As usual, Congress will soon start bickering again over the budget, with all Republicans wanting more tax cuts for the rich and large corporations, and a lot less government spending. Whereas most Democrats will want to close tax loopholes, raise workers' wages, strengthen Social Security and Medicare, and invest in infrastructure. But with a Republican Congress and a Democrat in the White House, the scenario will likely be another gargantuan political battle.

Meanwhile, the U.S. middle-class has been shrinking, while 14.5 percent of all Americans live below the poverty line. As entire cities are going bankrupt, our infrastructure has been falling into a state of decay. Because our wages are declining, so has our tax base — helped by tax breaks for the rich. Since PNTR with China, over 64,000 factories have shut down due to the offshoring of jobs, putting millions of Americans out of work — or forcing them into low-wage service jobs, or into early retirements.

As recently as 2000 (before Clinton gave PNTR to China), only 4 percent of urban households in China were middle-class; by 2012, that share had soared to over two-thirds. And by 2022, China’s middle-class should number 630 million. China has reduced the share of its people in extreme poverty to just 4 percent this year from 61 percent in 1990. And China also embarrasses the U.S. when it comes to infrastructure spending.

Back in the good ole U.S.A., lower tax revenues meant less government spending — because more tax breaks for the rich meant more hoarding for them in offshore banks. But if we could double the budget, we can double spending on such things as defense (that the Republicans want) and infrastructure (that the Democrats prefer) — and also expand Social Security.

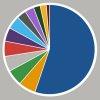

New Jersey Republican governor Chris Christie told Fox News Sunday that 71% of federal spending now goes to debt service and "entitlement" programs, which includes Social Security and Medicaid. So 71% of the U.S. budget goes to service 99% of all Americans — that at some time in their life, will need these entitlements.

Christie's pronouncement was very close. According to the Center on Budget and Policy Priorities it's closer 66% — which pretty much aligns with the official CBO report — which also says:

"Outlays as a share of GDP are projected to rise significantly more than revenues over the coming decade—by two percentage points, from 20.3 percent in 2015 to 22.3 percent in 2025."

So we'll need cuts in spending or more tax revenues or both. If we doubled the budget, the percentage of the budget we currently spend on entitlements would be half of what we currently spend — meaning, it would only be 33% of the budget instead of 66%. Or using Christie's number, it would only be 35.5% of the budget instead of 71%.

Another 18 percent of the budget, or $615 billion, pays for defense and security-related international activities (combined, making it 84% of the current budget). But by doubling revenues and doubling the budget, we can also double defense spending. That should make the political hawks, the Military Industrial Complex and the generals happy too.

And we can double the budget by doubling our tax revenues — and we can do this by reforming the tax code and making other changes. We can start with this:

- Tax capital gains income from investments at the same tax rate as regular wages for common labor — and then tax that income for Social Security (because capital gains income has always been exempt from Social Security taxes). Currently capital gains is taxed at 23.8% — much lower than the top marginal rate of 39.6% for wages (In 1979 capital gains were once taxed at 39.5% --- and under George W. Bush this tax was lowered to a mere 15%).

- Completely eliminate the $118,500 "cap" for Social Security taxes so everyone pays this tax on 100% of their annual income. For example: Members of Congress are taxed for Social Security up to $118,500 of their $174,000 base salaries — meaning only 68.1% of their salaries are taxed for Social Security — and much less for those making millions of dollars a year.

- Add another top tax bracket to the current tax code that will tax all annual income over $1 million at 50% (similar to the Buffett Rule). The top rate was once 90% in the 1950s.

- Eliminate all tax loopholes for corporations so they all pay a "flat tax" of 35% (many pay no tax at all, and actually get tax subsidies or refunds). While the current 35% corporate tax rate is one of the highest in the world, the actual "effective" tax rate corporations pay is much lower. According to the Government Accountability Office, as of 2010 large profitable U.S. corporations paid an average effective federal tax rate of 12.6% — and even when foreign, state and local taxes were taken into account, the companies paid only 16.9% of their worldwide income in taxes.

- End all corporate tax subsidtities, especially for those who make huge profits every year — such as big oil.

- Force the repatriation of over $2 trillion in overseas corporate profits for taxation that's currently being hoarded offshore.

- Make personal offshore banking illegal for domestic citizens and hire more IRS auditors to ENFORCE the law (exempting U.S. citizens temporarily living abroad, such as diplomats and military personal.)

- Impose a financial transaction tax on all Wall Street trades.

- Hire more IRS auditors to review tax returns of individuals with annual incomes over $1 million. (The GOP wants to cut the IRS budget and some want to eliminate the IRS altogether).

- Hire more IRS auditors to review tax returns of corporations with gross revenue streams of over $50 million a year.

- Tax all financially liquid inheritances: i.e. Silver, Wine, Art and Gold (aka SWAG investments), cash, bonds, vacation homes — and stocks when sold, according to the same adjusted gross income as regular wages, exempting only what's necessary in business accounts for the operation of a family business (etc) — and eliminating the $10.86 million exemptions for parents leaving big allowances for trust fund babies. (Why should grandma pay tax on 100% of her meager tips that she earns at the local diner, but the Hilton brats can get $5.43 million tax-free?)

- (Report) Billionaires’ Bluff: How America’s Richest Families Hide Behind Small Businesses and Family Farms in Effort to Repeal Estate Tax (Fix this!)

- Eliminate other tax loopholes in the individual tax code (i.e. "carried interest", the "step-up-basis" loophole, 529 college plans, exemptions for gift taxes, etc.) that only benefit the wealthy — so that everyone pays the same equitable share according to the current progressive tax code for regular wages (which would include the new tax bracket of 50% for earnings over $1 million)

- Eliminate all the Medicare fraud (that Republican governors Rick Scott and Mitt Romney were once implicated for) to lower the cost of Medicare.

- Have the IRS curb the abuse of "non-profits" known as 501(c)(4) organizations — and better scrutinize charities and "foundations" — known for tax-free revenue streams.

- Raise the federal minimum wage to $15 an hour and index it to inflation. This will help eliminate a lot of government spending on entitlement programs such as food stamps (etc.), while at the same time, bring in more tax revenue — and increase discretionary spending, lifting the economy and raising the GDP.

- Use RICO laws to stop busting labor unions. This will increase wages and the tax base.

- Make stock buy-backs illegal like they once were, so companies will reinvest and raise their workers' wages to increase the tax base — rather than stuffing extra cash into the CEO's pockets.

- Curb the abuses of excessive CEO pay — and start enforcing the current laws under Dodd-Frank, such as Executive Compensation Disclosure. Both the AFL-CIO and the Economic Policy Institute report that last year Chief executive pay at major American corporations outpaced worker pay by over 300 times.

- Stop offshoring the better-paying jobs to lower-wage countries (i.e. China, India, Mexico, Vietnam, Cambodia, etc.) with bad trade deals like TPP, TTIP and TiSA. This will also increase the tax base if more jobs that paid a "living wage" were kept here in America.

By raising more tax revenues in a more fair and equitable manner, we can double the budget — and then, not only will "entitlements" account for a smaller share of the budget, the additional revenues can be used to expand Social Security, as well as provide the revenues needed to repair and modernize our crumbling infrastructure.

And every year, any excess revenues can be used to pay off existing debt until we can begin a surplus — but to only be used during the NEXT recession/depression — and not for new wars. A "war tax" can be introduced and voted on by Congress to fund any new wars. (aka Overseas Contingency Operations).

The economist, Mark Thoma, recently had a few thoughts on the subject, showing how we can raise taxes without raising the federal deficit to spend more and grow the economy:

Monetary policy [by the Feds] alone isn't enough to offset the effects of a massive economic downturn ... Attempts to use fiscal policy [by the politicians] run into a big stumbling block: objections to the large increases in the deficit that come with tax cuts or additional government spending needed to stimulate the economy ... the political will needed to pursue deficit spending on infrastructure or anything else simply isn't there ... but stimulative fiscal policy doesn't necessarily require an increase in the deficit.

The first is known as the balanced-budget multiplier. Under this policy, new spending is financed in full by raising taxes ... part of the taxes will be paid by reducing saving rather than consumption, and this will have a net positive impact on the economy. There are also Keynesian multiplier effects associated with this new spending ... when these effects are fully realized, the balanced-budget multiplier is one. That is, when multiplier effects are included, a dollar of new spending financed by raising taxes by a dollar will have a $1 effect on aggregate demand and output ... if we're willing to raise taxes and use the new revenue to finance new government spending, it's possible to give the economy a substantial boost.

The second way to stimulate growth without creating new government debt is through income redistribution. The amount that households save depends on household income. When income is low, saving is also low, often nonexistent or negative (i.e. they are net borrowers). But when income is high, the amount of income that is saved is much, much higher ... households at the upper end of the income distribution save about one-third of any additional income they receive, while those at the bottom have zero or negative saving. Thus, in a severe recession when saving isn't being turned into productive investment, one-third of the income of the wealthy sits idle, doing nothing to help to stimulate the economy.

If we could somehow put that idle savings to work, it would have a fairly large impact on aggregate demand. One way to do this is to use the tax system to temporarily reduce taxes on lower-income households and offset it completely by raising taxes on the wealthy. The effect of this is to take a dollar from the rich and give it to the poor, and increase overall spending by about a third. Because the poor do not save one-third of their income as the rich do, overall consumption will increase.

Noam Scheiber at the New York Times ("Why a Meaningful Boost for Those at the Bottom Requires Help From the Top") writes that, based on unpublished data he's reviewed from the Bureau of Labor Statistics:

"If we’d raised the minimum wage to $15 an hour, the top 10 percent would still have emerged from the 2009-2014 period with a substantially larger share of the increase in the nation’s income than the bottom 90 percent. Inequality would still have increased, just not by as much. And even raising middle-class wages probably wouldn’t be enough to offset the recent gains at the top ... If reducing inequality is the goal, there’s simply no alternative to slowing the income growth of the highest earners by, say, raising upper-income tax rates or limiting the favorable tax treatment of pay for corporate executives — a point a variety of economists, like Joseph Stiglitz, have made of late [Rewriting the Rules]

According to Social Security wage data, about 99.93% of American workers earned less than $1 million a year in wages. But in an Associated Press-CNBC poll four years ago, 20% of Americans foolishly said they'd be millionaires in the next decade. But in reality, only one in every 20 households was a millionaire (that's 5% all of households). Only 60 percent of Americans had said it’s "very unlikely" that they’ll be worth $1 million by 2020 — when probably 95% should have said it was almost impossible without a lot of very good luck (like being born to wealthy parents).

But the vast majority of us will never be millionaires (no matter how smart or talented we are). And although "nominal" wages have gradually increased over the past several decades, because of inflation, "real" wages have remained stagnate, or even declined (especially in the case of minimum wage workers and many of those working in non-union houses). If wages had kept pace with productivity — or stayed on par with CEO salaries and corporate profits all this time — workers today would be earning much more; and not only would more tax revenues have been generated to fund the budget, but more discretionary spending would have been driving our economy — and a lot less entitlement spending would have also been necessary — thereby lowering the share that is currently being spent on entitlement spending.

In his sales pitch for smaller government, Rand Paul philosophizes on tax rates: “If we tax you at 50%, you are half slave, half free”. Via Buzz Feed:

“This past week I put forward a plan to have a simple flat tax, where everybody pays there fair share. Everybody pays, and you can fill it out on one page. Fourteen-and-a-half percent for personal income tax, fourteen-and-a-half percent for business tax."

According to Bloomberg, "the net effect of Paul's plan is that the top tax rate on labor income falls from its current 43.4 percent to 26.9 percent. Taxes on capital gains and dividends would fall to 14.5 percent [from 23.8%] , and taxes on estates to zero."

Currently the federal estate tax exemption is $5.43 million in 2015 (per parent). After that, the top federal estate tax rate is 40%. And currently, the tax rate on personal income is 39.6% for single filers on income above $413,200 (so I'm not sure where Bloomberg came up with 43.4% — and wouldn't the new tax rate be 14.5% for all personal income as well?)

Also, according to Bloomberg, what middle-income households will no longer owe in payroll taxes they'll pay in hidden consumption taxes (i.e. VAT tax). This is a regressive tax on the poor, because they less one earns, the greater percentage of their income is spent on necessities (such as housing, food, utilities, auto loans, gas, clothing, etc.) Those at the top can pay cash for homes and cars, or borrow at rates close to zero — and as venture capitalist Nick Hanauer had said, they don't buy than many more shirts or eat more food than anybody else. So they also have the ability to hoard save more money than everyone else does.

The Tax Foundation concludes that the Rand Paul's plan would reduce federal tax revenue by $3 trillion over a decade, not counting any effects it would have on economic growth. Paul says he'd cut spending to prevent the deficit from rising, so this would mean benefit cuts that affect the poor and middle-class (Damn! Those pesky "entitlements" again!).

We really don't have to double the budget, or double taxes, but if we don't at least increase the budget somewhat more by increasing tax revenues, the American working-class (99% of us) could very well end up just like the people in Greece and Puerto Rico — except the CEOs and bankers. And of course, those on the Forbes 400 list — the top 0.01% — they won't suffer at all; only everybody else will. As usual, it will only be the working stiffs, the poor, retirees and the disabled who would have to take a big austerity hit.

And most of the politicians pushing for these tax plans will always have their federal benefits and pensions to fall back on — at least, for the ones that aren't already millionaires themselves.

But either way, with or without tax increases — or with or without budget increases — the mega-rich will do just fine. So why not raise their taxes a little so everyone else can avoid all the suffering?

Recent comments