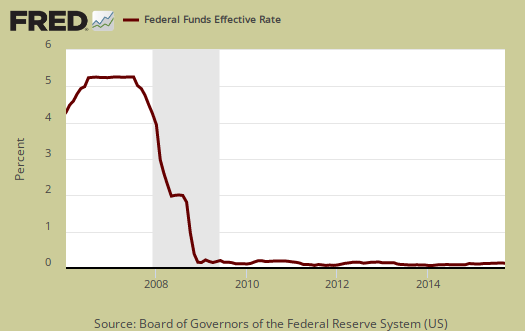

The Federal Funds rate is still effectively zero. Surprise. Since 2008 the Fed has keep interest rates an unprecedented effective zero, giving a free ride to big debt and Wall Street. The phrase that pays from the Fed is a highly accommodative policy. From the FOMC statement:

The Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate.

The reason is very low inflation and what is happening globally:

Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term.

The Committee continues to see the risks to the outlook for economic activity and the labor market as nearly balanced but is monitoring developments abroad.

The FOMC concern from deflation was clear in their revised economic projections. The median PCE for 2015 was only 0.4% and even excluding energy and food, their median projection was 1.4%, well below a 2.,0% inflation rate. Even more interesting the FOMC median projection for 2.0% inflation, either with or without food and energy considered, isn't until 2018. Wall Street doesn't seem to realize the damage deflation can cause an economy and this is precisely what the Fed is focused in on when determining to eventually raise rates.

The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.

It is clear the FOMC still expects to raise rates this year. Their median effective funds rate projection for 2014 is 0.4%, 2016 1.4%, 2017 2.6% and 2018 3.4%. Yet this seems inconsistent with the concern over inflation. From the FOMC statement:

Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation.

We now have free money, but primarily for high income individuals and institutions. Credit cards and student loans are still off the charts in interest rates in comparison to the effective federal fund rate.

Federal Reserve Chair Janet Yellen gave a conference to further explain the Fed's rationale. China and their recent currency manipulation was mentioned as causing a terrible net export amount and enhancing deflation. She said, the situation abroad needs close monitoring. Indeed, it is projected that China will further devalue their currency another 15%, which causes imports to soar and stunts U.S. economic growth. Alternatively she mentioned China and emerging markets and their slowdown causing downward pressure on raw materials and commodities prices. In other words, good old fashioned weak demand wreaks havoc on economies these days as national economies are all globalized and thus contagion can catch fire rapidly.

The FOMC also released GDP projections. which were lowered slightly from their June projections. GDP for 2015 is projected to be 2.1%, 2016 2.3%, 2017 2.2% and 2018 2.0%. What that tells us is the Fed believes the U.S. economy will just be maintaining, there won't be any sudden manufacturing Renaissance or something to really boost up growth. Unemployment rate was projected to be 4.8% past 2015.

Federal Reserve Chair Yellen explained the lack of inflation on worker bees. There is a lag from employment to wage increases and it appears the lack of middle class wage increases is impacting inflation. That said, offshore outsourcing, flooding the U.S. labor market with foreign workers and the infamous disposable worker syndrome is not addressed. If there is always an endless virtual supply of worker bees, one wonders how wages will rise by normal economic forces.

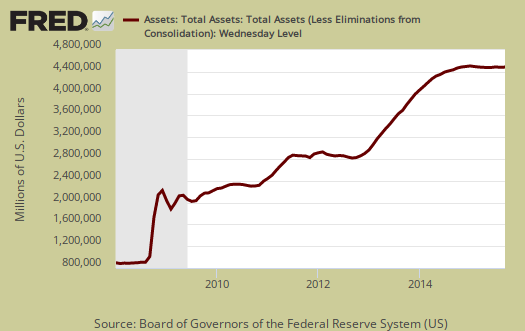

The Fed still holds large amounts of MBSes and other U.S. backed Treasuries and total holdings now stands at a whopping 4,48 trillion.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

A report mentioned that interest rates primarily effect the wealthy. Yellen responded income inequality is exacerbated by high unemployment, as if zero interest rates is getting these rich cats to hire people. There are so many facts influencing the labor market who really knows yet one thing is certain, the Fed and this government refuse to look at globalization and it's negative impact for U.S. workers.

Yellen also got in a jab to Congress to raise the debt ceiling so the United States can pay her bills and not be seen as a global deadbeat. This is a pointless hostage taking exercise by some Republicans and the debt ceiling increase is once again coming up in Congress.

So, here we are in 2015 with effectively zero percent interest rates. Today the effective Federal Funds rate was 0.14%.

Recent comments