With the release of today's January 2008 CPI showing a yearly reading of 4.1%, inflation hawks are certainly out in force in the blogosphere. While I certainly agree that the average American family has faced a vastly increased burden purchasing food, gasoline, and medical care, I do not think it is inflation itself that will be the problem going forward in 2008. Below I explain why.

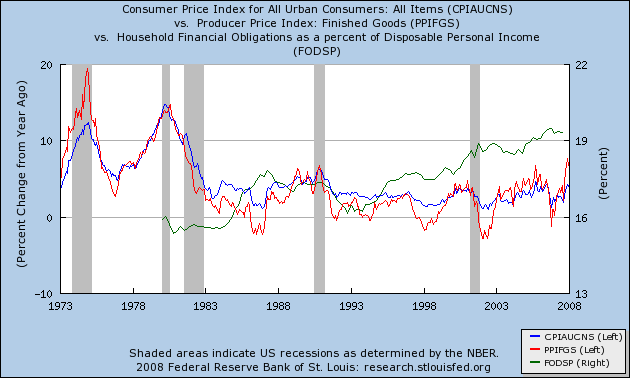

Below is a graph showing how inflation tends to play out over economic cycles. The blue line is consumer inflation (cpi). The red line is producer inflation (ppi) which is the rate at which costs are increasing to producers. The green line is household debt.

A regular pattern of cpi vs. ppi inflation unfolds over economic cycles. Consumer inflation is relatively tame, but consumer inflation starts out very low, and considerably less than consumer inflation (the red line is under the blue line). Simply put, producer costs aren't rising as fast as consumer prices can be increased, and increased production and sales leads to increased profits. Over time, both consumer and producer inflation increases. Ultimately, producer prices increase faster than consumer prices.(the red line is over the blue line). Producers aren't able to pass on their increased costs to consumers, and their profits decline. When their profits decline, they cut back and lay off employees. A recession ensues as consumers pull in their belts. Prices, especially producer prices, decline, thus setting off the next cycle.

In the graph above, you can see that just before every single recession, both the red and blue lines are going up, and the red line has overtaken the blue line. In other words, producer prices are rising, and have overtaken consumer prices. When the recession hits (the shaded area) both the red and blue lines decline, meaning that both consumer and producer inflation are decreasing.

The interesting question is, why didn't we have a recession in 2004? After all, both the red and blue lines were increasing, and the red line had overtaken the blue. That's where the green line comes in. The green line represents household debt. You can see that household debt has been increasing ever since Ronald Reagan ushered in the Republican era. But debt has really taken off since 2001. Simply put, in an era of rampant offshoring of jobs which lowered producer wage expenses, and the ability of anything that could fog a mirror to get a loan, producers were able to profit from increased production even in the face of non-wage producer price increases.

All the signs are that this brief era of producer sanguinity are over. Loan standards have tightened dramatically, inflation is now raging in China, and import prices in the US are increasing at the rate of 12% a year!

But it isn't the inflation rate itself that is the problem. Let's look at a little simple math.

Suppose a basic commodity like weekly food plus gas costs "100" at the beginning of our period. Every month it increases by 2, to 102, then 104, then 106, etc. After 4 years or so, it has reached 200. The cost has doubled. But the inflation rate, which started at 2% (100 to 102) has actually declined to 1% (198 to 200)! If wages have remained stagnant, our consumer must pay twice as much each month at the end of the period for the same basic materials, even though the rate of inflation is decreasing!

With that example in mind, let's look at what has actually happened to the American consumer. Here is a graph Russ Winter reproduced on his blog last Friday. It's slightly out of date, but most telling:

What this graph tells me is that we are at or near the peak for inflation in this cycle. Consumers have simply reached the limit of their ability to spend on essential goods. As per my last blog entry, it seems quite likely that we have already entered a recession. Companies and producers have already started the process of cutting back. The more inflation spikes in the next few months, the more consumers will cut back. At some point in about the next 4-6 months, we should see declining inflation as the recession bites.

So, it isn't inflation which will be the problem in 2008. Rather, it will be the widening and deepening recession as average Americans cut back and take a decline in their standard of living as they try to pay the high costs of food and gasoline, whether those prices briefly continue to increase, remain the same, or even decline slightly.

Comments

global vs. domestic

I'm glad you mention global economic indicators. (production) . I feel that generally analysis is still focused on the domestic indicators when we are gravely effected by global indicators (such as lower production costs due to global labor arbitrage).