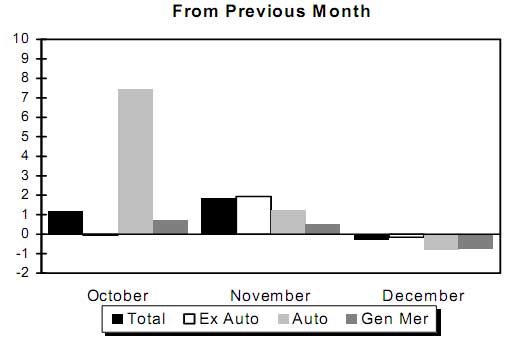

So much for that Christmas blow out. Retail sales dropped 0.3% from November 2009, but in comparison to December 2008, were up 5.4%.

Auto sales dropped 0.8% in December which dragged the index down a 0.1% total.

What is so amusing is now reports are claiming bad weather when on those supposedly spun holiday sales reports which made buzz headline du jour, weather wasn't an issue.

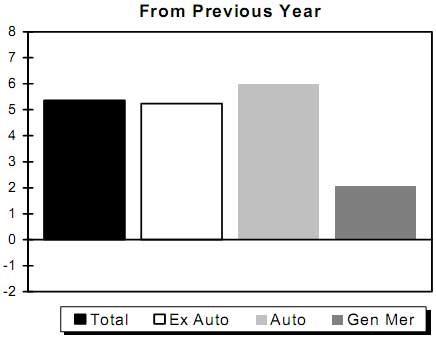

EconomPic Data (Becoming my favorite data in graphs blogger) has a great breakdown on December retail sales, which I borrow:

By amplifying the colors, you can see a vast increase in retails sales is gasoline because prices have risen.

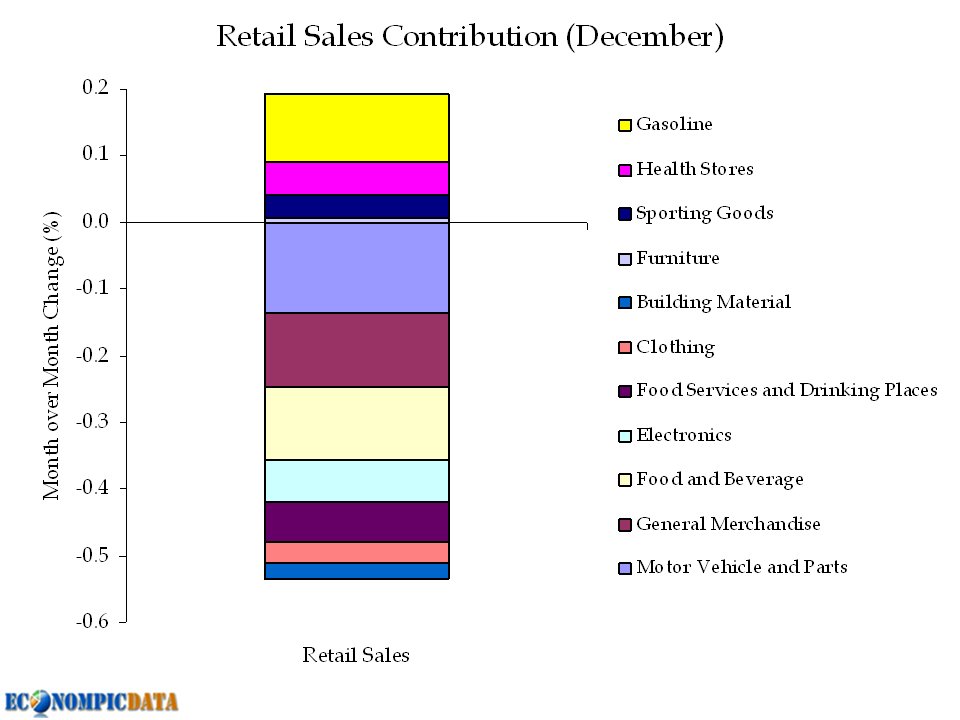

Calculated Risk also graphed out gasoline and shows demand just is a flat dog here in retail sales without the increase in gas prices. The red line is retails sales sans gas.

Folks you seeing the picture, brought to you by many bloggers? Demand is flat after falling off a cliff. So much for our consumer economy. Can we make stuff now?

Subject Meta:

Forum Categories:

| Attachment | Size |

|---|---|

| 70.94 KB |

Christmas retail sales

It's even worse than you point out above. Check this out.

So while December retails sales disappointed, the real numbers will actually wind up being worse because they aren't sales that the retail chains will collect money from.

These delinquencies are 47% higher than they were in 2007.

credit card charge offs - awesome!

Wow, that's a stat deserving of it's own title.

Ok, that implies we have a charge off rate of 12.5% for November.

I'm truly not surprised because credit card companies jack up the rates to absurd loan shark fees.

But in terms of retails sales, the merchant is always paid, it's the credit card companies themselves that take the loss.

So, Joe Blow buys a big LCD TV on his Visa issued by Wells Fargo, then later stopped paying on his card and it results in a charge-off (uncollectable debt), big screen TV seller already has been paid and it's Wells Fargo holding the bag.

Joe Blow keeps his TV unless he declares bankruptcy but is now hounded by debt collectors and also cannot get another credit card or car loan and so on.

He still keeps it

Once he walks out of the store with it, it becomes personal property. Well Fargo has just made a bad financial decision. Ask yourself: What would Jesse James do?

Frank T.

Frank T.