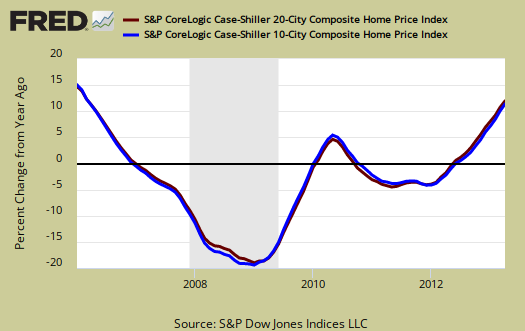

The April 2013 S&P Case Shiller home price index shows a 12.1% price increase from a year ago for over 20 metropolitan housing markets and a 11.6% change for the top 10 housing markets from April 2012. This is the highest yearly gain since March 2006. Prices are on fire exceeding the jacked up price pace of the housing bubble. The monthly jump in the composite-10 was an astounding 1.8% and 1.7% for the composite-20, seasonally adjusted. Not seasonally adjusted, the monthly increases were 2.6% and 2.5% for the 10- and 20-City Composites respectively. These are the highest annual gains in seven years,

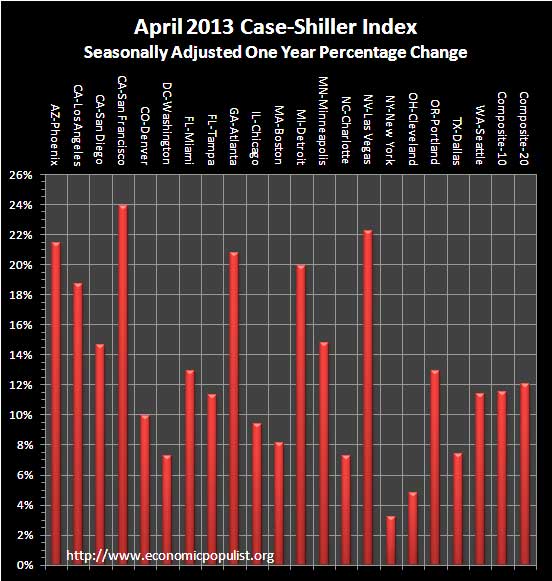

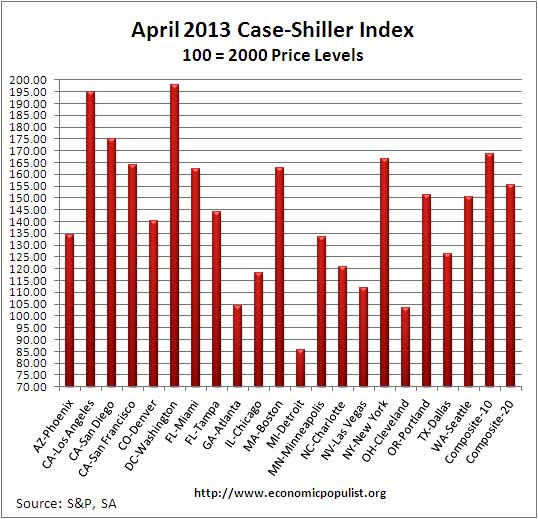

Below are all of the composite-20 index cities yearly price percentage change, using the seasonally adjusted data. San Francisco is now up 24%, back to it's have and have not housing market where one needs to be a millionaire to own a home. Fourteen of the 20 cities saw double digit annual home price increases in their respective areas, four above 20% Double digit gains imply the housing bubble has clearly been re-established.

S&P reports the not seasonally adjusted data for their headlines. Housing is highly cyclical. Spring and early Summer are when most sales occur. See the bottom of this article for their reasoning.

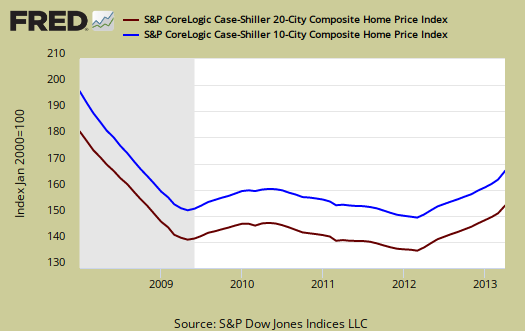

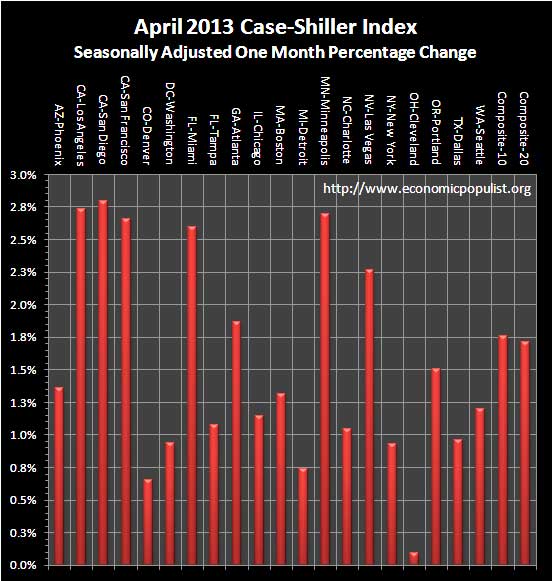

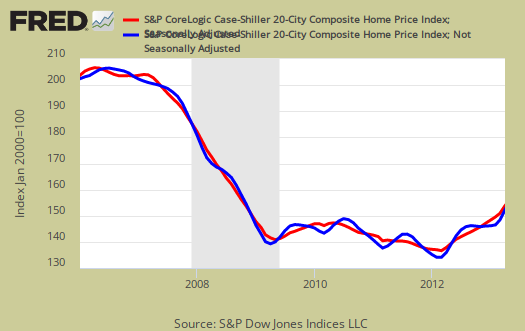

All city home prices have had positive gains for four months in a row. For the month, the not seasonally adjusted composite-20 percentage change was 2.5% whereas the seasonally adjusted change for the composite-20 was 1.7%. The monthly not seasonally adjusted composite-10 percentage change was 2.6%, whereas the seasonally adjusted composite-10 showed a 1.8% increase as well. There were record monthly gains for Atlanta, Dallas, Detroit and Minneapolis, not seasonally adjusted. The below graph shows the composite-10 and composite-20 city home prices indexes, seasonally adjusted. Prices are normalized to the year 2000. The index value of 150 means single family housing prices have appreciated, or increased 50% since 2000 in that particular region. Case-Shiller indices are not adjusted for inflation.

Some in the press use the seasonally adjusted data, and others do not. Some report the monthly change, others the annual change. S&P themselves use the not seasonally adjusted housing price data. To make matters worse, some in the press do not specify which statistic they are quoting from S&P. Below are the seasonally adjusted monthly home price percentage changes for each City reported by S&P.

Below are the seasonally adjusted indices for this month. The index itself tells you what has happened to home prices, per city, from the year 2000. Only Detroit is below their 2000 home price values.

S&P estimates home prices are down approximately 26-27% from the height of the housing bubble's June and July 2006 price peaks. These statistics use the not seasonally adjusted home price indices. The question now is who is buying up all of these homes? Somehow we do not believe institutional investors making fast profits means the housing market has returned to healthy levels. below are homeownership rates for Q1 showing they are down to Q4 1995 levels. Rents are also increasing. Both of these metrics do not support your average person buying a home and instead to institutional investors and potentially inventory being kept off the market, such as bank owned foreclosures.

No housing bubble would be complete without easy credit. S&P specifically addressed the trend for easier credit in their report. Note the return of adjustable mortgages.

Last week’s comments from the Fed and the resulting sharp increase in Treasury yields sparked fears that rising mortgage rates will damage the housing rebound. Home buyers have survived rising mortgage rates in the past, often by shifting from fixed rate to adjustable rate loans. In the housing boom, bust and recovery, banks’ credit quality standards were more important than the level of mortgage rates. The most recent Fed Senior Loan Officer Opinion Survey shows that some banks are easing credit restrictions.

To Season or Not to Season, That is the Question:

The S&P/Case-Shiller Home Price Indices are calculated monthly using a three-month moving average and published with a two month lag. Their seasonal adjustment calculation is the standard used for all seasonal adjustments, the X-12 ARIMA, maintained by the Census.

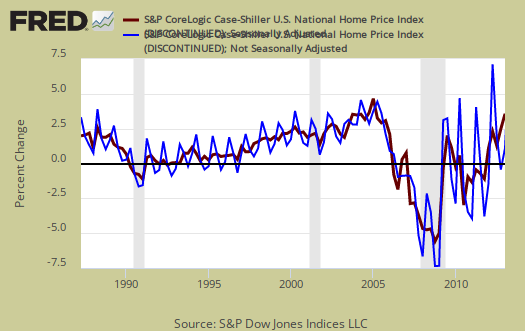

So, why would S&P report the not seasonally adjusted data? According to their paper on seasonal adjustments, they claim the not seasonally adjusted indices are more accurate. It appears the housing bubble burst screwed up the cyclical seasonal pattern. What a surprise, although those steep cliff dives are now going back to 2009, one would think the seasonally adjusted data would now start to converge back to it's cyclical, seasonal pattern.

The turmoil in the housing market in the last few years has generated unusual movements that are easily mistaken for shifts in the normal seasonal patterns, resulting in larger seasonal adjustments and misleading results.

To see S&P's argument in action, look at the below graph. The maroon line is the seasonally adjusted national index, reported quarterly. The blue line is the not seasonally adjusted national index. As we can see before the housing bubble burst, we see a typical cyclical pattern difference between the seasonally adjusted and not seasonally adjusted data points. Yet after the bubble burst we see large swings, which would throw off a seasonal adjustment adaptive algorithm. This is going to become a major question among statisticians, how does one adjust for seasonality in the face of tsunami like economic events?

Not seasonally adjusted data can create more headline buzz on a month by month basis due to the seasonality of the housing market. S&P does make it clear that data should be compared to a year ago, to remove seasonal patterns, yet claims monthly percentage changes should use not seasonally adjusted indices and data. This seems more invalid than dealing with the statistical anomalies the massive housing bubble burst caused. Below is the seasonally adjusted and not seasonally adjusted Composite-20 Case-Shiller monthly index, for comparison's sake.

For more Information:

S&P does a great job of making the Case-Shiller data and details available for further information and analysis on their website.

Here is our Case-Shiller past overviews as well as the overviews of residential real estate statistics.

the housing delusion and madness of the crowd

most people are short sighted and dont understand what a house is..homes are not an appreciating asset any more than a car or other durable is, & they are no more like to "recover" to their former high prices than are dutch tulip bulbs going to recover to the prices they sold for in 1637...houses deteriorate over time & eventually are torn down, just as automobiles deteriorate & are eventually junked...originally, the reason houses seemed to appreciate in value was the inflation of the 70s; because money depreciated faster than houses, houses went up in price...if inflation was 100% per year, cars would appear to go up in price every year too; you could then buy a car & drive it three years & sell it for more than you bought it for...with core inflation at record lows, inflation expectations falling below 2% on the possibilitly of QE withdrawal, and disposable personal income stagnant, there is no reason for homes to go up in price..

rjs

see the comments on credit, adjustable mortgages

Case-Shiller is calling "healthy" residential real estate what we call a return to the bubble.

They want a return to the bubble and are setting up all sorts of conditions to make that happen.

The fact people cannot afford even a $200,000 mortgage, never mind $300,000 banks and those vested in making money off of real estate could care less.

I think prices are going to continue to rise, with a potential pop since wages are projected to fall further and the ongoing employment crisis is being swept under the rug as the labor participation rates go to record lows.