There is only $53 billion in FDIC insurance to cover $6.84 Trillion in bank deposits

- Mike Shedlock, a/k/a Mish, "You Know The Banking System Is Unsound When...."

This is a trivially inadequate amount of insurance, right?

Wrong.

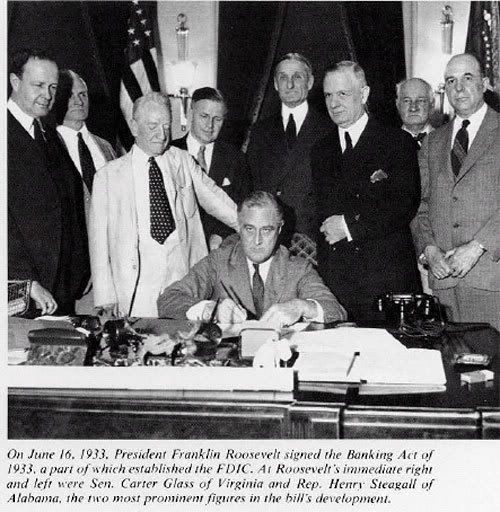

One of the many great accomplishments of the New Deal was the Banking Act of 1933, also known as "Glass-Steagall", which among other things established the FDIC.

When FDR signed the FDIC into law, there too we had fear being a self fulling prophesy. Before FDIC existed, even in the Roaring 20s, there were hundreds of bank failures with losses of depositors' money, every years. Here is the history of actual bank failures in the years leading up to and during the Great Depression:

| Year | Suspensions | Deposits | Depositors' Losses(K) | Losses to Deposits Ratio |

|---|---|---|---|---|

| 1921 | 506 | $172,806 | $59,967 | 0.21% |

| 1922 | 366 | $91,182 | $38,223 | 0.13% |

| 1923 | 646 | $149.601 | $62,142 | 0.19% |

| 1924 | 775 | $210,150 | $79,381 | 0.23% |

| 1925 | 617 | $166,937 | $60,799 | 0.16% |

| 1926 | 975 | $260,153 | $83,066 | 0.21% |

| 1927 | 669 | $199,332 | $60.681 | 0.15% |

| 1928 | 498 | $142,386 | $43,813 | 0.10% |

| 1929 | 659 | $230,643 | $76.659 | 0.18% |

| 1930 | 1,350 | $837,096 | $237,359 | 0.57% |

| 1931 | 2,293 | $1,690,232 | $390,476 | 1.01% |

| 1932 | 1,453 | $706,187 | $168,302 | 0.57% |

| 1933 | 4,000 | $3,596,708 | $540,396 | 2.15% |

Source: Columns (1), (2), (3), FDIC; Column (4). Friedman and Schwartz

The US government initially capitalized the FDIC with a loan, which was paid back in full within 15 years by member banks. Under the temporary initiating legislation

Banks admitted to insurance under the temporary plan were to be assessed an amount equal to one-half of one percent of insurable deposits. One-half of the assessment was payable at once; the rest was payable upon call by the FDIC.

Under several amendments made in 1935:

The FDIC had calculated that during the period 1865-1934, an annual average assessment rate of about one-third of one percent of total deposits would have been required to cover the actual losses on deposit balances in failed banks. However, if certain "crisis" years in which losses were unusually high were eliminated, the necessary rate would have been lowered to about one-twelfth of one percent. Adoption of the lower rate was justified on the grounds that many banking reforms and improvements had occurred to strengthen the banking system and prevent bank failures.

....

The annual assessment rate was set at one-twelfth of one percent of total (adjusted) deposits.

The Act has functioned at this level of assessment ever since, and was an immediate and spectacular success at instilling confidence in the banking system:

| Bank Failures | Deposit Payoffs | Deposit Assumptions | |||||

|---|---|---|---|---|---|---|---|

| Year | # | Assets(K) | Losses(K) | # | Assets(K) | # | Assets(K) |

| 1934 | 9 | $2,657 | $207 | 9 | $2,657 | 0 | 0 |

| 1935 | 25 | $16,023 | $2,685 | 24 | $11,105 | 1 | $4,918 |

| 1936 | 69 | $31,955 | $2,333 | 42 | $12,989 | 27 | $18,966 |

| 1937 | 75 | $40,462 | $3,672 | 50 | $19,376 | 25 | $21,086 |

| 1938 | 74 | $69,518 | $2,425 | 50 | $13,925 | 24 | 55,593 |

| 1939 | 60 | $181,522 | $7,152 | 32 | $43,933 | 28 | $137,589 |

| 1940 | 43 | $161,898 | $3,796 | 19 | $7,960 | 24 | $153,938 |

| 1941 | 15 | $34,805 | $591 | 8 | $17,812 | 7 | $16,993 |

| 1942 | 20 | $21,756 | $688 | 6 | $1,603 | 14 | $20,153 |

| 1943 | 5 | $14,059 | $123 | 4 | $7,382 | 1 | $6,677 |

As we can see from the above table, all Depositors in a failed bank recovered their money and to note that when a bank failed, there are still assets available to cover a large percentage of customer deposits.

Deposit insurance charges were effectively reduced by the Federal Deposit Insurance Act of 1950. Rather than lowering the basic assessment rate, however, the reduction was accomplished through a rebate system. After deducting operating expenses and insurance losses from gross assessment income, 40 percent was to be retained by the FDIC, with the remainder to be rebated to insured banks. This procedure meant that losses were to be shared by insured banks and the FDIC on a 60 percent - 40 percent basis. This provision has tended to stabilize FDIC earnings during periods of fluctuating loss experience.

The FDIC functions at the same level of assessment that was studied by the FDIC and Congress in 1934, namely 1/12 of 1%:

The FDIC had calculated that during the period 1865-1934, an annual average assessment rate of about one-third of one percent of total deposits would have been required to cover the actual losses on deposit balances in failed banks. However, if certain "crisis" years in which losses were unusually high were eliminated, the necessary rate would have been lowered to about one-twelfth of one percent. Adoption of the lower rate was justified on the grounds that many banking reforms and improvements had occurred to strengthen the banking system and prevent bank failures.

Contrary to the claims expressed by the author of the highly recommended diary on a large site who admitted that he didn't know "jack s%^t", Indymac didn't leave the FDIC with 10% less "insurance". The FDIC is not like a corporate insurance company, which is limited to the value of its invetments. Rather, the FDIC is like a Joint Insurance Fund which can levy additional assessments on its members. Indeed, the FDIC immediately levied replacement funds from its member banks.

And beyond that, the FDIC is authorized to borrow up to $30,000,000,000 from the US Treasury:

(a) BORROWING FROM TREASURY.-- The Corporation is authorized to borrow from the Treasury, and the Secretary of the Treasury is authorized and directed to loan to the Corporation on such terms as may be fixed by the Corporation and the Secretary, such funds as in the judgment of the Board of Directors of the Corporation are from time to time required for insurance purposes, not exceeding in the aggregate $30,000,000,000 outstanding at any one time, subject to the approval of the Secretary of the Treasury: Provided, That the rate of interest to be charged in connection with any loan made pursuant to this subsection shall not be less than an amount determined by the Secretary of the Treasury, taking into consideration current market yields on outstanding marketable obligations of the United States of comparable maturities.

Thus, currently the FDIC maintains about $53 billion in its "kitty" -- exactly the 1/12 if 1% that the New Deal Congress found was sufficient in, and has been sufficient since, 1934.

Finally, it is worth noting that Indymac is nowhere near the biggest intervention made by the FDIC: in 1984 the 7th largest bank in the country, Continental Illinois, failed, and required a $4.5 takeover by the FDIC -- an amount equal to almost $10 billion today. But that brings us to the one example of failure in our story, for the FSLIC for Savings and Loans was capitalized in the same percentage, and in the 1980s it did run out of insurance.

Next: The failure of the FSLIC

I am grateful for the assistance of Rob Oak in researching and editing this series of diaries

Recent comments