Everybody is picking on the multi-billionaires. The beggars (aka "the takers") are always holding out their hand and constantly demanding more — a living wage or a minimum wage, healthcare insurance, paid sick days, vacation days, safety regulations, equal pay for women, pension contributions ... the list goes on and on. When will it ever stop? And can multi-billionaires even afford these unreasonable demands without tanking the entire economy?

Now some of these ungrateful people also want to tax our job creators for Social Security too! After working these "slackers" like plow horses for 40 or 50 years — literally killing many with increased worker productivity (but without sharing those gains with comparable wages) — now these peons want their paymasters to help them when they're too old or sick to work for them anymore! (Of all the nerve!) Rather than letting these obsolete workers retire with a little dignity, shouldn't these billionaires be allowed to just sell them off for glue or Soylent Green?

Billionaires don't need Social Security benefits when they retire (or become disabled). But we can also assume that they made (or inherited*) their billions from consumers and employees (workers) who will eventually need these benefits at some point in their life. So should billionaires, who are exempt from paying Social Security taxes on their "investment income" (aka "unearned income"), be made to contribute more to the Social Security Trust Fund? (* Forbes: "Over 20% — including many Walton family members — inherited enough wealth to place them on the Forbes 400 list with their inheritance alone. It's like they were born on home plate!")

Speaking of which, is it really "investment" income, or is it just "unearned" income?

A recent article about Carl Ichan — "Could a four-year-old do what Carl Icahn does?" — is an interesting piece about the corporate raider who uses vulture capitalism to rake in over a billion dollars a year. This is the guy who sent Apple’s CEO Tim Cook a letter urging him to “meaningfully accelerate and increase the magnitude of share repurchases” — meaning, using “stock buy-backs” to increase the stock value of the remaining outstanding company shares.

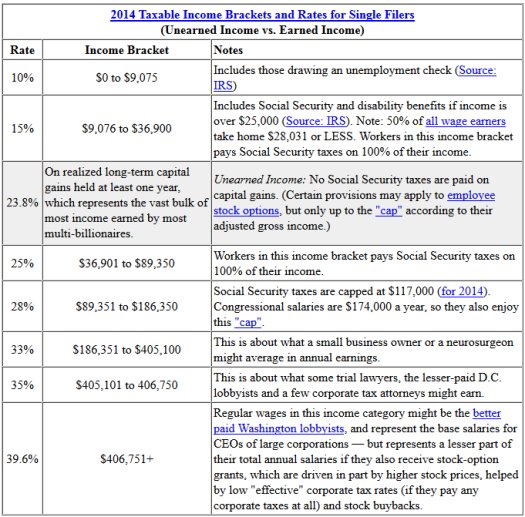

Besides greatly benefiting major stockholders like Carl Ichan, this strategy also bodes well for company execs (such as CEOs like Tim Cook) who holds millions of dollars in stock-option grants as "pay for performance". Once vested, after an option is realized after one year, they can cash out with millions and pay a capital gains tax rate of 23.8% — whereas, the top marginal tax rate for regular wages over $406,750 is 39.6% --- not to mention, there is no Social Security taxes paid on any earnings from capital gains if that is someone's only income. (More on this in the notes at the end of this post.)

That’s why Warren Buffett says he pays a lower tax rate than his secretary. Not only does she pay a higher tax rate, but she also pays Social Security taxes* on the first $117,000 of her wages.

* Most employers in the U.S. (working on behalf of the IRS) deduct payroll taxes from their employees' paychecks, and are most commonly for federal income taxes and FICA (Social Security and Medicare). Sometimes employers might also deduct for state, county and city taxes as well (depending on where a person lives and works). Employees defined as "independent contractors" are responsible for paying their own taxes and pay the tax rates for "self-employed" workers. Note: 95% of ALL wage earners pays the Social Security tax on 100% of their wages; whereas billionaires like Warren Buffett and Carl Icahn (whose only income might be from capital gains) would pay ZERO in Social Security taxes — unless they also paid themselves a "base wage" or an annual salary; in which case, if they paid themselves only one dollar, they might only have to pay about 3 cents in Social Security taxes on that one dollar in regular wages — because "investment income or "unearned income" is exempt from Social Security taxes. (More on this in the notes at the end of this post.)

Regarding Justin Fox’s article at the Harvard Business Review, he writes:

Carl Icahn’s game plan looks something like this:

* Buy stock in a company.

* Write a letter to the company’s board demanding that it do something different from what it’s doing (buy back shares, break up, sell out to another company, throw out the CEO).

* Wait a while. If necessary, write another letter, or a few tweets. Go on TV.

* Sell stock in the company.Carl Icahn’s campaign to get eBay to spin off PayPal succeeded last month. Then their CEO quit the board. Ichan reportedly took home compensation of $1.7 billion in 2013, making him the fifth highest-paid fund manager in the land. In 2012 it was $1.9 billion, putting him in second place. In 2011 it was $2 billion, good for third place. In 2010 it was $900 million — seventh place. In 2009 it was $1.3 billion, which tied him for sixth.

I'm always interested in Carl Ichan. I used to work at the Stratosphere Hotel and Casino in Las Vegas when he once owned it (that was before he later fired a top exec for embezzlement). He has since sold the hotel/casino to Goldman Sachs, who has since fired a few more employees (Job terminations are always a by-product of vulture capitalism creative destruction).

From the IRS data for "Individual Income Tax Returns, Preliminary Data 2012" (2013 is not yet not available. If you find it, please leave a comment.) Tax Year 2012: "Taxpayers filed 144.9 million U.S. individual income tax returns, a decrease of 0.4 percent from the 145.6 million returns filed for Tax Year 2011. This decrease occurred because of the large decline in returns filed by taxpayers in the smaller adjusted gross income (AGI) classifications. The largest decrease (3.9 percent) was a 1.5 million change in the number of returns with an AGI of under $15,000. (Maybe raising the minimum wage and reshoring jobs from Asia could help rectify this tragedy.)

But the news for top income earners was much better. According to the IRS, in 2012: "Net capital gains showed the largest increase, rising 60.4 percent from $310.9 billion in 2011 to $498.7 billion in 2012" — and no Social Security taxes were paid on this income. Assuming gains like this were also realized in 2013, then over those 2 years alone close to $1 trillion in realized capital gains was not taxed for Social Security.

And according to Bloomberg, the $498.7 billion in capital gains in 2012 were concentrated among the highest-earning U.S. households. Taxpayers with more than $250,000* in adjusted gross income received 83 percent of the net capital gains. This is because, most capital gains are earned from holding and selling stock; but it's also earned from the sell of "assets", such beachfront mansions, fine art, wine collections, precious stones, gold, silver (etc.) — aka SWAG investments. (* Less than 1% of all wage earners made more than $250,000. For more detailed wage data, see this recent post: Graphing American Wage Statistics is Not a Pretty Picture)

During 2012, long-term capital gains and qualified dividends were subject to a top rate of 15 percent. Starting in 2013, the top rate was 23.8 percent, because of the expiration of some of President George W. Bush’s tax cuts and an investment tax in President Obama’s 2010 health care law.

A short history of the current capital gains tax rate: Capital gains were taxed at 28% before Bill Clinton lowered them to 20%. Then George W. Bush lowered them again to 15%. By law, this tax cut was set to expire at the end of 2010 — but Obama extended this tax cut for 2 more years in a compromise with the GOP in exchange for also extending payroll tax cuts for regular wage earners and for extending federal unemployment benefits for the long-term jobless. This tax cut finally expired at the end of 2012, and went back to 20% with a 3.8% surtax added under Obamacare to expand Medicare. This 3.8% tax on capital gains for the rich is the GOP's biggest of all reasons for wanting to repeal Obamacare — while at the same time, denying health care for the poor and working-class. (Historically, the maximum capital gains tax rate was once close to 40% in 1978.)

According to Forbes, for 2012 the top 5 hedge fund mangers had personal earnings of $1 billion or more. And those who have their own capital invested (and not just managing other people's money and collecting a management and/or a performance-based fee) earned this with realized capital gains, and subjected to one of the lowest tax rates when compared to "marginal tax rates" for wage earners.

1 - David Tepper $2.2 billion - Appaloosa Management

2 - Carl Icahn $1.9 billion - Icahn Capital

3 - Steve Cohen $1.3 billion - SAC Capital Advisors

3 - James Simons $1.3 billion - Renaissance Technologies Corp.

5 - George Soros $1.1 billion - Soros Fund Management LLC

And many of these hedge fund managers (like Robert Mercer, Paul Singer and Julian Robertson) are giving tons of money to "buddy groups" to rig our elections with dark money to get preferential legislation enacted — such as lower (or zero) capital gains taxes. (A new analysis from Public Citizen shows the biggest “dark money” spender is none other than the US Chamber of Commerce, a mega-lobbying group representing all sorts of big corporations and are constantly lobbying for lower tax rates.)

And if multibillion-dollar hedge funds and other big-money corporations had less than 500 employees, should they also be considered a "small business" (and get an additional tax break) based on their number of employees rather than on their revenues? The GOP thinks so. From Bloomberg:

"A Republican proposal to give small businesses an extra 20 percent tax deduction may yield cuts for some multibillion-dollar hedge funds, law firms and other enterprises that create significant profits with few employees. Republicans hope to release details of the bill during the week of March 19 [2012], said Laena Fallon, a spokeswoman for Representative Eric Cantor, the House majority leader. Cantor told House members in a memo last month his plan would let every business with fewer than 500 employees deduct 20 percent of its profits."

VOX: Exploding Wealth Inequality in the United States (October 28, 2014 by Emmanuel Saez and Gabriel Zucman):

"Current preferential tax rates on capital income compared to wage income are hard to defend in light of the rise of wealth inequality and the very high savings rate of the wealthy. Second, estate taxation is the most direct tool to prevent self-made fortunes from becoming inherited wealth – the least justifiable form of inequality in the American meritocratic ideal. Progressive estate and income taxation were the key tools that reduced the concentration of wealth after the Great Depression. The same proven tools are needed again today."

Full Disclosure: There were 2.4 million LESS individual federal tax returns filed in 2013 than there were in 2012. I was one of those that didn't need to file a tax return that year (or the year before in 2012, or the year before that in 2011). I last filed a federal tax return for 2010 when I was jobless and only had unemployment compensation for that year — but even then, I still owed a little over $135 in federal taxes. Before 2010, I had filed a tax return every year for the previous 35 years.

Political Commentary:

In addition to taxing capital gains for Social Security, all capital gains should be taxed as regular wages based on the current progressive tax rates. This would GREATLY help pay down the government debt and shore up the Social Security Trust Fund (of which 95% of all wage earners will eventually rely on). The first big hurtle to getting this tax reform passed is getting voters to vote in their own best economic interests by voting for progressive Democrats — those who would actually reform the tax code and strengthen Social Security (see below).

- “Social Security 2100 Act,” legislation introduced on July 31, 2014 by Representative John Larson (PDF version)

- "Keeping Our Social Security Promises Act," legislation introduced as S. 500 (113th Congress) on March 7, 2013 by Senator Bernie Sanders (PDF version)

- "Strengthening Social Security Act of 2013," legislation introduced on March 14, 2013 by Senator Tom Harkin (PDF version)

- "Rebuild America Act," legislation introduced on March 29, 2012 by Senator Tom Harkin (PDF version)

- "Middle Class Tax Relief and Job Creation Act of 2012" as specified in the conference report on H.R. 3630 (H. Rep. 112-399), requested by Representative Xavier Becerra (PDF version)

- "Keeping Our Social Security Promises Act," Requested by Senator Bernie Sanders (PDF version)

The next biggest hurtle would be electing a president that would sign this tax reform into law — because multimillionaires like Mitt Romney or Hillary Clinton (like foxes guarding the hen house) might veto such legislation; whereas someone like Senators Elizabeth Warren or Bernie Sanders (if elected as President) would pass this legislation. Of course, once again that brings us to what any politician will "say" before they're elected as opposed what they would "do" after they're elected. But either way, so long as the U.S. Supreme Court keeps upholding voter suppression laws, we shouldn't expect too much change. New voting restrictions could swing the 2014 election. (How many Veterans who fought and bled in wars for these rights might now be denied these rights? The GOP "claims" they support our troops, but do they really?)

* Charles Schwab — (re: long-term capital gains and qualified dividends) "A top rate of 15% applies to qualified dividends and the sale of most appreciated assets held over one year (28% for collectibles and 25% for depreciation recapture) for single filers with taxable income up to $406,750 ($457,600 for married filing jointly). Long-term capital gains or qualified dividend income over that threshold are now taxed at a rate of 20%" [with a surtax of 3.8% for Medicare].

** Long-term and short-term capital gains: Any capital gain (or loss) is the difference between the cost of purchase and the amount of sell of an asset (Source: IRS). When someone sells a capital asset (such as stocks, which again, hit another all-time record high today) they’ll end up with capital gain if the amount they receive from the sale is more than what was paid for the asset. If an asset is sold after being held for one year or less, any gain is considered a short term capital gain and is added to their annual income and taxed at the same rate they’d pay on regular income (depending on their adjusted gross income and the regular marginal tax rates in the chart below).

*** SSA — Social Security's Old-Age, Survivors, and Disability Insurance (OASDI) program and Medicare's Hospital Insurance (HI) program are financed primarily by employment taxes. The tax rate for self-employed workers is 15.3% (12.4% Social Security and 2.9% Medicare). That's for those who pay themselves a "wage". The Medicare tax of 3.8% applies to net investment income (which may include capital gains regardless of holding period as well as certain dividends) as part of the Patient Protection and Affordable Care Act (aka Obamacare) that was enacted March 23, 2010 — but didn't go into effect until 2013.

**** Bank Rate — Employee stock options that have appreciated is considered additional salary and would be included in your wages, subject to Social Security, Medicare and federal and state income tax withholding. Of course, any appreciation in sold stock options that, when combined with your salary, exceeds [the current "cap"] would not be subject to Social Security tax.

Related Posts:

- A Must Read: Understanding the CEO Pay Debate (Roosevelt Institute, October 23, 2014)

- CNBC: 400 richest Americans now worth $2 trillion

- Forbes: Inside The 2013 Forbes 400: Facts And Figures On America's Richest

- Forbes: They're Back! … And Rich as They Ever Were

Comments

FICA taxes don't fund your SS check

Re: "In addition to taxing capital gains for Social Security, all capital gains should be taxed as regular wages based on the current progressive tax rates. This would GREATLY help pay down the government debt and shore up the Social Security Trust Fund."

I agree with much of what you said and I agree 100% with your sentiment, but your economics not so much.

Since leaving the gold standard in 1976, Federal taxes serve 2 purposes 1) to throttle inflation by sucking money out of the economy and 2) to redistribute wealth. Federal taxes do NOT pay for spending since the dollar is fiat and Uncle Sam can pay any bill with keystrokes, limited only by inflation.

Hence a FICA tax is not required to "fund" the SS trust fund. In fact, there is no physical SS trust fund, it's merely an imaginary accounting identity. Can you show me a picture of the trust fund vault where all the dollars and bonds are stored? No, you can't, because no such vault exists.

In addition, the FICA tax is a regressive tax and no progressive should support regressive taxation. To the contrary, progressive tax rates are a cornerstone of progressive values.

Removing the cap would make FICA less regressive, but still regressive nonetheless. I repeat, no progressive should support regressive taxation.

I propose eliminating the regressive FICA tax all together and "paying for" SS out of the general budget, the same way we "pay for" the CIA.

If demand-pull inflation rears its head at some point in the future, it may be necessary to raise taxes to suck money out of the economy (I advocate indexing tax rates to U-3 -- the lower the U-3, the higher the tax rate). But anti-inflation taxes could and should be progressive taxes.

Re: paying down the government debt. If Congress ordered it, we could start paying off the national debt tomorrow, since Uncle Sam can pay any bill with keystrokes. In fact, it is not necessary to sell treasury bonds in the first place, since Uncle Sam can deficit spend with keystrokes (there is a law requiring the treasury to sell bonds equal to the deficit, but Congress could simply repeal that law). The practice of selling treasury bonds dates back to the gold standard and no longer makes sense with today's fiat money.

To sum things up, I agree with you that progressive taxation is a good thing and that the rich should pay more. However, the main purpose of taxes is to suck money out of the economy to control inflation, not to "pay for" government spending. Let's stop handicapping SS with the myth that it has to be funded by an imaginary trust fund.

Where do FICA taxes go?

Where do the FICA taxes deducted from our paychecks go, if not to a mythical "trust fund"? And exactly what is your plan for "strengthening" Social Security if not for taxation to finance this imaginary fund? I'm a little confused as to your remedies. Are you saying the Social Security Trust Fund can never go broke or be under-funded because there is no fund? And if all we need is a few "keystrokes" (if it's really that easy) why don't we already do this — and also give everybody on disability and all our retirees a big raise too!

Other news on the subject:

(Washington Post) How you would fix Social Security: Tax higher earnings -- "If 90 percent of all earnings were covered and taxed by Social Security, the earnings cap would be $250,200, based on the intermediate assumptions of the 2014 Social Security Trustees Report. Even though plans to raise the cap would also include increasing benefits for higher earners, this change would still erase 20 percent of Social Security’s projected shortfall in 2033, the year in which it would no longer be able to pay full benefits. This change would touch very few workers, so maybe it’s no surprise it was the most frequently chosen solution in a survey that allowed readers to choose more than one solution."

http://www.washingtonpost.com/news/get-there/wp/2014/10/27/how-you-would...

(Forbes) "Congress Proposes Three Changes To Social Security That Make Sense 1) Change in Cost of Living Adjustments (rather than using CPI-W, or chained-CPI, use CPI-E) 2) Increase in the Threshold Amounts for Inclusion of Social Security Benefits in Taxable Income 3) Phased-in Increase in Social Security Tax Rate"

http://www.forbes.com/sites/jamiehopkins/2014/10/29/congress-proposes-th...

(The Hill) "Once Republicans are in control of both houses of Congress, it will only be a matter of time before they send legislation to the president's desk to cut [Social Security] benefits. Given the president's history, it is almost certain he will be forced to or willingly sacrifice these financial safety nets." (Such as switching to chained-CPI to calulate COLAs in exchange for not shutting down the entire government.)

http://thehill.com/blogs/pundits-blog/campaign/222406-social-security-co...

(Tucson.Com) Changes for the necessary credits one needs to qualify for Social Security: "Most people who are working earn four credits per year. In 2014, you earned those four credits once you made $4,800. In 2015, you won’t get those credits until you make $4,880. (You actually will get one Social Security credit for each $1,220 you earn in 2015. But no one can earn more than four credits per year.) To qualify for retirement benefits, you generally need 40 credits. Fewer credits may be needed to get Social Security disability payments, or for your family members to get survivor benefits if you die."

http://tucson.com/business/national-and-international/social-security-an...

Again, it's about the inequality

What would be the change in income subject to Social Security taxation if US citizens had the same total combined income, but it was distributed as a function of gross income in the same way it was distributed in 1979?

The Social Security trust fund is not in horrible financial shape - it will soon begin to run into the red, but has built a hefty surplus since its inception in the 1930s. The big increases in FICA taxes made in the 1980s were supposed to "fix" deficits for the future since it was assumed that productivity growth and the FICA tax increases would compensate for the demographic aging of the populace. If the fruits of productivity gains had gone to earners in the same proportions as earners had been getting in the '80's when the increases went into effect, those assumptions would have been correct, Social Security would in excellent shape.

Once again, if inequality were addressed and reversed only to the extent that pre-Reagan income distributions were restored, Social Security would be secured as a byproduct. Increases in capital gains taxes may be one of the mechanisms to redress our gross inequality, but I think it's a mistake to say that we're taxing billionaires for Social Security. Better to say that we should tax billionaires because their incomes have increased to levels far beyond anything reasonable or healthy for the economic and political health of our society. Fixing Social Security financial stability is just one byproduct of addressing inequality, but even more serious is corruption of our media and politics by the entrenchment of plutocratic aristocracy.

FICA

This is crazy. We need the Fair Tax so that 100% of what we earn is what we take home.

SS tax

Yes, I suggest a short term capital gains tax of 90% for anything over $1 million a year. Except in the case of option grants where the tax would be 90% on the first dollar of gain. If they don't work for it then they shouldn't keep it. Inflation of assets or simply trading them isn't work.

Wanna see how quickly smart

Wanna see how quickly smart men will make the stock market tank if you tax their gains by 90%?

Even if the 1% were to pay the "average" percentage in taxes - say 35%, they are still paying 35% on BILLIONS of dollars and contributing more in a month than the average shmoe will pay in his lifetime.

Why should a rich person be expected to pay millions of dollars a year to live in the same country, with the same government services, as someone who contributes only a measly couple hundred grand in their LIFETIME to receive the same services?

This was all covered in Wealth of Nations.

Even with a flat tax - which we used to, and still should have - the rich pay significantly more into the pot, without progressive taxation. A million dollar home, for example, generates more revenue in property tax for the government than a $100,000 home... and since the only people who can afford million dollar homes are the rich, they already pay more taxes than the rest of us. Same for people who buy Ferraris and pay sales-tax on a $250,000 car rather than a $30,000 car.

At the end of the day, they already pay exhorbitant taxes for receiving the identical bloody services as the poor.

Do you think it's justified for McDonald's to charge a billionaire $500 for a Big Mac when you, a 99%er, can buy one for $4?

I don't think so, and as a billionaire, I'd tell McDonald's to stuff up their rear end, and create a fast-food joint in my 20,000 acre back yard that gives me Big Mac's for free. Probably in a different country too, since the bureaucrats would tax the snot out of me and try to rezone the entire municipality to screw me out of my money.

Just because you're rich doesn't mean you should accept being ripped off.

Billionaires SHOULD be taxed for Social Security AND Medicare

The question of whether to tax capital gains for Social Security and Medicare "as regular wages" is a no-brainer, as is the question whether to cut benefits, raise taxes, or a combination of both to "save them." But that is a false choice. There are certainly other, more desirable, options. For example, means testing, wherein people with high retirement income who do not need Social Security lose eligibility.

Another, and much more comprehensive solution would be to simply close two gaping LOOPHOLES that enable very wealthy people to avoid paying most or all of both Social Security and Medicare taxation: the $118,500 cap on taxable Social Security earned income and the total exemption of unearned income (income from profits, interest, rents, etc.) on both. Why should people living well, without having to work, on often inherited income, be exempt from paying those taxes on it while the struggling poor and minimum wage earners do?

In 1968 LBJ conflated the general US budget with that for Social Security to conceal the cost of the Vietnam War. The SS trust fund has $2.9 trillion dollars. If just the capital gains exemption was eliminated it would bring in an additional $62 billion (at 12.4% of the $500 billion cited above) while Medicare would gain another $12.4 billion (at 2.9%).

This would not only solve any and all imagined future problems, but would raise sufficient additional funds to fully fund a single payer national health care system for all Americans (especially if combined with reasonable controls over drug and medical care overcharging). Doing so would also eliminate the crippling retirement and health care problem burdens so many unions, public bodies and companies face as more and more people retire. In fact, if well-implemented it would enable the overall Social Security and Medicare tax rates to actually be reduced! It is telling that the Western European countries spend an average of about half of what is spent in the US yet have better overall outcomes.

Finally, it is cruel to people hoping to retire at 65 to keep raising the bar to save money. Why not just raise the retirement age to 85 and be done with it!?