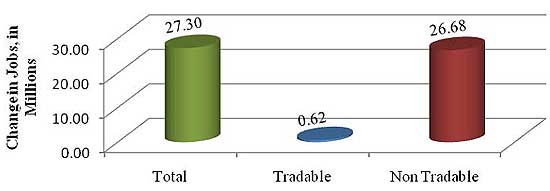

The Council of Foreign Relations has released a new study with the benign title, The Evolving Structure of the American Economy and the Employment Challenge. Contained within are some horrifying statistics for American workers. From 1990 to 2008, all of the job growth was in non-tradable jobs. In other words, your suspicions are true, any job that could be offshore outsourced....was offshore outsourced. You were traded for a cheaper offshore counterpart. Below is the total job growth from 1990-2008, separated into jobs that can be traded, i.e. offshore outsourced and those which cannot.

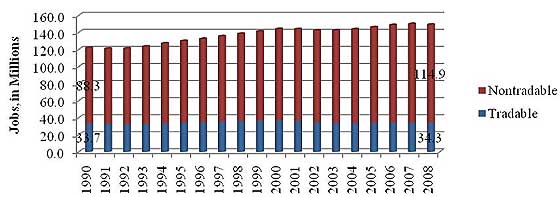

Of the 27.3 million jobs added from this time period, 97.7% of them were non-tradable. What do the authors mean by tradable jobs? Jobs that can be offshore outsourced. Their production and results are not bound to a domestic economy. As an example, health care must be domestically sourced because sick people are here. Computer architecture, on the other hand, can be offshore outsourced and the results moved around the globe to a manufacturing center. Below is a graph from the paper showing the growth in non-tradable jobs, in red and the blue, that's the lack of job growth in domestic jobs that can be offshore outsourced.

Just reading the paper abstract is a horror show of statistics and implied warnings for the U.S. labor force:

This paper examines the evolving structure of the American economy, specifically, the trends in employment, value added, and value added per employee from 1990 to 2008. These trends are closely connected with complementary trends in the size and structure of the global economy, particularly in the major emerging economies. Employing historical time series data from the Bureau of Labor Statistics and the Bureau of Economic Analysis, U.S. industries are separated into internationally tradable and nontradable components, allowing for employment and value-added trends at both the industry and the aggregate level to be examined. Value added grew across the economy, but almost all of the incremental employment increase of 27.3 million jobs was on the nontradable side. On the nontradable side, government and health care are the largest employers and provided the largest increments (an additional 10.4 million jobs) over the past two decades. There are obvious questions about whether those trends can continue; without fast job creation in the nontradable sector, the United States would already have faced a major employment challenge.

The trends in value added per employee are consistent with the adverse movements in the distribution of U.S. income over the past twenty years, particularly the subdued income growth in the middle of the income range. The tradable side of the economy is shifting up the value-added chain with lower and middle components of these chains moving abroad, especially to the rapidly growing emerging markets. The latter themselves are moving rapidly up the value-added chains, and higher paying jobs may therefore leave the United States, following the migration pattern of lower-paying ones. The evolution of the U.S. economy supports the notion of there being a long-term structural challenge with respect to the quantity and quality of employment opportunities in the United States.

A related set of challenges concerns the income distribution; almost all incremental employment has occurred in the nontradable sector, which has experienced much slower growth in value added per employee. Because that number is highly correlated with income, it goes a long way to explain the stagnation of wages across large segments of the workforce.

The paper does not answer how many jobs were offshore outsourced during this same time period. Bear in mind, a multinational corporation doesn't necessarily have to directly move a job to another country. Instead, they can simply create jobs in other countries, which they have been doing in droves. Multinational corporations and so called body shops also import cheap labor via guest worker visas to displace American workers as well. Literally the H-1B guest worker Visa is called the offshore outsourcing visa in India. Visa holders are sometimes trained in the United States and are used to transfer complex technology and corresponding obtained skills out of the United States and to the emerging economy for further development.

Government was the number one provider of jobs with health care coming in second. When added together these two sectors are responsible for 40% of all job growth since 1990. Not exactly the innovation economy so often touted.

Even worse, the research results show that global labor arbitrage pays. When corporations offshore jobs and labor arbitrage U.S. workers, it actually increases their profits and even U.S. GDP.

Declining employment in electronics in the United States, despite the high growth in value added, is explained by the offshoring of a growing number of parts of the value-added chain, ranging from labor-intensive assembly to semiconductor manufacturing and design, and even to product development. So here we have the classic case: industry growth is high and value-added growth is high because the high value-added portions of the supply chains have remained in the domestic economy. Meanwhile, the lower value-added portions migrate off shore, explaining declining employment.

This all paints quite a bleak picture for the economic future of most Americans. While the U.S. middle class pocket is picked by multinationals hopping the globe in their hunt for cheap labor and profits, most Americans are not sharing in the bounty. The authors predict downward wages will surely continue along with more income inequality, which is at crisis levels, with no break in site for America's middle class and corresponding job crisis.

The report is fairly mealy-mouthed on policy recommendations and no surprise, after all, one cannot upset the free trade religion zealots, or G.E. for that matter. Regardless, the results of this paper prove our trade policy is a labor arbitrage one, that's the bottom line.

The paper executive summary is reprinted below. If this doesn't raise the hair on your head and ring America's job crisis alarm bell, I don't know what will.

- Employment growth in the U.S. economy between 1990 and 2008 was substantial, on the order of 27.3 million jobs, off a base in 1990 of 121.9 million.

- Virtually all (97.7 percent) of the incremental employment stems from the nontradable sector. This occurred despite dramatic labor-saving technology in information processing that ran across all sectors of the economy.

- The leading employment sectors are government and health care, in that order, both on the nontradable side. Together these two sectors generated more than 10 million additional jobs over the period, accounting for almost 40 percent of the increment. Health care added 6.3 million jobs on a base of 10 million. Government added 4.1 million on a base of 18.4 million.

- Given the pressure on the government budgets, continued gains in government employment seem unlikely. Equally, health care absorbs a large enough fraction of GDP (on the order of 16 percent) that expansion in that sector is at least questionable. An aging population may require more health services, but the government’s ability to finance the expansion is in doubt.

- Growth in other nontradable services that generated employment gains—for example, retailing—has been driven in part by debt-financed consumption. After the financial crisis, the prospects for job growth in these sectors are duller.

- The tradable sector experienced job growth in high-end services including management and consulting services, computer systems design, finance, and insurance. These increases were roughly matched by declines in employment in most areas of manufacturing.

- The loss of employment in the manufacturing sector was caused by the out-migration of functions in global supply chains associated with lower valued added per job. But as the emerging markets grow, they will compete for more sophisticated functions. This does not mean that the United States will lose all the sectors in which it has developed a comparative advantage—just that more potential competition is on the horizon.

- Manufacturing sectors that suffered a loss of employment nevertheless experienced rising value added. Therefore value added per job rose, in some cases dramatically. High-income jobs remained in the tradable sector.

- For the tradable sector as a whole, value added per job rose substantially, an increase of 44 percent from 1990 to 2008, far above the increase of 21 percent in the economy as a whole. The tradable sector is gravitating toward higher value-added components of global supply chains. These consist, in broad terms, of high-end services, some in manufacturing industries and some, like finance and insurance, in pure service industries.

- Given the prospect of slowing employment growth in nontradables and rising competitive pressure on tradables, major employment problems in the near future are a certainty. Even if the nontradable sector is able to continue to absorb the growth in the labor force, pres-sure on wages and salaries will be downward, and consequences for income distribution unavoidable.

- The postcrisis shortfall in domestic demand is causing stubbornly high unemployment even as the economy begins to recover some of its growth momentum. In principle, foreign demand, especially from the high-growth emerging economies could make up some of the difference. But it probably will not happen. Although the U.S. trade deficit fell to $375 billion in 2009, from $702 billion in 2007, the adjustment came entirely from a sharp decline in imports, from $2.35 trillion to $1.95 trillion, whereas exports actually fell slightly, from $1.65 trillion to $1.57 trillion. In other words, the adjustment came from a fall in imports not a rise in exports.

- To create jobs, contain inequality, and reduce the U.S. current-account deficit, the scope of the export sector will need to expand. That will mean restoring and creating U.S. competitiveness in an expanded set of activities via heightened investment in human capital, technology, and hard and soft infrastructure. The challenge is how to do it most effectively.

Look at this crisis and even the more modest policy proposals listed in the paper. Recommendations such as restructuring the tax code to give incentives for manufacturing, tying tax breaks to hiring U.S. citizens and permanent residents, even those modest policy changes will be opposed by our economically inept Congress. Imagine trying to get enacted what really needs to happen. The researchers even cited Germany as a prime example of a nation which has been successful, as an advanced economy for their citizens and workforce in our globalized world. Yet, any policy or legislation modeled from German's success will surely be rejected by our politicians.

Economix also overviewed these research results and the paper is attached to this post. The paper authors are Economist Michael Spence with researcher Sandile Hlatshwayo. Dr. Spence talks about his research results in the below interview, about 40 minutes into the segment.

Comments

How globalism destroyed jobs

You might also check out Trade Reform's post how globalism destroyed jobs.

The ultimate question from this report is who is the economy for? Corporations and quarterly profits, even GDP, or is it for citizens of the nation. The two are seriously diverging in the United States.

How does Osellout find the time

Between pushing Unfair Trade Agreements, stealth Social Security - Medicare - Medicaid cuts via the manufactured Debt Ceiling "crisis", pushing extension of the Bush Tax Cuts, and raising "campaign" funds from Wall St, the poor guy doesn't have enough time to work on his golf game

Osellout vs. pure economic fiction and insanity, i.e. GOP

While I think this site focuses in on Obama because frankly we probably "lean left", lest we not forget the pure economic insanity spewed by the likes of Eric Cantor, Mike Pence and other cloaked corrupt conservatives.

Remember, they think that the entire social safety net should be dismantled. No social security, no Medicare and no Medicaid, nothing.

They have no problems walking over the dead bodies all the while screaming abortion is wrong. Don't forget those crazies.

Good cop, bad cop

Totally agree. BUT the GOP extremists are at least a clear and known danger......... we see them for the extremists and corporate lackeys they are. Osellout is in many ways a greater danger - a stealth lackey who says one thing in order to sneak thru a non-progressive agenda.

The winner is Wall St and the wealthy who have set up the perfect Good cop - Bad cop routine.

true, America doesn't have representative Government

NO doubt about it. If we did, from just even the polling, trade would have been reformed ages ago. That is desired across the political spectrum.

We now have absurd extreme at civil war with the U.S. Chamber of Commerce I guess.

These special interests are literally destroying the United States at this point. I think most of America is waking up to this fact, but they often don't understand enough to figure out what we need to do to get our nation back.

Media of course spins it to fiction so that doesn't help the situation.

Money Printing Out of Thin Air is Directed Towards Offshoring

The US prints new money out of thin air to fund the outsourcing of jobs, factories, technology transfers overseas which help to build up the Chinese military, infrastructure spending abroad, military bases and military conflicts overseas and the consumption of foreign made goods from protectionist countries.

Companies such as GE, GM, Dell, Boeing and etc. are all planning to invest hundreds of billions of dollars in China over the next decade. A lot of these multinationals that have record profits from the money printing out of thin air stimulus packages are taking these newly printed dollars created out of thin air to invest in manufacturing plants and R&D research facilities overseas. This is why not many new jobs are being created in the US with all the increased budget deficits that have been monetized.

A solution would be for every state to follow the North Dakota model. It is the only State in the US that has a State Bank where they keep their tax funds. By having their own bank, they recycle the tax funds within the State to create jobs and fund industrial activity by having the ability to create credit. North Dakota is the only state in the US that regularly has high GDP growth, low unemployment, regular budget surpluses, low bankruptcy rates, low foreclosure rates and low crime.

It makes sense why they are successful. They grant credit to fund industrial activity within the State, unlike the Federal government that creates new money out of thin air to fund the outsourcing of jobs.