss cheese regulation maze, figuring out how many rats can get through it is tough. There was some Basel committee analysis on capital ratios and margins correlated to a lower next financial crisis probability.

Higher capital and liquidity requirements can reduce the probability of banking crises. For example, the models suggest, on average, that if the banking system’s capital ratio—as measured by the ratio of tangible common equity to risk-weighted assets—is 7 percent, then a 1 percentage point increase in the capital ratio is associated with a 1.6 percentage point reduction in the probability of a financial crisis.

Worse than that, the do not know if Dodd-Frank will reduce the probability of another financial crisis even by a small percentage. They don't know. Five years later, a ridiculous amount of rules and governments world wide have no real clue on how to stop the next one, especially with Dodd-Frank. With $200 trillion in derivatives out there like nukes of the cold war, it's no surprise systemic risk is yet to be quantified.

Along with Too Big to Fail and Too Big To Jail we need to add a new phrase. If one cannot quantify systemic risk, then those elements should not exist.

Comments

Banksters control the debate

In the future these times will be seen as a fantastic study in money controlling the debate. Banksters are deemed the "best and brightest" despite the endless failures and bailouts they require, to say nothing of their actual crimes. But anyone asking that money managers and CEOs that screw up, lose money, and need taxpayer $ to survive actually be held accountable, lose their jobs, and not earn such ridiculous sums of money are labeled "Commies," "hippies," and "lazy." Now this comes from people that were often born into wealthy and connected political circles that often feed at the government trough (e.g., political families that have endless generations in both D & R). But their families still deny cronyism and nepotism aid them.

Look at salaries. Banksters and their press always claim they deserve everything. If they get a bonus even though they screw up and destroy companies, it's because they deserve it. If they have jobs in which they get 4 weeks vacation and never break a sweat (literally), it's because they are so much smarter. If they earn $1 billion as fund managers, it's because they deserve it and are working "smarter."

Compare that to the minimum wage debate. Look at the wages needed to barely survive in cities across the country. At a bare minimum probably $12/hr. for one person living in hellhole apt. that excludes entire areas of the country that must be within walking distance of a job. But if he dares complain or people say the wage is too low, the response from the establishment/banksters is stop whining, get another job, work smarter/harder, work your way up. They honestly don't care that hours are purposely kept down to avoid benefits. That people can't get second jobs when their 1st job requires on-call commitments. That jobs that pay so little often cause injuries that bankrupt people with no benefits.That people didn't plan on working for less than $8/hr. when they invested their lives and time in Masters and PhDs. That someone didn't know they would be fired and be deemed "overqualified" at 40 when they got married and had one kid (yes, these folks actually bemoan people for having a kid and being unable to predict they would be unemployed at some point in life). That managers purposely fire people if they start making too much money or don't hire people that might rise in the ranks in the first place.

The message is the same - the banksters at the top are the best and brightest despite the fact they screw up, break laws, fail all the time, and need handouts from taxpayers. And the average person that wasn't born into connections and doesn't break laws or ever lobby Congress (even simple letters are ignored) is always lazy, always ignorant, always begging for handouts even when he/she literally collects nothing from the Government and can't convince anyone in power to care.

Tell a lie long enough and control entire media empires and people will start buying it, especially when the oligarchs do everything they can to keep people unemployed and desperate to survive.

the recession that shouldn't have happened

If Glass-Steagall was in place and most importantly, they finally banned certain derivatives which clearly have contagion, system risk baked right into them in part due to faulty models (CDS), this disaster would have never happened.

This is not a business cycle, or normal ebb and flow, but a financial sector generated disaster which they actually lobbied Congress for and got around 2000.

It is astounding considering the damage done that these people were not tarred and feathered globally. They didn't even lose their jobs and they are busy setting up the same rigged house of cards again. They trashed the global economy for Christ sakes and "Dodd-Frank" is the result? Are you kidding me?

Self-Defense

Regulators were so involved with Wall Street that possibly if lawsuits were filed in criminal court the regulators would also be found guilty. We need an independent commission and courts free of politics and corruption, but that is a dream.

Hedge funds using Bermuda and "reinsurance" to avoid taxes

Yet more non-shocking, but completely repulsive news: these crooks aka "managers" and "best and brightest" are setting up reinsurance companies in Bermuda to help them avoid taxes in the US. The link's at the bottom.

Yes, that's right, hedge fund managers now of all a sudden are interested in the reinsurance game. The funny thing about that (besides the obvious fact that insurance used to have nothing to do with hedge funds and banksters) is that AIG was also a big reinsurance player, was actually involved in the game (not strictly for tax purposes), linked to Bermuda, and still faced destroying the entire global economy unless we, the taxpayers, bailed it out.

But now we have billionaire idiots that can't beat market indexes, earning billions in management fees, and are getting into "insurance" in tax havens for a very obvious purpose of avoiding US taxes. Oh, to top it off, their entry into the actual reinsurance game puts us all, again, at very real risk because INSURANCE and REINSURANCE aren't supposed to be tools for tax evasion, but are actually supposed to be safe, conservative backups when things go wrong for people and businesses that rely on it. No taxes, companies and individuals brazenly evading US taxes by setting up sham or legitimate companies meant solely to avoid taxes, money laundering?, and endangering the global economy once again. How are these not sham companies and transactions a la Enron and KPMG and Arthur Andersen? Hey, buddy, can you spare a dime, because close to 30 million of us here never evaded taxes, never laundered money, but we can't afford to feed ourselves or families and we're scum? Screw this circus, it's vomit-inducing.

And of course regulators, bankster-owned media, big law firms, politicians, and anyone else in the corruption game will say it's all legal and fine because of a "lack of clarity" or it's not illegal at the same time demanding less regulation and fewer laws and ethics because rules, laws, ethics, and enforcement only hurt tax-evading banksters and job killers. $1 billion? Damn, these assclowns begrudge people that want to earn $30,000, or $50,000, or $60,000 for jobs that actually help other people or create real value, but not paying $1 in taxes is too much for them?

http://www.bloomberg.com/news/2013-02-19/paulson-leads-funds-to-bermuda-...

Oligarchs destroy lives but polish their evil with charities

Look at the news today, some ridiculous "Giving Pledge" where the oligarchs donate their wealth that they make through visa abuses, derivatives, insider information/deals, political corruption, crony capitalism, etc. But in order to varnish their images after destroying hardworking Americans and others across the globe, they donate money in their own names to charities, in addition to naming charities and foundations after themselves.

http://blogs.wsj.com/emergingeurope/2013/02/19/russian-oligarch-joins-u-...

Save the charitable donations and self-love, how about you don't steal or make the billions on the backs of struggling and utterly destroyed fellow citizens? How about Bill Gates, you let Americans actually find jobs in their own country and make enough to feed themselves and one or two kids without demanding even more cheap labor? How about the Oracle of Omaha doesn't have annual conventions to kiss his ass and avoids making billions on insider deals with Goldman and the US Government? These vultures get rich off the flesh of their own Nation and have the nerve to donate their ill-gotten wealth in their own names to make themselves appear benevolent. No more.

Oligarchs' charitable giving? Pablo Escobar also gave to certain segments of Colombia and made sure people knew who did it, did that erase his actions? But that use of wealth, power, and making sure people knew his name when the donations were made sure does have a familiar ring.

Resolution by Jedi mind trick (and a time machine, of course)

If I had a time machine and the ability to perform a Jedi mind trick, I would travel back in time and prevent Clinton from instructing Robert Rubin, his Treasury Secretary, to rewrite the charters of Fannie Mae and Freddie Mac.

The original charters of those two GSEs allowed them to purchase only prime loans from banks. Bankers themselves - evil, greedy subhumans though they are - must sell their mortgages in order to get new capital and - before the Clinton/Rubin rewrite of Fannie and Freddie's charters - there was no one to sell bad loans to. The Clinton/Rubin rewrite quite literally created a new (taxpayer subsidized) secondary market to sell bad loans to.

When the rewrite itself didn't trigger the greed response in sufficient numbers of bankers, Clinton used a blunt force instrument - his Attorney General, Janet Reno - to demand compliance. She warned the banking industry that not making their quota of bad loans would not be tolerated: "No loan is exempt (from CRA requirements), no bank is immune. For those who thumb their nose at us, I promise vigorous enforcement". ("Social Justice" was at stake - the Ends certainly justified the Means!)

Greed, like gravity, is always with us, but creating and facilitating it with official public policy can really mess with an economy.

policy time machine

I'd stop the Clinton administration from repealing Glass-Stegall, signing NAFTA and especially the China PNTR. Some Democrats eh?