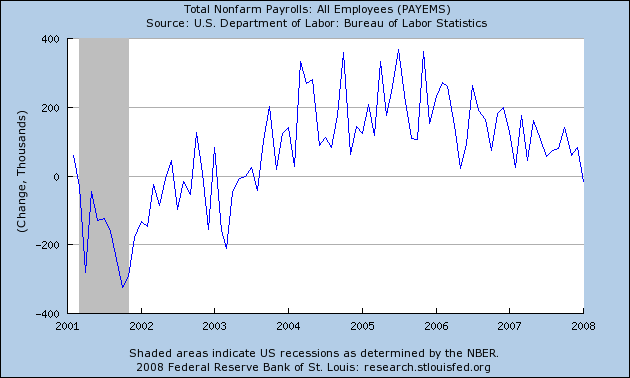

One of the things I wanted to try here is to post bits of significant economic data that would scroll off the page on the great orange satan in about 10 minutes. One of those items was yesterday's retail sales number. For about the last 6 months, most economic data has been deteriorating steadily, but two of the holdouts were retail sales and jobs data. A couple of weeks ago the December nonfarm payroll number finally went negative.

Yesterday retail sales came in at +3% in January, surprising most observers. "The American consumer still isn't dead!" seemed to be the dominant theme. Yours truly, however, looked at the number differently, because official consumer inflation for 2007 was 4.1%, and retail sales hadn't kept pace. In other words, in REAL terms, retail sales were negative, for the first time since coming out of the last recession, as shown in this graph (courtesy of Haver Analytics via the Big Picture):.

What's worse, much of the "positive" retail sales number was spending on gasoline! So, in summary, the American consumer has cut back, and reallocated what they are spending towards purchasing gas. Sound like a healthy economy to you?

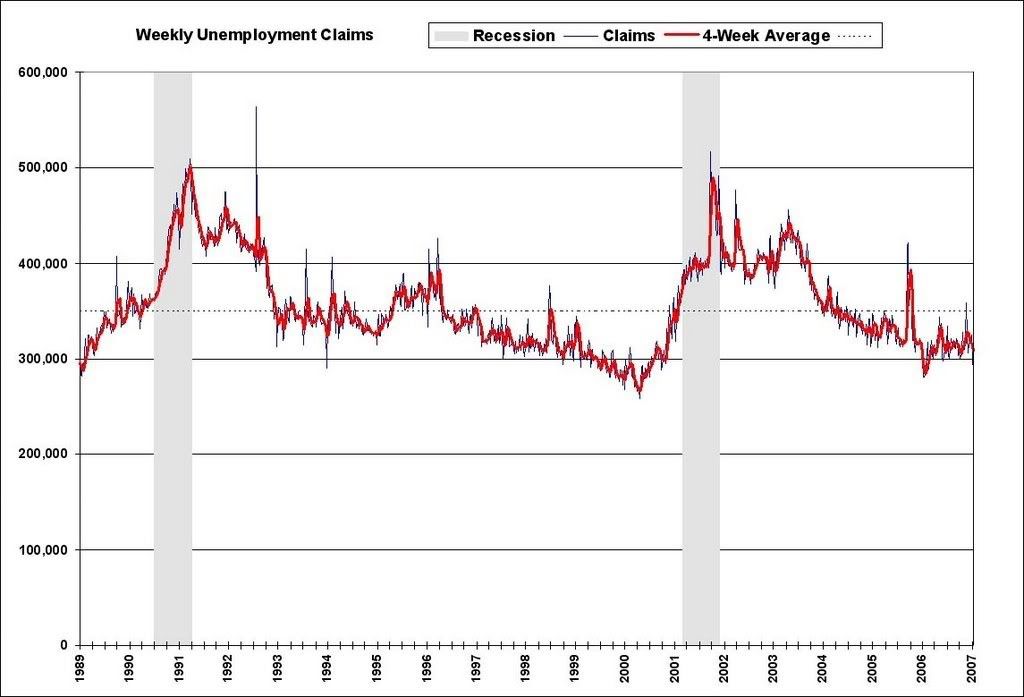

This morning at 8:30 we just got weekly initial jobless claims. When they move above 350,000 on a sustained basis, that's another harbinger of recession. For the longest time, jobless claims were meandering between 300,000 to 340,000 a week, as shown in this graph from 2007, courtesy of Calculated Risk:

Then, in the last two weeks, they broke substantially above 350,000. This morning's number was 348,000. The 4 week moving average, which smooths out the weekly noise, now stands at 347,250. It is quite likely that next week, for the first time, that number as well will break 350,000.

Translation: all of the domestic economic numbers, with the exception of durable goods and new factory orders (which in large part translates into Boeing's order book) have finally caved in and are signaling recession.

Recent comments