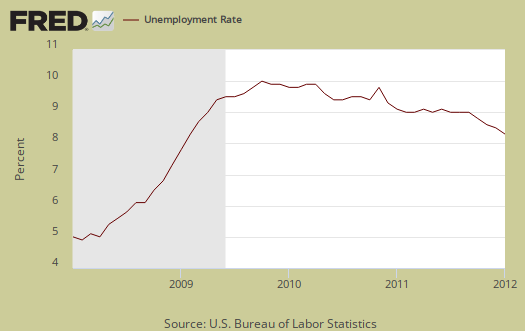

The January 2012 monthly unemployment figures show the official unemployment rate dropped -0.2 percentage points to 8.3% and the total jobs gained were 243,000. Total private jobs came in at 257,000. Government jobs dropped -14,000. Information jobs dropped by -13,000 and financial services payrolls dropped by -5,000. All other major job categories had payroll gains.Temporary jobs increased 20,100. Manufacturing gained a much needed 50,000 jobs.

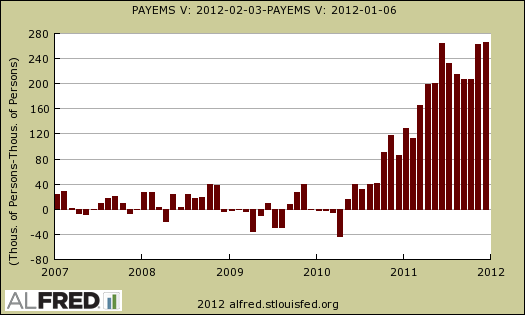

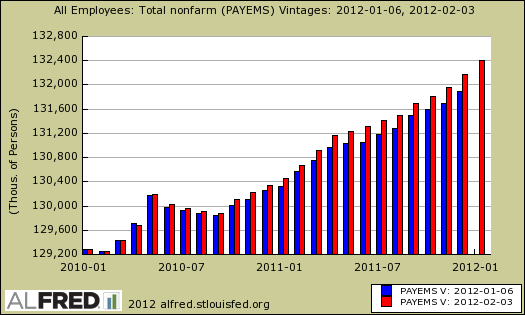

The BLS not only incorporated the 2010 Census data but also revised their payroll statistics all the way back to 2007. Part of this is their annual payroll benchmarks, calculated from March 2011 tax receipts, which modified their monthly change statistical model, adjustments to the businesses started and ended and finally the seasonal adjustment algorithm was modified. Finally, the BLS changed their NAICS categorizations. NAICS stands for North American Industry Classification System and is a way to categorize business establishments by their economic activity and the changes did not affect payroll statistics much. Graphed below are the monthly differences between reported payrolls from before the benchmark adjustments and after.

January's 243,000 jobs are not only from the business survey results, but also statistically extrapolated from those survey results. There were also monthly revisions to payrolls for December and November 2011. These revisions come from business survey reports. For more information on how the BLS tabulates non-farm payroll jobs, see this article, Under the Hood of the Employment report.

The change in total nonfarm payroll employment for November was revised from +100,000 to +157,000, and the change for December was revised from +200,000 to +203,000.

The grand whopping cumulative total, seasonally adjusted, is a 266,000 upward revision on nonfarm payroll jobs by December 2011. Below is a bar graph of the nonfarm payrolls differences in seasonally adjusted data. The blue bars are before the revisions were incorporated, the red after.

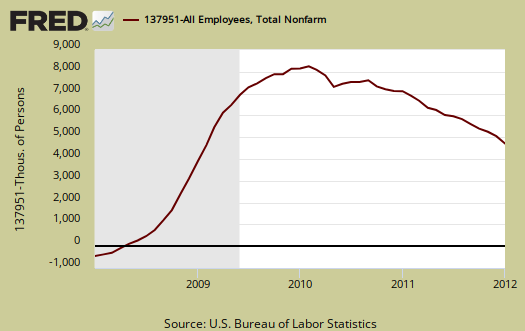

Where does that leave us with jobs? The start of the great recession was declared by the NBER to be December 2007. By looking at the start of the great recession, we can calculate how many jobs we're still down from that fateful 2007 December. Just last month were were down -6.083 million jobs. With the bench mark revisions, plus the real January job growth, the United States is now down -5.573 million jobs.

Additionally the 2010 Census data was incorporated into part of the unemployment survey which gives unemployment rates and demographic data. Previously unemployment rates, participation rates were based on the 2000 Census data, with statistical yearly adjustments. Here's the crux of what changed:

The adjustment increased the estimated size of the civilian noninstitutional population in December by 1,510,000, the civilian labor force by 258,000, employment by 216,000, unemployment by 42,000, and persons not in the labor force by 1,252,000.

Below is a running tally of how many official jobs permanently lost since the official start of this past recession, with the new numbers. Increased population growth, implies the United States needs to create at least 10.27 million jobs or self-employment. This estimate assume a 62.7% civilian non-institutional population to employment ratio, as it was in December 2007, which implies an additional 4.69 million jobs were needed over a 49 month time period beyond the ones already lost.

8,230 million of the 26.87 million part-timers working low hours are doing so because they cannot get full time jobs. We cannot compare the change from last month due to the Census adjustments added to the December data. So, one needs to realize that's a hell of a lot of people stuck in part-time jobs who need full-time work.

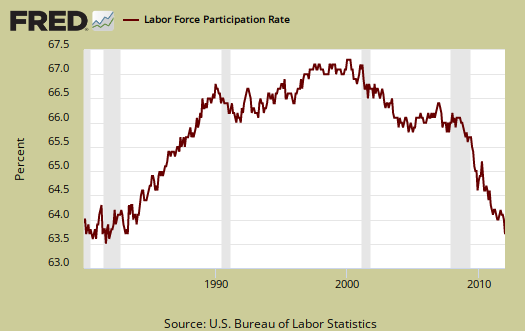

The increasingly low labor participation rate is now at 63.7%. If we go back to December 2007, the labor participation rate was 66%. The highest civilian labor participation rate was in January 2000, at 67.3%. What this means is there are over 5.572 million people not be accounted for in the official unemployment rate, in other words counted as employed or unemployed, who probably need a job and can't find one. That's in addition to the official 12.758 million unemployed.

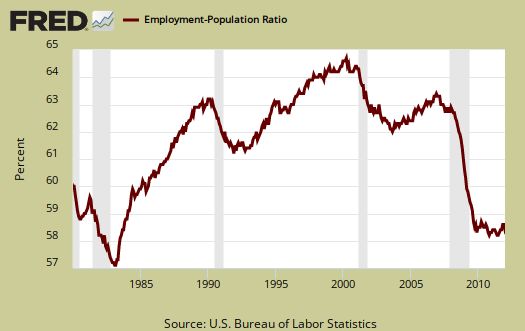

The employment to population ratio is now 58.5%, no change from last month and at record lows. You have to go back to the severe recession of 1983, October to find such low ratios. The uber-low ratios are not a structural change, such as all families decided to have a stay at home caretaker, or magically a host of people could retire early, or magically all young people went to school as some want to claim. The low employment to population ratio are people dropping out of the labor count. Once can see this simply by the cliff dive on the ratio during 2008-2010. There is no way magically, suddenly, a huge increase of population volunteered to drop out of the labor force. These ratios are with the 2010 Census population adjustments incorporated.

These numbers are important because unemployment is a ratio, percentage or during a limited time period, the number of people actively looking for a job and counted. Many people are not counted in the official unemployment statistics, yet when looking behind the official numbers it's clear America has more potential workers and less jobs in so called recovery than during one of the worst post WWII recessions.

The January 2012 unemployment report incorporated many statistical adjustments. Additionally one cannot compare the monthly changes between December and January because all of the adjustments are added to the December 2011 data only, not spread out over the entire year, which makes a monthly comparison statistically invalid.

We'll be reviewing sections of this months unemployment report in excruciating detail so check back! Leave your questions in the comments and we'll try to dig out the answer in the BLS data.

Boomers

Robert, do you think this is a shift in labor participation rates because of the boomers?

Many two income boomer families are adapting to one as children leave college and mortgages are paid off or refinanced at lower rates for longer terms. We just did and both of us are lucky enough to have jobs. But we could do it on one income if disaster strikes.

My thought is maybe the second earner if unemployed isn't planning to come back to the workforce. Is that cliff dive on the EMRATIO maybe ten years of dropouts consolidated into one by necessity?

Better 50+ second earners then young adults who are currently raising our next generation. They need their jobs very badly. If this is the case at all.

I'm just putting it out there that I suspect the participation rate and the EMRATIO will not bounce back to pre-recession levels but its not the end of us.

What do you think?

this is one of the claims from the report, more in retirement

So, my plan is to examine, by age bracket, the actual real number of retired, going off of Census 2010 vs. the labor participation rates for those age brackets.

I don't buy this claim period. I already proved young people simply cannot get a job, they simply are not all in school as claimed earlier.

Then, we know absolutely there is institutionalized age discrimination, people lost home equity from 401ks plus their jobs. Last I heard the majority of people over 50 are reporting they now must work til they drop.

I have to go hunt data series, do a host of number crunching plus graph all of this up, so hold on.

I plan on analyzing labor market data all weekend! (hey, what do you do for fun?) and labor participation rates is a huge one I'm working on.

I hope there is something to it.

It would ease the pain a bit. Part of my fun this weekend will be reading The Economic Populist to find out if there is any merit to retirement lowering the labor participation rate! Sunday Morning Comics! Great Blog. Thanks for your efforts.

hey you mentioned the SMC!

That's just for us, the regulars, but glad people like it cause I personally have to take a good laugh at this insanity at least once a week.

There is some baby boomer effect

This effect has been studied for some time now, and expectations are that the participation rate will decline as baby boomers retire. What has been happening, however, is that the participation rate is collapsing much faster than would be expected if baby boomers retired in their 60s. There seem to be a lot of forced retirements of people 50 and older in this depression. In fact, I think in the end this will be called the Baby Boomer Depression, because this generation will bear the brunt of the pain of the 2007-2008 financial collapse.

There are several things going on that are impacting Baby Boomers:

1) Corporations are jettisoning employees after they reach age 50. They dress this up as getting rid of expensive staff, and in a way this is correct. Baby boomers in middle management are expensive, and any layoff program that is fundamentally related to reducing corporate personnel costs is going to naturally zero in on people over 50. This is how companies avoid charges of ageism.

2) Once someone over 50 is unemployed, they have a very difficult time finding work at their old salary. Surveys are showing most people in this category take a pay cut, usually in the form of working as consultants without benefits. Others wind up working part time, or in entirely new industries.

3) Baby boomers are the best educated generation ever in the United States; Generations X and Y have lower rates of both college degrees and advanced degrees. This talent pool is being forcibly jettisoned by corporate America, who are now complaining they cannot find talented replacements. What they really mean is they cannot find talented replacements willing to work at 50% of the pay and benefits that baby boomers used to get. Hence the push to increase immigration quotas for cheap but educated foreign labor. The boomers, in the meantime, are left out to pasture when they would otherwise expect to be working in their peak earning years.

4) Baby boomers are very poorly prepared for the forced retirement being pushed on them. Those who have no college degree tend to have no savings. Those who saved up some money during their careers have seen their 401k's damaged, and now interest income on fixed income investments like bonds has been cut to near zero in order to transfer wealth from savers to the banks. As a consequence, many are eating into their capital from savings. This could last a few more years, but eventually people will run out of savings - it is already happening to many. As of now, the average cash savings of a baby boomer is $10,000 - of course this is heavily skewed and the wealthy boomers have hundreds of thousands or millions in savings. But overwhelmingly, this generation will enter retirement with nothing, because there are few that are wealthy, and tens of millions with no assets and eventually no income.

5) Many baby boomers will ultimately find themselves around age 60 out of work, unemployable, and impoverished. This process has begun and can only accelerate. If they do get work, it will be part-time with no benefits, providing just enough income to live a subsistence life. This is where both chance and life style choices will play a role, because at some point after age 60 everyone sooner or later develops a debilitating and ultimately fatal disease. Many baby boomers are already entering their 60s with problems relating to being overweight, having diabetes, etc. Though there will be a desperate demand by baby boomers to continue to work, this vast pool of people will, in five or ten years time, have few members who will be able to work even part time.

6) Add to this picture the fact that both Democrats and Republicans are now looking at ways to cut back on Social Security and Medicare, and you have a social disaster in the making. Nobody is talking about it now, but by 2020 they will be. In the next eight years the problem will slowly become evident. People have their pride; baby boomers will live in poverty quietly, band together for support, move in with their children, and the desperate will resort to suicide, which will include those who will want to leave something of their remaining assets to their children. You simply won't hear much about it because the country doesn't want to hear about it - it doesn't fit into the rugged individualism motif that the Republicans sell - a motif that has destroyed the sense of community the country used to have. Eventually, though, even Republicans will get tired of the poverty and desperation they are experiencing, or their parents are going through.

7) Whether the US will have any resources left to devote to these problems is unclear. Depending on interest rates, much of the tax revenue received by the federal government will be going to paying interest on its debt. The only other option will be to dismantle the military-industrial complex as a luxury the US can no longer afford. Expect the debate to be framed as a choice between being a superpower or taking care of the needs of the elderly.

I want to emphasize some of the points in 4) and 5). We are at the beginning of the baby boomer retirement wave. Talk right now is of people working until they are 70 or 80, because the first wave of retirees are now showing they are still healthy enough to work. By the time they reach 70 - if they do - most simply will not be physically or mentally able to work. We will have to abandon the idea that this generation can keep working well beyond age 65. Only a minority of this group will be able to do that, whichis true in any generation. The rest will have to be supported by the country or left to die, because they will have no source of income.

A horrible end

Partly of our own making by voting for Voodoo economics in 1980, 1984, 1988, 2000 and 2004. I was guilty in 88' because Dukakis freaked me out. I ranted about the debt from Reagan until the GWBush collapse. Now is not the time to take billions out of the economy hopefully soon but not now.

I wish the Republican candidates would receive closer scrutiny. Their "cures" for the economy are based on many, many unemployed as government spending collapses. How a whole political party can go insane is something we have not seen in my lifetime...maybe 1964? These people are truly scary.

Taxes and Spending

Your voodoo economics comment is entireley about taxes and doesn't consider the growth in spending during that period. The 1992 and 1996 periods had a low growth in spending (and a dot-com boom that collapsed as GWBush took office). But overall growth in the economy would have taken care of the deficits if spending hadn't far exceeded inflation-adjusted growth. And, no, the wars don't make up the difference.

Good Write Up

Excellent write up. Poked holes in all the mainstream press of how 'great' things are suddenly going. Kudos.