Remember the days when we had grand public works, when people worked at one job and were rewarded? A corporation actually cared about their employees? When buying a home was the ultimate American Dream?

Remember the days when we had grand public works, when people worked at one job and were rewarded? A corporation actually cared about their employees? When buying a home was the ultimate American Dream?

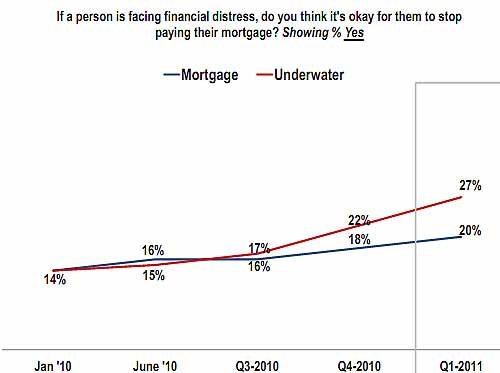

That dream has been replaced with strategic default on one's home, praying the onslaught of foreclosures allows you to live rent free for a long period in order to not be homeless. According to Fannie Mae, 27% of negative equity homeowners think it's ok to walk away from their mortgage. Who can blame them when only individuals consider the ethics and morality of a contract these days?

The situation is so bad, the U.S. is turning into Squatter Nation:

Some 4.2 million mortgage borrowers are either seriously delinquent or have had their cases referred to lawyers to pursue foreclosure auctions, according to LPS Applied Analytics. Of those, two-thirds have made no payments at all for at least a year, and nearly one-third have gone more than two years.

These cases can go on and on. Nationwide, it takes an average of 565 days to foreclose on borrowers in default from their first missed payments to the final auction. In New York, the average is 800 days and in Florida, where the "robo-signing" issue is particularly combative, it's 807.

If they want to fight evictions hard, borrowers can remain in their homes even longer while their cases are being worked through.

According to JP Morgan Chase there are millions of Americans living rent free for 5 years and counting:

Squatter's rent increased to over a $60 billion annual rate early last year, but with delinquencies declining that has come down recently to just over $50 billion

The amount of equivalent rent is so high, now Squatter's rent is a glorified subsidy to disposable income:

Millions of Americans have more money to spend since they fell delinquent on their mortgages amid the worst housing collapse since the Great Depression. They are staying in their homes for free about a year and a half on average, buying time to restructure their finances and providing an unexpected support for consumer spending, which makes up about 70 percent of the economy.

So-called “squatter’s rent,” or the increase to income from withheld mortgage payments, will be an estimated $50 billion this year, according to Michael Feroli, chief U.S. economist at JPMorgan Chase & Co. in New York. The extra cash could represent a boost to spending that’s equal to about half the estimated savings generated by cuts to payroll withholding in December’s bipartisan tax plan.

“We’ve had a lot of government transfers to the household sector; this is a transfer from the business sector to households,” Feroli said. “It’s a shock absorber that has helped the consumer ride out the storm.”

Even the government data is skewing as economist Tom Lawler shows, homeownership has dropped to 1990's rates.

If 2010 headship rates and homeownership rates for each age group had been the same as in 1990, the US homeownership rate would have been 66.7% instead of 65.1%. If 2010 headship rates and homeownership rates had been the same as in 2000, the US homeownership rate would have been 67.3%!

In fact, the aggregate data suggest that in 2010 the homeownership for most age groups was probably below 1990 rates!!!

They flushed the American Dream right down the john, no doubt prepackaged in some MBS baked CDO to boot.

In fact the Federal Reserve flow of funds shows home values have lost $6.6 trillion since their peak and now household percent equity declined to 38.1%, but this number is deceiving:

Something less than one-third of households have no mortgage debt. So the approximately 50+ million households with mortgages have far less than 38.1% equity - and 10.9 million households have negative equity.

So, the American dream of having a middle class income, stable career, a home of one's own has turned into strategies on the hits to one's credit score and how long one can squat in a home before the lights are turned off, all the while to looking forward to never being able to retire:

The EBRI Retirement Security Projection Model® (RSPM) was developed in 2003 to provide an assessment of national retirement income prospects. The 2011 version of RSPM adds a new feature that allows households to defer retirement age past age 65 in an attempt to determine whether retirement age deferral is indeed sufficiently valuable to mitigate retirement income adequacy problems for most households (assuming the worker is physically able to continue working and that there continues to be a suitable demand for his or her skills). The answer, unfortunately, is not always “yes,” even if retirement age is deferred into the 80s.

LOWEST-INCOME LEVELS, 50-50 CHANCE OF ADEQUACY: RSPM baseline results indicate that the lowest preretirement income quartile would need to defer retirement age to 84 before 90 percent of the households would have a 50 percent probability of success. Although a significant portion of the improvement takes place in the first four years after age 65, the improvement tends to level off in the early 70s before picking up in the late 70s and early 80s. Households in higher preretirement income quartiles start at a much higher level, and therefore have less improvement in terms of additional households reaching a 50 percent success rate as retirement age is deferred for these households.

LOWEST-INCOME LEVELS, HIGHER CHANCES OF ADEQUACY: If the success rate is moved to a threshold of 70 percent, only 2 out of 5 households in the lowest-income quartile will attain retirement income adequacy even if they defer retirement age to 84. Increasing the threshold to 80 percent reduces the number of lowest preretirement income quartile households that can satisfy this standard at a retirement age of 84 to approximately 1 out of 7.

IMPORTANCE OF DEFINED CONTRIBUTION RETIREMENT PLANS: One of the factors that makes a major difference in the percentage of households satisfying the retirement income adequacy thresholds at any retirement age is whether the worker is still participating in a defined contribution plan after age 65. This factor results in at least a 10 percentage point difference in the majority of the retirement age/income combinations investigated.

FACTORING IN RETIREMENT HEALTH COSTS: Another factor that has a tremendous impact on the value of deferring retirement age is whether stochastic post-retirement health care costs are excluded (or the stochastic nature is ignored). For the lowest preretirement income quartile, the value of deferral (in terms of percentage of additional households that will meet the threshold by deferring retirement age from 65 to 84) decreases from 16.0 percent to 3.8 percent by excluding these costs. The highest preretirement income quartile experiences a similar decrease, from 12.8 percent to 2.6 percent.

Welcome to the new American Dream, brought to you by Goldman Sachs, Wells Fargo, JP Morgan Chase and Bank of America.

Comments

What if Everyone Stopped Paying Their Mortgage?

I'm not advising anyone to stop paying their mortgage, other than to say an individual should have no moral qualms about deliberately defaulting on their mortgage even if they can pay (a strategic default). Assuming that individual has sought proper legal and tax counsel to protect themselves and their family, they should be able to do exactly what Morgan Stanley and many other businesses have done. Donald Trump has made a career of walking away from his bond obligations, and he has just run for President of the United States.

The question, rather, is what happens to the United States if tens of millions of Americans decide to walk away? You point out in your article that 10.9 million mortgagors are already underwater, and these borrowers we know are the most likely to strategically default. Suppose Robert Schiller is right and we get a further 20% or more depreciation in housing values. How many more millions of Americans are now underwater? Suppose the recession bites hard again now that government and Fed stimulus are being withdrawn, throwing millions more out of work. Suppose millions of retired people and others living off their investments, which are now earning 0%, deplete their capital and find themselves in poverty? The articles about people living rent free for two to three years are spreading, and now television news has begun carrying stories. Plus, it is becoming increasingly clear that the banks often cannot prove they are the mortgagee, that they don't really want possession of the home and the obligations of upkeep and tax payments, that they don't want to take write-downs on their biggest asset class, so they let defaulters linger for years in their property rent free.

On the flip side, what's the penalty for the homeowner strategically defaulting? A trashed credit rating doesn't mean anything these days in an economy in which banks aren't lending except to people like Donald Trump. In some states, the banks can go after all the homeowner's assets, not just the home, but so far the banks haven't pursued these rights against people who by and large are bankrupt anyway. Besides, if over 50% of all mortgages are legally suspect thanks to MERS and sloppy bank securitization practices, then a lawyer can easily challenge the right of a bank to take any remaining assets.

There has to be a tipping point where millions of homeowners join their underwater neighbors and stop making payments on their mortgages. It could be financial desperation brought on by a recession that turns into a depression, it could be jealousy that other people are getting away with free money, it could be collective anger at the banks and their predatory practices, it could be a general breakdown among American public opinion that paying back a debt is an honorable thing to do, or it could be a combination of these things.

What if 20 million or more Americans stop paying their mortgage? That would be nearly a third of all mortgagors. At that point, the four Too Big To Fail banks which own the bulk of America's home mortgages are out of business. So are most of the second tier regional banks. They no longer would be able to pretend these defaults were meaningless or wait until they are cured, because their cash flow would dry up, and no amount of Fed liquidity programs could replace the trillions of dollars that have disappeared.

The federal government would be scrambling to find the resources to shore up the FDIC, which is already bankrupt and would need massive capital infusions, again in the trillions of dollars, to protect depositors in the failed banks. The government would have to decide whether it is going to pursue foreclosure against one third of all homeowners, leaving one third of the nation's housing stock empty. As you can see, there is a point where the sheer numbers of people who decide to initiate their own reverse mortgage payment scheme will overwhelm the economy in a multitude of ways.

Bear in mind also that this process is well underway, and may be unstoppable. People have lost faith in the banking system as fair, and that has undermined the essential sense of responsibility that has always been the foundation of the creditor-debtor relationship. The doubts as to whether a typical homeowner can identify the party who legally holds their mortgage are growing as one court after another challenges the banks on their rights to foreclose. Lawyers all across the nation are looking for work, and here is a whole new field of endeavor open to them. If enough people find they can no longer pay their bills, the home mortgage becomes a large and tempting payment to let lapse. As the CEO of Wells Fargo said earlier this year, his bank was shocked to learn that people are defaulting on their mortgage first, while continuing to pay on their credit card loans. That is the reverse of previous experience.

This is the stuff out of which Financial Armageddon arises - a sort of "Argentina" moment when that country defaulted and a massive deflation brought down everyone's earnings, as well as most costs, to a much lower level. And why shouldn't this happen in the US? The American standard of living has been under pressure for nearly 25 years from global labor arbitrage; our earnings are slowly approaching those of workers in China, our housing values have already collapsed over 40% in three years, and costs in this country are going to have to come down as well if people are going to survive. In a general deflation, people will grab on to whatever cash flow they can find, and the home mortgage payment is about the juiciest there is. By withholding so much cash, the American homeowner has the power to destroy all of the big banks and throw this country into a severe depression. It would be the equivalent of a tax strike where wage earners refuse to pay the government what is owed in taxes.

If enough people participate, it becomes very difficult for the government to enforce payments, despite what will no doubt be extensive efforts by the federal government to coerce and shame people into complying with the "system."

No way to stragegically default on property taxes

Sounds like the banks are more compassionate than the government. If you don't pay your mortgage for several years then maybe the bank will let you live in the house.

But stop paying your property taxes for that period of time and see what the government does. First, they'll charge you an unbelievably high interest rate, like 17.5%. Then they'll put a lien on your home. The sherrif will kick you out of your home. The government will sell it for whatever they can get, take the money for back taxes + interest, and your savings or credit record are history.

See: Delinquent property taxes recouped in lien sale

"The percent interest that will be charged to property owners, in addition to their delinquent taxes, will have a 17.5 percent annual interest rate, ..."

"...But stop paying your

"...But stop paying your property taxes for that period of time and see what the government does...."

Are cities doing this to banks that foreclose and who thus (I assume) now own the foreclosed house? From what I have heard, banks have been trying to be owners and non-owners of these houses at the same time, depending on whether they benefit or not. Cities have been left holding the bag, to say nothing of the loss of collective mil value in the abandoned or devalued properties.

Lender pays the taxes

In order to preserve their collateral, the bank will pay the taxes, or strategically decide to let the property be sold. Then the highest bidder at tax sale takes the property free of the mortgage. Perhaps the buyer at sale is an LLC controlled by the foreclosed borrower who has saved enough after strategic default to buy it!! Hmmm

It depends ...

Depends on state law and on practices at the county level.

Often, the first sale is a sale by the bank and the bank buys the property back from itself, but that usually requires payment of at least some of the back taxes. What it accomplishes is a write-down and a simplification of the legalities. Renters or squatters may also be involved.

Banks are reluctant either to negotiate realistically with mortgagees or to actually let auctions proceed on a realistic basis for fear of the hit they would take on all the properties they are holding paper on.

Banks and other corporate interests have been employing all kinds of strategems in order to avoid anything like a general decline in property values to what they would be if a non-manipulated market should be allowed to operate.

Anyway, that's my 2¢.