According to a new report from the Department of Labor (Trends in Long-term Unemployment), people unemployed in 2014 couldn't count on a college degree to save them from long-term joblessness. The data also show it doesn't matter what industry you work in — and confirmed previous studies, that the longer you're out of work, the less likely you are to get another job. One Princeton University study last year showed that after 15 months, the long-term unemployed were more than twice as likely to have withdrawn from the labor force than the short-term unemployed.

The share of the unemployed who were out of work for 52 weeks or longer reached a record high of 31.9 percent in 2011. The share unemployed for 99 weeks or longer reached a record peak at 15.1 percent in 2011 (99 weeks = 1 year, 10 months and 3 weeks). There were 6.8 million unemployed over 27 weeks in April 2010.

But because so many left the labor force, all of these measures of long-term unemployment have trended down since their respective peaks, but still remain high by historical standards. Five years after the Great Recession officially ended in June 2009, the number of long-term unemployed still made up a larger share of unemployment than during any previous recession.

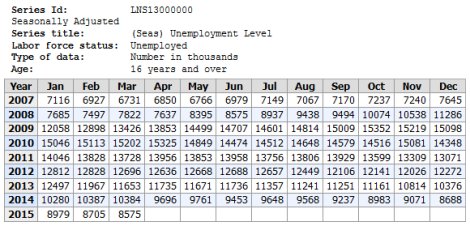

Below are the numbers of all who were counted as "unemployed" since the onset of the Great Recession to the present.

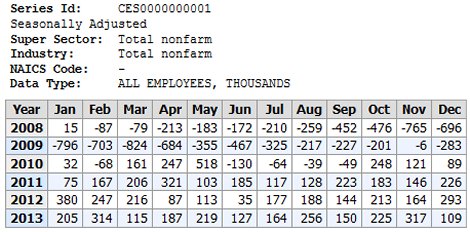

From July 2008 to December 2013, we had a whopping 24 million long-term unemployed workers who once qualified for federal extended jobless benefits. These people were once known as the 99ers, because in some States, the maximum one could receive for federal extended unemployment benefits was 99 weeks. One can see from the Bureau of Labor Statistics (chart below) how many jobs were lost and gained during that same time period. So the question becomes: "Where are they now?"

During that time, while still at Fox News, Glenn Beck had called the 99ers socialists — and said, "I bet you'd be ashamed to call them Americans". The 99ers had been protesting for more jobs and for extending jobless benefits until the job market had recovered. This was when over 15 million were still unemployed every month from September 2009 to April 2010. But in 2014, according to the DOL report, 11.4 percent of all unemployed people had still been looking for work for 99 weeks or longer.

Even so, over the last two years seven states have reduced regular State benefits from 26 to 20 weeks (14 weeks in Florida and 15 weeks in North Carolina). During that time, federal extended benefits for the long-term unemployed were allowed to expire by the end of 2013. According to one study by the NBER (National Bureau of Economic Research), by Congress failing to reauthorized the extension of unemployment insurance for the long-term unemployed, they claimed it had resulted in 1.8 million additional people getting jobs — but yet, only 1.3 million were receiving these benefits when the program expired.

As of March 2015, of those still counted as unemployed (and still counted as part of the labor force), the number of people getting State unemployment benefit rates had reach historic lows. And even most short-term unemployed workers don't get state unemployment benefits. By December 2014, only 23.1% of the short-term unemployed receive regular State jobless benefits — and of course, no "long-term" unemployed were receiving any jobless benefits at all (because the program had expired at the end of 2013).

So what happened to those 24 million long-term unemployed workers who once received extended unemployment benefits (aka The 99ers)? Of those who didn't die, were not incarcerated in prison, were not housed in a medical facility, did not leave the country, were not awarded for a disability claim, and didn't retire — the rest had most likely left the labor force — if they aren't now working under the table in the "shadow economy" and not paying taxes (link, link, link, link).

According to the new report from the Department of Labor, unemployed people who left the labor force spent a median (half more, half less) of 8.6 weeks looking for work in 2007 — but the median reached 16 weeks in 2014. According to the BLS report, regardless of how long they have been looking for work, roughly one-fourth of those unemployed in 2014 left the labor force the following month. Last month we had a record high of 93.1 million "not in the labor force" (and over 11 million just since the recession ended in June 2009).

The Princeton study also shows that:

- Even after finding another job, the long-term unemployed are frequently jobless again soon after they gain reemployment: only 11 percent of those who were long-term unemployed in a given month returned to steady, full-time employment a year later.

- The unemployed who have been out of work for more than 6 months still exceeds its previous peak reached in 1981-82, even though measures of short-term unemployment are close to their average rates. As a result, overall unemployment remains elevated because of the large number of people who have been unemployed long term.

- The long-term unemployed have problems finding work wherever they are, even in states with the lowest unemployment. The largest proportion of the long-term unemployed is over age 50 and is unmarried.

- The long-term unemployed have a 20 to 40 percent lower probability of being employed 1 to 2 years in the future than do the short-term unemployed — and the longer workers are unemployed, the less attached they become to the labor market.

According to a new report by AARP, older workers who lose their jobs spend longer periods out of work, and if they do find other jobs, they tend to pay less than the ones they left. Although overall unemployment is lower among workers over 55 (because they're working longer), the situation is reversed when it comes to long-term unemployment. (The Washington Post has a recent article covering AARP's latest survey).

Other bullet points from the Department of Labor's most recent report on long-term unemployment:

- Men were more likely than women to be unemployed 99 weeks or longer. Unemployed Asians and blacks were more likely to be jobless for 99 weeks or longer than unemployed Whites and Hispanics.

- The incidence of long-term unemployment increases with age. In 2014, for example, 22.1 percent of the unemployed under age 25 had looked for work for 6 months or longer, compared with 44.6 percent of those 55 years and older.

- The percentage of the long-term unemployed who were jobless for 6 months or longer was about the same across the major educational attainment categories in 2014.

- In 2014, 29.6 percent of the unemployed who worked in natural resources, construction and maintenance occupations had been looking for work for 27 weeks or longer — but those whose last jobs were in sales and office occupations and in management, professional, and related occupations were more likely to be long-term unemployed.

An added note about those on Social Security disability...

According to the Current Population Survey (CPS) 29.3 million Americans (16 and older in the civilian noninstitutional population) reported a disability. Of those, less than a third (8.9 million or 30.5%) were disabled workers in payment status for Social Security disability benefits — while almost 6 million were still working.

In July of 2012, (while bloviating) Bill O'Reilly opined on Fox News: "Why has the disability rate increased more than 100 percent? I'll tell you why. It's a con. It's easy to put in a bogus disability claim. In '92 out of every 33 Americans working, one was out on disability. Now that number is one out of 15."

First of all, everything eventually increases 100% over different periods of time. But because terminations for disability benefits cancel out "awards" in any given year, and because only 1/3 of claims were awarded last year in 2014, there was only a net gain of 11,934 workers in payment status for disability benefits last year — and that's out of over 2.5 million claims.

Deaths and conversions to regular Social Security retirement benefits account for most of the terminations that occur — because most people on disability are older workers who have worked for decades and paid in to the Social Security trust fund through their wages.

So people such as Bill O'Reilly should know that:

- Not anybody can put in a bogus claim (and most people probably don't, and for many different reasons).

- The vast majority of most "claims" never end in actual "awards" because it's very difficult to prove a case, and many times it can take 3 years or longer to resolve through appeals.

- It's been estimated that Bill O'Reilly's bloviating has increased over 100% during the last 2 years.

| Year | Applications | Awards | Terminations | Approved | Net Gain |

| 2014 | 2,521,459 | 810,973 | 793,646 | 32.16% | 17,327* |

* 11,934 of those 17,327 were "disabled workers" — the remainder were widowers, children, (etc.) Source: SSA

Senator Doctor Rand Paul had indicated earlier this year that there were many “malingerers” who are “taking money” from more deserving individuals who were "horrifically disabled" — such as quadriplegics. So Bill O'Reilly and Rand Paul (and all their loyal but misinformed fans) should know that those on disability are not driving the decline in the labor force participation rate, or the decline in those not in the labor force, or the decline in the employment-population ratio. Disabled workers only make up a small percentage of the unemployed who recently dropped out of the labor force when compared to prime-age workers who can't find jobs — or regular retirees (there were over 1 million last year).

Comments

Long-Term Unemployed

per recent posting, from my experience as an SSA Interpreter, no one can submit a bogus Disability claim and get approved. Claimant must be seen by two SSA physicians & have substantial medical reports from their own doctors. And the % of 99er's Long-term Unemployed, haven't dropped out of the work force. They survive on P/T jobs or become self-employed. FOX News can only maintain an audience by portraying villains on any given issue or persons. Truthful reporting doesn't make money for them.

Study on "Hidden Unemployment"

NBER: "Underemployment and hidden unemployment currently account for the bulk of the U.S. employment gap ... Using state-level data, we find strong statistical evidence that each of these forms of labor market slack exerts significant downward pressure on nominal wages."

http://www.nber.org/papers/w21094

Here's the open link to the 25-page wonkish study (by David G. Blanchflower and Andrew T. Levin -- March 24, 2015)

http://www.dartmouth.edu/~blnchflr/papers/Blanchflower-Levin%20labor%20slack%2024mar2015.pdf

Comment from Mark Thoma's blog: