Rob a 7-11 with a gun? Get at least 20 years in prison. Rip-off investors to the tune of $1.6 billion, get no jail time, no charges and you don't even need to make restitution. MF Global represents yet another example how financial crime goes unpunished and not penalized.

Rob a 7-11 with a gun? Get at least 20 years in prison. Rip-off investors to the tune of $1.6 billion, get no jail time, no charges and you don't even need to make restitution. MF Global represents yet another example how financial crime goes unpunished and not penalized.

We know MF Global played around with customer's money. The amount they lost is even larger than originally estimated, now at $1.6 billion bucks. Seems there is $700 million overseas and that branch of MF Global in the U.K. ain't giving the money back.

The Trustee, relying on the books and records of MF Global Inc., the investigation that has traced a majority of the cash transactions during the last week before the bankruptcy of MF Global Inc., and the claims process, currently believes there is at least a $1.6 billion gap between the value of the Trustee’s estimate of potentially allowable commodities claims and the assets that are currently under the Trustee’s control. This reconfigured estimate is expected to change over time as claims are processed and assets recovered, and depending on claims reconciliation and the ultimate outcome of claims the Trustee may contest, the estimated deficiency may rise or fall in significant amounts. The estimate applies to claims from commodities customers who traded on US exchanges, as well as commodities customers who traded on foreign exchanges, including approximately $700 million that the Trustee is disputing with the Joint Special Administrators of MF Global UK Limited.

Bloomberg Law's Bankruptcy Journalist Bill Rochelle, concludes investors will probably never get the money back. Why? Because the MF Global bankruptcy trustee, James W. Giddens, calls playing around with customer's money a loss of control of the backroom and gross incompetence, rather than intentional fraud. Rochelle explains the legal difference, known as safe harbor, in the below video clip:

Get that? If you're just labeled an idiot and a buffoon, you too can lose $1.6 billion dollars of other people's money and not even have to pay it back, never mind go to jail. Think about it. Aren't all people who rob 7-11's at gunpoint idiots, buffoons and incompetents? They get 20 years. Wall Street gets debt forgiveness. Losses in the billions of other people's money are just business failures. La de da, bummer for you, ha, ha ha, bankruptcy law covers our asses, how about yours?

Rochelle says MF Global investors are gonna have to march on Capital Hill to change corporate bankruptcy law. This will pit Wall Street against customers, investors. There is no way Wall Street will give a prayer's chance to criminal or civil liability when gambling and losing other people's money. As Rochelle points out, customers do not have lobbyists. No lobbyist, no law change and MF Global customers are gonna take a 25% loss hit on their money invested with MF Global.

Rochelle says MF Global investors are gonna have to march on Capital Hill to change corporate bankruptcy law. This will pit Wall Street against customers, investors. There is no way Wall Street will give a prayer's chance to criminal or civil liability when gambling and losing other people's money. As Rochelle points out, customers do not have lobbyists. No lobbyist, no law change and MF Global customers are gonna take a 25% loss hit on their money invested with MF Global.

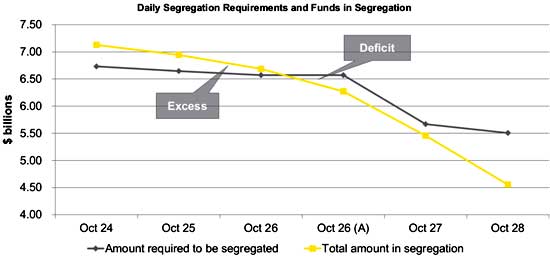

The argument for MF Global's general buffoonery and panic is amplified by this timeline. Notice how the customer's money is just wiped out during those panic stricken final days. The below chart is the segregated MF Global customer funds. Over the last days of MF Global, segregated customer funds went from a surplus to a deficit, otherwise known as Sorry people, we have margin calls on our reckless repos!

The company reported it was segregating more than the required $6.75 billion in customer funds on Oct. 25, according to a chart included with the trustee’s report.

Starting the next day, that surplus evaporated, with the amount of segregated funds falling to about $4.5 billion by Oct. 28, less than the $5.5 billion required. The trustee’s investigation covers 47 bank accounts at eight financial institutions

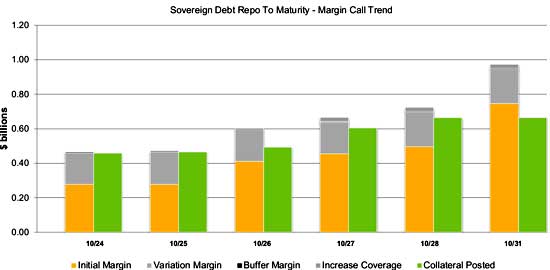

Below are the increasing margin calls on MF Global. There is a massive margin call on October 31st, over $309 million. October 31st is the day of MF Global's bankruptcy filing. Additionally on October 26th, there was another massive margin call, over $108 million.

In the table below, we see disaster in the making. See how quickly MF Global implodes with repos and margin calls. According to the MF Global bankruptcy trustee, the bonds borrowed program unwind created a liquidity gap of approx $450 - 500 million.

| Date | Variation Initial Margin | Margin | Increase Buffer Margin | Coverage | Collateral Total Margin | Posted | Margin Call |

| 24-Oct | 278,049,205 | 182,979,874 | 5,000,000 | 466,029,079 | 457,962,898 | 8,066,181 | |

| 25-Oct | 277,302,875 | 188,277,470 | 5,000,000 | 470,580,345 | 464,694,118 | 5,886,227 | |

| 26-Oct | 410,963,534 | 185,592,415 | 5,000,000 | 601,555,949 | 492,732,015 | 108,823,934 | |

| 27-Oct | 454,624,390 | 182,811,558 | 5,000,000 | 23,280,469 | 665,716,417 | 604,003,047 | 61,713,370 |

| 28-Oct | 495,975,763 | 199,344,353 | 5,000,000 | 23,219,740 | 723,539,856 | 663,925,523 | 59,614,333 |

| 31-Oct | 745,975,763 | 199,344,353 | 5,000,000 | 23,219,740 | 973,539,856 | 663,925,523 | 309,614,333 |

These trades which faced margin calls were repos. Anyone recall repo 105's?

The revelation that MF Global’s off balance sheet leveraged repo-to-maturity play was stuffed full of toxic Eurozone debt proved to be its downfall. The prospect of a Eurozone default spooked markets and MF Global’s liquidity drained away. A review of U.S. banks’ SEC disclosures reveals, however, some troubling implications of the gaps in U.S. GAAP filings as the true nature of hidden debt exposure becomes apparent.

SEC filings from Nomura, Santander and Merrill Lynch have all acknowledged the heavy use of off-balance sheet repo-to-maturity transactions, and some even admitted to including Eurozone debt within these structures.

Which brings us to playing games with Sovereign debt. How could anyone be so stupid as to bet the farm on PIIGS as MF Global did? Seems plenty! Below is another Bloomberg law video clip on why foreign banks, with subsidiaries operating in the United States, are balking at the Volcker rule. It's not what you think, or maybe it is considering the above. The Volcker rule prohibits foreign banks, outside the U.S. from trading in their own national sovereign debt if they have U.S. branches.

While investors are getting screwed here, how many times do we have to see sovereign debt, sovereign credit default swaps, repos and global economic Armageddon all mixed together? Wasn't 2008 enough?

The sovereign-debt trades were so-called repurchase-to-maturity transactions, where MF Global used borrowed money to invest in the debt of Ireland, Italy, Spain, Belgium, and Portugal.

For the actual MF Global trustee report, click here.

Comments

Tell the Attorney General

Tell the Attorney General of NY what you think. 103 day so far. Should there be indictments? I think so. If you do too, then let him know.

Its easy to send him a message. Use this form:

http://www.ag.ny.gov/online_forms/email_ag.jsp

MF Global Scam

You should charge these people . If we cannot trust in the Government to serve and protect the people. People will stop investing as their is a lot of miss-trust.

Shootings will rise in the Financial District if Investors have no recourse.

look at the phrase "$1.6

look at the phrase "$1.6 billion bucks".

if I wrote "$1.6 billion", this would be pronounced "one point six billion dollars".

if I wrote "bucks", this would be pronounced "bucks".

you wrote "one point six billion dollars bucks".

good morning to person who had too much coffee

$1.6 billion reads, $1.6 billion. One can put in the word "dollars" at the end, even though the number has the $ symbol and it's still correct, it's optional. If it read with an additional dollars by substituting in the dollar symbol the word "dollars" would be there. The $ symbol is similarly to commas (delimiters), quotations and period points. Slang bucks can be interchanged for dollars. The phrase stands,but at least your read the post!

As I said on the other post,

As I said on the other post, if you want your writing to be respected, follow the rules!

http://boards.straightdope.com/sdmb/archive/index.php/t-337555.html

The AP style guide agrees with me. Just depends on what caliber writing you want to produce, I guess. Perhaps I won't come back!

O'Rly, ic, u reporter, additional note to all grammar police

That explains it, and I'll be sure to consult the AP style guide at every turn! Bummer AP cannot get the basics right in their economics and labor statistics reporting. Thank you AP reporters for being calculator disabled! But by golly, stick to those dictated grammar rules from 1950!

Please, be more OCD. The world obviously needs more grammar police, ignoring the main content, missing the point. Please dismiss hand calculated percentage declines on housing prices, straight from the S&P data. Please focus on grammatical context exclusive of comprehension. Finally we have an answer to explain so much inaccurate economic and financial reporting, especially coming from AP. Reporters are too busy making sure they do not violate grammar rules, even for stylistic emphasis through a double negative or use of slang terms to amplify a major financial scandal.

Mo' P's Plz Q!

What would ee cummings do with you people? Assuredly he would have been the bottom of the trash can if up to the Comma Cops, but we cannot live without the OCD, grammar police. Oh, punish us for the error of our ways......

Enough of these anal retentive comments versus the meat, content, point of these articles. Comments from grammar police, comma cops and spelling sycophants will not be published herein thereafter.

I find this almost a brain disease, some sort of OCD disorder. One can publish a beyond belief damning article on Contagion, proving there is no international macro economic model to isolate national economies from economic Armageddon, yet these people scour the web to point out the lack of a comma with nary a nod to the absolutely horrifying facts detailed. We love people who focus on the comma,,,, instead of the facts. Little does it matter housing hasn't hit a bottom and MF Global typifies the use and abuse of the little guy and their 2-bits. (OMG@! A friggin' dbl -- must = +, else no, if mix w/ lang.(sub)ENG). FREAK OUT, u have no context, now do u?)

;) Everyone else, this is the end of the grammar cops destroying the focus of posts in comments.

why no run on brokerage firms?

I feel sorry and outraged for the people (“customers”) who had their money in de facto escarole accounts (i.e. it was THEIR money MF was holding in their accounts). As I understand it they literally were robbed. But, the ‘icing on the cake’, again as I understand it, is that they thought their accounts were insured by the CME or one of the organizations with a lot of initials. So there should be two Justice Dept. or AG investigations: MF taking the money and why the CME et al didn’t cover the loss.

But, the even bigger question is why haven’t there been massive runs on commodities brokerage firms in the form of ‘customers’ pulling money out of their escarole accounts. Clearly, a firm can rob them with impunity and their accounts are de facto not guaranteed.

Anyone who loses money from here on has no one to blame but themselves! And, is there any reason to believe that it will not happen again?

Thanks Tom, can you find more on CME?

I've not seen a lick of information, including browsing the Trustee's documents about customer accounts being insured so that's a beyond belief outrage if true. Can you dig up where you read this and give a link, quote?

I don't see anything keeping this from happening again, why this article is on Populist rant level 5.

eco blogs missing big picture e.g. chapt 7 vs 11 bankruptcy

I can’t really be of much help. I’m not a student of, let alone analyst of economics - not even an investor - I’m just a ‘click around blog links’ reader. However, there are a couple of things that I have come across that seem significant and not given much coverage – more like parenthetical comments than in-depth coverage. Such comments about MF Global being a case in point.

Why has MF been give by a court the right to file for Chapter 11 bankruptcy rather than Chapter 7 subchapter 4 which (as I understand it) applies to commodities brokerage firms, given that MF had tens of thousands of commodities futures accounts on its books?

The implications of this decision has to do with who has first claims on the assets of the bankrupt organization – customers who put money in escrow or lenders who fronted the money for CDS transactions (think JP Morgan). What is implication for ‘futures market’ and the economy as a whole?

Why is there no criminal investigation - not moral lamination but legal analysis? What is implication for ‘futures market’ and the economy as a whole?

Why has the CME which claims to insure customer escrow accounts not covered those loses? What is implication for ‘futures market’ and the economy as a whole?

I can’t answer any of these question and don’t even understand them – I just read about them and they seem cogent. I wish the eco. blogs would lighten up a bit on the minutia of national accounts statistics and broaden their vision to the more subtle components of the economic situation.

For example, the volume of words written about the Greece situation without any discussion about who sold the CDS that issuer the bondholders. If JP Morgan, Bank of America and other American banks are the biggest sellers, then they no doubt are behind the German and French bank news scene that we read so much about. And, no discussion about the impact on the American economy if Greece defaults and American banks cannot cover their CDS.

corporate bankruptcy types

as I understand it, and I'm not a bankruptcy expert by any means, a Ch. 7 corporate bankruptcy means a 100% liquidation. A Ch. 11 means they can reorg and there is more control on which creditors are paid back first (i.e. investors, customers). Ch. 11 I believes gives MF Global customers a better shot at getting any money back, whereas chapter 7 is a complete wipe out, and there is less analysis, it's just liquidated.

So, it seems that Ch. 11, if I understand the differences right, is the better situation, although bankruptcy generally ain't good to get any money back, which was kind of the point of this piece.

Part of the sea of Greek coverage so you cannot find anything out with the lame no info stories, I just put a little bit of who owns what that I could dig out in Numerian's comment thread. I agree, and part of the problem is most of the CDS market isn't regulated, we plain don't know.

On the U.S. economy, we're hearing some vague impacts, but it appears from what I've gotten so far, they are avoiding CDS payout triggers at all costs, because it's gonna hit U.S. banks to the tune of $80 billion.

I linked up and quoted what I could find and supposedly the SEC is asking U.S. banks to disclose more but it hasn't come out yet.

I sure agree with you, and to me this is part of the casino gambling game, corporations won't show their cards.

good point on 7 vs 11 bankruptcy - but...if I may

Reuters and Chicago Tribune 2/1/12

“MF Global Inc. (MFGLQ)’s brokerage customers can’t have the bankruptcy of the company’s parent converted to a Chapter 7 liquidation or conduct their own probe into its collapse, a judge ruled...three former customers, who claimed to have had $241 million in their commodity accounts, had sought to liquidate the parent under a bankruptcy law concerning commodities brokers. THIS COULD HAVE ALLOWED COMMODITY CUSTOMERS SUCH AS THEMSELVES TO BE REPAID FIRST...Glenn, however, said the parent could not be classified as a "commodity broker" deserving of liquidation...”

How could it not be a commodity broker with, as I recall reading, it has something in the range of 30,000 commodities accounts? What business was it in, if not community brokerage?

But, apart from the legal question and to revisiting my point above...

What are the economic implications for the futures market and the economy as a whole? We read volumes on fractional percentage changes in labor and consumer variables and virtually nothing on issues that could lead to trillions of dollars TARP type actions and economic collapse.

I’m don’t mean to be critical of the many hardworking and excellent econ blogers. I just think that the economy has experience a paradigm change from national to global and too many economists are still extrapolating 20th century models in the 21st century. Just glance at the link blogs over at Calculated Risk. They represent some of the best minds publishing on eco issues...but just how relevant are they? The endless debate about more or less government spending. That’s so 20th century!

For example, go back to the 2000-2008 period and demonstrate how government spending up or down would have affected the events leading to TARP and the economic collapse.

Best

Tom

who are the brokers vs. actual investors

Huh, the level of details on this I just don't know, except who exactly is Reuters referring to, the brokerage houses who gave the margin calls or the actual MF Global investors? It seems opposite of Ch. 7 definitions in terms of "launching their own probe".

As far as Calculated Risk goes, he has his own beliefs but I like him because he is extremely data centric, although lately he's putting out some beliefs that if one looks at the data, are not there.

I think all of this is extremely relevant, but then to find the issue, one needs to drill down into that data...or in this case, it looks like bankruptcy law and the judge's actual ruling on the actual motion and by whom was this motion presented, i.e. brokerage houses or actual final MF Global investors?

update on MF Global

Someone tried "corporations are people my friend" as a legal argument, of course deemed frivolous.

bombshell memo proves Corzine used customer $$ @ MF Global

A memo has surfaced which proves MF Global CEO John Corzine ordered customer money be used to cover a JP Morgan margin call on MF Global proper. Will this be the smoking gun to see someone actually go to jail? Bloomberg has the story, link here.