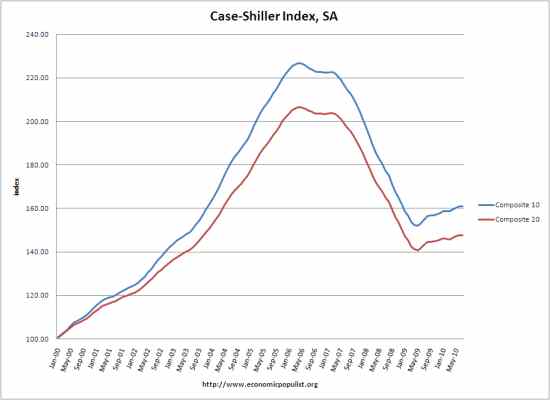

The S&P/Case-Shiller Home Price indexes for July 2010 were released today. Seasonally adjusted, prices were flat from last month, still up for the year, but slowing. From the graph below, one can see the flat tail showing the slowdown in home prices.

Data through July 2010, released today by Standard & Poor’s for its S&P/Case-Shiller Home Price Indices, the leading measure of U.S. home prices, show that the annual growth rates in 16 of the 20 MSAs and the 10- and 20-City Composites slowed in July compared to June 2010. The 10-City Composite is up 4.1% and the 20-City Composite is up 3.2% from where they were in July 2009.

While prices are increased over the year, seasonally adjusted, the change from July is 0.0% for the composite 10 and -0.1% for the composite 20. These are seasonally adjusted, to see the total data, read their report and to see more graphs and analysis, read Calculated Risk.

There is a slowing on that increase and Las Vegas seems to be a bottomless pit. The report warns that the stimulus has not dissipated yet from home sales:

While we could still see some residual support from the homebuyers’ tax credit, which covers purchases closing through September 30th, anyone looking for home price to return to the lofty 2005-2006 might be disappointed. Judging from the recent behavior of the housing market, stable prices seem more likely.

In the monthly data, 12 of the 20 MSAs and the two Composites were up in July over June; but the monthly rates also seem to be weakening. The next few months may give us an idea of the true strength of the housing market, as the temporary economic stimuli will have ended. Housing starts, sales and inventory data reported for August do not show signs of a robust market, and foreclosures continue.

The composite indexes are local (city) housing markets. The list of cities, with the home price break down is in their report.

On another note, Zillow reported 1/3rd of people cannot get a mortgage due to their credit scores:

Nearly one-third (29.3 percent) of the population with scores below 620. For them, getting a mortgage is likely out of reach. Even if with a healthy down payment of 15 to 25%, they are rarely offered even one conventional loan quote by lenders.

Recent comments