Back in February I wrote:

With the release of today's January 2008 CPI showing a yearly reading of 4.1%, inflation hawks are certainly out in force in the blogosphere. .....

A regular pattern of cpi vs. ppi inflation unfolds over economic cycles.

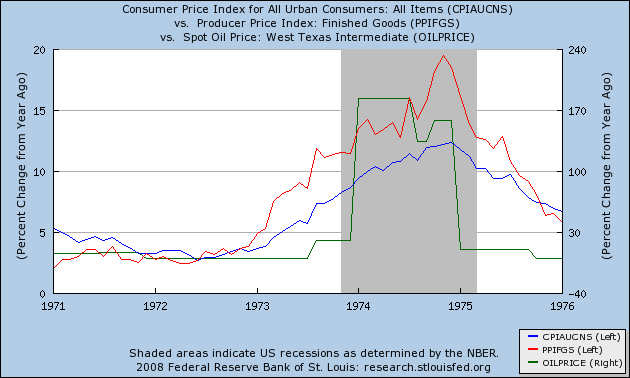

Consumer inflation is relatively tame, but producer inflation starts out very low, and considerably less than consumer inflation (the red line is under the blue line). Simply put, producer costs aren't rising as fast as consumer prices can be increased, and increased production and sales leads to increased profits. Over time, both consumer and producer inflation increases. Ultimately, producer prices increase faster than consumer prices.(the red line is over the blue line). Producers aren't able to pass on their increased costs to consumers, and their profits decline. When their profits decline, they cut back and lay off employees. A recession ensues as consumers pull in their belts. Prices, especially producer prices, decline, thus setting off the next cycle.

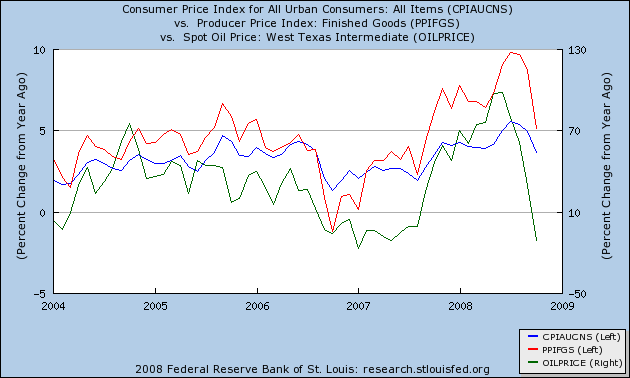

.... we are at or near the peak for inflation in this cycle. ....The more inflation spikes in the next few months, the more consumers will cut back. At some point in about the next 4-6 months, we should see declining inflation as the recession bites.

I followed this up in March, saying:

if this recession follows the patterns of the 1974, 1980 and 1990 recessions, the CPI measure of inflation, which reached recent highs of 4.3% in November 2007 and January 2008, may continue to climb for a few more months, perhaps reaching 5% or more sometime between now and the end of summer, before declining for the remainder of the year.

Here is the graph showing consumer inflation (blue), producer inflation (red) and the inflation rate for oil (green) for the period up to and including the 1974 recession (I included a variety of similar graphs in the March diary):

Well, it certainly took almost all of those 6 months I predicted before consumer inflation peaked, but peak before Labor Day it certainly did, at a rate of increase over 5% and now both producer and consumer inflation, as well as the price in oil, are all in a steep decline, just as in the latter part of the 1974 Oil shock recession:

As I wrote this morning, the Panic of 2008 has become the first deflationary recession in almost 60 years, as rampant inflation has abruptly turned into (-1.5%) deflation in the last 3 months. There is a distinct possibility that we are seeing the beginning of a deflationary spiral of declining prices and large increases in unemployment. That being said, if this recession follows the pattern of previous oil shock recessions, we can continue to expect producer prices to decline faster than consumer prices. Possibly as soon as December year over year PPI will be less than CPI, meaning the profit margin for producers has increased. Somewhere around that time, perhaps in the first half of 2009, the recession will bottom out, and at least a weak recovery may begin.

Comments

I'm wondering

if they allow the big 3 go into bankruptcy what kind of ripple effect that will have on these numbers.

Man, you did call it when every one thought you were kind of nuts! ;)

you read my mind

RO, I was just thinking the same thing.

well

some sort of nationalization, restructuring on the auto industry is in order.

I still can't believe they are arguing considering the absolute giveaway to the financial institutions.

This is insane.

priorities

A bailout of the auto industry (blue-collar) would be a tenth of the size of the bailout of Wall Street (white-collar), and would effect many more people.

That this is likely not to happen, while the bailout of Wall Street happened without oversight or debate, only shows who the real owners of this country are.

If I may be so bold to say..

looking at these graphs, you can say that any growth in the economy was pure fantasy these past four years. Indeed, this could well explain a good portion as to why many companies went into debt. Manufacturers who went to China thinking they could escape wage increases I'm sure got a rude awakening this past half decade. Yes...you may have escaped paying fair wages, but the laws of supply and demand and prices still apply to you bastards. I remember watching the price of copper and the statements coming from mining companies like Rio Tinto. Their customers were bitching, but hey, that's how it is. To the author, if I may say so, good job. Another reason why I like EP.

pure fantasy

That's why I see, when the China PNTR kicked in, about 2000, then the United States literally just handed over their wealth, economic well being to China and now the bill has become due.

The gorilla in the corner is the financial crisis ...

... because recall that the last time there was a recession after a financial crisis of at least this magnitude, the recession lasted multiple years, the first recovery was short-lived and followed by a second steep, multi-year recession, and unemployment peaked at around 25%.

Even if the headline rate includes 1% deflation from energy prices, 0.5% deflation on the fix-price sector (that is, excluding the flex-price sector) is quite genuinely deflation ... and of course deflation makes debt overhang problems worse.

When Japan had a finance sector melt-down approaching these levels, what followed was ten years of stagnation, punctuated by three recessions.

Now, this financial melt-down seems to be less severe ... so far ... than the Panic of 1929 which helped ensure that the Recession of 1929/30 became the Great Depression, and more severe than the Japanese Real Estate Bubble collapse leading into the Lost Decade of the 90's.

So within the bracket of financial melt-downs in this range, 10 years of depression or, with very aggressive fiscal policy, stagnation would seem to be a norm.

Breaking that norm is one of the four main economic challenges for 2009.