Although retail sales data reported last week surprised by not being as awful as expected, nevertheless the plunge in consumer spending since "Black September" has been dramatic.

Just how dramatic? Let's compare the cliff-diving plunge in retail sales at the end of 2008 with past retrenchments.

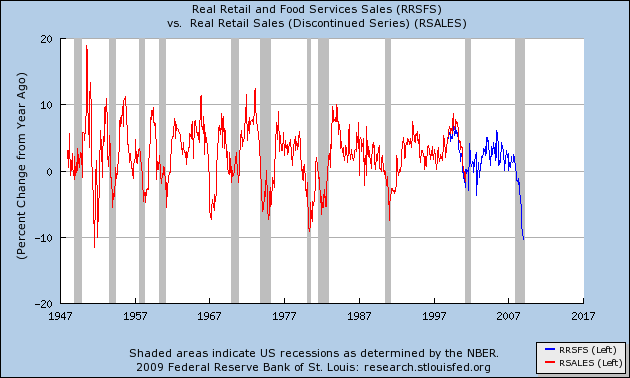

Below is a graph of real retail sales (i.e., adjusted for inflation) since the original, now-discontinued series was started in 1947 (in red) with the more modern version since its inception in 1990 (in blue):

You can easily see that the 2008 decline in retail sales equals the worst since the series were started (the other equally steep decline coincided with a slightly deflationary slowdown in 1954), and worse than the decline during the 1973-74 and 1981-82 major recessions. Any further decline would set a record.

The abrupt decline in consumer spending is confirmed by the private statistics kept by Shoppertrak, which reported a (- 4.4%) decline in spending for the 2008 holiday season compared with 2007, and an equally abysmal (- 3.8%) year over year comparison in January 2009.

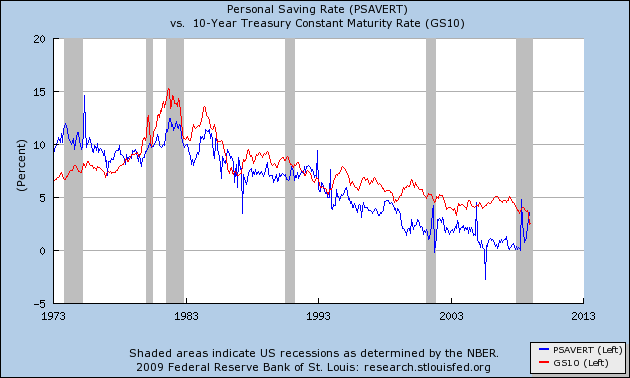

Frightened families are saving the money instead: the abrupt decline in spending is matched by an equally abrupt increase in the personal savings rate in 2008 (in blue). I have included the 10 year treasury yield (in red) -- as, insterestingly, from 1979 until this recession, when the increased savings rate/decreased long-term interest rates intersected, the recession was ending:

Note that consumers started to retrench earlier in the year, but were temporarily overtaken by the surge in gasoline prices to $4+ last summer, after which the spike in saving has resumed. Only the spike in saving at the end of the 1973-74 major recession is equivalent.

I will discuss the sudden and dramatic increase in consumer saving in more detail in my next blog post.

Comments

graphs

What I'm wondering (and doubt) that spending and savings is a 1:1 ratio. In other words, people are losing their ass and this whip out is the main cause in the consumer spending decline, instead of people are socking away the cash. Then there is no ATM called a home equity loan anymore. I know many people were using home equity loans to stay afloat, especially older people who have no other possible source of income.

So, it would be nice if we could see the ratios with more data fine tuning. on spending vs. savings.