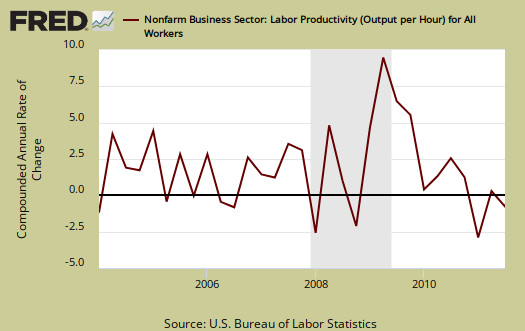

The Q3 2011 Productivity & Costs report showed Labor productivity increased +3.1% from Q2, annualized. Output increased +3.8% and hours worked increased +0.6%. This shows workers are being squeezed in hours and compensation for more output. Below is business, nonfarm labor productivity per quarter.

The basic equation for labor productivity is , where

is the total output of industry.

How does the DOL calculate labor productivity?

Labor productivity is calculated by dividing an index of real output by an index of the combined hours worked of all persons, including employees, proprietors, and unpaid family workers.

, or Labor, is measured in hours only. Both values are normalized to a base year, 2005. Output directly correlates to real GDP, minus the government, all of those nonprofits and our infamous, often illegal nannies and gardeners. The output, or

is about 75% of real GDP reported. Farms, if you can believe this, only subtract off about 1% from output totals. Labor productivity is reported annualized. The main productivity numbers above are all business, no farms. This does include the manufacturing sector.

From Q3 2010, annual productivity increased +1.1%, output +2.5% and hours +1.4%. Changes from a year ago show a little less worker squeeze for increased output than the Q3 annualized numbers. Output only growing 2.5% shows an anemic economy as well.

BLS defines unit labor costs as the ratio of hourly compensation, , to labor productivity,

, or

. For more formula definitions see the BLS handbook. From the report is the relationship of the ratios:

BLS defines unit labor costs as the ratio of hourly compensation to labor productivity; increases in hourly compensation tend to increase unit labor costs and increases in output per hour tend to reduce them. Real hourly compensation is equal to hourly compensation divided by the consumer price series.

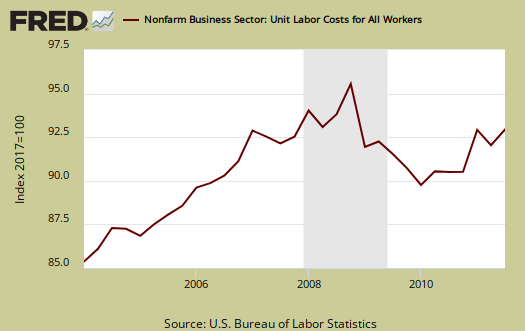

Graphed below are unit labor costs, compounded annual rate, percent change. Unit labor costs decreased -2.4% for Q3 2011, although from a year ago, Q3 2010, labor costs are are up 1.2%.

Graphed below are unit labor costs, indexed to 2005. Notice the decline starting in the Great Recession, that's right, we're becoming mega cheap. This Q3 2011 decrease in unit labor costs is not good news for workers.

Real hourly compensation is wages adjusted for inflation. Real hourly compensation is equal to hourly compensation divided by the consumer price series, or .

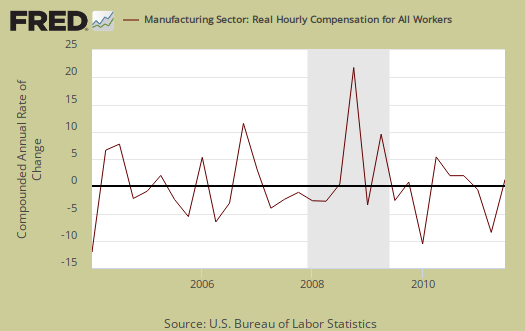

Yet the consumer price series, , increased at a 3.1% annual rate for Q3, so in terms of real dollars, adjusted for inflation, we have an annualized -2.4% decline in real hourly compensation for Q3 2011 and a -1.4% decline in comparison to Q3 2010. This implies workers are being squeezed and squeezed. Wages are not keeping up with inflation. Below are quarterly changes to hourly compensation, adjusted for consumer prices. You can see the rise and fall with deflation and inflation. Bottom line, increased productivity is not turning into increased wages.

The BLS also reports separately on manufacturing productivity, but uses a different calculation method than the one for business productivity. So, don't think ya can subtract the below and get services productivity, the two ain't the same.

Manufacturing is sales, removing duplicates, adjusting for prices and output () is correlated to shipments and the industrial production. indexes. Hours are hours like above. Page 4 of the report has the manufacturing productivity measurement nitty gritty.

Manufacturing productivity increased, annualized, 5.4% in Q3 2011. Manufacturing output increased +4.7% while hours worked decreased -0.8%.

Manufacturing unit labor costs are down -4.6% for Q3 2011, at annual rates.

Real compensation (wages) in manufacturing decreased -2.4% for Q3 2011, even though compensation per hour, not adjusted for inflation, increased 0.6%. Manufacturing wages aren't keeping up with inflation either.

What you see these days in productivity is not what it appears. The press will claim increased productivity is a great thing, and maybe that's true for corporate profits, but it's clearly not translating into wages and jobs for workers.

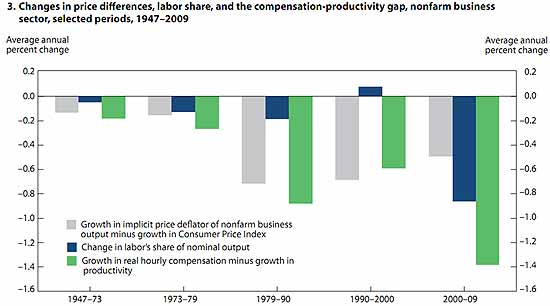

While leads me to this paper from the Monthly Labor Review, The compensation-productivity gap: a visual essay. Now these are the people who maintain the BLS productivity statistics. In the report, they go over their methods, calculations, which can make a huge difference in results. Bottom line they show since the 1970's, workers are getting less and less of the labor share or payout, less of a slice from the American pie called increased economic output. What they found was most of the productivity vs. how much you get in your pocket to spend gap before year 2000 could be attributed to a couple of different measures for inflation. After 2000, the gap is because workers are getting screwed. From the paper:

Labor share is a measure of how much of the economic pie goes to all workers. When labor share is constant or rising, workers benefit from economic growth. When labor share falls, the compensation–productivity gap widens. Concurrently, nonlabor costs—which include intermediate inputs into production and returns to investments, or profits—represent a greater share of output.

Their paper is loaded with graphs, but the above was reprinted for it shows clearly, since 2000, American workers are simply getting shafted while those making the profits are taking it to the bank.

Here is the Q2 2011 productivity report overview, unrevised.

Q3 productivity released on 11-03, 6 days ago

I decided to overview it because it's one of the most incomprehensible economic reports put out by the government, but it's important and I missed it and couldn't get to an overview until now.

The worst is they use an price series based off of CPI-U-RS, vs. easily obtained CPI-U and part of it is the CPI-U. So, just take my word on it that the inflation rate for Q3 was 3.1%, annualized. (long story).

Anyway, it's yet another U.S. labor squeeze indicator.