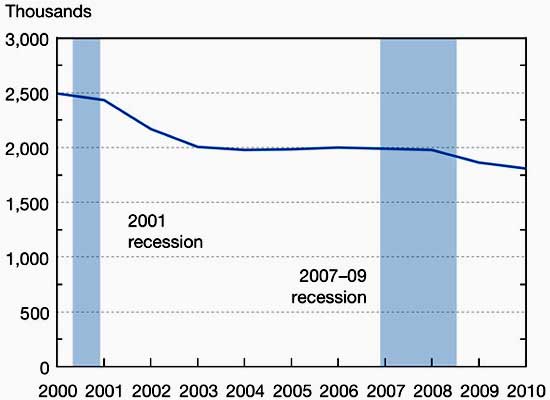

Howz that globalization workin' out fer ya? A new National Science Board report, Science and Engineering Indicators 2012, finally shows some bleak statistics for American Scientists and Engineers. High-technology manufacturing has lost 28% of jobs since a 2000 employment high of 2.5 million. That's 687,000 jobs. Below is the NSB report graph of the drop in high-tech manufacturing employment for the last decade.

U.S. employment in high-technology manufacturing reached a peak in 2000, with 2.5 million jobs. The recession of 2001 provided the first big hit causing “substantial and permanent” job losses, the report said. By the end of the decade, more than a quarter of the jobs were gone.

NSB committee chair Dr. José-Marie Griffiths:

We’re seeing the result in the very real, and substantial, loss of good jobs

Additionally U.S. corporations are moving advanced R&D offshore. From the NSB press release:

U.S. multinational corporations also created research and development (R&D) jobs overseas at an unprecedented rate.

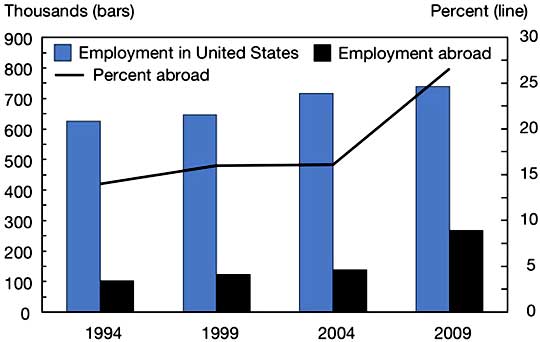

Below is the NSB graph of research and development employees by U.S. multinational corporations from select years. Bear in mind 2009 was the depth of the global recession. The below statistics do not separate out the hundreds of thousands of foreigners brought over to work in the United States by these same companies. Those foreign guest workers are included in the U.S. statistics.

On top of the lost manufacturing employment, U.S. multinational corporations are rapidly expanding their R&D jobs overseas. For a decade, from 1994-2004, U.S. firms established R&D jobs abroad at a relatively slow annual rate of three percent, increasing the share of their R&D employment overseas from 14 percent to 16 percent. But according to preliminary figures, in the next five years, 2004-2009, the number of new R&D jobs overseas took off, growing to 27 percent of all R&D jobs at these U.S. firms. Since 2004, about 85 percent of R&D employment growth in U.S. multinational corporations has been abroad.

That rapid increase in employment by U.S. firms abroad contrasts with very modest growth in R&D employment in the United States by foreign companies.

We clearly have U.S. R&D itself technology transferring abroad. China is pouring investment and funds into advanced research and development. So are other Asian countries, such as India. These Asian make sure they hire their own citizens. They are not committing global labor arbitrage, unlike the United States.

The U.S. share of global R&D expenditures dropped from 38% to 31% between 1999 and 2009, according to NSB's new report, Science and Engineering Indicators 2012. Meanwhile, global R&D share in the Asia region grew from 24% to 35% during the same time frame. Asia's rapid ascent has been driven largely by China, where R&D growth spiked 28% in 2008-2009, landing it in second place behind the U.S.

The American Manufacturing Alliance wondered if this precarious declining position can be reversed at this point.

The relative shift of R&D to Asia can also be seen in overall expenditures. The U.S. still does more R&D than any other single country, spending $400 billion in 2009. But, for the first time, the Asian region has nearly matched the U.S., with R&D expenditures of $399 billion.

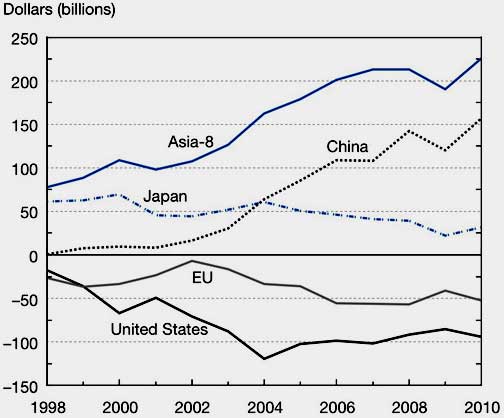

As we've noted month after month in the trade deficit overviews, the United States is now running a deficit in advanced technology. China is now the de facto world leader on high-technology trade with the rest of Asia about to exceed the United States. Below is the NSB graph on the high tech goods trade balance of various countries. Notice China's rise and America's fall.

Recent trends are also reflected in the dramatic change in shares of global high-tech exports. After rising from 19 percent to 22 percent between 1995 and 1998, by 2010 the U.S.’s share of the global high-tech exports dropped to 15 percent. At the same time, China’s share nearly quadrupled, growing from 6 percent in 1995 to 22 percent in 2010.

Asia now produces more than half of all high-tech goods exports worldwide, while the U.S. and the European Union countries each produce 15 percent. During the 15-year period of 1995-2010, Japan’s share fell from 19 percent to 7 percent.

Until 1997, the U.S. enjoyed surpluses in trade of high-tech goods. But by 2010 those surpluses had turned into large annual trade deficits of nearly $100 billion, largely driven by the shift in production of communications and computer goods to Asia at a time of growing U.S. demand. At the same time, China’s 2010 high-tech trade surpluses reached $157 billion, while eight Asian countries (excluding China and Japan) collectively enjoyed trade surpluses of $226 billion.

What the report does not say is how many U.S. citizens, Americans, have been forced out of their careers or dissuaded from entering the field at all by offshore outsourcing and the use of foreign workers to labor arbitrage Americans. If immigration actually helped U.S. Science and Engineering, clearly the United States would not be seeing these other dire statistics. Literally our universities are flooded with foreigners when it used to be dominated by American Scientists and Engineers. This isn't to say an international community isn't vital to R&D, it is, but there is a difference between enabling international talent and squeezing out Americans.

There is also a huge difference in investing in Americans versus believing advanced skills are just another commodity to be traded. This article started with a snipe. America knew how to dominate advanced technology, R&D and provide high quality, rewarding careers to American Scientists and Engineers. It seems Washington and U.S. multinationals had no problems throwing it all away, starting in earnest about the year 2000. Now, here we are, on the cusp of losing our R&D and advanced technology dominance. We haven't even mentioned how many careers and lives these policies already destroyed.

Comments

Innovation occurs in manufacturing environments

When a population is not actively building, assembling, and manufacturing products, the opportunity to "know" the product in depth decreases. Thus too, the opportunity to see a "better way" to accomplish the task diminishes.

very true, innovation follows manufacturing

Very good point. A nation loses their manufacturing base, loss of advanced R&D and innovation is soon to follow. You can see this in places like the U.K. who lost their manufacturing base during "Thatcherism".

Innovation is not something that pops up in thin air by magical geniuses. It requires investment, support and your point, where ideas come from immersion into a subject area is 100% true. You're not going to come up with a new manufacturing process innovation if you're not knees deep into the current process and see it's shortcomings.

The fiction spun by those multinationals pushing offshore outsourcing, labor arbitrage and bad trade deals is magically somehow Americans are superior and they would just magically generate all of the ideas and these other nations would be more than happy to be the worker bees of the world.

Nope, America and Americans dominated because they were supported, invested in and their careers were extremely secure. Literally, corporations would foot the bill, plus salary, to send some select people to graduate school. We need that again.

innovation

Beautiful point! We can see it directly in the design of appliances that have been outsourced to China. 1970's appliances showed great attention to usability and repairability, because the designers had a close feedback loop with the assembly line, and another feedback loop with franchised dealers. The dealers acted as delegates for the customers and repairmen.

Now the designers are stuck inside their CAD/CAM screens, the final product goes straight to WalMart, and there are no franchised dealers. All open-loop.

It's a little like locking the barn after the horse is out.

The Asian financial press for the past twenty years has been pubicizing the tens of billions of dollars that left the US and went into Asian industrial and infrastructure build-up.

This has been going on for thirty years.

The time to worry about going over the cliff is when you see the cliff coming toward you, not when you see the ground coming toward you.

I remember lobbying my Senators - Cantwell and Murray - back in the late 90s, when both Bills - Clinton and Gates - went to India to announce tens of millions of dollars of US taxpayer money and US investment monies to move software development to India. Also talked to Representatives McDermott and Inslee. McDermott was one of the founding members of the Indian Caucus - dedicated to moving the high tech sector to India. THe US Embassey used to post web articles talking about public-private partnerships (using US taxpayer monies) to move the pharmaceutical industries to India.

The same week that Carly Fiorini, CEO of HP, said "There is no such thing as an American job" in response to criticisms that HP was shipping tens of thousands of US jobs to India, she joined a growing chorus of high-tech companies asking for us taxpayer subsidies - and got it.

I remember talkign to the Speaker of the House in Olympia, WA, in the early 2000s protesting giving Microsoft tax breaks when they were outsourcing thousands of jobs to their R & D Centers in India. He didn't care, he was fine with his constituents loosing all those jobs. Microsoft announced a $2 billion investment in setting up R & D and training in India and China.

This has been going on for thirty years. I could continue for a long time on example of after example of the US government actively destroying our economy. In the late 90s, Clinton expanded a limited-purpose visa program so that 200,000 + newly graduated students from the Indian Institute of Technology could come to the US for 3 to 6 years, get On-The-Job-Training from experienced US programmers, and then take their skills, and the jobs, back to India when they were done. This involved millions of programmers and jobs. To this day, high-tech groups are trying to fight this H1-b visa, but it has turned into a myriad of other visas as well, like the L-1 and H2, and other visas.

The time to be concerned about this was twenty years ago, when we could have done something.

It's a Done Deal now. No way are they going to do a knowledge transfer back to the US.

done deals can be undone

The AAM is wondering the same thing you are. So many warned this would happen and have been shouting from the rooftops for the last 10 years, some going back 30 years. They are screaming this is horrific policy and frankly I think they will continue to do so from the grave.

Yet, our corrupt politicians, it falls on deaf ears. That's the problem, corporate lobbyists and the corrupt politicians they purchase.

Still, some of this could be undone. If they simply hired back Americans, confronted China currency manipulation and starting tying tax incentives to jobs, worker training (yes a corporate sponsored PhD study is training), and then cut off the global tax manipulation game, we'd be half way there.

There is an algorithm by ISM to maximize profits by manipulating national tax codes. Frankly the U.S. should subpoena that algorithm, run it themselves and craft a corporate tax policy to wipe out all savings by nation hopping by MNCs accordingly.

IBM stupidly tried to patent this algorithm/software and why we know about it. Grab it and figure out how to subvert their global labor arbitrage and tax arbitrage game. End of their Monopoly game as we know it.

Innovation Economy

It is ironic, indeed quite paradoxical, etc, that all of these issues were discussed during the Regan Administration. Firstly, China was recognised at the time as a significant manufacturing threat and Secondly, analysis concluded that Wall Street would collapse the US economy if a focus on 'finance capital' were adopted as would hollow out the 'real' economy, people's lives and well being.

The link below is a good read and shows what the US could have become - an innovation power house that would have stream rolled China.

http://quadrigy.com/papers/Technology-based%20Planning%20and%20Impact.pdf

Ironically, the innovation economy strategy (Project Socrates) was developed for the US during the Regan Administration and was closed down by the first simpleton Bush when he came to office after Regan. Bush 1 was aligned totally to Wall Street.

The 'finance capital' approach only benefits a very narrow group in US society - the elites. A way of making money through cost reduction without the need for all that complex investment in people, plant, etc, so as to design and build desirable products that people outside the US wanted to buy.

We all know the perverse outcome now - the US is now being torn apart socially and valuable IP is being shifted remorselessly off shore to the detriment of the US population in general. The workforce in the US is being systematically de-skilled and rapidly marginalised as part of a global pool of labour that now includes a couple of billion cheap Indians and Chinese. Working in government will not save anyone as is it ultimately futile if you have no productive manufacturing sector to create value through exchange. There is only so much you can borrow.

On Thatcher...I lived and grew up in the UK and the woman was a monster (the recent film is an absolute joke). The whole perverted premise of her administration was the massive theft of public assets via her 'privatisation' agenda and the seizure of the 'commons' - sold off so that we could pay for assets and public services that we had already paid for through tax and public investment.

They (Thatcher and her flunkies) used that idiot Friedman's Monetarist crap as foil to demonise public services and steal using the banks as 'partners' in crime a number of grandiose public offerings .

The result - decline of manufacturing, the rise of debt economy, the property owning delusion, decline in public services (the UK will probably run out of generating capacity as the private sector will not invest) and the unfortunate rise of the wankers, sorry bankers, who as we know add sod all value but continue to destroy value on an unprecedented scale and continue to skim off the top.