Oh here we go. The headlines scream the biggest budget in history, it is wealth redistribution and on and on.

So, let's find out what is in the Obama administration Budget Proposal of 2010. Firstly the actual budget is on The White House website. Secondly, here is the total cost:

government outlays for this year will end up at $3.94 trillion, up 32 percent from a year ago. That would yield a record deficit of $1.75 trillion in the year ending Sept. 30, equal to about 12 percent of the nation’s gross domestic product, the highest since World War II.

Here are some hard numbers discovered so far that might be of interest:

- E-verify legal worker: $110 million

- TARP II: $750 billion

- Bush Tax Cuts expire: -$318 billion

- State Department & foreign assistance: $51.7 billion

- Health Care: $634 billion

- Iraq/Afghanistan: $200 billion

- DoD: $533.7 billion

- 2.9% military pay raise

This list is no where near complete and of course Congress will change this all around.

On the infamous rhetoric to close tax loopholes which make the offshore outsourcing of jobs more profitable, the details are not known as reported by Public Citizen:

A colleague alerts met to page 122 of the budget document, which indicates that some non-elaborated combination of "international enforcement, reform deferral and other tax reform efforts" is projected to generate $210 billion in additional federal revenue over 2010-2019.

As we know closing these loopholes alone will not have any dramatic effect on global labor arbitrage.

Some Subsidies removed:

- subsidies to private institutions for student loans

- subsidies to corporate farms

- $31.5 subsidy removal to oil & gas companies

Predatory Student loans, giving subsidies to corporate farms and not taxing oil and gas companies have been strong Populist demands, so this is encouraging they are included.

Another important issue, that of no-bid DoD contracts, procurement, runaway costs...the details are also not available but simply a framework.

I would not take that as a problem. More to tell you how intense the Defense budget is, Defense Secretary Gates is requiring NDAs be signed! So, clearly in dealing with billions and billions of dollars, the ability to literally tank or raise a private company, something is going on to require a additional "don't talk about the budget or you're screwed" document.

This post is a primarily first pass at the budget. If you would be so kind to leave more information or links in the comments and I will update this post with your insights.

Earmarks and special interests are always especially fun. The huge amount allocated to even more bank bail outs is clearly something all of us should raise hell about. Zombie banks walk the earth and eat up all our brains.

Update: Commongood's comment is so in depth, it's added to the post below:

The banks are critical

All reports I have heard and read are very, very favorable with regards to the Obama budget. By most accounts it is honest, transparent, forward looking and consistent with his campaign promises. Some progressives would like to see more on the revenue side, e.g. - more tax rollbacks on the upper 5% of income earners. But there is enough rollbacks in the current plan to keep the lobbyists quite busy. In the meantime though, resolving the bank situation is drifting from ridiculous to absurd. Geithner has not fooled any investors so far and his latest nebulous plans will not change that. Krugman is feeling the same. But I think this post on automatic earth says it all:

Ilargi: Bernanke says the recession will be over in a few months. MarketWatch has a deadline that says "Evidence mounts that recession's worst is past”. The Dow is up 3.5% when I write this. Now I'm sure Bernanke would look just fine with a party hat on his skull, but by now words like his this morning have become irresponsible. You can't keep on lying to people and expect them to always come back for more. The high and mighty in the markets are understandably giddy at the prospect of hundreds of billions of additional taxpayer dollars being moved into their failed institutions.

.

This is the cover of the February 15, 1999, issue of TIME Magazine.

Robert Rubin, Alan Greenspan and Larry Summers as the three wizards who will save the world. Ten years later, Rubin is the man behind the scenes of Obama's finance team, Greenspan is busy doing mea culpa's that leave him without blame, and Summers has his eyes on Greenspan's old throne. These guys have orchestrated the downfall of the American economy ten years ago, through the Glass-Steagall repeal, insanely low interest rates and lack of regulation for 'innovative' financial instruments. They are today still firmly in the seats of power. I can't think of anything more worrisome than that.

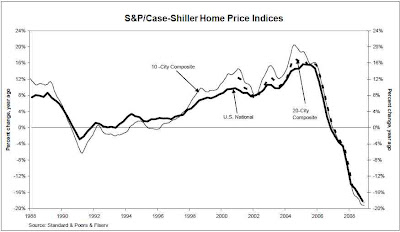

So what are the chances that the new bank bail-outs will accomplish what they are supposed to do? It may seem like a very complicated question, and one that many will claim no-one can foresee the answer to, but maybe it's actually pretty easy. A new version of the Case/Shiller S&P Housing Index was published today, and it shows another record fall in US home prices. 18.5% in one year, a 9th consecutive record.

Professor Robert Shiller, someone I’ve taken issue with for his overly rosy forecasts in the past, did an interview yesterday with Henry Blodget in which he makes three points with regards to the future of domestic real estate.

House prices are still only halfway back down to fair value.Prices don't usually stop at fair value. (Shiller calls this overshoot, I have referred to it as oscillation, what goes up must come down harder)

Obama's plan won't turn house prices around.

What this means is that prices have come down between 25% and 30% already, that they will drop another 30%, and that's before the overshoot. Shiller is getting very close to the prediction of 80% or more peak to trough I have been using for well over a year now, don’t you think?

How do we link housing prices to the bank bail-out? Like this. MoneyandMarkets has a cute little set of numbers.

Mike Larson adds a few comments:

Citigroup is on the list because of three factors: Its main banking unit has a C- financial strength rating. It has large exposure to the credit risk of derivatives. Plus, it has a big exposure to mortgages — $198 billion. Wachovia is in a similar situation: It made the fatal mistake of buying the nation’s largest and most aggressive mortgage lender — Great Western Financial — at the worst possible time. And it’s also got some serious exposure to derivatives. Washington Mutual, the nation’s largest thrift, has a D+ rating and is loaded with mortgage exposure. HSBC has a D+ rating. Plus, it has an exceptionally large 721% of its capital exposed to the credit risk of derivatives. In other words, for every single dollar in capital, HSBC is taking a credit risk of $7.21 with trading partners in derivatives, according to the U.S. Comptroller of the Currency.

Citi's market cap is around $12 billion. Its "assets" (wonder what is in that pot) are stated as over 100 times its cap, at $1,292 billion. If Citi indeed has all those assets, investors would be nuts not to buy in, wouldn't they? Its mortgage exposure is 16 times the market cap, while its derivatives risk is $2.79 per dollar in capital. (NB: total Citi derivatives positions were estimated at $38 trillion last year)

If housing prices keep falling in the way and to the extent that Shiller indicates, Citi will lose another $100 billion on its mortgage portfolio, while its mortgage backed securities and other derivatives will easily add a trillion here and there to the bleeding. Which in turn indicates that if home prices don't come back up, which Shiller says they will not, that Citi is way beyond salvation.

In 1999, mere months before the Glass-Steagall repeal was voted through, Robert Rubin handed the Treasury Secretary seat to Larry Summers, in order to move on to Citi and put to "good use" all the new financial powers he himself was responsible for writing.

In 2009, Rubin left Citi throuigh the revolving door that connects Wall Street to Washington, to team up again with Larry Summers and Tim Geithner, and make sure hundreds of billions are being poured into the bank he helped implode. None of Obama's initiatives will do anything to save the banking system, or restore economic growth, or benefit the taxpayer. We're witnessing the liquidation of the US as a going concern.

I sure hope Ilargi is wrong but it is hard to argue with his reasoning. Especially when Krugman, Roubini, Reich, et al are saying pretty much the same thing.

Comments

The banks are critical.

All reports I have heard and read are very, very favorable with regards to the Obama budget. By most accounts it is honest, transparent, forward looking and consistent with his campaign promises. Some progressives would like to see more on the revenue side, e.g. - more tax rollbacks on the upper 5% of income earners. But there is enough rollbacks in the current plan to keep the lobbyists quite busy. In the meantime though, resolving the bank situation is drifting from ridiculous to absurd. Geithner has not fooled any investors so far and his latest nebulous plans will not change that. Krugman is feeling the same. But I think this post on automatic earth says it all:

.

This is the cover of the February 15, 1999, issue of TIME Magazine.

Mike Larson adds a few comments:

I sure hope Ilargi is wrong but it is hard to argue with his reasoning. Especially when Krugman, Roubini, Reich, et al are saying pretty much the same thing.

your comment is so in depth

I added to the blog post itself so it would go out onto the RSS feed. Good work, hope you write a post or two soon.

I do think there are some problems myself, I'm really not into some of the open borders, unlimited migration groups like La Raza and I think there is some good reason to be wary of ACORN too. I know these are "the right" complaints but I think they have some points. I wasn't sure about where it was in the budget that they claim though.