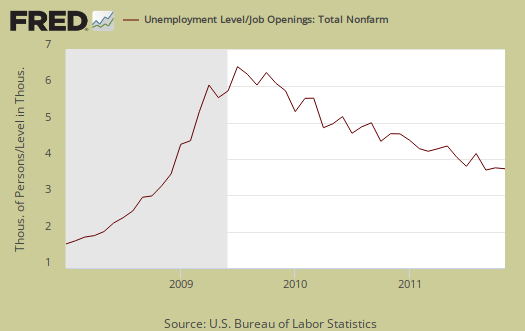

JOLTS stands for Job Openings and Labor Turnover Survey. The November 2011 statistics show there were 4.22 official unemployed people hunting for a job to every position available*. There were 3,161,000 job openings for November 2011, a decrease of -1.95%, from the previous month of 3,224,000. For the 40th month, JOLTS again reflects a dismal jobs market and this is with job openings increasing 30% from their June 2009 trough. Below is the graph of number of official unemployed, 13.323 million, per job opening for November 2011.

If one takes the official broader definition of unemployment, or U-6, the ratio becomes 7.71** unemployed people per each job opening for November. The November U-6 unemployment rate was 15.6%. Below is the graph of number of unemployed, using the broader U-6 unemployment definition, per job opening.

If you do not like the use of U-6 to look at the real number of people looking for a job to actual opportunities, consider this number. In November 2011, of those not in the labor force, 6,595,000 were actually wanting a job. U-6 only includes 2,591,000 of these people.

The rates below mean the number of openings, hires, fires percentage of the total employment. Openings are added to the total employment for it's ratio. Openings and hiring rates decreased but so did firings, as a ratio, from last month.

- openings rate - 2.3%

- hires rate - 3.2%

- separations rate - 3.0%

- fires & layoffs rate - 1.3%

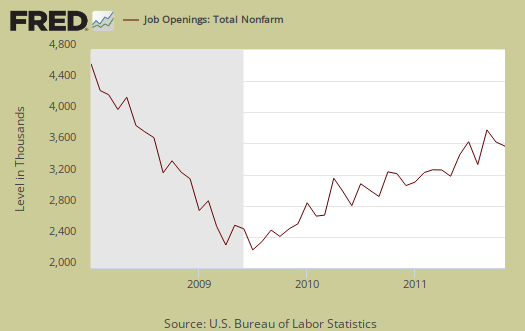

Job openings dropped -63,000 from last month to 3,161,000. Professional/Business services alone dropped -59,000 in job openings. Below are raw job openings, way below the 4.4 million pre-recession levels.

Believe this or not, one month past the so called end of the Great Recession, July 2009, job openings have only increased by 1,049,000. July 2009 was the low point of job openings, 2,112,000. In March 2007, a few months before the start of the recession (December, 2007), the number of job openings was 4,755,000.

October's hires were 4,149,000, an increase of +2.65% from October's 4,042,000 hires. This basically cancels out September's decrease.

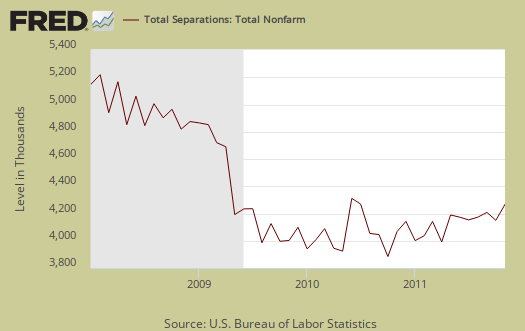

Below are total job separations, 3,995,000, a +2.49% increase from last month. Leisure and Hospitality separations were 74,000 of the total 97,000 increase for November. The term separation means you're out of a job through a firing, layoff, quitting or retirement. The report has a breakdown of separations, hires and openings across occupational categories. Layoffs and firings were 1,691,000 of the total 3,995,000 and to pre-recession levels.

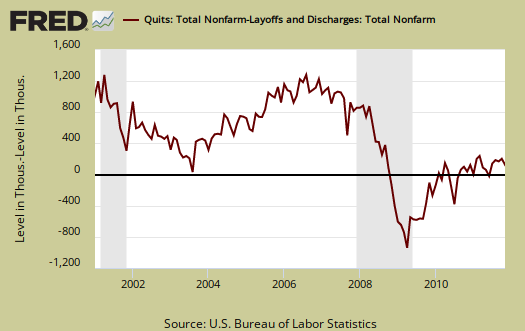

For November, of total separations, the quits were 49% whereas layoffs and fires were 42%. Below are quits minus discharges and layoffs. When quits comes close to firings that means people have little choice in employment. You want to see choice, or quits, rise and be much higher than firings. The below graph shows people still do not have that many options when it comes to a job for quits are still way below pre-recession levels. The ratio is nowhere near the 2009 mass firings and layoffs.

The JOLTS takes a random sampling of 16,000 businesses and derives their numbers from that. The survey also uses the CES, or current employment statistics, not the household survey as their base benchmark, although ratios are coming from the household survey, which gives the tally of unemployed.

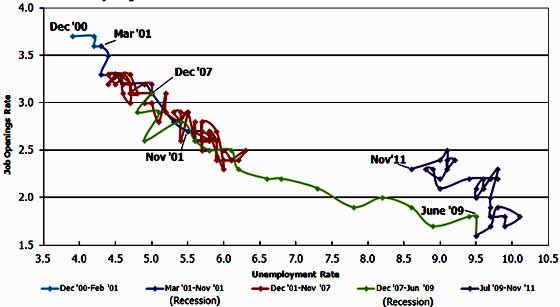

The BLS was kind enough to make a credible Beveridge Curve graph, reprinted below. The Beveridge curve shows the official unemployment rate vs. the job openings rate, over time. If you see a bunch of data points to the far right, that's bad, it means there is long term unemployment and not enough jobs. Look at how we're stuck to the right. November 2011 moved vertical down, left. That means job openings remained about the same, yet the unemployment rate decreased slightly. A right up move in the Beveridge curve can indicate a skills mismatch, so this graph also refutes the corporate lobbyists claim there is a skills shortage per their cheap labor arbitrage agenda. The green, representing the 2009 time period, shows how fast we went to the right and the purple, which is 2010, 2011, means we are stuck there in job market malaise. All of that purple line is the last two years and shows the U.S. worker is stuck and stuffed, in no man's land for jobs. Look at how awesome 2000 was for landing a job.

JOLTS includes part-time jobs and does not make a distinction between part-time, full-time openings. A job opening reported to the survey could literally be take out the trash twice a week and be counted. This is a shame, it would be nice to know a little more about the quality of these new opportunities.

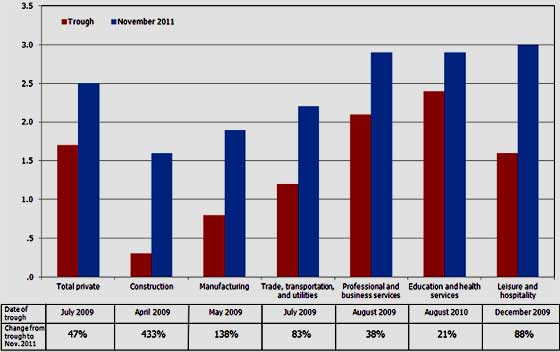

For the JOLTS report, the BLS creates some fairly useful graphs, some of which were reprinted here, and they have oodles of additional information in their databases, broken down by occupational area. The Saint Louis Federal Reserve also had loads of graphing tools for JOLTS. Below is a reprint of the BLS graph showing the percent change in job openings from the July 2009, there were no jobs trough. Just unbelievable how construction jobs dried up during that time. The 433% increase in construction job openings first looks great, but more it should show you just how bad it got.

Professional and technical services is notorious to import workers on foreign guest worker Visas, displacing Americans. Unfortunately the government refuses to separate out U.S. workers from foreign guest workers in their data. This can distort certain occupational categories and hide the fact Americans are being labor arbitrated.

*The BLS rounds up to 1 decimal place.

** is defined as the official unemployed plus people who are in part-time jobs for economic reasons plus the marginally attached. The marginally attached,

, are officially not part of the civilian labor force,

, and also not seasonally adjusted. The above graph was created by the seasonally adjusted levels of the unemployed, part-time for economic reasons and the marginally attached. The raw U-6 totals can also be calculated by this formula, which gives a slightly higher ratio.

where

Last month's JOLTS overview is here, unrevised.

Recent comments