Welcome to the weekly roundup of great articles, facts and figures. These are the weekly finds that made our eyes pop.

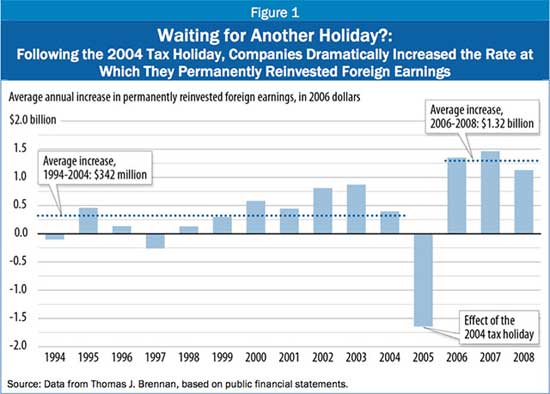

How Corporate Tax Holidays Shifts Jobs Overseas

Great report by the Center for Budget and Policy Priorities on how the latest corporate tax holiday to bring profits abroad back to the U.S. without being taxed enables more offshore outsourcing:

- A tax holiday enacted in 2004 failed to produce the promised economic benefits. The evidence shows that firms mostly used the repatriated earnings not to invest in U.S. jobs or growth but for purposes that Congress sought to prohibit, such as repurchasing their own stock and paying bigger dividends to their shareholders. Moreover, many firms actually laid off large numbers of U.S. workers even as they reaped multi-billion-dollar benefits from the tax holiday and passed them on to shareholders.

- Repeating the tax holiday would increase incentives to shift income overseas. If Congress enacts a second tax holiday, rational corporate executives will conclude that more tax holidays are likely in the future. That will make corporations more inclined to shift income into tax havens and less likely to make investments in the United States. That’s why Congress, in enacting the 2004 tax holiday, explicitly warned that it should be a one-time-only event and should not be repeated.

- The claim that a tax holiday would increase domestic investment by freeing multinationals from cash restraints is extremely dubious. U.S. non-financial corporations currently have $1.9 trillion in cash and other liquid assets, the highest level as a share of total corporate assets since 1959. The ten companies lobbying hardest for a new tax holiday alone have at least $47 billion in cash and other liquid assets that could be used for domestic investments — without triggering additional tax liability.

- Some of the biggest beneficiaries of a tax holiday would be firms that have aggressively shifted income overseas. Companies in the technology and pharmaceutical industries have been particularly aggressive in shifting income abroad because they rely on intellectual property, which is relatively easy to shift to other countries as a tax avoidance strategy. Half of all repatriations from the 2004 tax holiday came from companies in these two sectors alone. The same corporations and sectors would stand to benefit disproportionately — and enormously — from a second tax holiday.

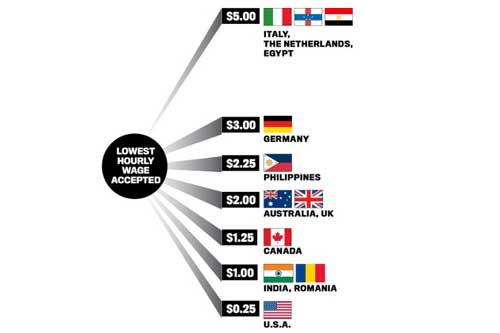

Newsweek Exposes the Real Minimum Wages, 0.25¢/hr.

I'm so glad someone in the major press took this on. Newsweek posted job ads on online job bidding sites, where the lowest bid gets the job. Newsweek found Americans are being forced to work for as low as 25¢/hr. There are tons of these online sites, forcing workers to bid on short projects. Where is the DOL or EEOA on some of these sites? Yes, Virginia, these online bidding sites are circumventing minimum wage laws and forcing Americans to compete against super low wage countries to get any money at all.

Super Rich Got Richer From Economic Armageddon

Naked Capitalism says it all with Quelle Surprise, overviewing a new report on how the rich got richer from the financial crisis.

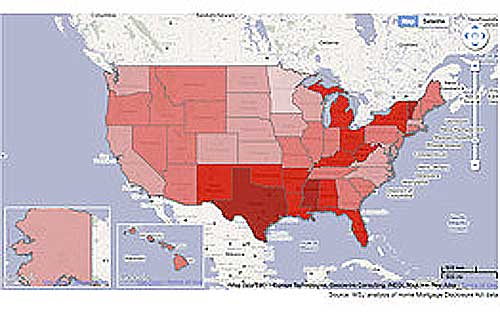

Mortgage Rejection Rates - 26.8%

The Wall Street Journal has an overview on mortgage rejection rates. No duh, add the requirement of 20% down, 36% of income to mortgage payments, the destruction of the U.S. middle class and magically few can afford to buy a house. The dark red map color means rejection rates of over 40%. Click this link for the interactive map.

How to Allow Greece to Default Without the Default

We mentioned big banks, through their EU and ECB counterweights are trying to figure out how to let Greece default without the actual default classification. Reuters has the latest:

European banks and insurers moved closer on Friday to a voluntary rollover of their Greek government debt holdings, hoping to get around rating agencies' reservations and avoid a Greek default.

National finance officials are discussing with banks and insurers a proposal to replace existing Greek debt with a different type of bond in a deal they hope will persuade credit rating agencies to refrain from declaring Athens in default of its obligations.

TBTF Banks Need to Cough Up

We're finally seeing a little action on raising capital requirements to too big to fail financial institutions:

The chief oversight group of the Basel Committee on Banking Supervision proposed that the world’s largest and most complex banks would need to hold a reserve of high-quality capital of between 1 and 2.5 percent of their assets to cope with any unforeseen losses. That would be on top of their proposed minimum capital levels for all banks, currently set at 7 percent of assets.

Cost of Raising a Child

Wall Street 24/7 shows us no one can afford kids these days.

It cost $25,299 to raise a child from birth to age 18 in 1960. The amount rose to $226,920 last year. This may be one of the many reasons Americans are having fewer children these days.

Adjusted for inflation, the 1960 sum equals about $192,497 compared to $235,996 in 2010, about a 22% increase. Neither number paints a complete picture. Median household income rose 25% between 1960 and 2010. The cost of raising a child is, in comparison to income over the 50-year period, up very modestly.

Obama, Politics, Strategic Reserve and Gas Prices

We have gas prices dropping and a prediction they will drop 50¢ soon. Obama released the strategic oil reserve, just in time for election 2012.

Here Comes the Double Dip

Economist Shilling is predicting a double dip recession for 2012. Well, technically not a double dip, since GDP growth has gone on past the definition, but a new recession. For us regular folks on the ground, I don't believe the 2001 recession stopped for most of us. When will business cycle people weight more the disappearing U.S. middle class for cycle dating? Regardless, the infamous sun will come up tomorrow mantra is starting to be challenged.

Comments

little out of sequence, but READ these stories!

Hi Folks,

I had to take off over the weekend, but I found such incredible stories and material, I'm doing the weekly series a little late.

Regardless, this has some absolutely astounding articles in it this time. All could be expanded with more data and details into an original article for this site. Read them, way more than just casual links this week.

You Are Right: Great Stuff, Thanks

Too late to go to the links but I'll follow up tomorrow.

I have been meaning to check out those work bidding sites.

Why do Americans get just 25 cents? Let's hope this exposure -- or should I say expose? -- in Newsweek gets the Labor Dept. on the case.

Paint the Roofs White

In spite of Bill Clinton's obvious corruption, bringing us NAFTA, China and the deregulation which laid the seeds for the financial crisis, he often has good ideas. One of them is we can save 10-20% and 20% on a hot day in energy costs, usage by simply painting roof's white. Pretty simple and very obviously a good direct jobs program in the mix as well.

FOREIGN investment benefits from US Corporate Rate Reductions!!!

Pointing out this issue, too, now that we're in a tax debate:

Subpart F income are profits earned by the foreign subsidiaries of US corporations that are earned, primarily, from passive-type activities. Royalties and interest are good examples of Subpart F income. Subpart F income MUST be included in the income of the US parent corporation currently, as though it is a dividend, so it increases the parent company's US tax bill. However, if the foreign corporation has paid a foreign tax equal to 90% of the US tax rate, the income can be permanently excluded from Subpart F income and thus not recognized and taxed. Most of the EU has a tax rate much lower than the US rate; so, rarely does Subpart F income get excluded from most companies under what is known as "the high tax exception".

However, if the US tax rate is reduced, as is being proposed, the rate reduction would actually incentivize the companies to recognize MORE income in their foreign subsidiaries and LESS in the USA!!! Why? Because the lower US tax rate would make MORE of the foreign Subpart F income qualify under the high tax exception!

Excellent analysis!

Thank you.

Members of Congress, while many probably do not understand the details, certainly understand what happens on the bottom line. GAO accountants and analysts tell them ... as do their campaign contributors (who are also, in many cases, their prospective employers should they be voted out.)